Summary:

- AT&T Inc. had a successful quarter and year, beating raised guidance and putting controls in place to lower downside risk.

- The market focused on “weak guidance” compared to expectations, but upside surprises are likely to result when management knows how to play the guidance game.

- AT&T management is addressing challenges and making progress, with the decline of legacy businesses expected to be less material over time.

- The pension liability transfer counts as eliminating liabilities just like a cash payment.

- The growing businesses appear to be doing just fine. That augurs well for the future of AT&T Inc.

Bloomberg/Bloomberg via Getty Images

AT&T Inc. (NYSE:T) just closed on a very successful quarter and year. Management noted during the conference call that guidance was raised, and management beat the raised guidance. But the market has not realized that this management appears to know how to play the guidance game while putting controls in place to lower downside risk.

Therefore, instead of focusing on more upside surprises in the future, the market focused on “weak guidance” compared to expectations. This means that there is still an asymmetric return on the stock in the future. The downside is likely fully priced in, even though the stock overall has been slowly rising from its lows. Meanwhile, upside surprises are likely to result in a higher stock price valuation in the future as management builds investor confidence in the guidance given.

Good management tends to surprise on the upside. This is more and more looking like good management that the market will appreciate in the long-term. The Q4 conference call listed in several places all the challenges management overcame to deliver the guidance (and then some).

“We additionally completed an $8 billion pension liability transfer through the purchase of insurance annuities last spring. And we’ve done all of this despite overcoming meaningful declines in the legacy Wireline part of our business.”

This quote from Pascal Desroches, Senior EVP & CFO, gives some idea of the progress that was needed to be made while meeting guidance. Transferring the liability is every bit as good as repaying debt by using cash. The name of the game when it comes to investment grade is to get liabilities down as part of a risk reduction expected for investment grade. Clearly that is exactly what management is doing.

But more importantly, current management found a fair number of things (some of which are later detailed) that needed to be corrected. These items are now being addressed throughout the company. In the meantime, management now feels that enough progress has been made to forecast improvements that can be seen by the market.

Market Issue With Guidance

The other issue is that management has legacy businesses like old-fashioned landline phones and legacy business that is primarily used for cash flow. This business is in decline. But it is not going to be a big crash and then no more business. Therefore, the cash flow generated by these legacy businesses can be used to invest in the growing part of the company.

The net growth is what investors see. I personally have trouble with “weak” guidance as an issue when it is known that there are legacy businesses in decline. That decline is such that the growth of the other businesses will overtake the declining businesses (in terms of significance) to the point that the legacy business decline will not be material. Therefore, the focus here needs to be on the growing businesses and how long that growth with last. Overall, “weak” growth guidance is actually a fading issue.

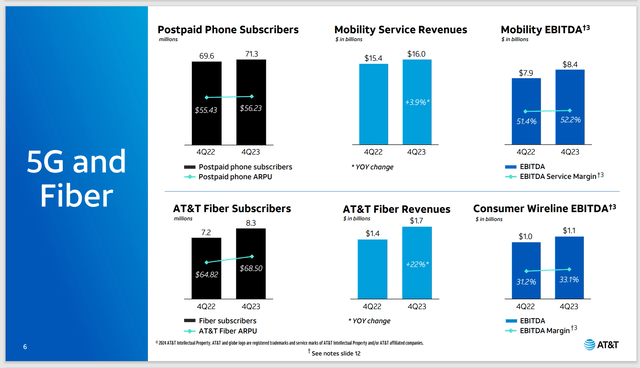

AT&T 5G & Fiber Growth Comparisons with Profitability Comparisons (AT&T Fourth Quarter 2023, Earnings Conference Call Slides)

The company focuses on the growth, with this slide in particular to show that they are growing, while implying “there is more growth where that came from.” For a large company, the growth rates shown above are significant.

There is some worry about the large capital budget. But that is not unusual for a company that has been refocused after a bunch of divestments. There is often a catch-up period that will take time.

Interestingly, there were a lot of questions about value-added services as well as the ability to raise rates. Left unstated is that this is actually a very technology-sensitive business. Cell phones, alone, are rapidly evolving. So, the technology needed to handle the data generated by cell phones needs to evolve as well. There was no such thing as texting, for example, when I was growing up. So, the questions really miss the point that the future is likely to bring all kinds of things we just do not foresee that are likely to begin as value added and then take the product development through to generic. However, Mr. Market does not bet on things that cannot be seen and are not certain. Hence, the actual conference call questions.

The Cash

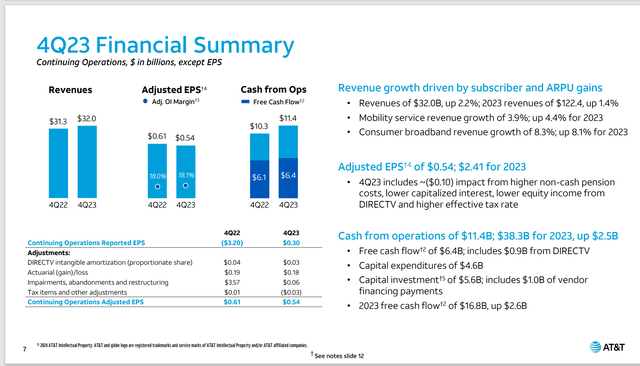

What investors want, after all, is cash results, and this management is getting those cash results.

AT&T Summary Financial Fourth Quarter Results (AT&T Fourth Quarter 2023, Earnings Conference Call Slides)

Management did guide to slightly less dependence upon the fourth quarter for much of the cash flow and free cash flow. However, the pattern of a weak cash flow (because it is loaded with payments) is going to probably be the new cash flow pattern for the foreseeable future.

Last year, Mr. Market “had an irrational reaction” over the first quarter cash flow and free cash flow results. Investors may want to see if that happens again because that is likely to be an entry point to initiate a position if the market has that same reaction. As I noted in a previous article, Verizon Communications (VZ) has long had this cash flow pattern. In the eyes of the market, this is ok for Verizon, but it is not ok for AT&T. One of those will change over time.

What should be clear to investors is that this management now gives conservative guidance in the hope that guidance can be raised throughout the year unless a whole lot of unfavorable events happen. That should demonstrate somewhat better financial controls and business strategy controls than existed before the current management became in charge.

Summary

Properly managed, AT&T should be a giant cash flow machine. But that is not going to happen overnight. Clearly, the company lost its focus for some time and needs to catch up. That will affect the capital budget until the “catch up” has sufficiently done what it is supposed to.

In the meantime:

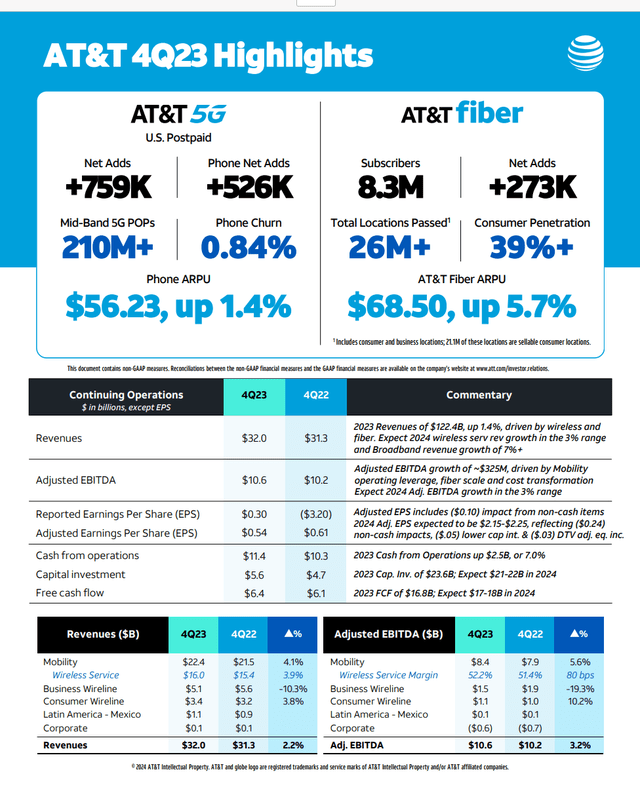

AT&T Summary Of Fourth Quarter 2023, Results (AT&T Summary Slide Fourth Quarter 2023)

It literally took years for management to get this far because large companies do not turn around overnight. Therefore, that growth rate guidance shown above will likely increase slowly.

There are two major reasons for that. The first is that the legacy businesses will slowly decline in overall importance to the company result. But that means they will still impact company results in a negative fashion as they shrink.

The second major reason is that management is working to grow the business. That likely means there will be an increasing growth rate to the higher single digits in the future. When that is combined with the dividend, the likely total rate of return will be in the low teens.

There are going to be new frontiers for this service. My new car, which is about to turn one year old, connects to my cell phone. The old car did that as well. Both cars have programmable chips to optimize operation. But it points to the expanding use of computer chips in cars, combined with the ability to update those chips without needing a service appointment with your favorite repairman. Industry carriers will be getting the information about the upgrade to the car. I am sure there are more frontiers to be conquered than I can think about.

The stock remains a strong buy on ever-growing corporate growth prospects as technology continues to evolve. There is always the risk that technology stops marching forward. But right now, that risk appears to be very small. In the meantime, what was a landline company is now very much a technology company with a bright future. Probably a future possibility is that the whole industry goes wireless to a far greater extent than we can imagine now.

For the time being, the AT&T Inc. turnaround prospects appear decent, as this issue continues to evolve towards growth and income play. The debt ratio is coming down as management “whips the company into shape.” There is evidently still a lot of work to be done. But this AT&T Inc. management is accomplishing what it set it to do.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.