Summary:

- AT&T shares may be ready for a comeback after a decade of hardship, with a focus on its core business.

- The company’s underlying business is strong, with growing customer bases and increased revenue per unit.

- AT&T’s debt is under control, and it has the ability to generate significant free cash flow to repay debt and provide value to shareholders.

jetcityimage/iStock Editorial via Getty Images

After a decade of hardship, AT&T (NYSE:T) shares may be ready to stage a comeback. AT&T has been one of the hardest stocks for me to own as it’s been an absolute cash cow, yet no matter what it did, the market never responded favorably. Over the past decade, shares have lost -38.12% of their value, and without the dividend, I don’t know if many shareholders would still be in AT&T. The days of venturing into the unknown seem to be in the past, and AT&T is focusing on its core business.

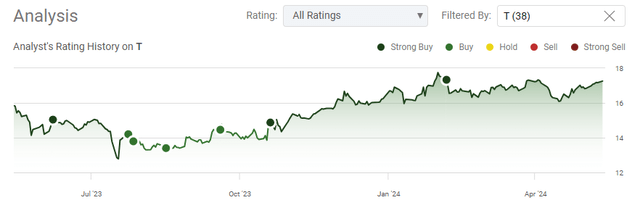

I have been bullish through the downturn because there has been a solid business throughout the chaos, and it looks like shares are finally bottoming. In October of 2022, shares dropped slightly below $15 then rebounded, and the same thing happened again in the middle of 2023. AT&T has been a disaster for shareholders, and nobody can change the past. The real question is, can AT&T change investor sentiment, and will Mr. Market eventually reward them?

If you have a long-term horizon, I think shares of AT&T can rebound and make their way back into the $ 30s, but there isn’t going to be any instant gratification from this investment. Shareholders are getting paid a 6.46% yield to stick it out, and if you invested when shares were in the mid-20s, this may not be the worst price-to-dollar cost average. AT&T is generating an enormous amount of FCF, its debt is under control, and I think AT&T is going to prove a lot of people wrong.

Following up on my previous article about AT&T

After the Q4 and 2023 full-year results were released, I wrote an article about AT&T on February 6th (can be read here). Since then, shares have declined by -2.35% while the S&P 500 has appreciated by 5.67%. After AT&T’s dividend is factored in, its total return over this period is -0.75%. In that article, I discussed how AT&T was turning the corner, and shares had looked to have bottomed out in 2023. Now that Q1 2024 earnings are in the books, I wanted to follow up with a new article to discuss why I think shares are still massively undervalued, and the debt narrative isn’t the issue it once was. AT&T may not be an exciting technology company, but it’s generating enough profitability to deleverage and change the market’s perception.

Risks to investing in AT&T

Many investors, including myself, have been wrong about AT&T. No matter what management has done, shares of AT&T have continued to trend lower. There is a large opportunity cost risk as AT&T shares are facing an uphill battle due to market perception. Shareholders have experienced a lost decade of returns as AT&T has provided a negative return while the S&P 500 has appreciated by roughly 175%.

The next risk is innovation, as AT&T generates the majority of its capital from its wireless business. As technology evolves, we can see disruptions in how communication is conducted. If this occurs, it would put a tremendous amount of pressure on AT&T’s business. While AT&T is in a position to facilitate its debt obligations, it still runs the risk of management getting sidetracked and trying to add different vertices to its operations. If AT&T decides to deploy capital away from its core business and starts to take on additional debt, the reaction from the market could turn more bearish than it already is.

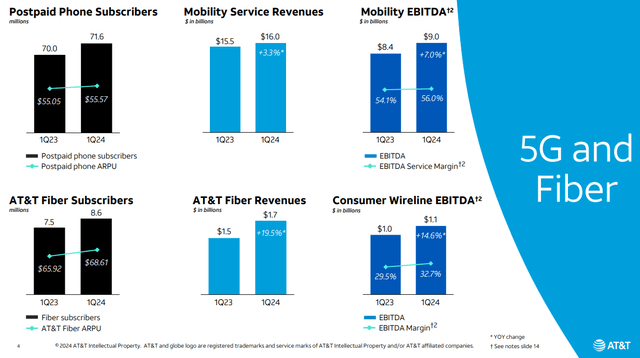

AT&T is continuing to showcase the strength of its underlying business, and shares are trading at an attractive valuation

Demand is one of the strongest determinations of a business’s viability. In companies that are being disrupted or where consumers are losing interest in their products, adoption rates decline. This is not an issue for AT&T as its main businesses are flourishing after shedding its media endeavors. In Q1 2024, AT&T added 349,000 postpaid phone subscribers, bringing its total customer base to 71.6 million. Over the past year, the number of clients AT&T has been able to add after churn is 1.5 million.

One of the big factors that investors are glazing over is that the average revenue per unit has increased by $0.52 YoY, which is improving margins and helping AT&T generate larger levels of top-line revenue and EBITDA. AT&T is also making strides in the fiber sector, as they have grown their customer base by 14.67% over the past year. AT&T has added 1.1 million fiber subscribers YoY, and their net additions in Q1 reached 252,000. Collectively, AT&T generated $30 billion in revenue throughout Q1 2024 and delivered $11 billion in adjusted EBITDA while producing $3.1 billion in FCF. AT&T continues to be a business that can generate over $100 billion in revenue on an annualized basis while producing tens of billions in profitability.

Despite fears about management veering off course, AT&T has the lowest amount of total debt on its balance sheet since the 2016 fiscal year. In 2016, AT&T ended the year with $165.67 billion in total debt, and it hasn’t recorded a number lower than $155 billion in total debt until Q1 of 2024. At its highest level, AT&T had $237.59 billion of total debt on its books in Q1 of 2022 and since then, have reduced its total debt by -35.99% as they have eliminated $85.51 billion in obligations. In March of 2022, AT&T had generated $12.14 billion in EBITDA over the trailing twelve months. After shedding the media entities, this figure has declined by only -4.05% in March of 2024, as the difference is $492 million. AT&T’s debt to EBITDA ratio has dropped from 19.57x at the end of Q1 2022 to 13.05x over the past 2 years.

AT&T is extremely attractive here as the strength of its business continues to deliver quarter after quarter. AT&T guided up the year and is expecting to generate $17 – $18 billion of FCF after allocating between $21 – $22 billion toward capital investments. It is projected that it will generate between $2.15 – $2.25 of adjusted EPS. AT&T is guiding for single-digit percentage growth in wireless and broadband revenue. This isn’t a business that is fading away, considering their annualized revenue run rate will exceed $100 billion in 2024.

There is a lot that AT&T can do to provide value to its shareholders with its retained FCF. In addition to paying a dividend that is yielding more than 6%, AT&T can repurchase shares and eliminate some of its annualized dividend payments through a lower share count. AT&T could also repurchase debt and lower its interest expenses. In addition to paying the dividend, buybacks and repaying debt can help boost EPS and make the value proposition even stronger.

Steven Fiorillo, Seeking Alpha

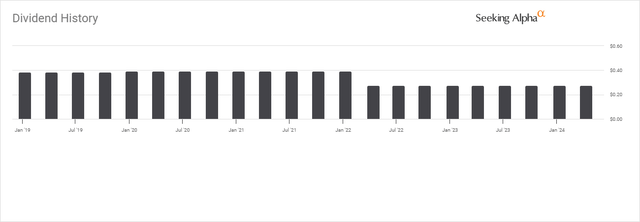

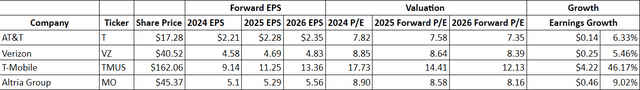

When I look at how AT&T is being valued, it’s perplexing, to say the least. There doesn’t seem to be much faith in AT&T as it is trading at a cheaper valuation than its direct competitors Verizon (VZ) and T-Mobile (TMUS), in addition to Altria Group (MO). AT&T is trading at 7.81 times 2024 earnings and 7.35 times 2026 earnings. This is lower than VZ and TMUS, while AT&T has more projected EPS growth over the next 2 years than Verizon. What is shocking is that Altria Group trades at 8.9 times 2024 earnings, and the market is giving AT&T’s earnings less of a multiple than Altria, which is a tobacco company. I think the market is going to wake up one of these days and realize that AT&T is a largely profitable entity and that shares are significantly undervalued. Until then, I will be happy collecting the dividend, which is still attractive as it has a yield that exceeds 6% after the resizing after the Warner Media spin-off.

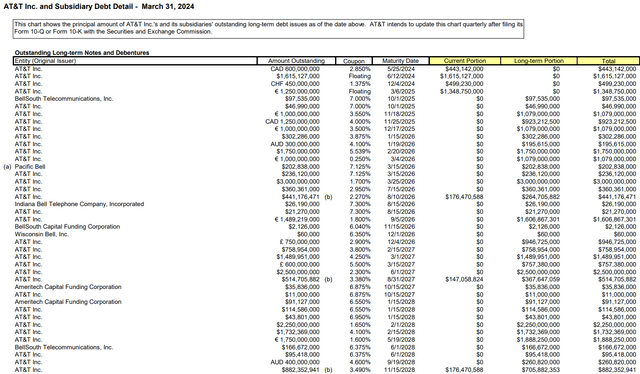

AT&T has $132.76 billion in total debt, but they do not have a debt problem

AT&T has $132.76 billion of total debt on the books, but there is a difference between having no way to repay the obligations and making more than enough to service the debt and repay the maturities. I am going to go through AT&T’s free cash flow (FCF), its dividend obligations and its debt maturities to show how AT&T is in a position of strength and their debt is not the crippling story it once was.

AT&T has 7.19 billion shares of common stock outstanding and pays an annualized dividend of $1.11 per share. AT&T has an obligation to its shareholders to pay $7.98 billion in annualized dividends, which works out to $1.99 billion each quarter. AT&T also has $3.52 billion in cash on hand. AT&T has projected that it will generate between $17 – $18 billion of FCF in 2024 and has already produced $3.8 billion in Q1 of 2024. I am going to use $17 billion of FCF on an annualized basis to stay on the conservative side and explain why AT&T is in a position to pay its annualized obligations and continue retiring debt.

AT&T has $2.56 billion of debt maturing in 2024, with another $533.1 million of the current portion from future maturities coming due throughout 2024 for a total of $3.09 billion of debt maturities due this year. AT&T generated $3.79 billion in FCF and paid $1.99 billion in dividends from their common shares in Q1. AT&T still has $5.23 billion in dividend obligations for the remainder of 2024 and is expected to generate at least another $13.21 billion in FCF. Between the dividends remaining of $5.99 billion and the $3.09 billion of debt maturing, AT&T is responsible for $9.08 billion of liabilities between them in 2024.

The remaining FCF AT&T is expected to generate, in addition to their cash on hand, puts AT&T’s liquidity at $16.73 billion. If AT&T repays its maturing debt and dividends from its FCF, it will end the year with $7.65 billion in liquidity if it chooses not to do anything with the remaining cash. Assuming they didn’t repurchase any shares or buy back future debt, they would have $7.65 billion of cash on hand against $4.57 billion in maturing debt during 2025. AT&T could repay all its 2025 debt and still have $3.08 billion in cash before Q1 2025 ended. After another $17 billion of FCF is generated and $7.99 billion in dividends on the common shares are paid, AT&T would have an additional $9.02 billion in FCF remaining.

If the retained FCF was put on the balance sheet, they could finish 2025 with $12.1 billion in cash, which exceeds the $10.17 billion of debt maturing in 2026. Assuming the same scenario, AT&T could eliminate all of its 2026 debt from the cash on their balance sheet and still have $1.92 billion in cash on hand prior to generating another $17 billion in FCF and retaining $9.02 billion after the dividends are paid.

AT&T could theoretically head into the 2027 fiscal year with $10.94 billion in cash on hand and eliminate $17.84 billion in debt from their balance sheet. AT&T is an FCF machine, and its debt is no longer an issue, despite being over $100 billion. I would get worried if AT&T wanders off the path of financial discipline, but things look good so far, as they continue to reduce their debt obligations. Based on AT&T’s past, it will take several years for investors and the market to believe that AT&T will continue on its current trajectory of repaying debt and deleveraging its balance sheet.

AT&T is in a position where it can repay all its debt maturities while repurchasing future debt at a discount, which will reduce its interest expenses over the next several years. AT&T can also repurchase shares, which will increase its EPS as long as profitability stays the same and reduce the amount of FCF that is allocated to the dividend payments as there will be fewer shares outstanding. AT&T is in a position where over the next 4-5 years, they can reduce their debt, interest expenses, dividend payments, and repurchase shares. I just hope they stay the course because when $17 – $18 billion of FCF is generated, there are many levers that can be pulled.

Conclusion

It’s not easy to be an AT&T shareholder, and I continue to be bullish when others aren’t. We can’t change the past, and AT&T has provided a decade of lost returns, excluding the dividend. I think that shares bottomed when they dipped below $15 and that the current financials do not warrant a share price that is Below $20. AT&T is projected to generate between $17 – $18 billion in FCF and has the ability to manage all of its maturing debt while allocating additional capital toward buybacks or eliminating additional debt on an annualized basis.

It may take some time for sentiment to change, but I am willing to stay invested and add to my position in AT&T because the core business is growing while providing a level of profitability that can be utilized to change the market’s sentiment. I believe that management will stay the course, and if they continue to eliminate debt and deleverage the balance sheet, the bear case will look less appealing. I am long AT&T and think there is significantly more upside than downside from here, and I will collect my dividends while I wait for the investment thesis to play out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.