Summary:

- AT&T Inc. faces challenges in delivering stable shareholder value due to a poor historical track record, lower 5G penetration, weak positioning in the 5G market, and a heavily debt-saturated balance sheet.

- There are three reasons why T stock could deliver sound returns in the foreseeable future: extremely cheap valuations, improving free cash flows, and enhanced sustainability of the dividend.

- The combination of improved cash flows, balance sheet optimization, and a high dividend yield could lead to a justified multiple expansion and potential stock price appreciation.

Brandon Bell

As some of my followers have probably noticed, I hold a rather bearish stance against AT&T Inc. (NYSE:T). I do not see sufficient evidence from which to justify a short position, but there are a couple of elements, which inherently weaken T’s prospects of delivering stable and acceptable levels of shareholder value; such as:

- Poor historical track record in terms of the dividend, management of the balance sheet, and incremental returns relative to the assumed debt load.

- Lower penetration of 5G use cases, which implies two things: (1) unrealized potential of 5G investments; (2) potential CapEx pressure to successfully monetize the already made investments in 5G space.

- Weak positioning in the 5G market, where T lags behind the closest peers on 5G coverage and experience; thus making it even harder to capitalize on the potential growth opportunities.

- Heavily debt saturated balance sheet, which not only introduces elevated financial risk but also puts a drag on T’s ability to allocate capital in a value-accretive manner.

In my previous article back in August after Q2, 2023 results were issued, I assigned a rating hold due to stagnant earnings profile, but sufficient underlying cash generation, which could easily accommodate the relatively attractive dividend (at that time yielding 7.5%). In other words, the Q2 did not deliver any surprises to investors that could justify a more bullish view. At the same time, the data points (e.g., dividend coverage, debt financing activity, earnings growth) remained solid for dividend-seeking investors.

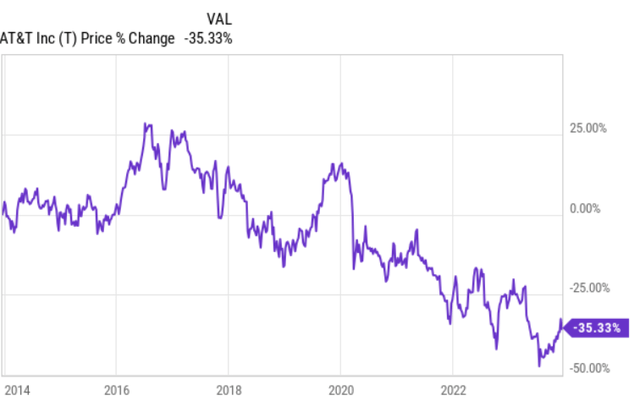

Moreover, if we look at the 10-year historical movement of T’s share price, we can see that the Company has been facing secular challenges to deliver great shareholder returns.

3 Reasons why T could deliver sound returns over the foreseeable future

While I still do not view T as an investment, which I could buy and just hold for a very long time, I think that currently the odds seem to be stacked in favour of experiencing an acceptable level of performance over the course of 2024 and 2025.

So, looking at T tactically, it could very well turn out to finally reward investors with some decent total returns.

Here are three main reasons why this is the case.

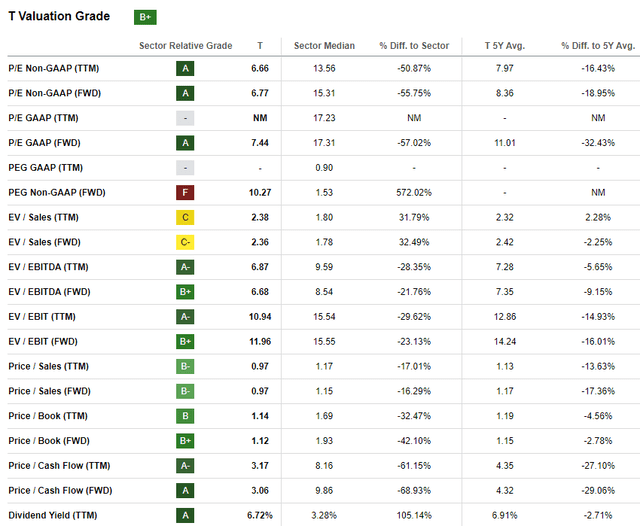

#1 Extremely cheap valuations

Almost all of the valuation metrics for T look very impressive.

Currently, T trades below the sector average and most importantly below its 5-year average. One might argue that T has always been valued quite cheaply and that this situation of attractive multiples is nothing new.

True. Yet, there are two aspects, which make the current status a bit different.

First, up until now T has been constantly assuming more and more debt, thus injecting higher financial risk in the books, which has, in turn, justified aggressive discounts. Given that T has laid out a concrete ambition to de-lever to 2.5x of Net debt to EBITDA by Q1, 2025, the underlying financial risk should gradually come down, thereby reducing some of the added risk premiums that are associated with elevated financial risk.

Second, the fact that T trades ~30% below its 5-year P/CF average is very interesting, especially factoring in the pandemic year and the period of constant assumption of incremental debt. The 5-year comp covers also a period of surging interest rates. Now when T is set to optimize its balance sheet, stabilize CapEx spend and go into a more certain and accommodative interest rate environment, it seems highly unlikely that the prevailing spread remains as wide as it is now.

#2 Improving free cash flows

One of the main reasons behind previous dividend cuts was the increasing need for massive CapEx that could not be accommodated by the growth in the underlying cash flow generation.

If we look at these two components now, the future outlook looks great in the context of so depressed valuations.

As T is bouncing of from yet another strong quarterly earnings, the market has started to calibrate improved earnings for 2024 and 2025 as well. The market now expects 2.1% and 0.7% EPS growth for 2024 and 2025, respectively, despite the already pre-communicated write downs (non-cash expense) and higher financing costs stemming from some debt rollovers.

In addition to that, T has recently communicated that its CapEx spend will stabilize at $21 – 22 billion, which implies a high double-digit FCF yield.

According to John Stankey, CEO of T, per UBS Global Media & Communications Conference call:

And we’re going to see, as I said earlier, a tapering of some of our capital investment, will be in the 21 to 22 range and — as opposed to 24.

Plus, according to Pascal Desroches, CFO of T, per Oppenheimer 5G Summit, the Company has managed to improve the cash conversion cycle, which again brings a further benefit to the free cash flow component:

Importantly, one of the things that we’ve done this year that I’m incredibly proud of, we have really upped our organic cash conversion. It’s allowed us to grow free cash flows, very nicely, plus also allowed us to pay down some of our short-term financing obligations.

#3 Enhanced sustainability of dividend

A final reason why T is in a great position to register attractive returns over the foreseeable future lies in its dividend profile.

The current dividend yield is rather attractive at ~6.7%.

However, the most attractive aspect in the context of T’s dividend is the payout profile. On a TTM basis, T’s dividend payout level is ~47% and from the free cash flow perspective, which is an even more important metric, the dividend payout ratio lands at 38% (based on annualized Q3 data, which reflects also the communicated trajectory of CapEx going into 2024).

Having that low payout ratios for so attractive yield is very rare.

With this in mind, I see two high probability scenarios where both of which could send the stock price higher from the prevailing levels:

- Ultimately, the market would have to appreciate the ~6.7% dividend that is underpinned by robust cash generation leading to a justified multiple expansion. The appreciation could also very likely stem from falling interest rates in 2024, which cause market to start chasing yields again (i.e., creating stronger demand for T).

- T might at some point decide to implement some dividend increases provided that the de-leveraging story progresses well. Given 38% of FCF payout, the probability of higher dividend is not distant. In such case, T’s stock price should definitely respond in a positive fashion.

The bottom line

While I am a fundamental bear of T, I have to admit that the near future of T looks rather bright. The combination of improved free cash flows and strong commitment to optimize balance sheet should provide tailwinds for T to reduce some of the risk premiums that are embedded in the currently depressed valuations.

Plus, T’s dividend of ~6.7% is not only attractive but also underpinned by robust free cash flow generation (i.e., FCF payout of 38%). This injects into an equation a notable probability of either dividend increases or gradual recognition of the market (also driven by the potential chase for yield against the backdrop of potentially falling interest rates) that should benefit the stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.