Summary:

- AT&T has been on a nice run over the past few months, up nearly 30%. This has caused a flurry of negative articles recently stating the run is done.

- As usual, I beg to differ! As if you didn’t see that coming! Ha!

- In the following piece, I do my best to debunk the bearish case by presenting just the facts, like Joe Friday of Dragnet.

Justin Sullivan

AT&T Buy Thesis

No matter how well AT&T (T) does, it seems like it just can’t shake the “Nattering nabobs of negativism.” This is actually a famous quote made Vice President Spiro Agnew while speaking at the California Republican state convention on Sept. 11, 1970, Agnew stated:

“In the United States today, we have more than our share of the nattering nabobs of negativism. They have formed their own 4-H Club — the ‘hopeless, hysterical hypochondriacs of history.’”

Agnew had a very acrimonious relationship with the press at the time. Yet, the phrase was actually written by White House speechwriter William Safire. I love this alliteration and choose to share it once in a while to keep it alive! No offense meant to the current AT&T bears. The point is, it seems no matter how much progress AT&T makes, the bears seem to ignore it completely and continue chanting the same negative mantras regarding AT&T that just don’t really apply any longer. Let’s get started, shall we?

The Bull case

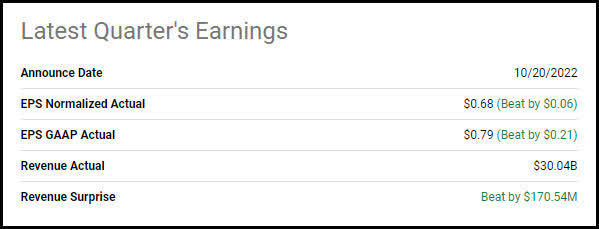

The stock is up substantially since reporting earnings on 10/20/2022.

10/20/2022 Earnings Results

Seeking Alpha

The company beat on the top and bottom lines and reiterated guidance. This came as a huge surprise to the market writ large as most were positioned incorrectly.

AT&T Current Chart

Finviz

This caused the stock to spike up parabolically over the following two weeks as shorts obviously had to cover. This was followed by prospective dividend and income buyers coming off the sidelines. This was in order to lock in the substantial yield before it got away from them. I, on the other hand, had made two large buys prior to earnings as I saw AT&T as a “point of maximum pessimism” buying opportunity. Let me explain.

Point of maximum pessimism buying opportunity

I have been in the market for decades. After graduating from college with honors in accounting, I began my career with Ernst & Young as an auditor in 1994. This is when I first began investing in stocks. Having just graduated college, I was used to studying for tests. I applied this strategy to investing. I began studying and reading up on all the great investing icons to learn their approaches. One of my favorites is Sir John Templeton. His most famous axiom was “Buy at the point of maximum pessimism.”

This means in order to have the best performance, you need to go against the crowd and buy when it seems the entire market has turned against the stock.

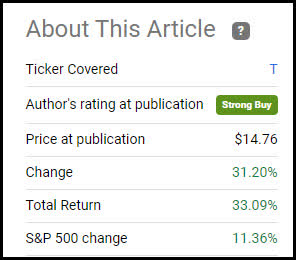

Seeking Alpha

That is what I did with AT&T just before earnings were announced. The negative narrative was so intense, I posit many were short as well as many weak and strong hands had hit the sidelines. I took a chance and decided this could be the point of maximum pessimism and bought a tranche of AT&T for my Seeking Alpha Marketplace service. AT&T is now one of my biggest winners for the service. I wrote an article at the time detailing my Buy called “AT&T: Be Fearful When Others Are Fearful.” The stock is up over 30% from my buy call. One caveat I would like to add is you must have unrelenting courage in your convictions and a high level of risk tolerance when you make this type of buy. If I have any doubts regarding my buy thesis, I always wait to see signs of a trend reversal prior to opening a new position. Now, since the stock is up 30%, the bears are back on the war path stating the run is done. They state AT&T’s rally went too far too fast and the stock is due for a pullback. I say, oh contraire mon frère, the run has just begun. Here is why.

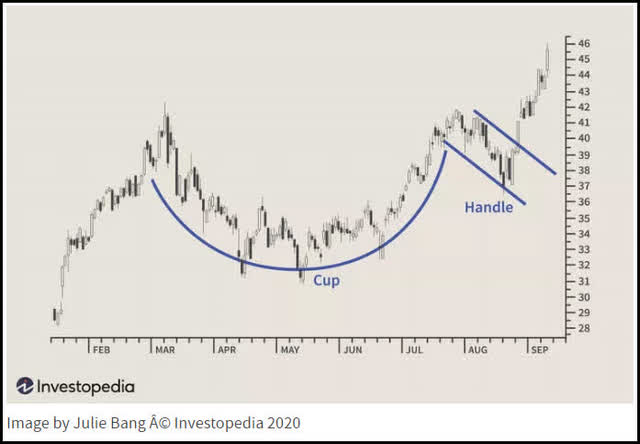

Classic Cup & Handle Formation

I have heard a lot of people say technical analysis is worthless. Well, I can tell you from decades in the market, it’s not. There are several technical setups that portend good things for a stock going forward. One of which is the Cup & handle formation which usually occurs just before the stock is about to take another leg up. I have seen this happen time and time again. AT&T’s stock just fulfilled this formation.

AT&T’s Cup & Handle

Finviz

The thing about technical analysis is its just a reflection of the current status of the bulls and bears at battle.

Cup & Handle Explained

Investopedia

American technician William J. O’Neil defined the cup and handle (C&H) pattern in his 1988 classic, How to Make Money in Stocks, as follows:

“As a stock forming this pattern tests old highs, it is likely to incur selling pressure from investors who previously bought at those levels; selling pressure is likely to make price consolidate with a tendency toward a downtrend trend for a period of four days to four weeks, before advancing higher. A cup and handle is considered a bullish continuation pattern and is used to identify buying opportunities.”

What adds to the bullish narrative for me is the fact that the stock has also spent the last couple of months consolidating at the recent highs. Now, let’s turn out attention to the fundamental reasons that will potentially drive the next leg up. Let’s take a look at the Seeking Alpha Quantitative metrics for the stock.

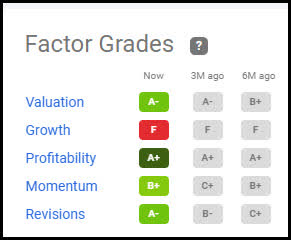

Seeking Alpha AT&T quant grades

Seeking Alpha

Seeking Alpha’s quantitative metrics are a good way to get an unbiased point of view regarding the stocks empirical results. AT&T gets high scores in every category besides growth. Let’s dig in to the details a bit further.

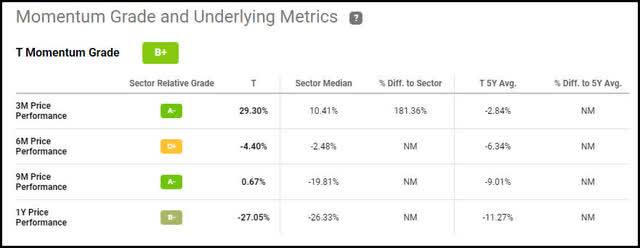

AT&T Momentum grade B+

Seeking Alpha

It’s easy to see why AT&T scores high in regards to momentum as it has outpaced its peers by 181%. AT&T is up 30% on the quarter while the rest of the sector is up 10%. Now let’s take a look at profitability.

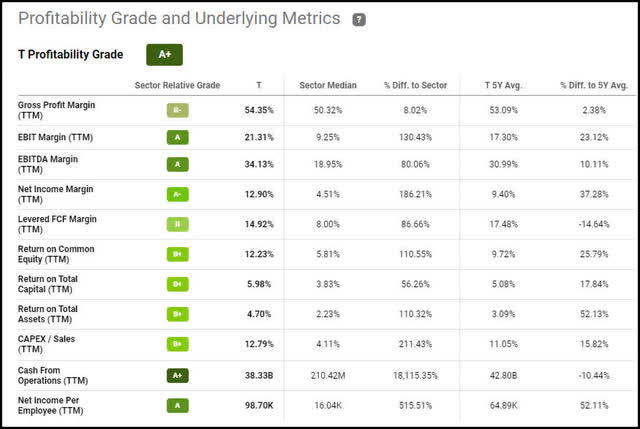

AT&T Profitability grade A+

Seeking Alpha

The company is firing on all cylinders when it comes to profitability. The one factor I see that really gives me a warm fuzzy is the A+ score for the trailing two month cash from operations outpacing the sector by leaps and bounds. This is really where the rubber meets the road, so to speak. Now let’s take a look and see where the company stands in regards to valuation.

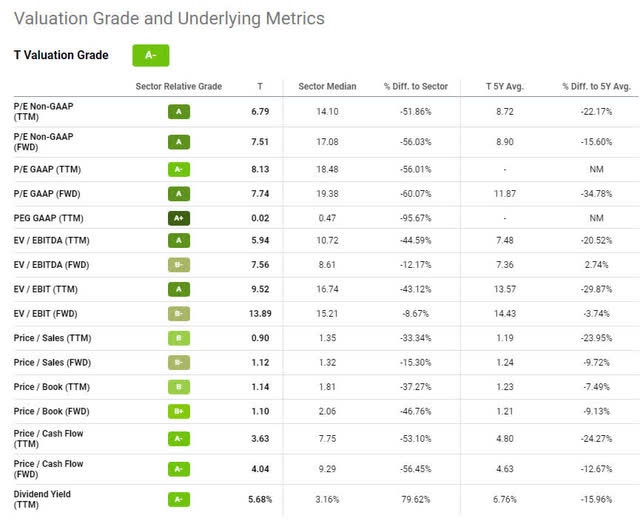

AT&T valuation grade A-

Seeking Alpha

Now, if you read the latest flurry of bearish articles on AT&T, which I have, they all say AT&T has hit the wall in regards to valuation for a variety of reasons. Yet, the fact of the matter is, AT&T is trading at a 50% discount to the sector and a 22% discount to its 5 years historical average. This means there is potentially 40% upside in the stock if things play out in AT&T’s favor. On top of this, the stock has been consolidating at this level for the past two months and just recovered from a substantial dip. I don’t see market participants as being particularly “greedy” at this time or AT&T’s “future at stake” at this particular juncture as other bearish authors would have you believe. The one quantitative metric that registered as negative was regarding growth. Let see why.

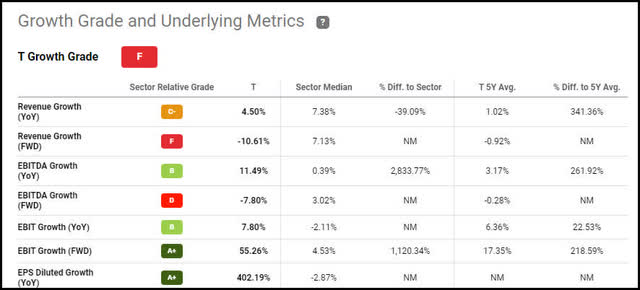

AT&T growth grade F

Seeking Alpha

I usually agree with the quant scores. Nonetheless, I have to say giving AT&T an F on growth doesn’t make a lot of sense to me. If you look closer EBIT and EPS growth both score an A+ and are expected to be up 55% and 402% respectively. Plus, researching the latest earnings report transcript and recent news, the company appears poised to do very well in regarding to expanding the fiber footprint.

CEO John Stankey stated on the last conference call:

The demand for fast and reliable 5G and fiber is at an all-time high, and our disciplined and consistent go-to-market strategy continues to resonate. In addition, as we begin to lap investments we need to optimize our networks, improve our distribution and transform our business, we’re now seeing the benefits of our growth fall to the bottom line, as we suggested they would and as evidenced by accelerating adjusted EBITDA growth.

Further, AT&T looks poised to vastly increase its fiber footprint as well. According to Seeking Alpha News:

“AT&T (NYSE:T) shares rose in late trading on Wednesday as the telecom giant’s finance chief said the recently announced joint venture for fiber would give it a chance to “experiment.”

Speaking at Citi’s investment conference, AT&T (T) CFO Pascal Desroches said the venture with BlackRock (NYSE:BLK) would allow the Dallas-based telecom to go beyond its region.

Announced in late December, the joint venture, known as Gigapower LLC, is with BlackRock (BLK) Alternatives, through a fund managed by its Diversified Infrastructure business.

Gigapower LLC will provide a fiber network to internet service providers and other businesses across the U.S. and will service customers outside of AT&T’s (T) traditional 21-state footprint.

AT&T (T) previously said it will be incremental to the company’s more than 30M fiber locations by the end of 2025.”

These developments have led to a majority of Wall Street analysts upgrading the stock and revising their estimates higher.

AT&T revisions grade A

Seeking Alpha

AT&T score an A in regards to revisions with 22 upward revisions vs 3 down for EPS and 13 upwards versus 7 down for revenue. To top it all off, Wells Fargo just named AT&T its top wireless pick for 2023. According to Seeking Alpha news:

“AT&T (NYSE:T) rose moderately Tuesday alongside an upgrade to Overweight at Wells Fargo, where they’re getting defensive-minded with telecoms ahead of a “choppy” 2023.

“We view the telecom sector as a relatively defensive play going into 2023, despite some growth challenges ahead,” analyst Eric Luebchow said, noting subscriber growth will remain “elevated” vs. historical levels but still slow year-over-year.

Fiber-to-the-home construction should grow more than 20% even amid hurdles in inflation and rising cost of capital, and fixed wireless will likely keep taking broadband share (though at a moderating pace), he said.

But AT&T (T) becomes the top wireless pick for the year, with upside to some lower expectations in free cash flow and earnings before interest, taxes, depreciation and amortization, he notes, along with an improving balance sheet that should “open up share repurchase optionality” of as much as $15B over the next few years.

Its valuation also looks “reasonable” particularly compared to the much more challenged Verizon (VZ), facing consumer phone declines amid rising rates.”

What strikes me about this statement is this guy is more bullish than I am! Ha! I like his insight that the extraordinary growth in EBITDA free cash flow, which I noted earlier, could lead to $15 billion in share repurchases in the coming years. Nice! Now let me put the never ending argument that AT&T has a debt issue to bed.

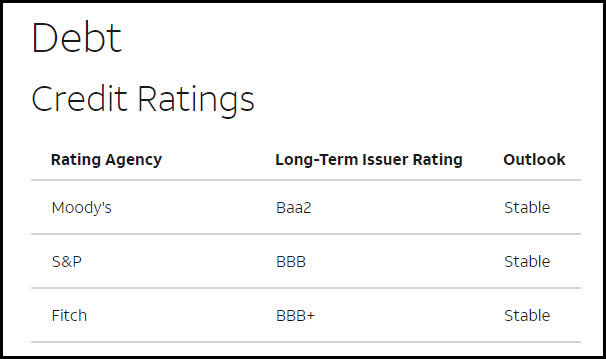

Detailed AT&T debt analysis

I’ve got to say, regarding the analysis of AT&T’s debt, most of the analysis is lacking any depth. This may be due to lack of effort by the bears, or the fact that if you do dig into it a little deeper than just the headline numbers you find that the company is actually doing a fantastic job of managing the debt. In fact, all three ratings agencies have the debt rated as stable. Just FYI, that’s good.

AT&T

The reason why they have it rated as stable is twofold. If you actually take the time to review the detailed debt maturity schedule, you will see that the vast majority of the debt is fixed not variable. So all the warnings that AT&T’s debt service is set to substantially increase due to rising rates is essentially hot air. What’s more, a majority of the debt doesn’t come due until after 10 years and stretches all the way to 2097. For those of you weak at math, that equates to 74 years out! I will be long gone by then! Ha! You can review the actual debt schedule here for yourself. Now let’s review the most important part of the investment, the dividend.

AT&T dividend review

I saved the best and most important aspect of an AT&T for last, the Dividend.

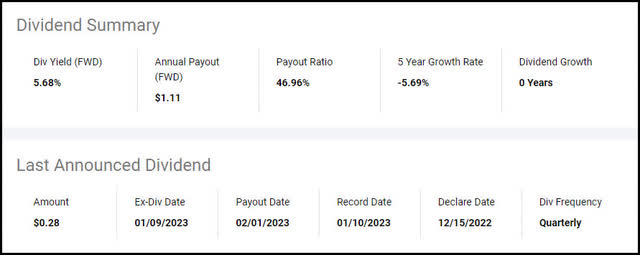

AT&T dividend summary

Seeking Alpha

As you can see AT&T pays a substantial dividend with a healthy 5.68% yield. What’s more, the payout ratio of 46.96% allows me to sleep very well at night. Seeking Alpha’s quant analysis regarding the dividend is mixed.

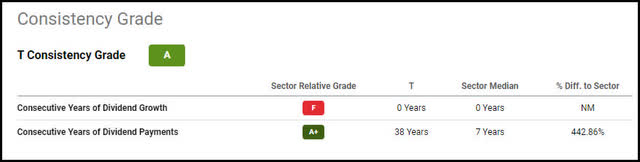

AT&T dividend grades

Seeking Alpha

The company scores high in regards to yield and consistency. Yet, falls short when it comes to safety and growth.

Seeking Alpha

Digging in a little deeper, the positive is the company has paid a quarterly dividend every year for the past 38 years. Think about it, this means AT&T did not stop paying a dividend through the 2000 dot com or 2008 housing busts. That says something. Yet, they did just cut the dividend in half when they sold off the Time Warner assets. I say they rightsized it based on the fact they sold off have the earnings as well. Yet, others state a cut is a cut regardless. I will concede that point. Nevertheless, I feel the dividend is very safe at present. Now let me tie a bow on this piece.

Investor takeaway

AT&T has been consolidating for the last two months and appears to be setting up for another leg higher technically. The company is firing on all cylinders fundamentally with EBITDA free cash flow expected to growth substantially going forward. The company just signed an awesome deal with BlackRock that will expand their fiber footprint substantially beyond their current 21 state footprint. With the 5.68% yield still very attractive compared to its peers, I’d say it’s time to pick up a few shares before the stock takes another leg up. I am adjusting my 12-month price target from $21 to $25 based on the recent developments. This implies another 30% upside from here making for an excellent total return play. One final point. AT&T makes for a nice safe haven play with a beta of 0.59. This means the stock is approximately half as volatile as the market writ large. That is helpful for those with a low risk tolerance profile. Those are my thoughts on the matter. I look forward to reading yours!

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join the #1 fastest growing new dividend income service! Our 6% SWAN and 12% High Yield Income Portfolios are substantially outperforming the market

We have opened up an addition 50 Charter memberships at a legacy rate and they are going fast! We have 10 FIVE STAR reviews in the first two months!

~ Quality High Yield Income – Current Yield – 12%

~ SWAN Quality Income – Current Yield – 6%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).