Summary:

- AT&T’s 2024 share performance has been strong and cash secured put options offer an alternative income strategy at its 52-week high.

- Despite revenue challenges, AT&T has managed expenses well, leading to a slight decline in operating income and a significant reduction in debt.

- The transformation from wireline to fiber is progressing, with substantial growth in fiber customers and revenue, supporting future earnings and free cash flow.

- AT&T’s sustainable dividend, debt reduction, and attractive valuation at 9 times forward earnings indicate a promising long-term investment opportunity.

RiverNorthPhotography

Introduction

Telecom giant AT&T (NYSE:T) has been good to its shareholders in 2024. The company has returned nearly 50% in income and gains since I wrote about them last September. The latest surge in share price is likely related to fiber’s role in the AI boom with Lumen Technologies and the deal by Verizon to acquire Frontier Communications. While investors may be gun shy to invest in AT&T at its 52-week high, the shares are still carrying underlying value, and investors can opt to collect income prior to buying the dip by selling cash secured put options.

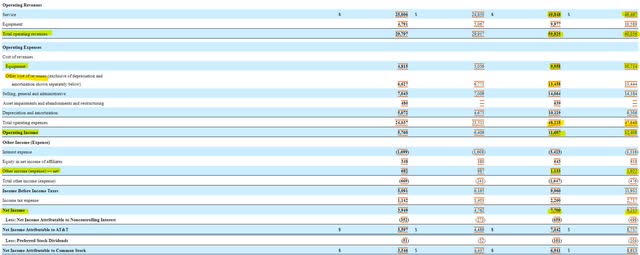

AT&T Financial Results

AT&T is not without its challenges, as it is facing revenue headwinds in 2024. During the first six months of the year, service revenue rose by 1%, but the drop in equipment revenue led to a $200 million decline in total revenue compared to the first half of 2023. On the expense side, AT&T was able to control its cost of revenues, with an $800 million decline compared to last year. Depreciation expenses, which are noncash, jumped by $800 million. The jump in depreciation was a major component in an $800 million decline in operating income from $12.4 to $11.6 billion for the first half of the year.

SEC 10-Q

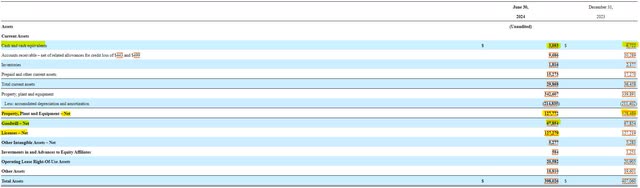

On the balance sheet side, AT&T saw a decline in total assets to under $400 billion, which was mainly led by a current asset decline and a $3.7 billion drop in cash to $3 billion. Fortunately, AT&T’s cash drop was put to good use as debt declined from $137 billion to just over $130 billion. Deleveraging will benefit shareholders in the long term with lower interest expenses and higher earnings. The debt paydown helped increase shareholder equity by nearly $2 billion to over $119 billion.

SEC 10-Q

SEC 10-Q

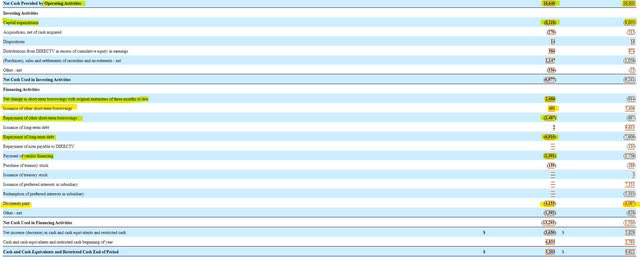

Cash Flow and Dividend Sustainability

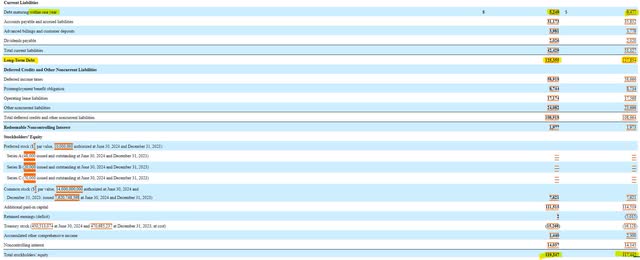

The cash flow statement is very beneficial to shareholders as it helps investors determine if AT&T can sustain its dividend and pay down debt. In the past, the importance of AT&T’s vendor financing obligations overshadowed free cash flow, leading to a dividend cut. In the first six months of 2024, AT&T generated $8.5 billion in free cash flow, up from $8 billion during the same period a year ago.

The company’s free cash flow generation was sufficient to cover the combined $5.5 billion dividend and vendor financing obligations. The remaining free cash flow, combined with more than $3 billion of cash on hand, was used to pay down long-term debt by nearly $7 billion. It appears as if the drop in vendor payments is expected to continue through the remainder of the year as AT&T negotiates vendor financing 90 to 120 days out and has disclosed a comparable short-term liability to the first six months of 2024 versus 2023.

SEC 10-Q

SEC 10-Q

Transformation Creating Risks and Opportunities

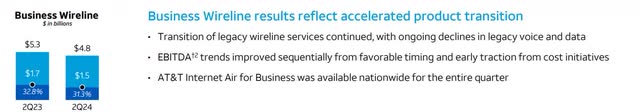

AT&T is undergoing a transformation from legacy wireline to fiber. The transformation requires the company to be able to grow fiber revenue commensurate with the decline in wireline revenues. AT&T still has $20 billion in annualized revenue in the business wireline space alone. While revenue has marginally declined, if a competitor gets to the wireline customers before AT&T does, it could result in a negative impact on earnings.

Earnings Presentation

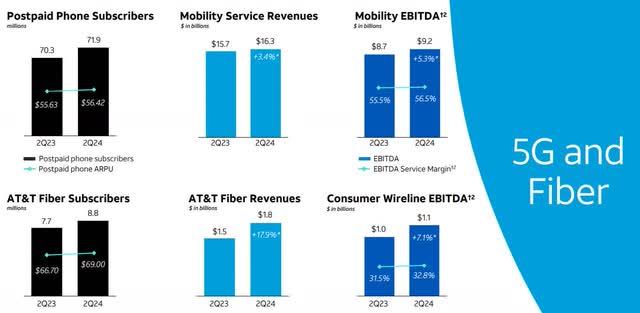

Despite the existence of wireline customers, AT&T is delivering on growing its fiber footprint. In the last year, the company has added 1.1 million fiber customers and grown fiber revenue by 18%. AT&T has also grown its ‘bread and butter’ cellular phone service with 1.6 million more phone subscribers and higher revenue.

Earnings Presentation

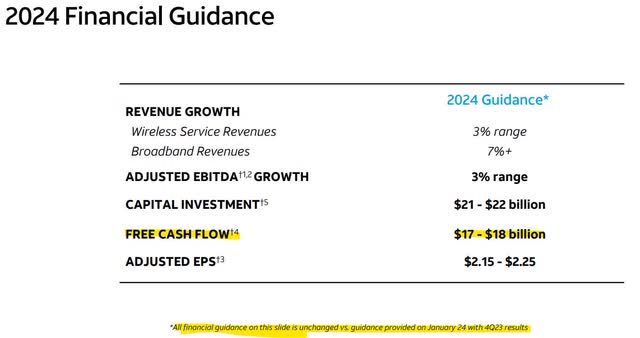

The transformation appears to be paying off, as AT&T is guiding full-year free cash flow between $17 and $18 billion, which would imply an increase in free cash flow of up to $1 billion for the second half of the year. Analysts are projecting earnings to grow over the next three years, albeit slowly. Despite the transformation working and earnings growth expected, AT&T is attractively priced at 9 times forward earnings.

Earnings Presentation

Seeking Alpha

Cash Secured Put Options, An Alternative Income Trade

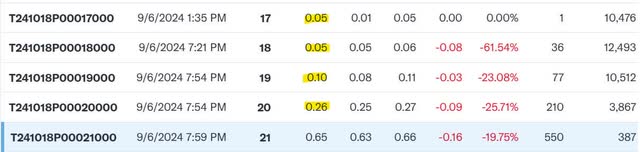

For many investors, buying shares of a company at a 52-week high is a tough pill. Fortunately, cash secured put options present an alternative strategy. Cash secured puts allow investors to set aside cash to buy shares at a predetermined price by a certain date. Investors are paid up front for taking on this commitment. If shares do not drop to the strike price, the contract expires and the investor keeps the income, with the ability to enter into a new options contract.

For AT&T, cash secured put options expiring six weeks out are currently trading at 10 cents per share for a $19 strike price. As a Fidelity investor, I get paid the money market rate plus the options premium if the contract isn’t exercised. This would provide a better income return than AT&T’s current dividend and present an opportunity to buy AT&T shares at a 10% discount.

Yahoo Finance

Conclusion

I do not believe the rise in AT&T shares is a fluke, but a sign of a sustained turnaround. The company’s revenue growth may not be strong, but they have kept expenses under control. The growth of free cash flow has also made the dividend more sustainable and given the company the ability to pay down debt, which will help future earnings. Investors should watch the wireline business as it transitions into new technology, but from all accounts, AT&T appears poised to handle the transition without an earnings decline and to the benefit of shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.