Summary:

- AT&T has shown growth in customer lifetime value, maintained a strong customer base, and reduced long-term debt.

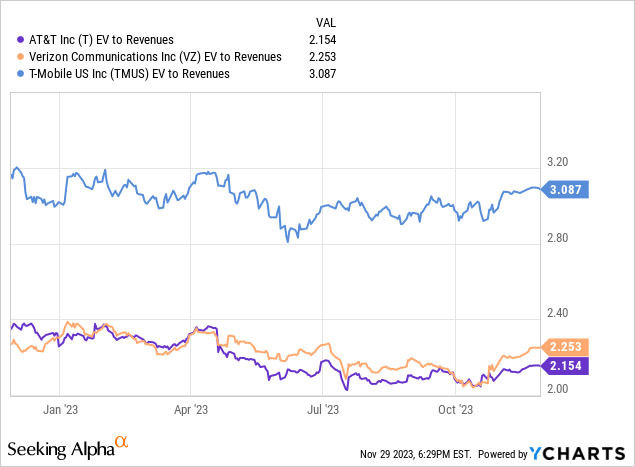

- Additionally, the stock looks attractively valued on an EV to revenue basis as compared to its peers.

- I take a bullish view on AT&T.

Brandon Bell

Investment Thesis: I revise my rating on AT&T from hold to buy.

In a previous article back in September, I made the argument that AT&T (NYSE:T) has the capacity to maintain its dominant position in the United States, but growth in customer lifetime value needs to improve and the company also needs to show that it can compete against T-Mobile (TMUS) effectively.

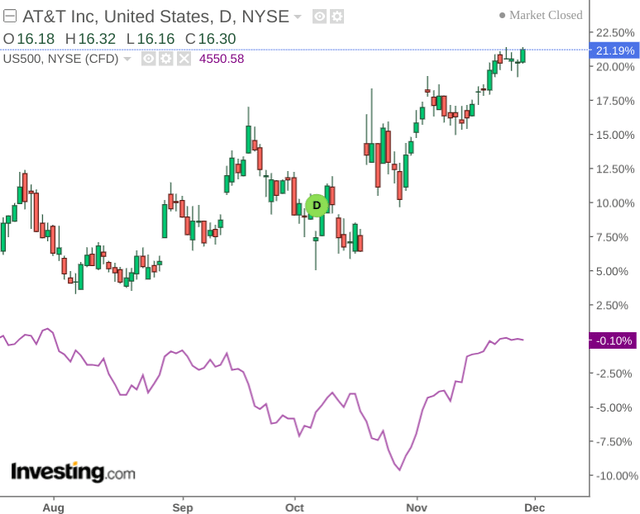

Since then, the stock has ascended to a price of $16.23 at the time of writing:

The purpose of this article is to assess whether AT&T has the ability to see continued growth from here taking recent performance into consideration.

Performance

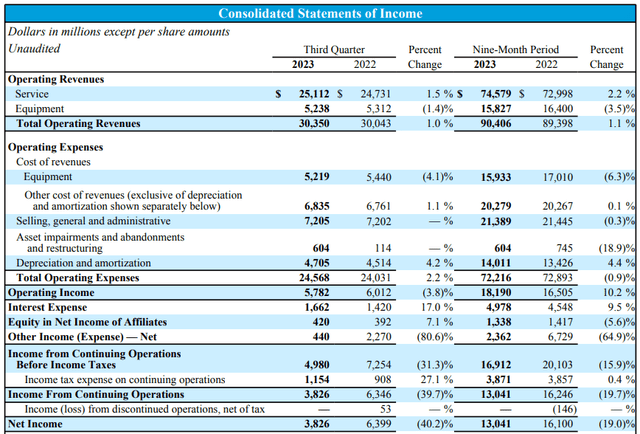

When looking at Q3 2023 earnings results for AT&T (as released on October 19), we can see that total operating revenues were up modestly by 1% over the prior year quarter, with operating income down slightly by 3.8%.

AT&T 3rd Quarter Earnings 2023: Financial and Operational Schedules & Non-GAAP Reconciliations

While net income saw a substantial drop from the prior year quarter – this was predominantly due to a sharp drop in other income (expense) – net, which the company does not take into account for EBITDA purposes as it does not reflect the operating results of AT&T’s subscriber base.

I had previously stated that while I was long AT&T, I would need to see clear evidence of growth in customer lifetime value as well as increased evidence that the company can maintain a low churn rate as compared with T-Mobile before taking a more bullish view on the stock.

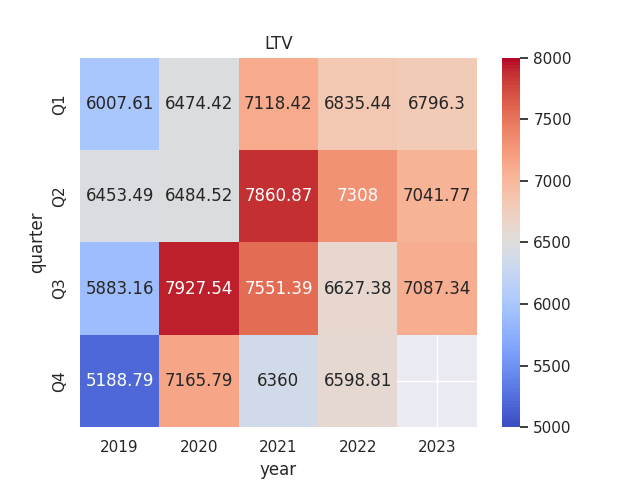

When looking at LTV by quarter (calculated as ARPU/churn rate), we can see that LTV for Q3 2023 came in significantly higher than that of the prior year quarter, and we have also seen consecutive growth in LTV over the three quarters year-to-date.

Heatmap generated by author using Python’s seaborn visualisation library. ARPU and churn rate figures sourced from historical AT&T quarterly reports.

We can see that this is down to an increase in ARPU over three consecutive quarters and a drop in churn from that of Q1.

| Quarter | Year | ARPU | Churn (%) | LTV |

| Q1 | 2023 | 55.05 | 0.81 | 6796.29 |

| Q2 | 2023 | 55.63 | 0.79 | 7041.77 |

| Q3 | 2023 | 55.99 | 0.79 | 7087.34 |

Source: ARPU and churn figures sourced from historical AT&T quarterly reports. LTV calculated by author.

In particular, given that inflation has placed upward pressure on the price of services and also that competition has been growing from T-Mobile – the fact that AT&T has managed to grow ARPU while concurrently not seeing an increase in churn indicates that AT&T has continued to maintain a strong customer base despite upward pressure on price as well as increased competition.

For instance, both AT&T and competitor Verizon (VZ) had raised prices on older unlimited plans, and AT&T cites a mix shift to higher-priced unlimited plans as a key driver behind the higher ARPU that we have seen this quarter, as well as higher international roaming.

From a balance sheet standpoint, we can see that the long-term debt to total assets ratio of AT&T has continued to see a slight decline – with a drop of 1.02% in long-term debt from that of the previous quarter.

| Dec 20 | Dec 21 | Jun 22 | Dec 22 | Jun 23 | Sep 23 | |

| Long-term debt | 153775 | 151011 | 129747 | 128423 | 128012 | 126701 |

| Total assets | 525761 | 551622 | 426433 | 402853 | 408453 | 406698 |

| Long-term debt to total assets ratio | 29.25% | 27.38% | 30.43% | 31.88% | 31.34% | 31.15% |

Source: Long-term debt and total assets figures (in millions of dollars) sourced from historical AT&T quarterly reports. Long-term debt to total assets ratio calculated by author.

We have seen that AT&T has been successful at reducing the size of its long-term debt over the above period – and the fact that the company has been able to bolster revenue without having to rely on increased long-term debt loads to do so is encouraging.

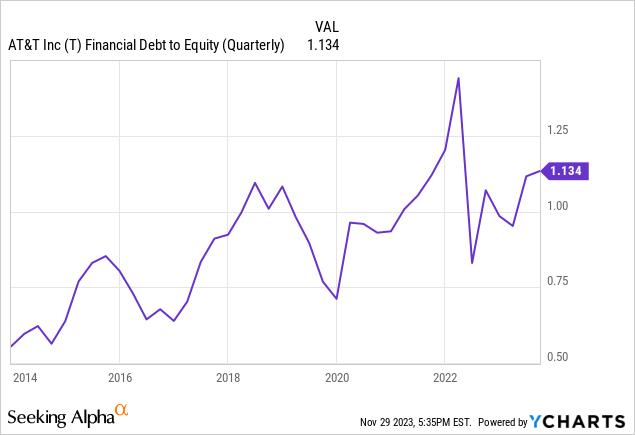

ycharts.com

Additionally, we also see that AT&T’s debt to equity ratio remains at similar levels as that seen five years ago – and the fact that AT&T is controlling its debt load while concurrently boosting revenue is encouraging.

My Perspective and Looking Forward

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, I had previously expressed a concern that AT&T may come under pressure as a result of increased competition from T-Mobile, as well as the possibility that higher prices could entice more customers to switch.

However, we have seen no evidence of this being the case in the most recent quarter. With AT&T’s stock price having reached a 30-year low earlier this year, the recent rebound that we have seen is in part a reflection of the company’s resilience to pressures faced on both the competitive and macroeconomic front.

When we look at performance for this year, we can see that AT&T has vastly outperformed the S&P 500 – up by over 20% during the period.

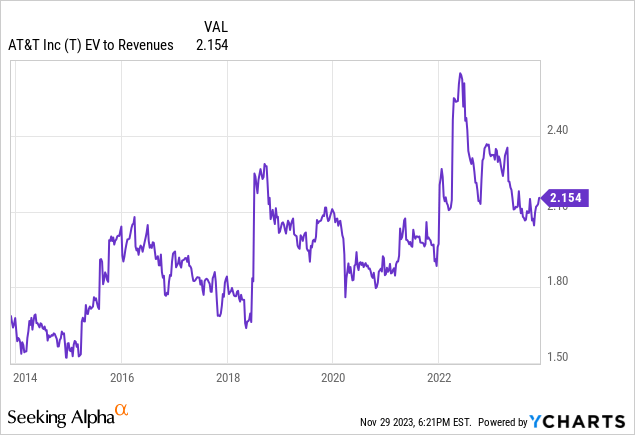

When looking at enterprise value to revenues for AT&T, we can see that while this is significantly lower than highs seen in 2022, the ratio is still trading at the upper end of the range as compared to previous years.

ycharts.com

With that being said, we can also see that compared to T-Mobile and Verizon, AT&T has a lower EV to revenue ratio and may be more attractively valued than its peers in this regard:

ycharts.com

Risks

In terms of the potential risks to AT&T at this time, while the growth in customer lifetime value has been encouraging this quarter – the risk of increased competition from T-Mobile or higher prices enticing customers to switch could still place upward churn on pressure once again – which in turn could place downward pressure on LTV.

In addition, while AT&T has the advantage of a large customer base – it continues to lag behind T-Mobile and Verizon in terms of 5G speeds. Should we see this also become an enticing factor for customers to switch network, then the stock could still face downside risk.

Conclusion

To conclude, AT&T has seen encouraging growth in customer lifetime value and has managed to boost revenues in spite of increased competition from T-Mobile and Verizon.

I take the view that the stock is not without risk, but the stock’s recovery so far has been quite impressive and the company looks to be attractively valued on an EV to revenue basis as compared to its peers. On this basis, I revise my rating on AT&T from hold to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written on an "as is" basis and without warranty, with no guarantee of accuracy or completeness. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.