Summary:

- AT&T is near its lowest prices in three decades.

- The company’s balance sheet is the culprit, and new potential problems with lead-sheathed cabling only pile on further.

- The stock has limited upside, but could be a solid dividend idea if AT&T’s financials remain stable.

Justin Paget/DigitalVision via Getty Images

U.S. telecommunications giant AT&T (NYSE:T) has been a dog for a generation; its recent lows put its price on par with levels seen 30 years ago.

After a futile decade, the company got out of the media industry, which placed investors’ focus back on the wireless business.

I wrote about that here.

Additionally, the company now faces potential headaches after the Wall Street Journal published an investigation into lead-coated cables allegedly leaching toxins into the environment.

Is AT&T a buy-the-dip opportunity or a stock to run from? Like many things in life, wisdom usually lands somewhere in the middle. Here is what that could look like for investors pondering what to do with AT&T.

Litigation has many outcomes… but few are positive

There aren’t many silver linings when a company is sued. Lawsuits cost money, even when your side wins, and there is uncertainty about when it might get resolved. AT&T isn’t currently facing a lawsuit, but that could come down the road. The California Sportfishing Protection Alliance (CSPA) sued AT&T over lead cables in Lake Tahoe in early 2021, which was settled later that year.

However, the company could have an estimated 200,000 miles of lead cables in its U.S. network. Estimates of potential remediation needs and costs are all over the place. AT&T estimated that at least two-thirds are either buried or inside conduit. Estimates for potential costs have ranged from a few billion dollars to as high as $34.4 billion.

AT&T, for now, has pushed back on the issue. It announced plans to delay remediation at Lake Tahoe until more studies are done. Additionally, the company didn’t comment on the issue in its 2023 Q2 earnings report.

The lead cables remind one of 3M Company’s (NYSE:MMM) forever chemicals lawsuits, which recently settled for $10.3 billion. Many outcomes are possible, including this being a nothing-burger for shareholders. However, it seems more likely that this will cost AT&T, the question being — how much?

Looking past Q2 earnings

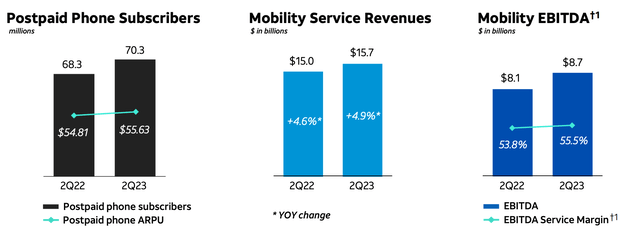

AT&T recently reported second-quarter earnings, and its wireless business performed pretty well. The company again grew its wireless business; service revenue is growing at a mid-single-digit rate, and added roughly two million subscribers.

AT&T Q2 2023 wireless metrics. (AT&T)

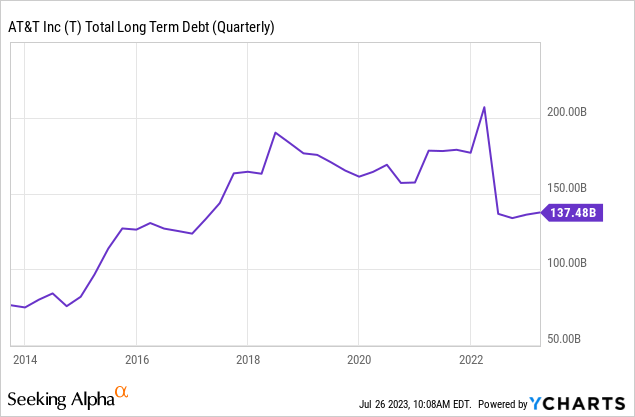

It’s good to see the core business growing, but AT&T’s balance sheet has long been the culprit for why the stock hasn’t performed well. You can see below that since 2018, management made little progress paying down debt until a cash infusion last year from spinning off its media business.

Management updated its financial outlook, guiding for a $4 billion debt reduction over the second half of the year. Additionally, management believes it can get leverage down to 2.5X non-GAAP EBITDA by the first half of 2025.

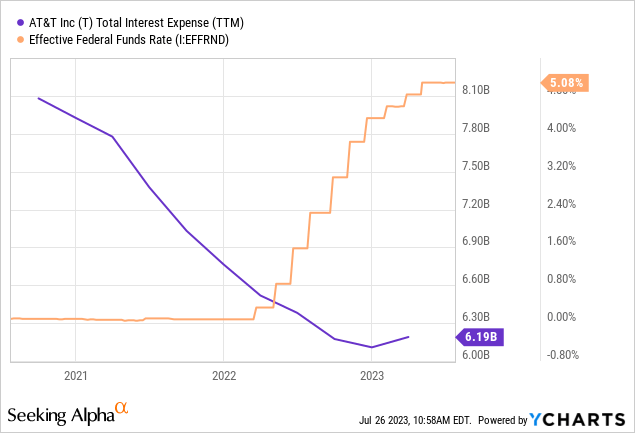

Deleveraging will be important moving forward; with the Fed’s rapid rate hikes, refinancing debt will become increasingly expensive. The company’s interest expenses dipped when rates were zero, but expenses are starting to tick higher again.

Interest expenses likely play a role in modest analyst estimates, which call for virtually zero earnings growth over the next several years:

Analyst estimates for AT&T earnings-per-share. (Seeking Alpha)

Investors should maintain modest expectations; the addition of potential litigation could make it even harder for the market to gain confidence in the stock.

What should investors do?

Some might argue that AT&T’s high dividend yield and cheap valuation at just six times 2023 earnings estimates make the stock worth owning, but it seems clear the stock is cheap for a reason.

All that said, AT&T could have a purpose in your portfolio. The stock offers an 8.25% dividend yield; even mediocre earnings growth can give you 10% annual returns.

However, it remains a riskier dividend stock than it once was. Management has little to work with after paying the dividend, which leaves little room for error.

In other words, any hiccups moving forward (litigation, free cash flow falling short) and management could move to cut the dividend to free up much-needed cash. Don’t write AT&T off, but proceed cautiously if you play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.