Summary:

- AT&T Inc.’s share price has stagnated with a market capitalization of $100 billion, but the company has strong cash flow generation.

- The company’s top priorities are growing durable 5G and Fiber relationships and maintaining efficiency.

- AT&T’s core business has performed well, with growth in prepaid phone subscribers and impressive growth in its fiber business.

Brandon Bell

AT&T Inc. (NYSE:T) reported its earnings for the most recent quarter. The company’s share price has continuously stagnated, with a market capitalization of $100 billion. However, the company continues to have strong cash flow generation, and as we’ll see throughout this article, represents a valuable long-term investment.

AT&T 2023 Business Focus

The company’s business remains focused on a number of key priorities.

The company’s top priority is to grow durable 5G and Fiber relationships. These are the company’s focus areas, and it’s spent $10s of billions of capital to perform in these industries. The company is hoping to build long-term customer relationships that combine both the strength of its fiber business and cellular offerings.

The company is focused on maintaining efficiency. It’s achieved $2+ billion in incremental savings and is continuing to focus on deliberate capital allocation. This combination shows the strength of the company’s business.

AT&T Core Business Performance

The company’s core business has continued to perform well, showing its strength.

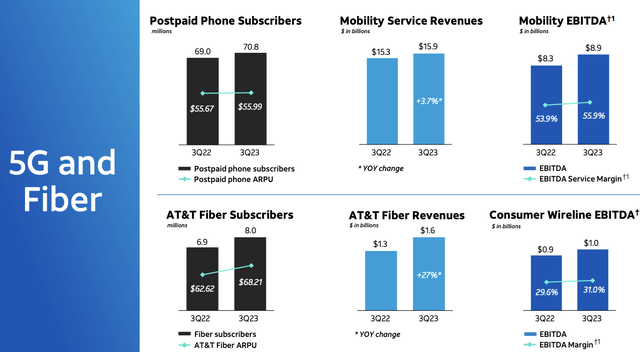

The company’s prepaid phone subscribers increased year-over-year by 1.8 million, with a slight increase in ARPU. That has resulted in revenue growing at just under 4%. Supported by strong margins, EBITDA has grown by more than 7%, to almost $9 billion in EBITDA from the business. That translates to the bottom line.

The company’s fiber business is growing much faster. ARPU was $68.21 and the company is now at 8 million subscribers, with double-digit YoY growth. Revenue grew by an incredibly impressive 27% and EBITDA grew by double-digits, also supported by strong margins.

AT&T Financial Results

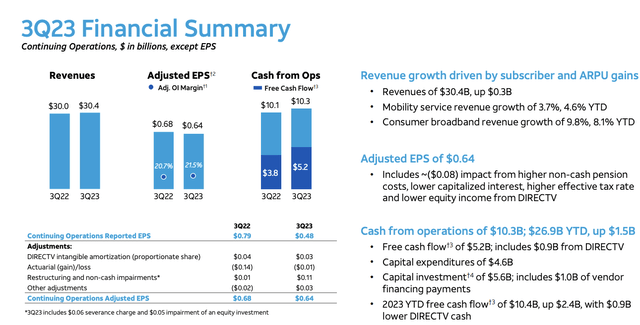

The net result of all of this was incredibly strong Q3 financial results for the company.

The company’s top-line revenue only grew just over 1%. Its adjusted EPS of $0.64 for the quarter, was a strong single-digit P/E ratio and shows the company’s financial strength. The company earned a massive $5.2 billion in free cash flow (“FCF”), supported by $0.9 billion from DirecTV. The company still spent $4.6 billion in capex.

YTD the company has earned $10.4 billion FCF, a strong showing for the first 3 quarters. The company slightly increased its FCF guidance, with guidance indicating the last quarter will be the strongest of the year. Its guidance is for roughly $16.5 billion in FCF for the year, versus its market capitalization of just over $100 billion.

The company’s net debt remains immense at just under $129 billion. The company’s guidance remains net debt to adjusted EBITDA of 2.5x in 1st half of 2025. Assuming no EBITDA growth, that means a ~$20 billion in debt reduction.

The company’s largest risk remains its massive debt load. The company’s dividend of ~7.5% is strong and manageable at $8 billion annually. The company’s FCF leaves $8 billion annualized. Given the rising interest rates, we expect rollovers for the company’s debt will be expensive. As a result, we’d like to see the company aggressively increase debt reductions.

$50 billion in net debt is the target we’d like to see. Still, regardless of how the company spends its cash, we expect long-term returns.

Thesis Risk

The largest risk to our thesis is the company’s debt load in a high interest rate environment. With 10-year yields (US10Y) at around 5%, corporate bonds are pushing the high single-digits and AT&T has a lot of them. Fortunately, the company can afford to pay off its debt as it comes due, and we’d like to see that continue, but it’s still a major risk.

Conclusion

AT&T had strong Q3 earnings, as the company is finally showing an ability to meet its FCF guidance. The company had more than $5 billion in FCF, and it’s guiding for an even stronger quarter going into the end of the year. That FCF is enough for the company to continue its strong dividend, and look at additional shareholder returns.

We’d like to see the company repay its debt as it comes due while repurchasing shares with the remaining FCF. We’d expect that to be incredibly profitable for AT&T Inc. shareholders over the long run, but the details remain to be seen. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.