Summary:

- AT&T, Inc. deserves the market’s scrutiny and doubts.

- But sometimes even fair punishments tend to go overboard.

- Median price target, which would represent a forward multiple of 8, presents nearly 40% upside.

- AT&T stock’s Relative Strength Index is the lowest I have ever seen with any stock, ever.

- The company is operating within its boundaries, with discipline.

Brandon Bell

I wrote this article on AT&T (NYSE:T) after the company reported its Q1 earnings. I rated the stock a “Hold” back then as I fully expected the market to punish the stock for an “okayish” earnings report. Since then, the stock has lost more than 17% and at one point on Thursday, May 25th had lost close to 20% since the earnings report, before the bounce on Friday with the rest of the market. The latest downturn was due to the announcement that DISH Network Corporation (DISH) was planning to sell phone plans on Amazon.com (AMZN), thereby competing head on with the likes of AT&T and Verizon Communications Inc. (VZ).

This sell-off has pushed AT&T’s already battered shares to depressing levels. Hence, I am upgrading the stock to a “Buy” and am presenting 5 reasons for doing so. Let us get into the details.

Valuation and Estimates

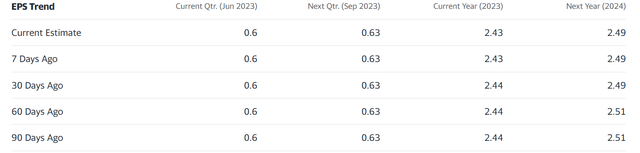

The first and most obvious reason is the stock’s valuation, as its forward multiple of 6.38 is below the well-covered dividend yield (see the section below) of 7.16%. In addition, AT&T’s EPS estimates have remained fairly steady as shown below, with 2023’s EPS slated to be at least 2.40, which means a forward multiple of 6.45. That is depressingly low even for AT&T’s expected growth rate or lack of it, especially when you factor in the 7% yield.

AT&T Estimates (Yahoo Finance)

Well-Covered, Almost 52-week high Yield

I established in my earnings review that even the slightly disappointing Q1 Free Cash Flow (“FCF”) sufficiently covers the high dividend. The recent sell-off has made this already high dividend even more attractive as the yield is approaching 52-week highs as the stock approaches 52-week lows. This is not a new situation for AT&T investors but the key difference this time is that the company has shown more discipline over the last one year (post WDB spin-off) than it ever did in the past. For example, the company’s debt level has more or less remained same over the past year. Shares outstanding has remained nearly flat as well over the last year since the spin-off.

Business Fundamentals

AT&T, as a company and stock, deserves the scrutiny from the market. But punishments tend to go over the line many times and companies stay in the penalty box longer than they deserve. In AT&T’s case, the company is getting pushed further and further into the time out box. However, the company is operating with enough discipline to deserve some respect. Examples below:

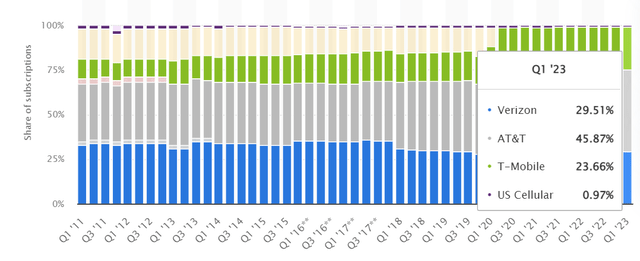

- AT&T’s share in the Wireless subscriptions market is the highest it has ever been in the last 10 years at least, at 45.87% at the end of Q1 2023. The previous highest was the 45.70% at the end of Q3 2021, which was followed by a small dip for a couple of quarters before the trend reversed higher again.

AT&T Wireless (statista.com)

- AT&T is touting its progress on its 5G initiatives with 5G standalone but the market couldn’t care less (and rightly so at this point). The company also recently expanded its 5G and Fiber to rural and tribal communities. And there are now three flavors of 5G. None of these are game changers overnight. But when you consider the fact that the company spent (after borrowing) nearly $150 billion to expand its 5G capabilities, these results should at least help the company not lose its ground.

- AT&T has beaten EPS estimates for 10 consecutive quarters. While revenue has been up and down (in terms of beats and misses), I pay more attention to EPS in case of companies like AT&T and Altria Group (MO) than with fast growers that need to show more revenue growth to command higher multiples. AT&T’s Opex in Q1 2023 fell by a small margin of 0.20% and the company highlighted the cost savings at the recent annual J.P. Morgan 51st Annual Global Technology, Media and Communications Conference. CEO John Stankey reported that the company has already accomplished $5 billion from its target of $6 billion in cost-savings.

- All that said, I do sincerely hope that some activist gets involved and shakes up the management. The team has been around far too long given the stock’s extreme underperformance over the years. If the stock continues getting hammered ($10 anyone?), I actually see this transpiring in the near future. This (management shakeup) may actually be the shot in the arm that the stock needs to turn around.

Price Target

The median price target of $21.50 represents nearly 40% upside, excluding dividends. If AT&T does churn out $2.50 EPS in 2024 or even 2025, the median price target represents a forward multiple of 8.60. The undervaluation thesis is clearly on the minds of large funds as evidenced by the fact that Steven Cohen’s Point72 Asset Management as well as Shell Asset Management both boosted their stakes in AT&T recently.

Depressingly Oversold

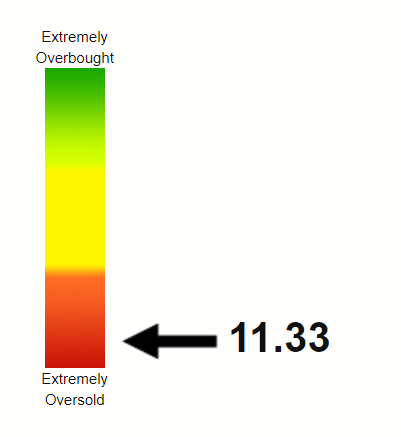

Readers are likely familiar with the technical oversold and overbought labels. I am coming up with a new category called “depressingly oversold” for stocks with Relative Strength Index (“RSI”) less than half the text-book oversold level of 30. Introducing the first inductee of this class, AT&T with its current RSI of 11.33. In my decade plus of writing on Seeking Alpha and looking at RSIs of stocks, I’ve never seen something as low as this for any stock, let alone a $100 billion company. If this doesn’t result in a short-term bounce, I don’t have any hopes on RSIs.

AT&T RSI (Stockrsi.com)

Conclusion

I’ve written in many of my past articles that both euphoria and pessimism go to extreme levels before sanity returns. Sadly for AT&T investors like myself, the company has almost always fed the pessimism narrative on top of Mr. Market’s overreaction. However, a near 20% drop post-earnings is unwarranted in my opinion and I am upgrading the stock to a Buy.

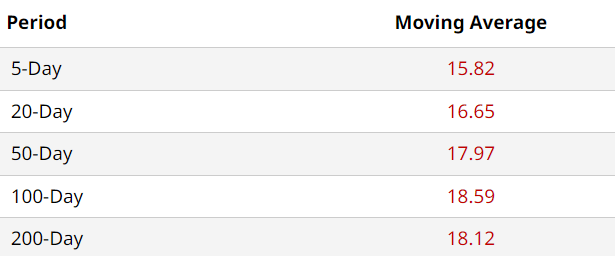

I recently added 1,000 more shares to my AT&T holdings. Please note that I am looking at this new addition as a trade and not a long-term investment, given my existing exposure to the stock. I fully expect a quick bounce back into the $17 region at least and if it does, I’d likely close out this new position. The stock’s 100-Day and 200-Day moving averages are at or above $18. While I don’t see the stock reaching that mark in a hurry, a bounce to the $17 area is not out of reach given the extremely oversold conditions, especially if the market rallies in general due to optimism around debt ceiling.

AT&T Moving Avg (Barchart.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, MO, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.