Summary:

- AT&T Inc. just reported Q1 2023 results.

- T stock price plunged on the disappointing report.

- While the stock may look cheap to many following the sell-off, we share three reasons why we remain on the sidelines.

Justin Sullivan

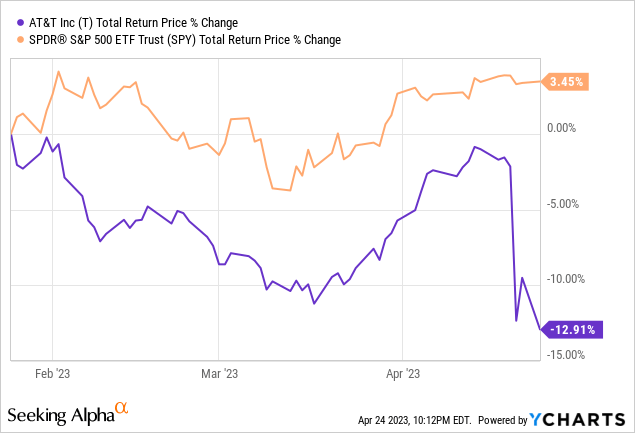

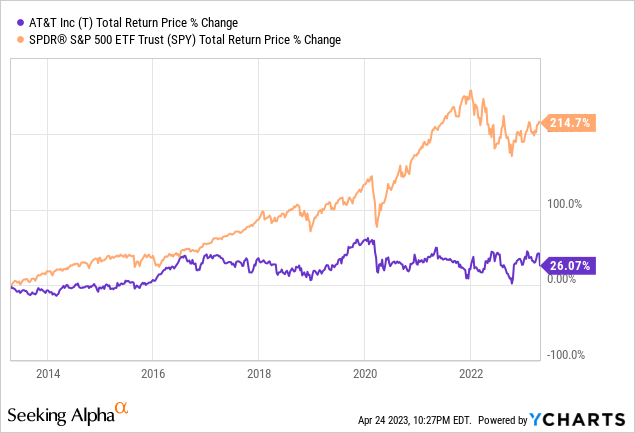

After AT&T Inc. (NYSE:T) reported its Q4 and FY2022 results, the stock price jumped and bulls began finally declaring victory after a long, hard path that saw the stock massively underperform the S&P 500 (SPY), culminating in a lackluster 2022 that saw the dividend cut:

While bulls may be heralding this report as clear evidence that AT&T Inc. is successfully executing its turnaround, we do not share the market’s enthusiasm. In this article, we discuss three reasons why we do not think it is prudent to buy the stock following the latest earnings report… Yes, T is expecting a meaningful increase in free cash flow in 2023 which is great, but if adjusted earnings per share do not turn around soon, this really does not matter much.

One quarter later, it appears that our caution was warranted. Since we issued that caution, T is down by nearly 13% while SPY is up by nearly 3.5%:

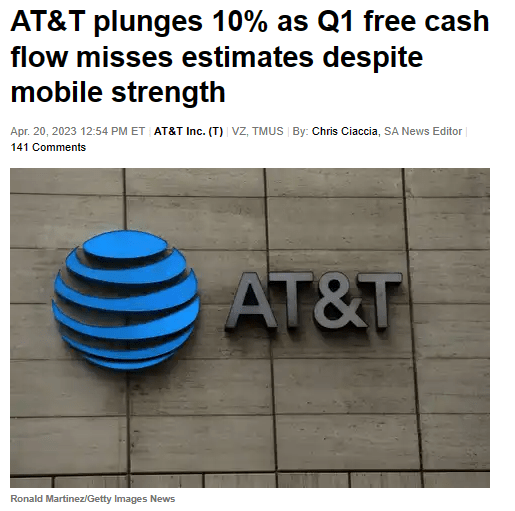

This is in large part thanks to a very disappointing Q1 report from the company, sending the stock price plunging:

T Stock Q1 Report (Seeking Alpha)

Breaking Down T Stock’s Q1 Numbers

The company beat analyst estimates on adjusted earnings per share by a penny and came close to matching estimates for revenue.

The company’s mobility unit had a very strong quarter, providing ~2/3 of the company’s total revenue, adding 424,000 postpaid phone subscribers during Q1 (though this showed decelerating growth relative to 2022), and setting a record for first-quarter profitability with EBITDA rising a whopping 8% year-over-year. Moreover, its churn rate was quite low at just 0.81% for postpaid and 2.73% for prepaid subscribers. T’s fiber business also continued to grow, adding 272,000 subscribers to bring its total count to 7.5 million.

However, the big disappointment in the quarter was that the company generated only $1 billion in free cash flow, whereas analysts were expecting it to generate $2.6 billion. While management doubled down on its belief that it can generate $16 billion plus in free cash flow this year, the extremely slow start to cash generation in Q1 was not an encouraging sign.

With that in mind, here are the three reasons why we remain on the sidelines with this stock and believe that if you are not there with us yet, you should run there as soon as possible.

#1. T Management Continues to Serially Underperform

Q1 showed what many preceding quarters have shown: T’s management is a serially underperforming team. While they may very well improve free cash flow generation in the remainder of the year due to timing factors, the $1 billion in Q1 free cash flow and missing analyst estimates by such a large margin is unacceptable, especially for a business that has emphasized repeatedly that its focus is on free cash flow generation and using that cash to deleverage the balance sheet.

This quarter only reinforced the narrative surrounding this company and its management that it is not to be trusted for anything but continued underperformance:

#2. The Balance Sheet Is Still A Major Issue

Management clearly acknowledges that debt is an issue for the company, stating even on this quarter’s earnings call:

And while we’re clearly committed to investing in our networks, we also remain focused on the strengthening of our balance sheet and reducing our net debt. We expect to increase cash generation over time, which will allow us to continue delivering an attractive dividend with improving credit quality.

However, its poor cash generation in this quarter makes its commitment to the balance sheet ring a little hollow. This is especially true with interest rates rising as fast as they have over the past year. Management acknowledged this as well on the earnings call:

We expected to transition back to more historical cost of debt. That is certainly underway, with the added dose of tighter credit availability to some segments of the economy.

Until they begin improving their free cash flow generation, the market will continue to punish T for its years of imprudent debt accumulation.

#3. AT&T Stock Is Still Not A Compelling Value

While its poor total return performance over the past quarter has certainly helped its valuation look less objectionable, it is remarkably still not undervalued in our view. Its current forward EV/EBITDA is 6.65x which is above its historical average of 6.41x despite interest rates rising rapidly recently and the company recently ending its dividend growth streak and slashing its dividend.

Analysts estimate that T will only grow earnings per share at an anemic 0.4% CAGR through 2027 (and this number may very well fall further once the most recent results are factored in), and – with its heightened focus on paying down debt and capital investments – dividend growth is likely going to come in at an even slower pace (if it even increases at all) over that period.

While the 6.4% dividend yield looks pretty good, it really is not that great compared to many other high yielding opportunities available in the current rising interest rate environment and the growth potential of the dividend and the earnings stream are extremely weak. Moreover, the EV/EBITDA multiple signals that valuation multiple expansion is unlikely to be meaningful either.

Investor Takeaway

T stock continues to prove us right quarter after quarter. Its management overpromises and underdelivers time after time and – while the stock price continues to flounder – it remains uninviting from a valuation standpoint.

Until management begins to generate meaningful free cash flow and make a serious dent in its debt pile while simultaneously sustaining its market share (a tall task given how much capital will be needed to do so and the lingering inflationary and interest rate headwinds), we are running away from this stock. There is nothing at all about it that attracts us to it in the current environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you would please click "like", comment below, and "follow" me that would mean a lot as it helps me to continue producing quality content.

SAVE 50% BY SIGNING UP TODAY!

You can join Seeking Alpha’s #1 community of high-yield investors at just $199 for your first year!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews and we spend 1000s of hours and over $100,000 per year researching the market and share the results with you at a tiny fraction of the cost.