Summary:

- AT&T Inc. stock has fallen by about 2% pre-market due to concerns about lead-sheathed cables, following a near 5% slide after J.P. Morgan’s downgrade on Friday.

- Despite the stock’s decline, AT&T’s dividend is still well covered based on the company’s Free Cash Flow, suggesting that the dividend is safe for now.

- Misery loves company, but so do bullies. I won’t be bullied into selling my shares in a panic.

Brandon Bell

AT&T Inc. (NYSE:T) has been hit with a double whammy, as Citi has just downgraded AT&T and a few other Telecommunication stocks based on worries about lead-sheathed cables. This has sent the stock lower by about 2% pre-market, following the near 5% slide after J.P. Morgan’s downgrade on Friday due to worries about wireless and broadband segments.

In my most recent article about AT&T, I upgraded the stock to a buy citing 5 reasons ranging from valuation to business fundamentals to technicals. And the stock has promptly lost about 8% since then, compared to the market’s 6.60% gain. Does that change my thesis, especially given the two downgrades above? Let’s find out.

Bottomless Pit

It seems like AT&T investors like myself have not managed to catch a break for a very long time, as the stock is (excluding dividends):

- At 30-year lows, as shown in the chart below. We need to go back to 1993 to find the last time the stock traded this low.

- Down about 40% in the last five years.

- Down 30% in the last year.

- Down nearly 25% YTD.

Junk Yield? Is The Dividend Safe?

With the stock’s yield approaching 8%, it is natural for investors to worry about the company’s ability to sustain the dividends. As I established in my previous AT&T article linked above, AT&T’s dividend is still well covered based on the company’s Free Cash Flow (“FCF”). Based on total shares outstanding of 7.15 billion and quarterly dividend of 27.75 cents, AT&T needs an average of $2 billion in quarterly FCF to cover its dividend commitment.

Despite the stock’s rout, AT&T’s FCF looks solid enough to set aside $2 billion/qtr or $8 billion/year for dividends. Let’s see a few examples below.

- On trailing twelve months [TTM] basis, AT&T generated $13.576 billion in FCF, which gives the company a payout ratio of 59%.

- The average quarterly FCF over the last five years stands at $5.88 billion, which results in payout ratio of 34%.

- Using the last full year, 2022’s FCF of $12.40 billion, AT&T has a payout ratio of 64.50%.

Bear in mind that AT&T’s Warner Bros. Discovery, Inc. (WBD) spinoff took effect only in April 2022. That means the TTM number is the most relevant out of these, and a 59% payout ratio based on this is comfortable enough in my opinion.

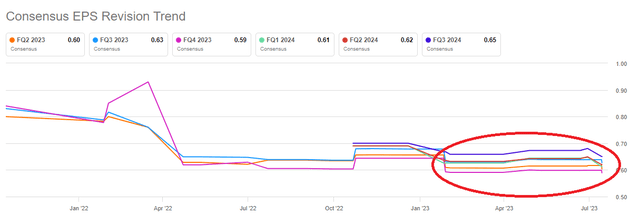

It is also interesting to note that earnings estimates have been steady over the last 6 months despite the stock’s plummet. This is an encouraging sign and should estimates hold true for the current FY at $2.43, AT&T has an EPS based payout ratio of 45.67%. Once again, a number comfortable enough to suggest that dividends are not in danger yet.

Overall, I believe the dividend is safe and sound for now.

ATT Estimates (Seekingalpha.com)

Debt Situation

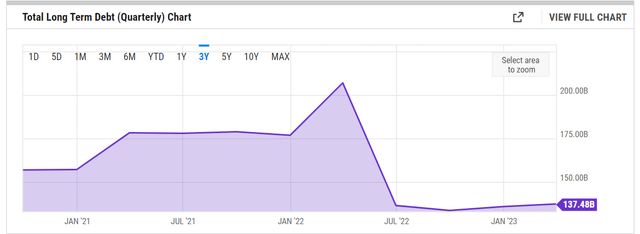

I’ve long maintained (since the spinoff) that I am monitoring the company’s debt level more seriously than in the past (thanks to the dividend cut in the name of a spinoff). Credit to the management that so far the company has not added any significant debt to what it had post spinoff. I’d like for debt to stay under $140 billion and will be ticked if it crosses $150 billion, which may be the final straw that breaks this camel’s back.

Valuation? What Is That?

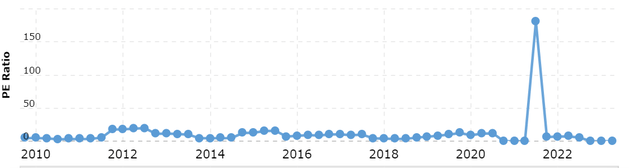

It feels funny to use the word “valuation” when talking about a stock trading at a forward P/E of 5.84, making me wonder whether AT&T stock is invaluable or value-less. As shown in the chart below (granted, it is due to the scale of the chart), there appears very little room for the stock’s valuation to go down on paper. Obviously, it “can” go lower, but I am making the case that things look so depressing right now that throwing in the towel now may not be the best strategy.

Based on 2024’s estimates, the stock has an even lower multiple of 5.60. Notice on the same link above that AT&T’s earnings, while slow growing in nature, have consistently beaten estimates. This means the valuation thesis should hold true within a tight range, say between a P/E of 5.5 and 6.5, which look good either way.

ATT Earnings History (Yahoo Finance)

Technically Sorry Too

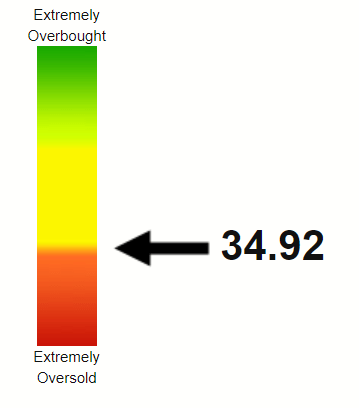

Given the beating the stock has taken, it is not surprising that the stock’s Relative Strength Index (“RSI”) is hovering in the 30s. With today’s impending selloff, it looks likely that the stock’s RSI falls below 30 and into the extremely oversold territory soon. I believe that should call for a relief rally, especially if the company report’s moderate numbers at least on July 26th.

ATT RSI (Stockrsi.com)

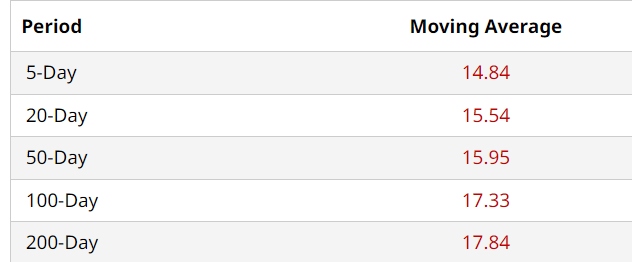

The moving averages shown below are progressively worse, meaning the stock is experiencing serious downside momentum each trading day. The 200-Day moving average is more than 17% away from the current trading price, and that makes me believe a new lower base is being established. I wouldn’t be surprised if the selloff continues, especially if earnings are bad, and takes AT&T’s stock to the $12 area, which would push the yield above 9%.

ATT Moving Avgs (Barchart.com)

Conclusion

Misery loves company, they say. So do bullies. I believe the investment firms are now bullying on AT&T’s stock on well-known issues like the slowdown in wireless and that the industry uses lead cables. Many times, such downgrades will bring down a weak stock further, so the big boys can scoop up shares cheaper while scaring the average Joe away. I am not getting scared away and, in fact, I am retaining my Buy rating on the stock. But, just know that the ride will be painful (just like it has been so far), but I expect a bounce back into high-teens once panic exits and sanity returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.