Summary:

- Shares of AT&T surged after the management team at the company announced financial results for the fourth quarter of 2022 that were mixed.

- On the whole, the company did quite well, but it did reveal some issues that make it marginally less attractive than it was previously.

- Shares are still cheap and offer significant upside potential in the long run.

Brandon Bell

When you run a concentrated portfolio like I do, a portfolio that consists right now of only 9 holdings, how any one company performs can have a major impact on your returns over time. You can imagine my elation, then, when shares of telecommunications conglomerate AT&T (NYSE:T) closed up nearly 6.6% on January 25th after management reported financial results covering the final quarter of the firm’s 2022 fiscal year. Although I am incredibly happy about the outcome from a share price perspective and I do believe that the company still deserves to be a top candidate for long-term, value-oriented investors, I am a bit surprised by the market’s reception. Yes, the company did beat expectations on the bottom line. They also announced some other very positive developments for the long haul. But all things considered, the earnings release provided by management revealed some shortcomings. Ultimately, because of how cheap shares are, I still rate the company a ‘strong buy’ and I still intend to hold shares for the foreseeable future absent something significant changing. But at the same time, I also believe that some of the enthusiasm I had about the firm has been dampened by this release.

Mixed signals

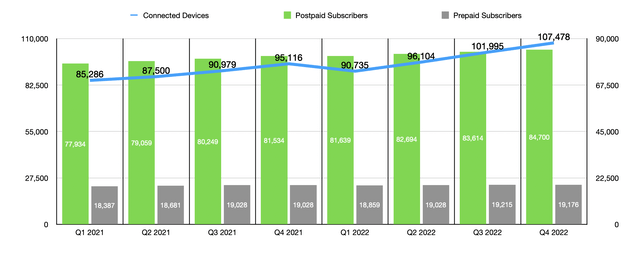

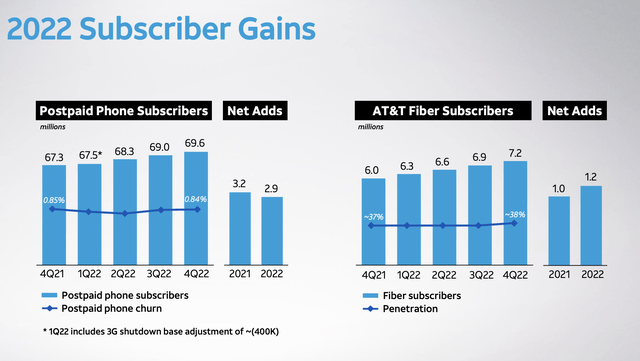

To start with, it would be prudent to cover the headline news for the company. During the quarter, management reported revenue of $31.3 billion. Although it represented a decent increase over the $31.1 billion reported the same time one year earlier, it did happen to fall short of the expectations set by management by roughly $70 million. The real driver behind this increase in sales involved the Mobility operations of the company. Sales of $21.5 billion came in 1.7% higher than the $21.1 billion reported at the same time one year earlier. On this front, the company benefited significantly from a 5.2% rise in service sales that was somewhat offset by a 6.3% decline in equipment revenue. Overall postpaid subscribers for the company ended the quarter at 84.7 million. That’s 3.9% higher than the 81.5 million reported one year earlier, with postpaid phone subscribers climbing 3.5% from 67.3 million to 69.6 million. In fact, during the fourth quarter on its own relative to the third quarter, the company saw net additions under the postpaid phone category of 656,000.

Even more exciting to me is a portion of the company that I have long viewed as a tremendous growth opportunity for the company. This involves the Connected Devices that the company sells. This number ended the final quarter at 107.5 million. That’s up 13% compared to the 95.1 million the company enjoyed the same time last year and it translates to net additions of over 5.1 million compared to what the company reported only one quarter ago. This robust growth is proof that the company’s services are in high demand. We also saw some strength in the Latin America segment, with revenue popping 22.3% from $704 million to $861 million. This came as the number of postpaid subscribers jumped 2.5% from 4.8 million to 4.9 million and as the number of prepaid subscribers shot up 7.6% from 15.5 million to 16.2 million. This is not to say that everything was great for the company on the top line. Its Business Solutions operations reported a 2.3% decline in sales from $9 billion to $8.8 billion. Even though wireless service revenue grew 7.1%, the unit was negatively impacted by declines across the wireline service, wireless equipment, and wireline equipment categories. Also painful was the 4.5% decline the company saw in its Business Wireline unit.

There was one other area of strength for the company worth mentioning. The Consumer Wireline portion of the firm managed to grow revenue 2.2% year over year. Although legacy voice and data services, as well as other service and equipment sales both managed to fall by double digits, driven by net subscriber losses, the company successfully added 280,000 fiber broadband customers in just one quarter and added over 1.2 million over the course of a year. This brings the number of fiber subscribers to the company up to 7.2 million compared to the 6 million reported one year earlier. Also along this vein, management updated investors on the number of fiber locations it has established. This number has now grown to 22 million, placing the company well on its way of hitting 30 million by 2025. This is a massive improvement compared to the 18.5 million locations that the company reported at the end of the third quarter of 2022. Similarly, the company managed to increase its 5G mid-band spectrum network to 150 million people. The prior expected guidance for the company for the end of the year had been 130 million, up from an initial 70 million to 75 million when the company announced expectations during the second quarter of 2021. The speed at which management has achieved all of this is remarkable and is likely the driving force behind shares of the company increasing in response to the earnings release. Also during this time, the company reported an increase in broadband revenue of 7.2% thanks to fiber growth and a rise in ARPU of 8.8% year over year.

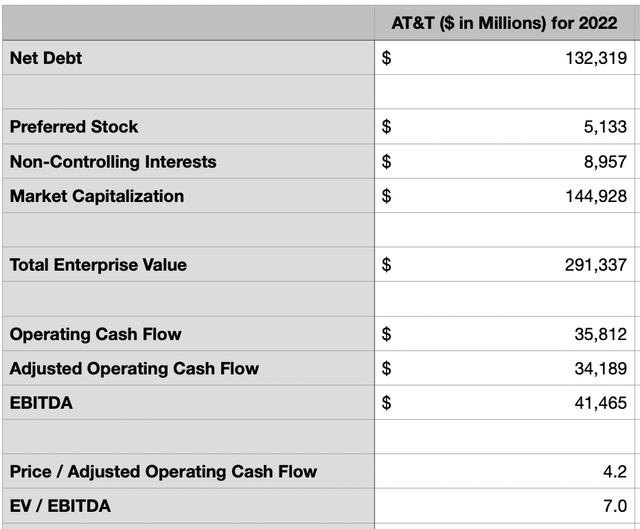

All of this is great news, as is the fact that the company managed to beat expectations at least on the bottom line. Earnings per share for the quarter came in at $0.61 on an adjusted basis. This was higher than analysts’ expectations to the tune of $0.04 per share. Although I am happy about this, there were some areas where the company could have done better. Overall operating cash flow for the quarter came in at $10.3 billion. While this increase over the $8.1 billion reported the same time one year earlier is fantastic, it fell short of the $12.5 billion the company would have needed to hit operating cash flow for the year of $38 billion. Instead, overall operating cash flow for the company came in at $35.8 billion, down from the $37.2 billion reported one year earlier. At least the company did hit the $41.5 billion in EBITDA it had forecasted for the year. This was because of a $10.2 billion reading for the final quarter, up from nearly $9.5 billion one year earlier. Because of the shortfall in cash flow though, and because of just the various decisions management made, overall net debt for the company came in a bit higher than I would have liked. In a prior article, I estimated that excess cash flow would allow this number to come in at $129.8 billion. The actual number was $132.2 billion, up from the $131.1 billion reported in the third quarter.

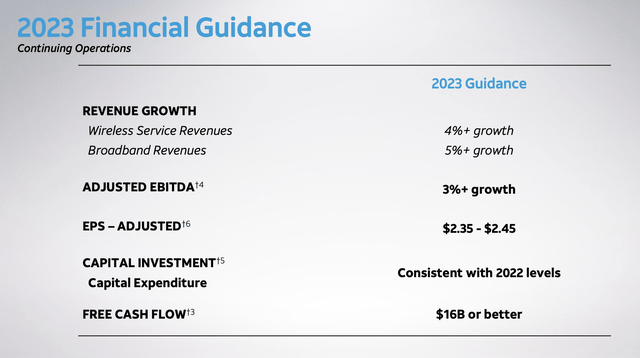

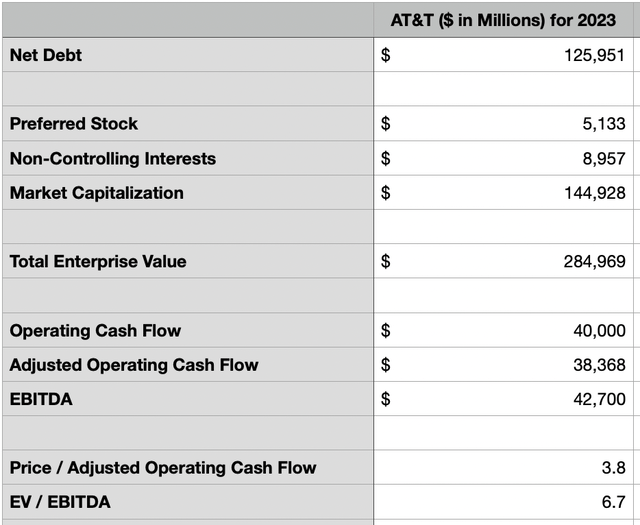

When it comes to the 2023 fiscal year, management also provided some soft guidance. Wireless service revenue is supposed to grow by 4% or more, while broadband revenue should be up 5% or more. Overall, EBITDA for the company should grow by 3% or more for the year. This would imply a reading of $42.7 billion. Going off of management’s own guidance from last year, I was expecting a reading of $44 billion for 2023. Keeping all else the same, we should end up with operating cash flow for 2023 of roughly $40 billion, with an adjusted reading of roughly $38.4 billion. The company should be aided on this front by management’s significant cost-cutting initiatives. Previously, the company had forecasted only $4 billion in annual run rate synergies from its cost-cutting efforts by the end of 2022. Management now claims that number exceeded $5 billion and should hit at least $6 billion by the end of 2023.

These shortcomings, combined with the failure of the company to reduce debt during the final quarter of the year, are rather disappointing. But this does not change my overall view of the company. On a forward basis, AT&T is trading at a price to adjusted operating cash flow multiple of 4 and at an EV to EBITDA multiple of 6.7. By comparison, if we were to use the data from 2022, these multiples are 4.2 and 7, respectively. During this time, the company should also continue to pay debt down further. As of the end of the final quarter of 2022, the net leverage ratio for the company came in at 3.19. But between the higher cash flows and the possibility of allocating at least $6.4 billion toward debt reduction this year, this number could fall to 2.95 by the end of 2023.

Takeaway

As a shareholder, I always want to see a perfect and rosy forecast for the future. I want to see a company that can hit all the targets or can even exceed them. Sadly, that’s not how reality works often. The fact of the matter is that AT&T posted some really good results and posted some results that weren’t the best. Guidance is a bit weak and net debt increased sequentially. The firm also missed expectations on the top line modestly. But when you look at subscriber numbers, overall cash flows, and how cheap shares are, I believe that the bullish case is far better than the bearish case for this enterprise.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!