Summary:

- AT&T may not be the most popular firm, but it certainly delivered relative to the broader market in 2022.

- The company is healthier than it has been in a long while, and 2023 is slated to be an even better year for shareholders.

- The dividend is safe, and the firm should be considered a high-quality play for value investors.

jetcityimage

For those who follow my work closely, it should come as no surprise that I run a very concentrated portfolio. I always do my best to make sure to have 10 or fewer holdings, with my current portfolio consisting of only eight. After all, how good is your 11th best idea? But I digress. One of the holdings in my portfolio that I feel most bullish about when it comes to 2023 is telecommunications conglomerate AT&T (NYSE:T). Although viewed by some as a relic of the old economy that has failed because of some major management mistakes, the company generates significant positive cash flow and is trading at fundamentally cheap levels. Based on what data does exist today, I have no reason to believe that 2023 will be anything other than a really great year for the firm. Cash flows should rise nicely and I believe that concerns over the company’s dividend are overblown. For these reasons, I have decided to keep the ‘strong buy’ rating I signed to the stock previously.

Cash flows should improve

Heading into the 2022 fiscal year, many investors may not have thought that AT&T would finish the year looking good. But by pretty much every way imaginable, the company significantly outperformed market expectations. While the S&P 500 dropped by 19.4% during the year, AT&T, inclusive of its dividend, and adjusting for the spinoff of WarnerMedia into what ultimately became Warner Bros. Discovery (WBD), generated upside for investors of 6.5%. Given how tough the market was for the year, I consider that a massive win.

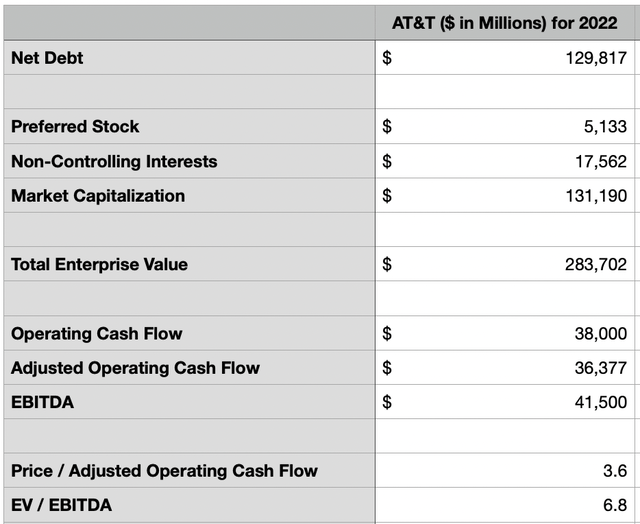

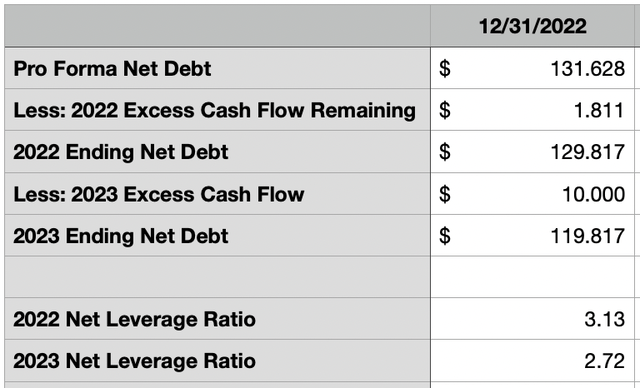

Based on the most recent guidance available, the company should report operating cash flow of around $38 billion for 2022, with EBITDA totaling $41.5 billion. About $8 billion of the operating cash flow would have gone to dividend payments, while $24 billion will have gone to capital investments, much of which is centered around capital expenditures. That will leave around $6 billion in excess cash to be used for various purposes. Based on my own assessment of the company’s results for the first nine months of its 2022 fiscal year, the total amount of excess cash that should be available for the company to use to pay down debt, net of dividends paid out and capital expenditures covered, should be roughly $1.81 billion. When factoring in other long-term liabilities onto debt, this should bring total net debt to the company down to $129.8 billion. In all, this should translate to a net leverage ratio for the enterprise of 3.13.

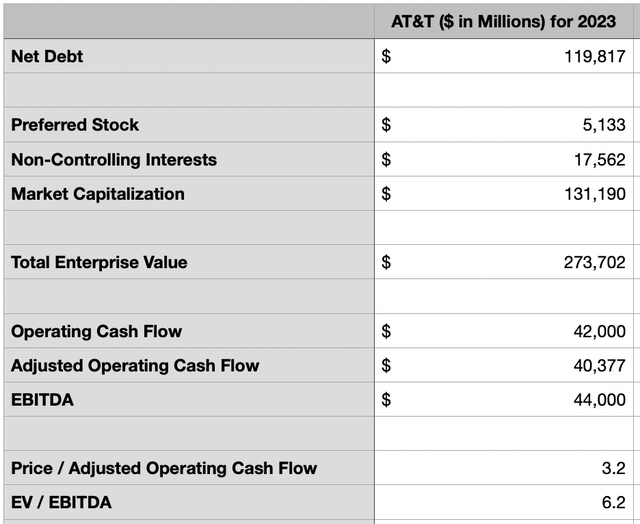

When it comes to the 2023 fiscal year, the most recent data available suggests that the company should generate operating cash flow of $44 billion. But given the downward revision in the cash flow that we saw in 2022 from the $40 billion down to $38 billion, I wouldn’t be surprised to see that number come in at $42 billion. Assuming that the company intends to keep dividends unchanged at roughly $8 billion, and factoring in another $24 billion in capital spending, we should end up with an extra $10 billion in cash for 2023. Given the company’s track record with acquisitions, just returning that cash to shareholders in the form of additional dividends, share buybacks, or some other means like paying down debt, may not be an awful idea. If the firm does pay all of that extra cash directly to debt, that would reduce net debt for the company down to $119.8 billion, translating to a net leverage ratio of 2.72.

Just the other day, another author on Seeking Alpha suggested that the loss of the NFL Sunday Ticket to DirecTV, which AT&T owns a sizable portion of, may result in free cash flow to the conglomerate falling by as much as $1 billion. In the event that some sort of pain like this does materialize, a case could be made that the extra cash flow for the company would be better used in other ways besides paying the dividend currently planned. But given the significant excess in cash already forecasted, even with a $2 billion haircut that I assigned it, I believe the probability of this is quite low. A lot of the increase in profits expected for 2023 should come from cost-cutting initiatives. Unless something has changed in the final quarter of the year, the company was forecasting $4 billion or more of a $6 billion cost savings plan to be completed by the end of the year. It’s likely that the remaining $2 billion will take place in 2023. The rest of the improvement should come from the company’s continued growth areas.

As for future growth potential, I believe that the company has plenty of opportunities at this time. As always, I remain confident in its execution when it comes to the Connected Devices operations that it has. So as to not beat the same drum to death by rehashing old arguments, I would just point you to articles on that topic that I wrote here and here. But in general, my assessment is that this is a rapidly-growing portion of the enterprise that many people often overlook and that should continue to add value for the company for the foreseeable future. In particular, it should appeal to investors who are interested in the IoT (Internet of Things) space.

We also have other mainstream areas of growth for the firm. In the first nine months of its 2022 fiscal year, for instance, the company experienced nearly one million net additions to its fiber operations. And for the same time, it experienced 2.2 million postpaid phone net additions when it comes to its 5G wireless services. When it comes to the fiber side of the firm, the company currently has the ability to serve 18.5 million customer locations. This place is on track to hit 30 million by 2025. Add in the niche FirstNet operation the company has, with wireless connections they are growing by 334,000 in the latest quarter alone, and I see no reason to be pessimistic when it comes to growth.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| AT&T | 3.6 | 6.8 |

| Verizon Communications (VZ) | 4.5 | 6.8 |

Of course, growth is only one side of the equation. The other is what price you pay for that growth. The good news for investors is that shares of AT&T look incredibly cheap at this point in time. Using data for the 2022 fiscal year, the company is trading at a price-to-adjusted operating cash flow multiple of 3.6 and at an EV-to-EBITDA multiple of 6.8. Although the EV-to-EBITDA approach indicates that the company is roughly fairly valued compared to rival Verizon Communications, the price to operating cash flow approach suggests upside of 25%. But to be fair, I would make the case that both companies look quite a bit undervalued at this time. If the estimates for 2023 prove to be accurate, shares will be even cheaper, with the price-to-adjusted operating cash flow multiple coming in at 3.2 and the EV-to-EBITDA multiple totaling 6.2.

Takeaway

In this market, it is difficult to find a company that could be accurately described as a cash cow. Add on top of that one that should continue to grow and that’s trading at incredibly low levels, and in my book, you have a clear winner. Although the picture could definitely change, I see no reason to believe that it will in a way that would materially impact the company in some negative way. So because of the stability offered and the fundamental condition of the company, I happily rate the enterprise a ‘strong buy’, and I believe that shares will likely outperform the broader market for 2023 just like they did for 2022.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.