Summary:

- AT&T’s stock has underperformed the S&P 500 by -17% to +11% in the past year.

- Financial metrics show significant improvement for AT&T in Q2 2023 compared to Q1 2023.

- Business is picking up and CAPEX will be coming down.

Brandon Bell

Overview:

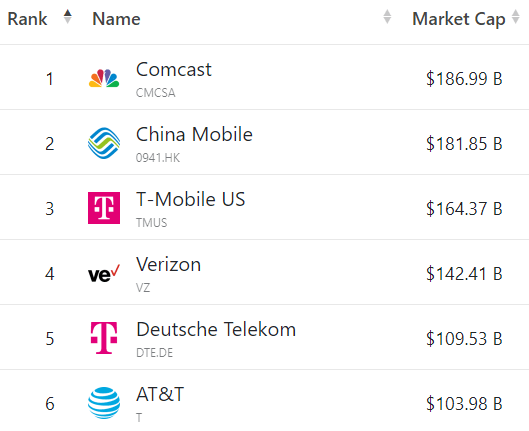

AT&T (NYSE:T) is the 6th largest telecommunications company in the world by MV (Market Value).

companiesmarketcap.com

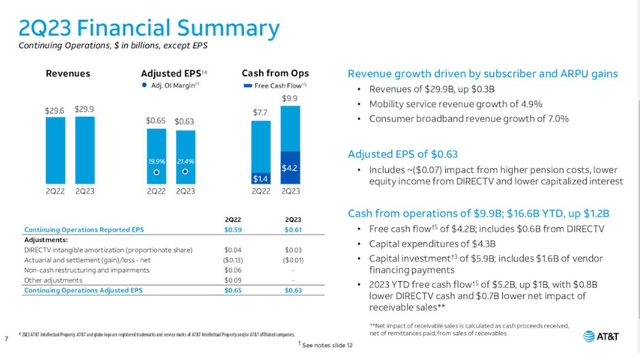

AT&T reported its latest quarterly earnings and cash flow and the results were better than expected.

AT&T

If we compare AT&T’s total return (including dividends) for the last 12 months, it has significantly underperformed the S&P 500 (SPY) by -17% to +11%.

Seeking Alpha

That indicates that it has not been a good year for AT&T.

At this point in time, the question is, does AT&T represent a reasonable potential investment return, including dividends, or should investors be on the lookout for better investment performance somewhere else?

In this article, we will look at AT&T’s prospects for the next year or two to try and determine the price direction out to 2025 as compared to the last year.

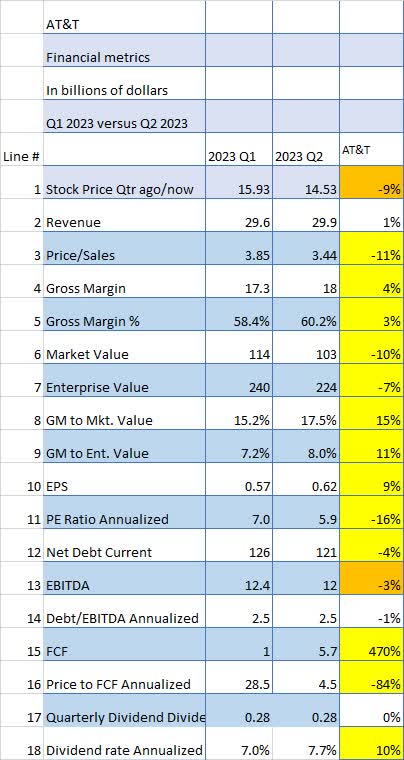

AT&T’s Stock Key Metrics

Let’s look at AT&T’s financial metrics, comparing the latest quarter’s results (Q2 2023) to the previous quarter’s results (Q1 2023) to discover what I consider to be positive investment numbers (yellow boxes) and compare them with any negative investment numbers (orange boxes).

Note that this chart is comparing quarter over quarter and not year over year like I usually do.

Seeking Alpha and author

One quick look at the financial metrics table above comparing Q1 2023 to Q2 2023 indicates AT&T showed improvement in almost every metric. I believe these results prove the doom and gloom predictions for AT&T from various sources after rather poor Q1 results were wrong or at least exaggerated.

Note that despite the rather small revenue increase of only 1% (Line 2) the Gross Margin improvement across the board (Lines 4,5,8, and 9) belies the idea that AT&T’s problems were related to modest revenue gains.

Despite the improved results, the PE Ratio (Line 11) has shrunk from 7x to 4.9x – a decrease of 16%. This could imply AT&T should be considered to be a potential turnaround candidate since the PE ratio dropped by 16% in spite of an EPS (Line 10) increase of 9%. This can also be seen in the free cash flow numbers (Line 15) which increased by around $5 billion.

Net Debt (Line 12) decreased by $5 billion and the Net Debt to EBITDA (Line 14) remained the same.

So AT&T had very positive results over the last quarter but in spite of that, the share price dropped. This could imply that AT&T’s share price has an excellent chance to turn around if they can keep results for the current quarter at least as good over the next 12 months.

AT&T’s business is not a complex, high-tech business – it’s basically a matter of blocking and tackling. In the 2nd quarter, they blocked and tackled much better.

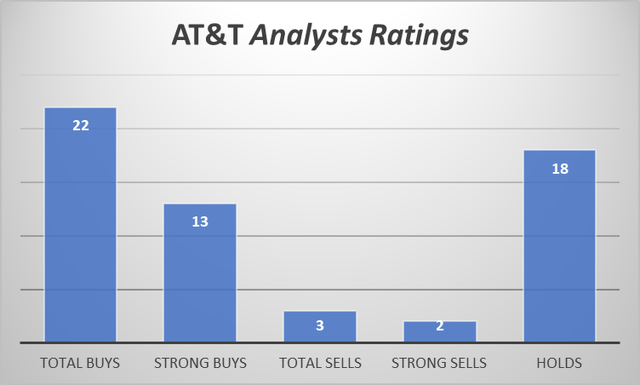

What Do Analysts Think Of AT&T?

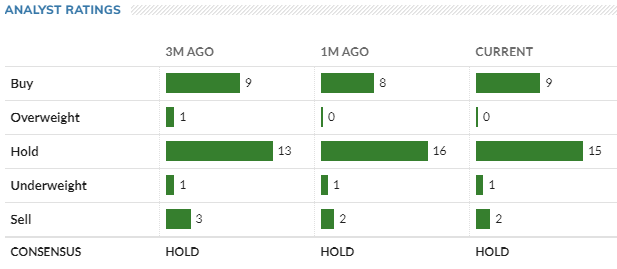

Wall Street and Seeking Alpha analysts are decidedly upbeat about AT&T with 22 Buys and only 3 Sells. Also, Strong Buys outnumber Strong Sells by 13 to 2. So analysts are upbeat about AT&T’s prospects going forward.

Seeking Alpha and author

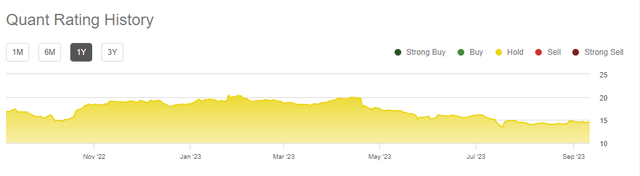

AT&T’s quant rating has been holding steady with a consistent Hold rating for the past 12 months.

Seeking Alpha

MarketWatch analysts also have a consistent “Hold” rating on AT&T in spite of a rather strong Buy rating compared to Sells. However, the large number of Holds seemed to carry the day.

MarketWatch

All in all, AT&T appears to have consistent Buy ratings from analysts but Holds from quants and MarketWatch.

So based on the above ratings AT&T seems to be a Hold.

How Does AT&T’s Price Compare To Other Companies In Its Market Sector?

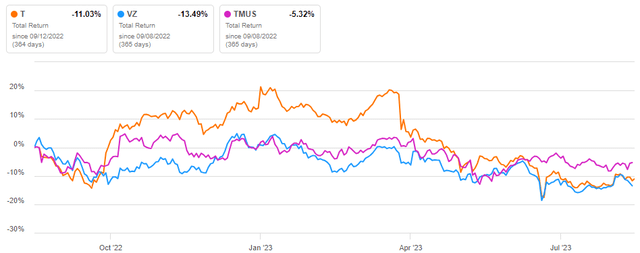

A legitimate question when looking at any stock is to compare its performance with other stocks in the same market sector. If we look at AT&T’s performance over the last year and compare it to other stocks in the telecommunications sector, we can see AT&T is right in the middle of the pack with a minus 11% return compared to Verizon’s minus 13% and T-Mobile’s minus 5%.

Seeking Alpha

This would imply the telecommunications sector has had a challenging year similar to AT&T’s. This could also imply AT&T’s recent problems are at least somewhat related to the sector in general.

AT&T’s Dividend and Share Buybacks

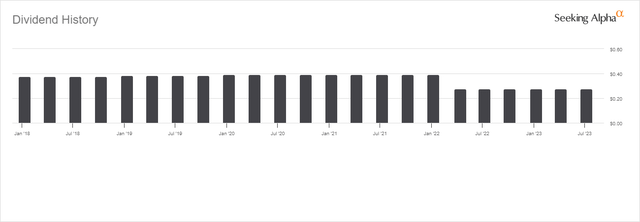

AT&T cut its dividend in 2022 and kept it at the lowered $1.11 annual level ever since.

Seeking Alpha

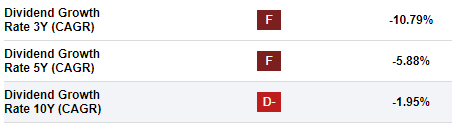

AT&T’s long-term dividend record is pretty atrocious too. It gets an F rating for the last 3 and 5-year period and a D- for the 10-year period. That’s about as bad as it gets.

Seeking Alpha

Although AT&T’s recent record on dividends is abysmal I think it is low enough now to be safe for the foreseeable future. And as the debt gets paid down over the next 18 months or so I think there will be modest dividend increases each year thereafter.

CFO Pascal Desroches. “The security of that dividend is very high,” Desroches said. “As a CEO or CFO, you only get to do [a dividend cut] once. It was the right thing to do at the time but, there isn’t going to be [any] need whatsoever [for another].” Source: Barrons

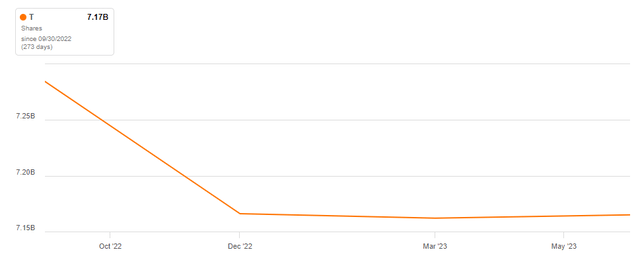

AT&T has also bought back a very modest percentage of its shares over the last year but I don’t see any significant buybacks in the foreseeable future. Debt reduction and dividend security will take precedence over share buybacks.

Seeking Alpha

AT&T’s dividend and share buyback record is lousy but the dividend may get a modest increase starting sometime in 2025. But as it stands right now the dividend is a healthy 8%.

Is AT&T’s Stock A Buy, Sell, or Hold?

Obviously, there are risks with an AT&T investment. Besides the day-to-day competitive risks, there are inflation and recession risks. Other risks such as the current lead pipe imbroglio could cause investors to hesitate even with better results.

And, of course, higher interest rates hurt businesses like AT&T which have large amounts of debt.

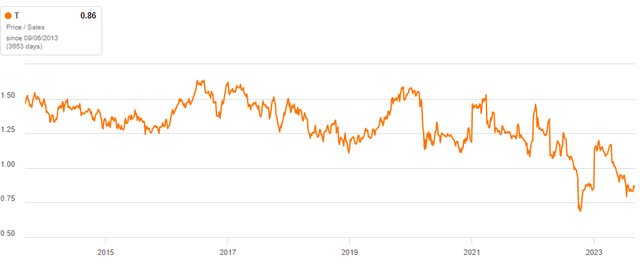

One positive point is AT&T’s Price to Sales ratio is near an all-time low for the last 10 years.

Seeking Alpha

That could be a positive sign for a possible turnaround in the share price if results continue to improve.

Here are 6 reasons I think AT&T is a good investment choice:

1. Free cash flow is estimated at $16 billion for 2023 and will allow AT&T to pay down another $5 billion in debt.

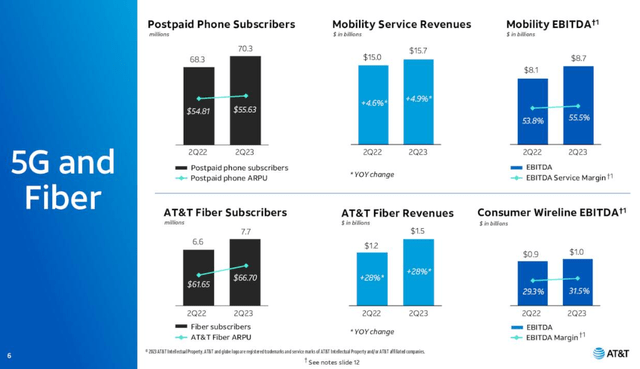

2. Results for 5G and fiber are excellent and the future is 5G and fiber.

AT&T

3. Excess CAPEX spending for fiber and 5G rollout will be coming down significantly in the coming quarters.

4. AT&T expects to have millions of 5G and fiber connections by 2025. “AT&T remains committed to deploying 5G+ on mid-band spectrum to 200 million people by year-end 2023 and to passing 30+ million consumer and business customer locations with fiber by the end of 2025.”Source: AT&T

5. AT&T’s price/sales ratio is about the lowest it’s been in the last 10 years.

6. AT&T’s 8% dividend is well covered by free cash flow.

For these reasons, I rate AT&T a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.