Summary:

- AT&T investors who bought T’s long-term lows in July 2023 have done remarkably well.

- AT&T should see improved performances this year, lifting buying sentiments.

- AT&T’s ability to control costs while building its fiber infrastructure has demonstrated its execution prowess.

- With a dividend yield exceeding 6%, it should attract more income investors to return as the Fed cuts rates this year.

- I explain why T’s rally looks set to carry on, bolstered by its dirt-cheap valuation.

Anne Czichos

AT&T Inc. (NYSE:T) investors have done incredibly well since T bottomed out in July 2023 (remember the days when fears of lead-sheathed cables dominated?). Panic sellers bailed out in droves, unduly worried about potential multi-billion liabilities. However, dip-buyers returned with a vengeance, picking up the pieces from these sellers at T’s long-term lows. T’s buying momentum has improved significantly since then, even though I decided to lower my rating to a Hold in mid-January 2024. I cautioned investors that T needed a well-deserved break after its surge. T’s relative underperformance to the S&P 500 (SPX) (SPY) suggests buying momentum has waned. Despite that, T looks ready to power ahead again, potentially achieving a decisive breakout.

AT&T posted its fourth-quarter earnings release at the end of January 2024, justifying the confidence of dip-buyers who remain invested. AT&T’s cost-cutting initiatives have reaped rewards, surpassing its guidance by delivering nearly $16.8B in free cash flow. In addition, AT&T achieved robust growth in its wireless and broadband business, demonstrating its competitive advantage in its fiber buildout and bundling strategies. As a result, it has likely provided investors more confidence that AT&T is well-positioned to ride a further recovery in 2024 as the Fed looks to cut rates three times this year.

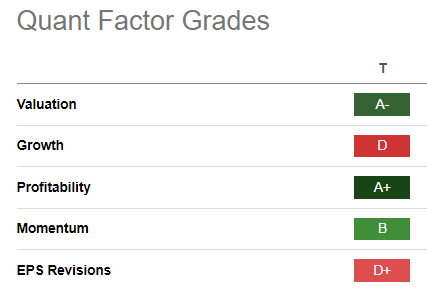

T Quant Grades (Seeking Alpha)

With Q4’s results done and dusted, we must consider the challenges and opportunities that could impact the market’s perception of T’s appeal at the current levels.

As highlighted earlier, I assessed the opportunity for T to stage a decisive breakout as increasingly possible, bolstered by its attractive valuation (“A-” valuation grade). In other words, it shouldn’t take much for the market to re-rate T higher if AT&T management can execute well this year.

AT&T management provided a reasonable outlook in 2024 amid further investment in its fiber network to meet AT&T’s 2025 goal of delivering more than 30M fiber locations. Accordingly, AT&T guided to a free cash flow outlook of between $17B and $18B, underpinning the market’s confidence in further improvement in operating performance. The company is also committed to deleveraging its balance sheet, targeting an adjusted EBITDA leverage ratio of 2.5x, down from almost 3x in 2023. With the company on track to “achieving an incremental $2B+ run-rate cost savings target by mid-2026,” I believe the market is likely betting on a more robust free cash flow inflection in the medium term.

AT&T could face more intense headwinds from cable companies broadening their bundled offerings to the wireless market. However, AT&T management is confident that its increased focus on higher-quality consumers should help reduce churn. Furthermore, with CapEx expected to lower in the medium term after rapid buildout over the last few years, AT&T should be able to secure its dividend, underpinned by a robust forward yield of 6.4% at the current levels. Hence, I didn’t glean significant downside risks, suggesting investors should consider taking substantial exposure off the table.

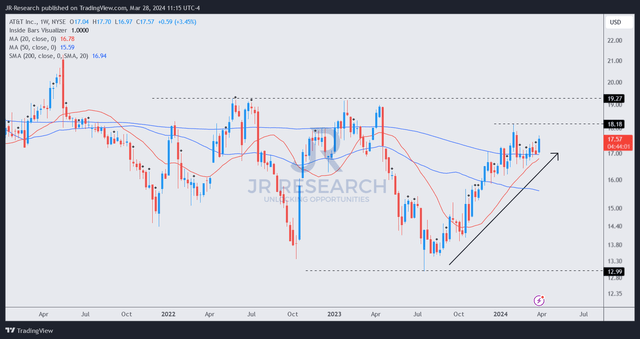

T price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, T has maintained its uptrend bias since it bottomed out in July 2023. Based on my observation, there are no sell signals. Dip-buyers defended every pullback resolutely, likely assessing its attractive valuation and solid dividend yields.

As a result, I believe AT&T’s solid buying momentum (rated “B” by Seeking Alpha Quant) has demonstrated the market’s increased confidence, potentially breaking above the $20 zone before an extended consolidation.

Hence, T investors looking to buy the recent pullback should consider pulling the buy trigger as the rally looks set to carry on.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!