Summary:

- AT&T stock offers a 7.4% forward dividend yield and has a wide upside potential.

- The company’s recent quarterly earnings showed a shallow YoY revenue growth but demonstrated sequential improvement in operating margin.

- Despite substantial indebtedness and regulatory risks, AT&T’s management is laser-focused on improving cost efficiency and the balance sheet improvement.

andresr/E+ via Getty Images

Investment thesis

My first bullish thesis about AT&T (NYSE:T) stock did not age well up to date. The total return since June 30 was approximately -4.5%, slightly lagging the broader U.S. stock market. However, my valuation analysis suggests that the recent weakness just provided a better buying opportunity for investors as the upside potential widened. Moreover, the stock offers a very tasty forward dividend yield of 7.4%. The massive pessimism regarding the stock is related to its substantial indebtedness due to vast investments in the 5G technology buildout in recent years. However, this large and complex project is almost finalized by the company in an efficient and timely manner, and the balance sheet is poised to start improving, given the management’s sound near-term capital allocation priorities. While the fully penetrated industry does not allow players to boost revenue growth, cost control should become the top priority and I like AT&T’s management’s commitment to improve operational efficiency. All in all, I reiterate my “Strong Buy” rating for the AT&T stock.

Recent developments

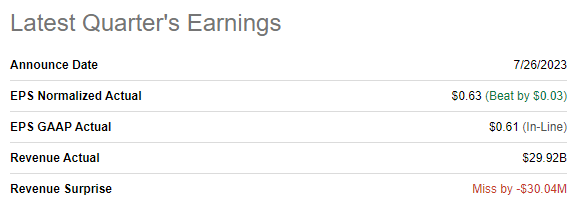

The latest quarterly earnings were released on July 26, when the company missed revenue consensus estimates but outnumbered the non-GAAP EPS forecast. Revenue demonstrated a shallow 0.9% YoY growth, while the adjusted EPS narrowed a little bit, from $0.65 to $0.63. The gross margin demonstrated a solid YoY expansion from 58.4% to 60.5%. Increased SG&A on the YoY basis weighed on the operating profit margin, which narrowed from 26.7% to 24.3%. However, I would like to highlight a positive sign here that the operating margin demonstrated sequential improvement again despite a sequential decline in revenue.

Seeking Alpha

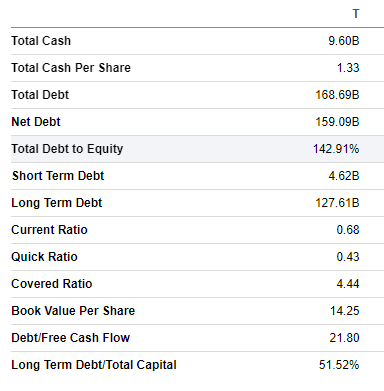

I cannot call the company’s balance sheet strong, since AT&T navigates through a substantial total debt of almost $170 billion. The amount of debt is considerable from the D/E ratio perspective due to massive investment in the 5G technology. However, this debt was inevitable for the company to innovate and align with the evolving technological landscape. AT&T’s covered ratio is not very high, but I am comfortable with it. Liquidity metrics are also average but far from being weak.

Seeking Alpha

While the company’s substantial indebtedness is an obvious risk for investors, I have a stable outlook. First, the company’s vast customer base and technological strength mean that the free cash flow [FCF] is safe and it will service the debt successfully. Second, the company prioritized the balance sheet improvement with debt payoffs and temporary. AT&T halted significant stock repurchases to mitigate its debt, and I consider this a wise decision. Third, dividend payouts are unlikely to grow significantly in the upcoming years, as the company will strive to decrease debt levels as soon as possible. Therefore, I consider credit risk as low.

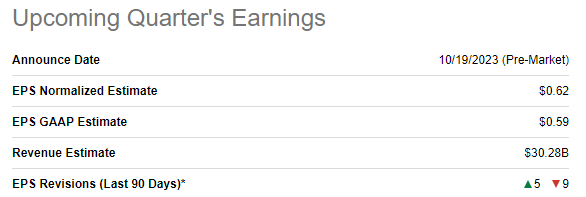

The upcoming quarter’s earnings are scheduled for release on October 19. Quarterly revenue is expected by consensus at $30.28 billion, which means a 0.8% YoY growth. The adjusted EPS is expected to shrink from $0.68 to $0.62.

Seeking Alpha

Despite all its financial and operational challenges, AT&T has managed to preserve its position as a critical player in the American telecom industry. The company’s broadband buildout, a large complex project, has been progressing in line with the management’s expectations. Even in the reality of almost full industry penetration and an uncertain macro environment, the company still managed to achieve a net gain of 464 thousand postpaid subscribers.

I am also optimistic about the company’s future due to the management’s focus on cost efficiency. In the situation of almost full telecom industry penetration in the U.S., it is difficult to expect substantial revenue growth. Therefore, keeping an eye on costs should be the number one priority for telecom giants. During the latest earnings call, the management reiterated the firm commitment to increasing cost-efficiency by simplifying the company’s business. According to John Stankey, the CEO, the management’s cost-saving initiatives achieved the $6 billion run-rate target, and there is still an opportunity to save another $2 billion over the next three years. Capital expenditures are expected to moderate as well, as the 5G buildout is getting closer to finalization.

Valuation update

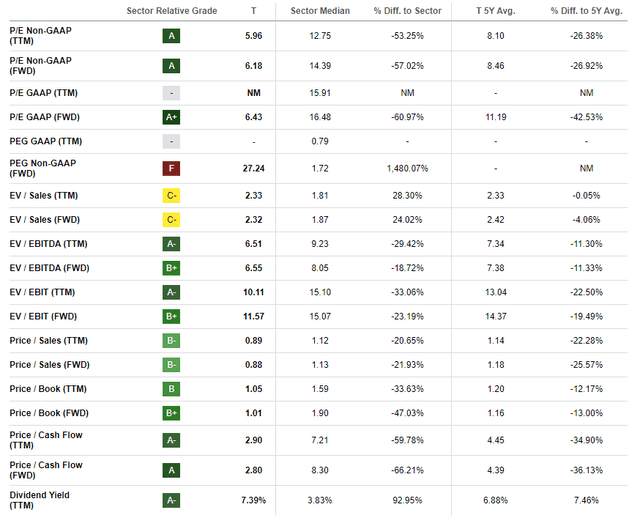

The stock price declined almost 20% year-to-date, substantially underperforming the broader U.S. market. Seeking Alpha Quant assigns the stock an attractive “B” valuation grade. The current multiples are substantially lower than the sector median and historical averages. From the valuation ratios perspective, the stock looks very attractively valued.

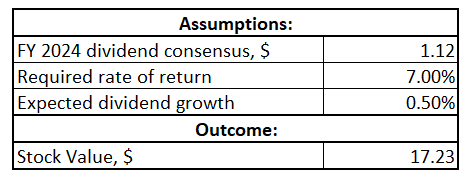

I want to expand my analysis to get more conviction. The dividend discount model [DDM] is a good fit to value a blue chip like AT&T. I use the same 7% WACC as a required rate of return as I did previously. Dividend consensus estimates expect the FY 2024 payout to be at $1.12, which is a fair choice for my DDM calculation. AT&T had struggles with dividend growth over multiple past years, so I implemented a mere 0.5% dividend growth.

Author’s calculations

According to the DDM formula, the stock’s intrinsic value is slightly above $17 per share, which suggests a 14% upside potential. It looks very attractive, especially considering the above 7% forward dividend yield.

Substantial risks update

Being one of the three key players in the U.S. telecom industry means that the company faces substantial regulation risks. Given the company’s massive market shares means that AT&T might face intensified scrutiny regarding antitrust and competition laws. Actions from regulatory bodies can impose restrictions on the company’s strategic plans like mergers, acquisitions, or partnerships.

I consider the recent research from WSJ regarding the adverse environmental impact a significant risk for AT&T as well.

AT&T, Verizon, and other telecom giants have left behind a sprawling network of cables covered in toxic lead that stretches across the U.S., under the water, in the soil, and on poles overhead.

While I do not expect any disruptions to the company’s operations or financial performance due to this publication, I think that such an article from a reputable media like WSJ might lead to adverse consequences for the company’s reputation. At the same time, it is important to underline that AT&T’s rivals are in the same position and were mentioned in the article.

Bottom line

To conclude, AT&T’s stock is still a “Strong Buy”. A lot of pessimism is related to the company’s vast leverage position, but my analysis suggests that the balance sheet is poised to improve as the management’s capital allocation priorities look extremely sound. Both operational and capital expectations are expected to moderate and I already see positive trends in the company’s profitability ratios in recent quarters. The dividend yield of 7.4% is a gift and there is an attractive upside potential as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.