Summary:

- AT&T has a few growth engines such as Fiber and Mexico operations, but they are too small to impact the overall growth profile of the company.

- Fiber-related growth has mostly come from pricing improvements and increased fiber-penetration of broadband rollouts. However, volume growth is needed for a longer growth runway and here, broadband connections are decreasing.

- Margin improvement of $2 billion over the next 3 years is expected, but given the EBIT margin surprise record, there is potential of falling under the guide.

- The US Broadband Equity Access and Deployment Program (BEAD) is the key growth catalyst; this is so far not expected to kick in until 2025, making mid-late 2024 a better time for entry into AT&T.

- AT&T trades at a 36% discount to peers; it may be a good value buy right now. But for investors who prefer to accompany value with growth catalysts, I believe the stock is a ‘neutral/hold’ for a few more months still.

matimix/iStock via Getty Images

Thesis

AT&T (NYSE:T) is trying to re-orient its business toward growth and operational efficiency and succeeding in some ways. But it not enough to make me buy it yet. Hence, I rate it a ‘neutral/hold’. The upcoming Q4 FY23 earnings call on 24th Jan 2024 is unlikely to change my stance as I need to see multiple quarters of traction in growth and margins to believe in a genuine turnaround.

-

AT&T has a few growth engines but it is hardly sufficient for meaningful overall growth

-

Longer term margin improvement is expected, but may be less than the guide

-

AT&T trades at a discount to peers, but it is not enough to trigger a buy

In the Q4 FY23 earnings call, I am looking for more clues on the sustainability of growth drivers from management commentary and some color on the key catalyst (discussed in the latter part of this article).

AT&T has a few growth engines but it is hardly sufficient for meaningful overall growth

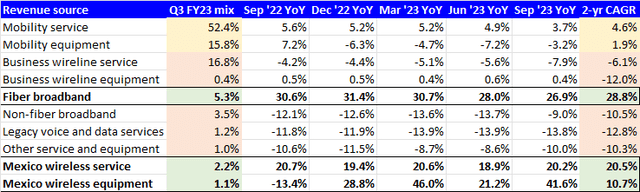

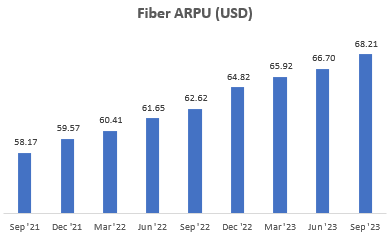

AT&T Revenue Growth Detail (Company Filings, Author’s Analysis)

The key takeaway from the table above is that AT&T’s largest revenue source is from services provided to Mobility (wireless) subscribers, making up 52.4% of the overall revenue mix in Q3 FY23. This has grown at only 4.6% CAGR over the last 2 years and looking at the recent quarterly trends, the growth is decelerating. Most of the other business is in decline. The only growth engines are Fiber Broadband services and Mexico wireless operations.

AT&T Growth Categories (Company Filings, Author’s Analysis)

Breaking up the growth categories further, I look at the mix*2-yr CAGR figures as I think that gives a better picture of the contributors to overall growth, looking at both the mix and the absolute growth rates. It’s apparent that the low revenue contribution mix of the growth engines (8.6%) has not been enough to materially change the overall revenue growth profile of the company, which is merely 2.2% in nominal terms. For context, US nominal GDP grew at a 8.4% CAGR over the last 2 years.

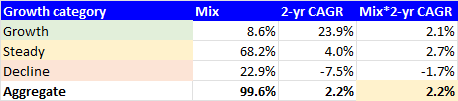

In its recent earnings and conference calls with UBS and Oppenheimer, a lot of the discussion was focused on the growth prospects in the US Fiber Broadband business, which has grown handsomely for the company at a 29% 2-yr CAGR:

Fiber Revenues (USD mn) (Company Filings, Author’s Analysis)

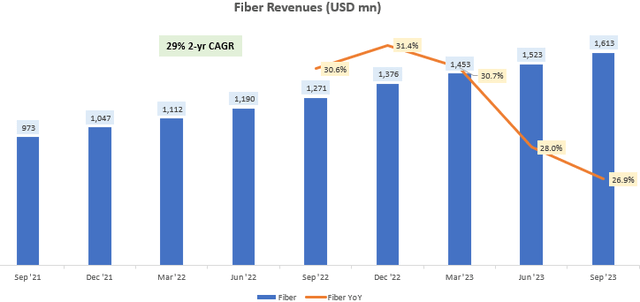

Looking at the composition of this growth, it has been driven by pricing improvements, as ARPU has risen consistently from $58.17 to $68.21 over the last 2 years:

Fiber ARPU (USD) (Fiber Revenues (USD mn))

How sustainable is growth driven by pricing levers? Sell-side analysts asked this very question in the Q3 FY23 earnings call, trying to find out what kind of runway there is for continued growth here. Now management said there is more scope in FY24; but I am skeptical about sustainability as pricing levers for what is ultimately a commodity service can’t continue on and on, especially as industry competition and technology evolves.

Also importantly, AT&T’s customer based is focused on people with a greater willingness to pay. Data from a study on AT&T’s customer demographics shows that AT&T has 52% of its users in the top 1/3rd of monthly household gross income compared to only 34% among the broader mobile carrier users category. So a key question arises; can AT&T rely on pricing increases with other customer demographics? That remains to be proven by the company.

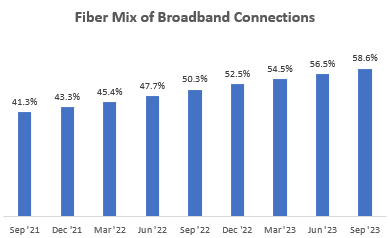

Moving onto volume growth analysis, it is clear that fiber volume growth has been driven by greater penetration of fiber-related broadband as the fiber mix of AT&T’s overall broadband connections has steadily increased 1700 bps over the last 2 years:

Fiber Mix of Broadband Connections (Company Filings, Author’s Analysis)

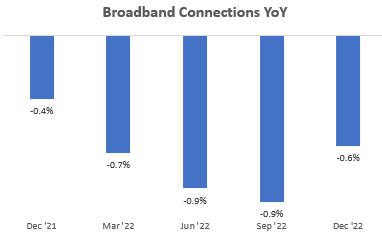

However, growth driven by increased mix penetration becomes incrementally harder. So absolute volume growth is also ideal. And on this front, I note that overall broadband connections are actually degrowing on a YoY basis over the last 5 quarters, from 13.8 million to 13.7 million:

Broadband Connections YoY (Company Filings, Author’s Analysis)

This is not ideal to see as it undermines the longer-term runway of a sustainable growth driver. On the positive side however, CEO John Stankey noted in the UBS Conference call:

I’d like to see us get into a unit growth business for customers as well. And I think we now have the formula where we can start to see that happen in ’24.

– CEO John Stankey, Author’s bolded highlights

I expect analysts to probe further on this in the Q4 FY23 earnings call. Given that it is the last quarter, when guidance is typically provided, I think and hope management may be more open in their answers.

Longer term margin improvement is expected, but may be less than the guide

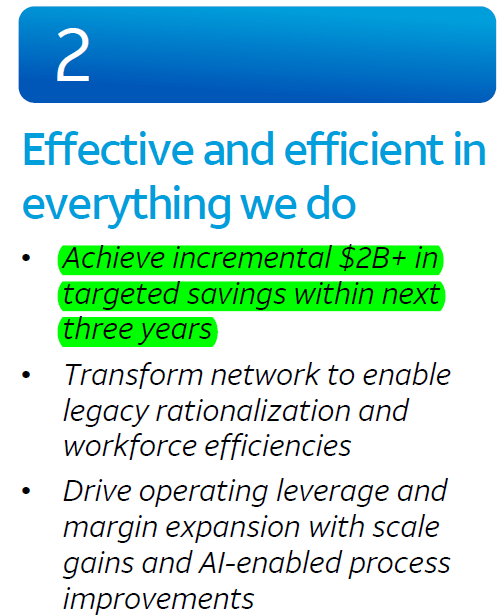

AT&T Margin Improvement Priority (AT&T Q3 FY23 Earnings Presentation, Author’s Highlights)

In the Q3 FY23 earnings call presentation, AT&T management stated their priority to unlock $2 billion in savings over the next 3 years. Assuming a steady linear run-rate of improvement, this implies $667 million of margin accretion every year. At the current TTM revenue base of $43 billion, this implies a 1.55% growth in adjusted EBITDA. Wall St is currently building in a 1.23% EPS growth for FY24, which is materially lower even after assuming some revenue growth. However, I think at the core operating margins level (EBIT), there may be further downside risk to this number since based on Capital IQ’s result surprises data, EBIT margins have tended to miss expectations by a median of 200bps since Q2 FY20 (around when the current CEO John Stankey took over in July 2020).

In the Q4 FY23 earnings call, I would expect affirmation of the $2 billion savings goal in 3 years. However, one quarter alone is unlikely to sway my expectations of them falling behind the consensus expectations over the longer term.

AT&T trades at a discount to peers, but it is not enough to trigger a buy

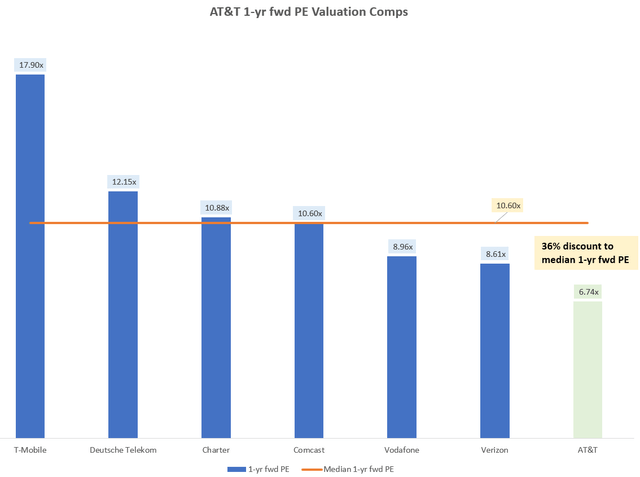

1-yr fwd PE Valuation Comps (Capital IQ, Author’s Analysis)

Comparables set includes T-Mobile (TMUS), Deutsche Telekom (OTCQX:DTEGY), Charter Communications (CHTR), Comcast (CMCSA), Vodafone (VOD) (OTCPK:VODPF), Verizon (VZ), AT&T (T)

As can be seen from the chart above, AT&T trades at a 1-yr fwd PE of 6.74x. This is a 36% discount to the median multiple of 10.6x. This may make it a good value buy, however for my style of investing, I prefer value to be accompanied by a key growth catalyst. And that is something I’m still waiting for:

The big growth catalyst I am waiting for

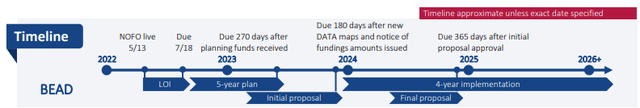

I think the US Broadband Equity Access and Deployment Program [BEAD] is the key growth catalyst for AT&T. I expect $42.45 billion federal spending initiative for broadband rollout across the US to trigger strong volume growth in broadband connections, reversing the degrowth trend so far and propelling fiber rollouts even further. As of the last earnings call, indications are that this impending catalyst is yet to really kick in until 2025:

Other than the wheels of government turn slowly, not really [any update on BEAD developments]… I think this is going to be a 2025-plus thing when kind of look at the aggregate portions of the build, the private capital that comes in and ultimately, customers that come on the network and start buying services that might not have been buying services before.

– CEO John Stankey in the Q3 FY23 earnings call

According to the US Government’s BEAD Information Sheet, implementation after the final proposal is also expected to continue after 2025:

BEAD Timeline (Department of Commerce, BEAD Information Sheet)

Hence, I don’t anticipate the stock to really begin its major up-move until mid-late 2024; still before 2025 as the market tends to be forward-looking. However it is important to be in-tune with the tempo of catalyst expectation vs catalyst playing out. I’ve discussed this concept more in my last article on Palantir (PLTR). And here’s a related lesson the investing great Stanley Druckenmiller learnt from one of his bosses in his earlier career:

But before he left, he taught me two things. A, never, ever invest in the present. It doesn’t matter what a company’s earning, what they have earned. He taught me that you have to visualize the situation 18 months from now, and whatever that is, that’s where the price will be, not where it is today. And too many people tend to look at the present, oh this is a great company, they’ve done this or this central bank is doing all the right things. But you have to look to the future. If you invest in the present, you’re going to get run over.

– Stanley Druckenmiller

Naturally, any color on what’s happening in the BEAD catalyst front would be very keenly sought by investors in the Q4 FY23 earnings call. In my eyes, it is the single biggest thing the market is waiting for before piling on the buys on AT&T.

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do, utilizing principles of Flow, Location and Trap.

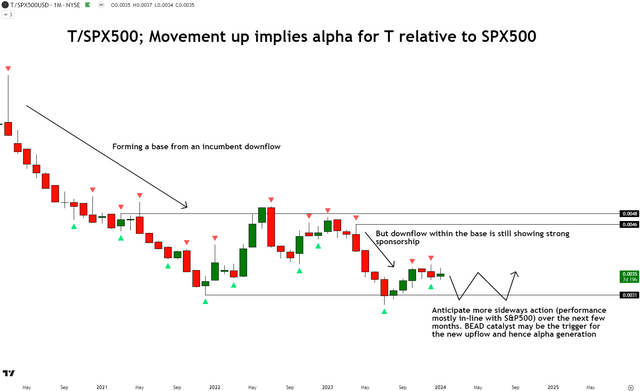

Technical Analysis of AT&T Relative to the S&P500 (TradingView, Author’s Analysis)

On the relative monthly chart of T/SPX500, a movement up corresponds to T making alpha over the S&P 500 (SPY) (SPX). I note that the ratio prices have started to consolidate sideways, coming from an incumbent downflow. However, even within this sideways consolidation, the downflow still looks quite strong with sponsorship, making me believe the big turnaround upward is not due yet. So far, I anticipate more sideways action for a few months until we get closer to the BEAD catalyst kicking in. Of course, there may be earnings surprise movements coming up, however I do not anticipate that to materially change the overall expectation.

Takeaway

I think AT&T has some growth engines in its Fiber business particularly and also its Mexico operations. However, this is undermined heavily by declining and weak growth segments, which make up a greater mix of revenues. As a result, the top-line for AT&T has grown poorly in recent quarters, well below US nominal GDP growth rates. The fiber business growth is so far driven mostly by pricing increases, which I do not think is a very sustainable longer-term growth driver. Instead, volume growth is necessary. And here, whilst there is some volume growth driven by increased broadband penetration, overall broadband connections is seeing a degrowth currently. I do not anticipate this to change materially until the US government’s broadband rollout catalysts (BEAD) comes into play from 2025 onwards.

On the margins front, management has shared their goal to create $2 billion of margin accretion from cost savings over the next 3 years. Consensus estimates right not seem to be baking in a little bit less than that. Looking at the tendency of management to miss EBIT expectations, I see the potential for disappointment even on the lowered expectations over the medium-longer term.

Trading at a 36% discount to peers on a 1-yr fwd PE basis, AT&T may be a good value buy. However for my style of investing, which requires an operational catalyst, it is not enough to make me a buyer yet. Hence, I rate the stock a ‘neutral/hold’. It is unlikely that this stance would change even after the upcoming Q4 FY23 results as I ideally require at least 2 quarters of proof in volume growth improvement, ideally around 6-12 months before the BEAD catalyst kicks in.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.