Summary:

- AT&T’s stock has underperformed the broad market for a long period, but now the share price looks unfairly low.

- The company is in a massive net debt position due to draining CAPEX invested in infrastructure expansion and innovation.

- I see a strong commitment from the management to optimize costs.

- With a high potential for margin expansion, balance sheet improvement looks like just a matter of time to me.

Ronald Martinez

Investment thesis

AT&T (NYSE:T) stock significantly underperformed the broad market over the past decade with a 41% decline in the share price, while the flagship SPDR S&P500 ETF (SPY) delivered a 165% price appreciation over the same horizon. Looking at the company’s volatile financial performance over the long term, with stagnated profitability metrics, the underperformance looks fair. On the other hand, my valuation analysis suggests that what we see now is highly likely to be a bottom for the stock price. I also like that the company’s decision to focus purely on the telecom business after the spinoff of WarnerMedia to Discovery. The 7% dividend yield looks attractive, and there is very little chance for downside for the stock price. Therefore, I assign T a “Strong Buy” rating.

Company information

AT&T provides telecommunications services to consumers in the U.S. and Latin America and businesses worldwide. The company has a vibrant history tracing back to 1885. AT&T’s offerings include mobile and landline telephony, high-speed internet, digital television, and enterprise networking services.

The company’s fiscal year ends on December 31. According to the latest 10-K report, services represented about 80% of the total revenue in FY 2022.

Financials

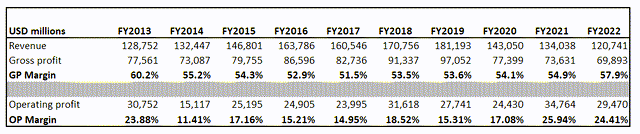

As the telecom industry reached almost complete penetration in the U.S., AT&T, and its peers started facing difficulties in driving revenue growth. Over the past decade, the company’s revenue declined slightly due to several reorganizations and divestitures. What I believe is essential is that profitability metrics are still solid, even in a current unfavorable environment with harsh secular headwinds. Gross margin and operating margin demonstrated a solid rebound from the lows in FYs 2017-2018. Therefore, restructurings were sound, as the company’s profitability improved significantly in recent years.

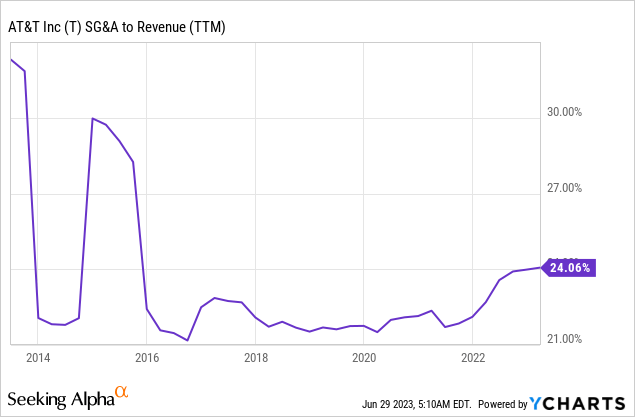

The SG&A to revenue ratio improved significantly over the decade, but stagnated over the multiple years as well. I think a 24% ratio is substantially high, and the company has room for improvement here. According to the latest earnings call, management indicated its commitment to cost optimization to achieve a $6 billion target in cost savings. Looks very promising, but at the same time doable, given the current high SG&A to revenue ratio.

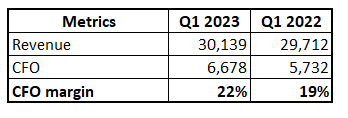

Narrowing down to the quarterly level, we can see that headwinds are still in place because the operating margin shrank YoY. On the other hand, the gross margin expanded again compared to both March 2022 and March 2021. I think that once the spinoff of Warner Media is finalized completely, the company will be able to return to the path of profitability metrics expansion. Despite shrinking operating margins, I would like to underline significantly improved cash flows from operations [CFO] margin. This was mainly due to the actions taken to improve the working capital management.

Author’s calculations

Looking at the company’s balance sheet, I can definitely say that there is a lot to improve both in working capital management and long-term capital allocation. The company is in a massive net debt position due to its heavy CAPEX over the past decade. The company’s payout ratio is at about 44% and I expect the free cash flow [FCF] to improve as the management executes its cost-efficiency action plans. Therefore, I think that AT&T is able to demonstrate a consistent improvement of the balance sheet every quarter.

Overall, I think that AT&T’s strategy of heavy investment in networks with extending fiber and 5G coverage gives it a solid infrastructure, improving the company’s strategic positioning. The balance sheet does not look strong, but over the next quarter the company will be able to demonstrate its priority of allocating free cash to decreasing the outstanding debt amount.

Valuation

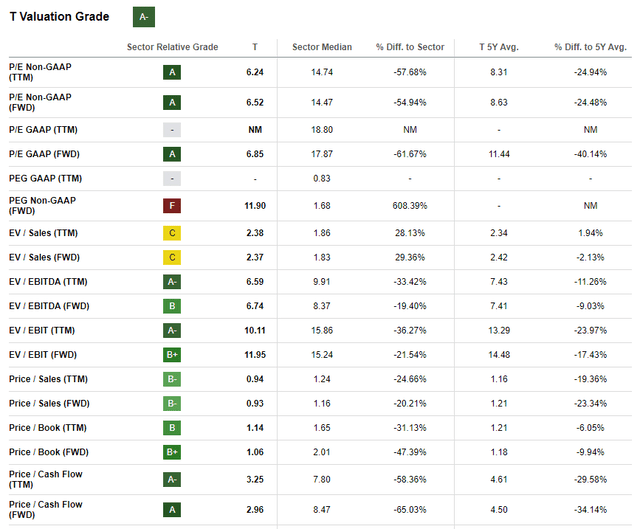

The stock significantly underperformed the broad market so far in 2023 with about a 16% share price decline year-to-date. Seeking Alpha Quant assigned the stock a high “A-” valuation grade meaning the stock is attractively valued. but making conclusions might be incorrect due to secular headwinds the telecom industry and T, in particular, are facing.

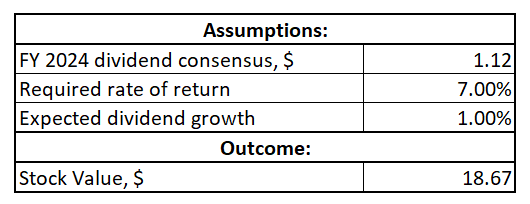

Therefore, let me extend my analysis with two more valuation approaches. I will proceed with a discounted dividend model [DDM]. I use a 7% WACC for the discount rate, the same one I used in my recent analysis of Verizon. Consensus estimates forecast FY 2024 dividend at $1.12. In recent years the company struggled with dividend growth, but over the next two years, consensus expects the payout to grow by 1 cent, meaning about a 1% growth. I will incorporate a 1% dividend growth rate for my base case DDM scenario.

Author’s calculations

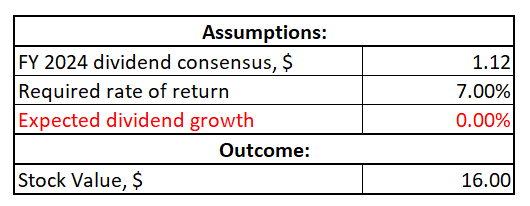

I would also like to simulate a scenario with zero dividend growth incorporated into the DDM formula. Even with no dividend growth the stock does not look overvalued and the fair value is very close to the current market price.

Author’s calculations

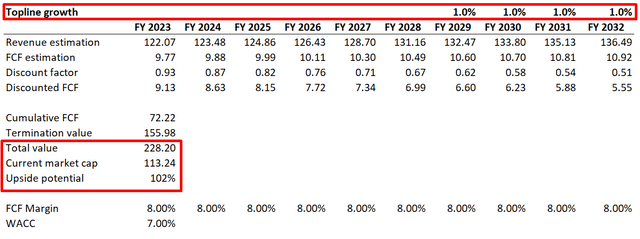

I will also simulate a discounted cash flow [DCF] valuation approach with the same 7% discount rate to get more conviction. I have revenue consensus estimates available up to the fiscal year 2028. For the years beyond I project a 1% revenue growth rate. I use an 8% FCF margin which is the current TTM level, which I consider fair and conservative.

According to the DCF, the stock is about twice undervalued, but I think such a massive discount is explained by the overall struggles in the industry and the company’s net debt position, and weak liquidity.

I think that we should trust the DDM the most, and from this perspective, the stock looks attractively valued and offers a 7% dividend yield. Moreover, the DDM calculations suggest that the downside for the stock price can be likely only in the case of dividend trimming, which I consider unlikely.

Risks to consider

Given AT&T’s dominant position and the nature of the business, the company is subject to thorough antitrust scrutiny. Potential antitrust investigations may arise from concerns over market dominance, unfair competition, or monopolistic practices. The company’s financial performance might be undermined in case of fines and penalties. Moreover, large antitrust lawsuits is highly likely to adversely affect the company’s reputation.

The next major risk is the company’s big bet on 5G to become the new wave for growth. While it is highly likely that the new generation of telecom technologies will become a big driver, the effect on the bottom line is uncertain. I think that the uncertainty about whether the investment in 5G will payoff soon is substantial because of massive CAPEX. The company’s investment in CAPEX was close to a staggering $90 billion over the past five years, and it was financed by debt. That is why the company is currently in a massive net debt position. Moreover, it is also uncertain how fast a new technology disruption will come to the telecom industry with draining CAPEX demands.

Bottom line

Overall, I think that T represents a solid investment opportunity. I like the 7% dividend yield and the valuation. My DDM analysis suggests that the stock is fairly valued even if dividend growth is not incorporated into calculations. The management focuses on improving profitability, and my analysis suggests it is doable. I assign AT&T stock a “Strong Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.