Summary:

- AT&T Inc. investors face a steep selloff as concerns about the company’s use of lead-sheathed phone cables resurface.

- Despite recent market volatility, AT&T management remains confident in meeting projections and reducing debt through partnerships and investments.

- The market has priced in potential rate cuts, but the question remains whether AT&T’s undervaluation and high dividend yield can sustain further recovery.

- I argue why investors who missed buying at its 2023 lows should wait out the recent pullback and assess where the selling pressure could subside.

- If the pullback could be sustained above the $15 zone, a more attractive buying opportunity could emerge subsequently for AT&T stock.

Brandon Bell

AT&T Inc. (NYSE:T) investors have endured another steep selloff this week, as T stumbled, following a remarkable recovery since it bottomed out in July 2023. Observant investors should recall that the Wall Street Journal, or WSJ, reported that the Environmental Protection Agency or EPA “requested meetings about their use of lead-sheathed phone cables.” As a result, the fears that drove T to its July lows have reemerged as investors assess the potential rectification costs if required. The WSJ added that “EPA has found over 100 soil and sediment readings with elevated levels of lead” in three states. Despite that, the agency didn’t require “an emergency response” to the discoveries, suggesting the damage is likely contained for now.

However, this week’s market volatility suggests investors weren’t taking their chances, particularly if they bought at its early summer lows. As a result, T has declined more than 7% this week, falling back to a level last visited in mid-December 2023. With AT&T slated to deliver its fourth quarter, or FQ’23, earnings release on January 24, should investors who missed buying its steep pullbacks in 2023 consider capitalizing on its pre-earnings weakness?

Management updated investors in two conferences (here and here) in mid-December 2023, driving home the company’s confidence in meeting their projections for FY23. AT&T also updated investors that the debt reduction plan remains in progress, notwithstanding the recently announced partnership with Ericsson on deploying Open RAN. The company intends to leverage its market leadership to lead in this area, highlighting its intent to accelerate its investment in Open RAN. AT&T underscored its ambitions to lead the industry for “future investment cycles, potentially linked to more spectrum availability or the advent of 6G technology.”

As a result, AT&T sees the opportunity to invest $14B in the partnership over the next five years. In addition, the company views the potential of having “70% of its wireless network traffic to be handled by open-capable platforms by late 2026.” As a result, I believe it’s a key investment area to be watched by investors, assessing the medium-term impact as AT&T looks toward further debt reduction. Accordingly, management is confident of its ability to reach a targeted adjusted EBITDA leverage ratio of 2.5x by H1’25.

Given the improved buying sentiments over the past six months, I believe the market has positioned itself on a more favorable report from AT&T heading into its Q4 release. However, the recent recovery in the 10Y (US10Y) has caused some concerns, as it bottomed out in late December 2023. Despite that, I have not yet gleaned a decisive recovery in the 10Y, as it remains below the 4% mark. However, the risk/reward suggesting a recovery is still more likely, which could suggest more pain for T holders. It should be noted that AT&T investors were battered in 2023 due to the Fed’s rate hikes. With T having recovered more than 30% through its January 2024 highs, I assess that the market has likely already priced in the Fed’s potential rate cuts this year.

Therefore, the critical question facing AT&T investors now is whether its relative undervaluation (“B+” valuation grade) and attractive forward dividend yield (6.9%) can sustain a further recovery in 2024.

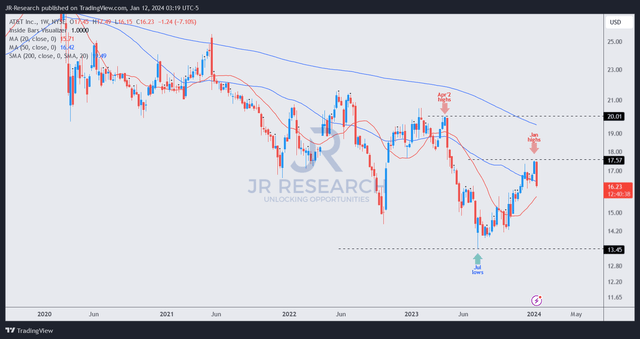

T price chart (weekly) (TradingView)

As seen above, T’s selling momentum has taken over this week, as it remains in a medium-term downtrend. As long as T’s $20 level is not retaken decisively, I don’t think momentum buyers will be keen to follow through and hold the bag long enough. As a result, I gleaned that the steep reversal this week underscored the lack of confidence in T at the moment.

However, with its July 2023 lows likely marking its long-term bottom, I also don’t expect T to drop back toward the $13.5 level. A pullback toward the $15 zone finding support could suggest that AT&T Inc. is ready to grind higher in 2024 as the market and industry environment turn more optimistic.

Therefore, I assess it’s time to be more cautious, moving back to the sidelines for AT&T Inc. stock, as we allow the market action to play out.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!