Summary:

- AT&T has underperformed the market over the past decade, but some investors remain bullish on the stock.

- Recent upgrades and positive signs of stabilization in the wireless competitive environment have injected new life into AT&T.

- Management has signaled plans to generate significant free cash flow, pay down debt, and improve financial metrics, which could lead to a potential turnaround for the company.

Brandon Bell

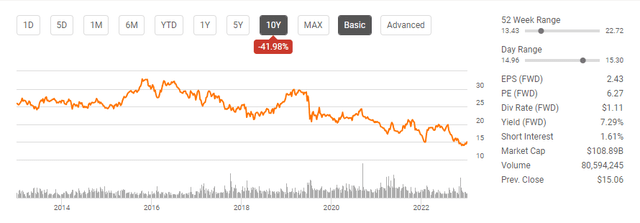

AT&T (NYSE:T) has been one of the most disappointing investments, creating a long-term track record of underperforming the market. While the large dividend yield has kept shareholders engaged, it’s simply not enough to overshadow a lost decade of shareholder value. On an adjusted basis for the WarnerMedia spinoff, shares of AT&T have declined by -41.98% over the past decade, while investing in the SPDR S&P 500 Trust ETF (SPY) would have produced 159.71% in shareholder returns. Some investors have written AT&T off and will never look back, while others, including myself, remain bullish no matter how painful it is. I don’t believe AT&T will experience a turnaround overnight, but I do see a path for shares to appreciate and management to reinstate an annualized dividend growth plan. Thankfully I have time on my side because I feel it’s going to take at least several quarters of solid results for the market to change its perception regarding AT&T. Thankfully, management has injected new life into the prospects that things are changing for the better, and now they need to deliver, otherwise AT&T may continue down the road of paying a large dividend at the costly price of eroding share value.

AT&T has rebounded off the lows, and a bottoming process could be occurring as life is being injected into AT&T once again

Shareholders watched shares of AT&T fall well under their pandemic lows, to the lowest level in more than a decade, as they reached $13.43 in July. There is an old quote, “It’s always darkest before the dawn” as there is the least amount of light right before the dawn because dawn starts when the first light begins to show. The summer of 2023 could be AT&T’s darkest point as things are starting to look better. AT&T finished the summer on a positive note as AT&T was upgraded to a buy at Citigroup (C) on August 29th. Citigroup indicated that the wireless competitive environment is showing positive signs of stabilization, which should help operating performance as increased levels of free cash flow (FCF) would help reduce leverage and support the dividend.

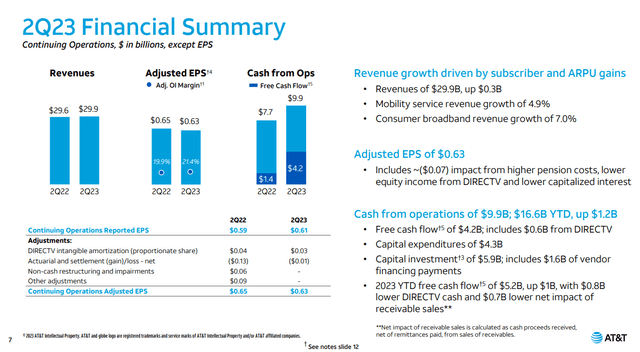

After ending the summer with an upgrade from Citigroup, AT&T presented at the Goldman Sachs (GS) Communacopia & Technology Conference on September 6th and the Bank of America (BAC) Media, Communications and Entertainment Conference on September 14th. At the end of the Goldman Sachs conference, AT&T CEO John Stankey closed out his discussion discussing cash. He disclosed that AT&T will be in a position where they end 2023 with a cash surplus which will allow them to pay down debt. AT&T will embark on an ongoing endeavor to move toward a 2.5x leverage ratio, which will improve the credit quality of the dividend. At the Bank of America conference, AT&T’s CFO Pascal Desroches discussed how they will generate $11 billion in FCF in the 2nd half of 2023 after generating $5 billion in the 1st half. He indicated that AT&T incurred peak levels of device spend, capital, and annual compensation in Q1. In Q3, AT&T is seeing lower device spend than in Q2, lower capital spend, and higher receipts from the growth that occurred in the 1st half of the year. He stated that when you put everything together, AT&T should generate between $4.5 to $5.5 billion in FCF in Q3.

Directly after the Bank of America conference, shares of AT&T gained 2.8% midday after Pascal Desroches expressed confidence in the 2nd half, producing enough FCF to meet the $16 billion annualized target. After generating $5 billion in the 1st half of the year in FCF, the market seemed worried that AT&T wouldn’t meet its annualized target. With Q3 winding down, Pascal Desroches gave the market exactly what it needed before earnings season begins again in October. AT&T’s CFO certainly has enough data to make accurate projections about how Q3 will finish, and if the move this week is any indication of what is to come, AT&T may have bottomed in the summer of 2023.

Why I am sticking with AT&T, and what I feel needs to occur for shares of AT&T to regain all of the losses from the past decade

When I discuss investments with my friends, the subject of AT&T comes up from time to time. On more than one occasion, I have been told to exit the position and never look back. Normally, I would have no issues exiting a loser and redeploying the capital to either an investment that I feel will recover the lost capital, or dump it into one of the income-producing positions I am building out. When it comes to AT&T, I will be the first to admit that I am having trouble exiting the position for two reasons. I still see AT&T as a broken stock, not a broken company, and the dividend yield exceeds 7%, so I am being paid to wait. If I didn’t feel that AT&T could significantly rebound, exiting my position would be an easier decision. Given the situation AT&T is in, I am inclined to dollar cost average further into my position as I see a path for AT&T to reverse the past decade’s performance. The main obstacle resides with management, as they will need to remain disciplined and not go off on any tangents in the future. For AT&T to erase the losses of the last decade, shares will need to appreciate by $10.68 (70.13%) to get back to $25.91, the price shares closed at on September 16th, 2013.

Mr. Market has had AT&T in the penalty box for what seems like an eternity, and I am under no delusions as to the degree of difficulty it will be for AT&T to trade between $25-$30. AT&T isn’t necessarily an exciting company with cutting-edge technology. Connectivity is looked at as more of a utility in 2023, and regardless of the technological advances, providing these services at quicker or more dependable levels doesn’t create a euphoric moment. I believe the most likely path for AT&T to travel down, which brings the share price back to $26, will be entirely dependent on its financial metrics. AT&T will need to deliver customer growth in its mobility and broadband segments, reduce its CapEx, increase its FCF, reduce its debt, and implement a share repurchase and dividend growth program.

We have been down the road of AT&T trying to expand into different businesses, and it didn’t create value. Unless AT&T embraces being a boring company that generates large amounts of FCF and net income, shares may never return to their previous levels. I do hope this time is different because if management embarks on a multi-year plan of fiscal discipline, they could set the stage for an incredible comeback story. The facts are that AT&T generates a tremendous amount of FCF, and management has signaled that they will generate $16 billion of FCF in 2023. At this point, the only things that I see getting the market excited are reduced debt, buybacks, and dividend increases.

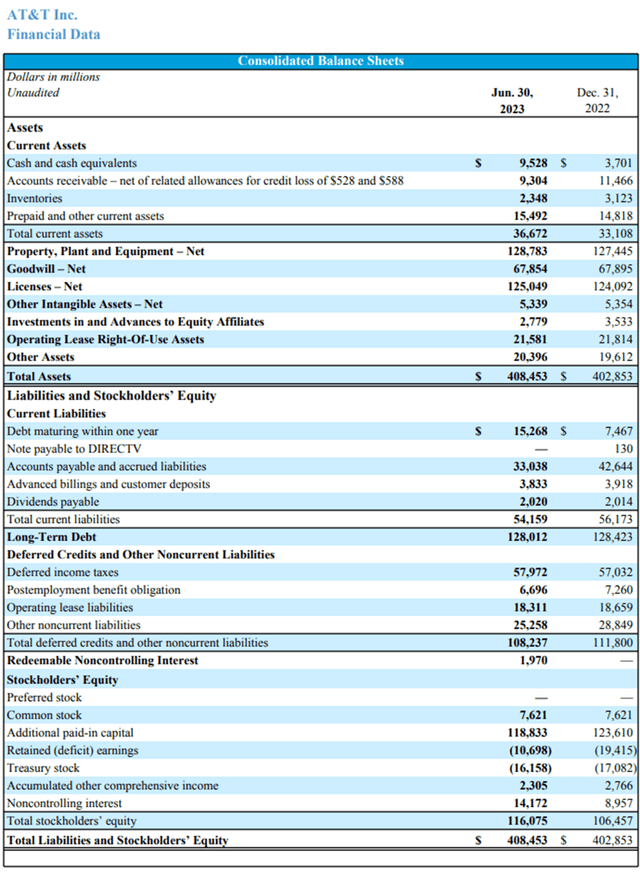

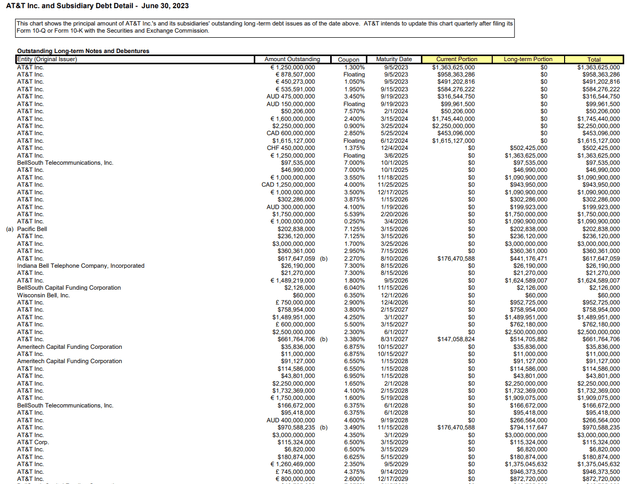

Assuming that AT&T generates $16 billion in FCF, then its annualized dividend payments of $8.2 billion would account for 51.25% of its FCF. On AT&T’s balance sheet, they have $15.27 billion of debt maturing over the next year, with another $128.01 billion in long-term debt. AT&T has $9.53 billion in cash on hand, which is 62.4% of the debt maturing over the next year. Hypothetically, if AT&T didn’t increase the amount of FCF it generates and remains stagnant at $16 billion, it would generate $4 billion per quarter and retain roughly $1.95 billion after dividends are paid. When you add the $9.53 billion of cash on hand, and the $1.95 billion in retained cash flow over the next 4 quarters, AT&T has $17.33 billion of capital to work with.

Even if we were in a low-interest rate environment, refinancing debt at lower rates wouldn’t help AT&T. The narrative has been that AT&T is ridden with debt, and this has been the major deterrent for investors. For AT&T to change the narrative, it must reduce the debt on its balance sheet. Based on AT&T’s schedule of debt, the $15.27 billion of debt maturing over the next year accounts for all the 2024 maturing debt except for $502 million terming in December 2024. If AT&T utilizes its cash on hand and the next 4 quarters of retained FCF, it could eliminate the $15.27 billion of debt maturing and be left with $2.04 billion in cash. This places AT&T in the summer of 2024 with $2.04 billion in cash and another $3.9 billion in retained cash flow being generated in Q3 and Q4 of 2024, with only $502 million of debt maturing for the remainder of their 2024 fiscal year. After paying off the $502 million, they could finish 2024 with $5.44 billion in cash on hand. In 2025, AT&T will have $4.64 billion of debt maturing, which could be covered by their cash on hand. Assuming that AT&T eliminates this debt and banks the retained FCF, they could finish 2025 with $8.6 billion in cash going into 2026, which has $10.38 billion in debt maturing. AT&T could use its retained FCF of $7.8 billion to eliminate the majority of this debt, then take the remaining $2.58 billion from its cash on hand and be left with $6.02 billion in cash.

This plan isn’t exciting, but it would put AT&T in a position where $30.79 billion of their debt is eliminated (21.49% of total debt) from now until the end of 2026, and leave AT&T with $6.02 billion cash on hand. AT&T’s debt load would decline from $143.28 billion to $112.49 billion and, based on the TTM EBITDA level, leave AT&T at a 2.59x debt-to-EBITDA ratio compared to the current 3.3x level. This would also reduce the amount of interest expenses AT&T incurs and position them to start a buyback program and annual dividend increases. If management decides to do this is a different story, but AT&T has the FCF to get to a 2.5x debt to EBITDA level and implement both a buyback and dividend increase plan before the 2027 fiscal year starts.

Conclusion

Maybe this is just wishful thinking, but I see a long-term path for AT&T’s management to correct its previous mistakes. It’s not going to be a quick recovery, and many things need to fall into place, but if AT&T can stick to $16 billion of annualized FCF and not lose sight of its objectives, shareholders could have a lot to look forward to. AT&T’s been a painful investment, but there is still a path for management to turn this around. If management doesn’t implement a version of what I outlined over the next several years, then I may be forced to throw in the towel. I do believe that management needs to look at the business as a cash-generating machine to pay down debt, buy back shares, and increase the dividend. Over the next 4-years, AT&T has the ability to eliminate over $30 billion of debt, get to a 2.5x debt-to-EBITDA ratio, reduce its interest expenses, and repurchase shares, which will indirectly help EPS increase and reinstate its dividend growth program.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.