Summary:

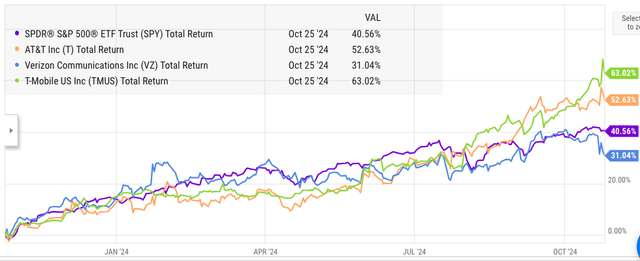

- AT&T stock has shown total returns of close to 50% in the last year after bottoming out in mid-2023, while S&P 500 has shown 40% in the last year.

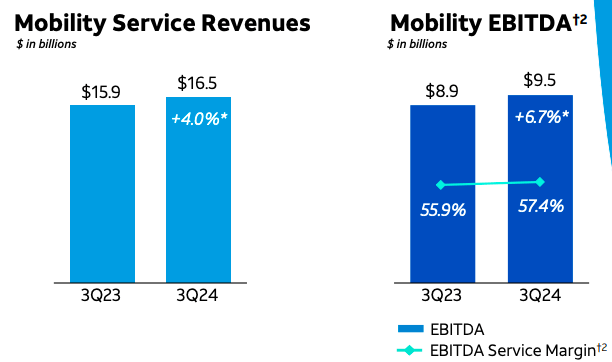

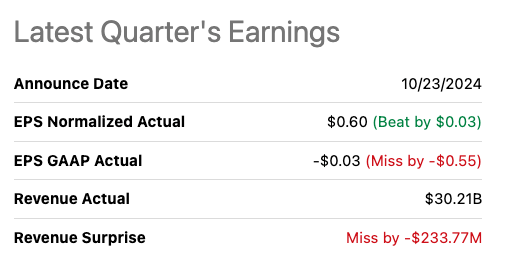

- While the EBITDA margin improvement is promising, we should also look at the revenue decline, which did not meet the consensus estimate.

- T isn’t out of the woods, and the current bull run can easily reverse if the next few quarterly numbers do not meet the expectation.

- The enterprise ratios for the stock are 10% higher than the historical average, making it difficult for the stock to continue the current bull run.

jetcityimage

AT&T (NYSE:T) stock has regained some of its lost lustre after showing close to 50% total returns in the last year. However, it is important to put this number in perspective by comparing it with the 40% total returns of S&P 500 in the last year and close to 60% returns by T-Mobile (TMUS) in this period. The recent earnings results have been mixed, with AT&T missing revenue targets. The management needs credit for cutting extra costs, which helped improve EBITDA margin in the mobility segment to 57.4% from 55.9% in the year-ago quarter. However, we saw another quarter of revenue decline at $30.2 billion, which missed the estimates by $233 million. In the previous article, it was mentioned that the company continues to show red flags in several key metrics. The stock has outperformed S&P 500 in the last few months, but this has also made it more pricey compared to its historical average valuation multiples. The enterprise ratios which include the massive debt pile of the company shows that the stock is over-priced compared to recent historical median values.

AT&T has put some of the worst-case scenarios behind it, but the company is still reporting very poor revenue growth potential. If it continues to miss the revenue estimates for another one or two quarters, the sentiment on Wall Street could change significantly. The EPS projection for the fiscal year ending 2026 is $2.36 with low single-digit growth in the next two years. At 5% dividend yield, the stock does not look as attractive when the fundamental growth estimates are very low.

Putting things into perspective

AT&T’s recent surge has improved the sentiment towards the stock and led to many up ratings on Wall Street. But it is very important to compare the stock trend in the last year with that of the broader market and its peers. Rising tide lifts all boats seems to be a perfect quote for recent AT&T performance. Bullish S&P 500 performance in the last year has also helped AT&T. Over the last year, AT&T reported total returns of 52% compared to 41% by S&P 500.

The telecom sector has performed well compared to the broader index in the last year after hitting a bottom in mid-2023. While we look at company-specific issues of AT&T, we should also look at the support it has received from the broader trend.

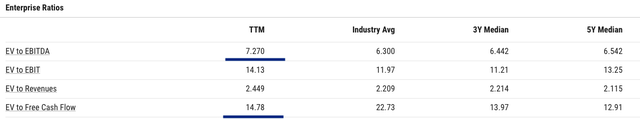

AT&T has a massive debt pile, which increases the importance of the enterprise valuation multiples for the company. In terms of enterprise value, AT&T’s valuation ratios have moved ahead of the median numbers for the past 3 years and 5 years. The EV to EBITDA ratio is 7.2 compared to 6.44 median value in the past 3 years and 6.54 median value in the past 5 years. Similarly, the EV to FCF ratio is 14.78 compared to 13.97 median value in the past 3 years and 12.9 median value in the past 5 years. In the recent earnings, AT&T missed the key revenue estimates, which puts greater pressure on the multiples. The current valuation multiple also reduces the possibility of further upside potential in the stock unless the company is able to deliver very good numbers in the next few quarters.

Positives and negatives

The recent earnings showed some improvements in AT&T’s performance. The EBITDA margin for mobility segment improved from 55.9% in the year-ago quarter to 57.4% in the recent quarter. This margin expansion increased the EBITDA by close to $0.6 billion from the year-ago quarter. At the same time, the mobility service revenue has also increased from $15.9 billion in the year-ago quarter to $16.5 billion, or 4% YoY growth.

Company Filings

AT&T has launched an aggressive cost-saving program, and the company hopes to save billions in this program. This will inevitably help improve the margins over the next few quarters. The management is showing discipline in capex and the forward projections show the lower need for investments.

However, despite these positives, AT&T has not been able to meet the revenue estimates. The company missed revenue estimates by $233 million and reported YoY revenue decline. Some of the blame could be due to the macroeconomic situation, but the forward estimates are also not positive. Even if inflation comes down significantly, we might not see a major uptrend in AT&T revenue numbers.

Seeking Alpha

Lower interest rate environment and forward EPS

The Fed is expected to announce another 50 bps rate cut in November. The lower interest rate environment should help AT&T as consumer sentiment improves. We could also see a faster debt reduction program from AT&T, which should help improve the sentiment towards the stock. However, the forward revenue and EPS projections continue to be very modest. AT&T is expected to show a mere 1.5% YoY revenue growth in 2025 and 2026, after barely growing revenue in 2024.

Seeking Alpha

The expansion of the fiber business will take some time to meaningfully impact the revenue growth numbers.

Seeking Alpha

In this situation, the long-term returns potential of the stock is dependent on the ability to move the valuation multiple. AT&T’s PE ratio is 12.5 which is low compared to the broader S&P 500 index but at a reasonable level compared to the historical average of the company. The stock is close to $22 and a push to $25 seems difficult unless we see some very good numbers from the company in the next few earnings. AT&T’s dividend yield is 5%, down from 7.5% a few months ago, which reduces the attraction of the stock for yield hunters. The Fed rate cut is certainly a positive for the company, but it does need to deliver better numbers to support the current bull rally.

Risk to the bearish thesis

AT&T is aggressively cutting costs in order to make the company leaner. The company works in a mature industry that does not have many growth options other than acquisitions. The management can only improve the key margin and EPS metrics by making the company leaner and being more frugal. We have already heard of the massive cost-cutting drive undertaken by the company, and it wants to cut another $2 billion by 2026. These cost savings will eventually trickle down to give better margins to the company.

YCharts

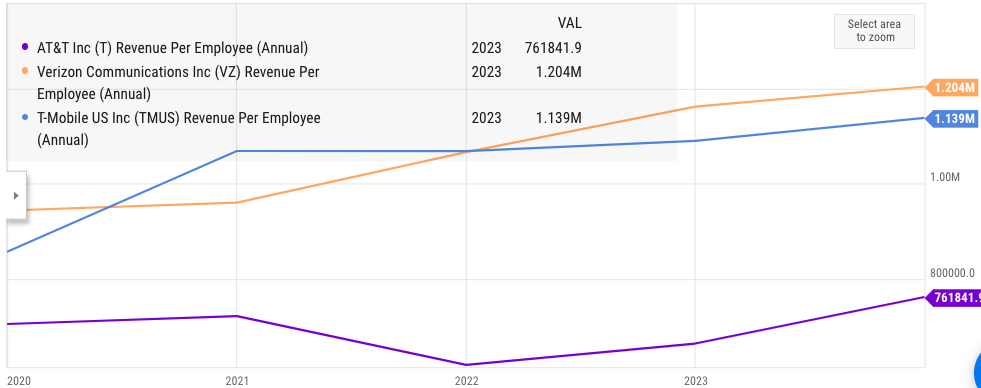

AT&T is still trailing Verizon (VZ) and T-Mobile in terms of revenue per employee metric. AT&T’s $0.76 million revenue per employee is significantly lower than $1.2 million revenue per employee for Verizon and T-Mobile. This shows that AT&T might be a bit bloated and there is room for cost-cutting. This gives the management a great opportunity to reduce the headcount.

Even a few basis point improvement in margins could significantly improve the EPS trajectory in the next few quarters, which can boost the sentiment towards the stock. Together with a macro tailwind due to rate cuts, this can help the company beat estimates.

However, investors would need to be cautious about further bullish momentum as the stock is already quite high compared to historical average. The company also has a massive debt load, and it will still take a few more quarters before it reaches tolerable levels.

Investor Takeaway

AT&T stock has seen a massive bull rally in the last year. The performance of AT&T stock has also closely tracked T-Mobile, which might indicate that this rally is not solely due to company-specific issues. The company continues to miss revenue estimates, which is certainly a negative signal for the near-term upside in the stock.

The dividend yield is close to 5% which might reduce attraction for income investors. AT&T’s enterprise ratios are more than 10% higher than the past 3 to 5-year median value. This limits the ability to deliver additional bullish momentum. The forward EPS projection shows low single-digit growth. Any further rally in the stock will only come from multiple expansions, but the stock is already reasonably priced compared to its historical average. This reduces the upside potential in the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.