Summary:

- Utility stocks have been hit hard in the recent market drawdown, with the XLU losing over 16%.

- AT&T offers a 7% yield, which is higher than today’s Treasuries, making it a defensive play for portfolios.

- Despite issues with its balance sheet, AT&T is worth owning at its current price and has the potential for dividend growth.

iantfoto

Thesis Summary

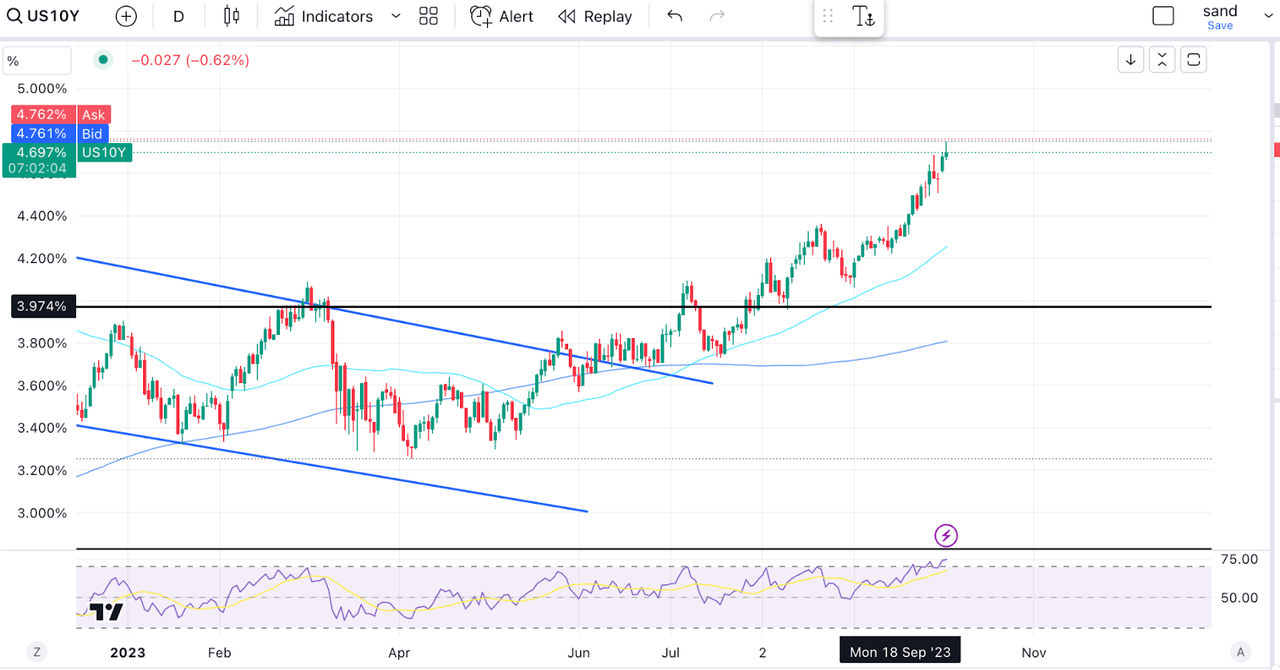

Utility stocks (XLU) have come crashing down in the last couple of weeks. This behaviour is quite surprising, though it is probably related to the higher rate hikes.

However, in AT&T (NYSE:T) we can find a “utility” that can weather the storm. Although the company has come under pressure recently, and the dividend has not increased, the company still offers a 7% yield that even today’s Treasuries can’t compete with.

AT&T has issues with its balance sheet, but the stock is worth owning at this price, especially if you are trying to find defensive plays for your portfolio.

Utilities Come Crashing Down

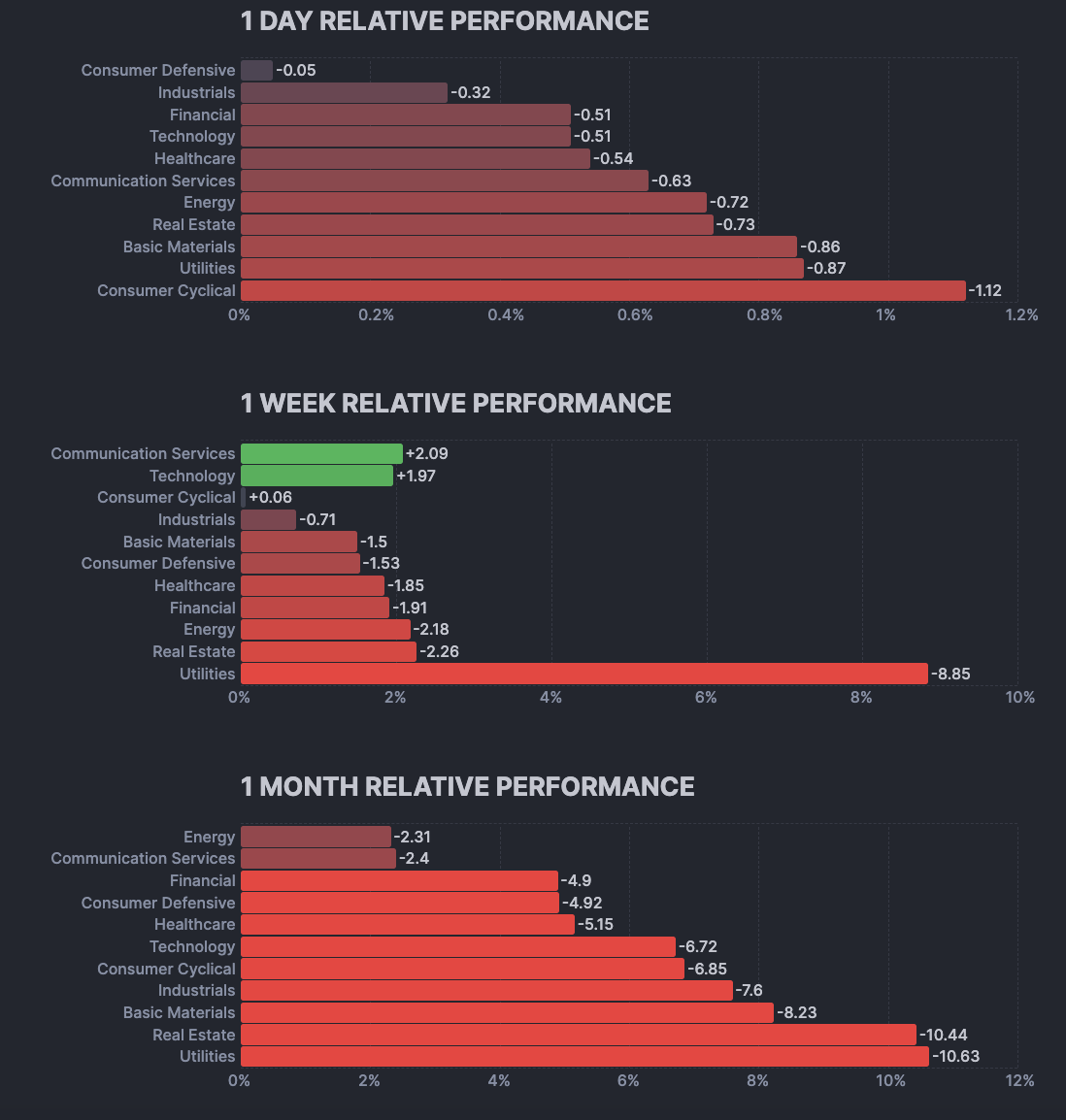

To the surprise of many, utilities have been the hardest-hit sector in this last market drawdown.

Sector Performance (finviz)

While the S&P 500 (SP500) is down around 8%, the XLU has lost over 16% since it hit a peak. This kind of underperformance is completely unprecedented, and it’s hard to understand why this is happening.

The only idea that comes to mind is that some investors might be looking at selling utilities in favour of Treasuries.

10-year yields are paying investors 4.7%. Meanwhile, XLU pays a dividend yield of 3.7%. Indeed, it seems like utilities are not worth the risk at these levels. But in my opinion, neither are treasuries.

10-year bonds now pay over 5%, but this has only been possible after a 50% collapse in bond values. Jamie Dimon believes rates could go to 7%, which would mean even more losses for bond buyers. So why risk it?

Instead, investors today can buy 7% yielding AT&T, trading at record low valuations and with a clear path to restoring its balance sheet and dividend growth.

Cash Flow And Balance Sheet

There’s no doubt that AT&T has a lot of work left to do, but nonetheless, I believe investors buying in now can do so at a reasonable margin of safety.

The only important question right now is if AT&T can clear up its balance sheet and if it can do so without cutting the dividend too far.

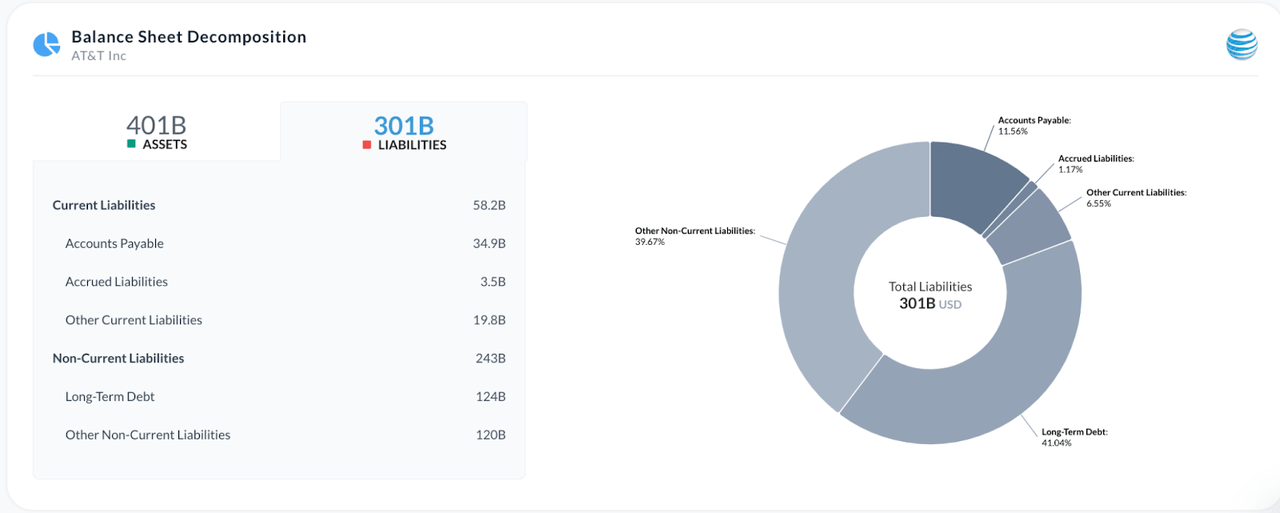

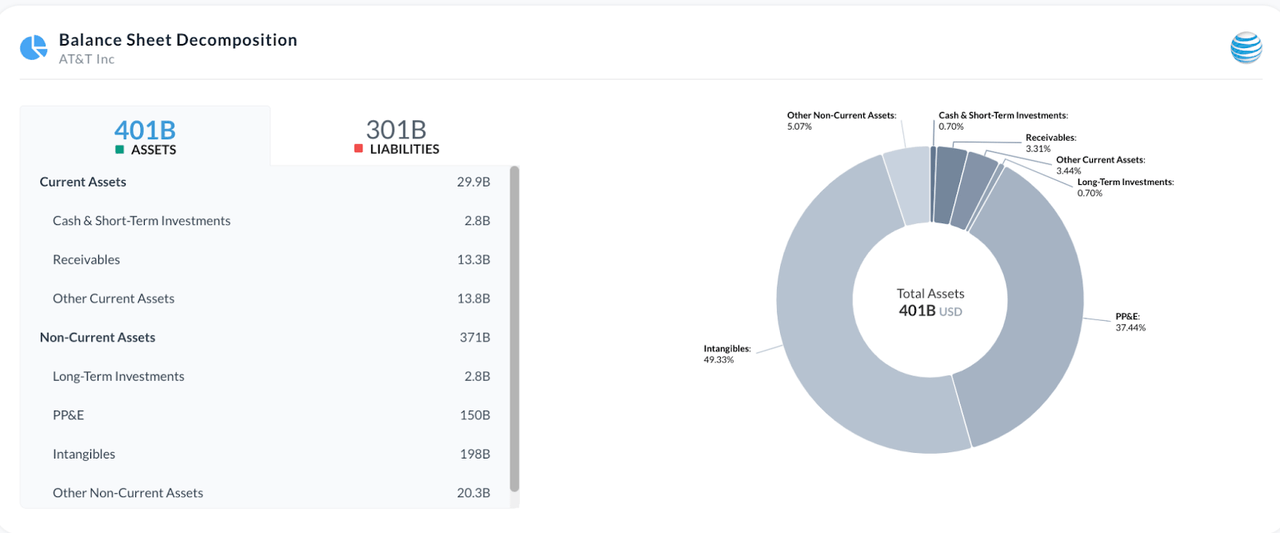

T Balance Sheet (Alpha Spread) T Balance Sheet (Alpha Spread)

The company has $58.2 billion in current liabilities, with only around $29.2 billion in current assets.

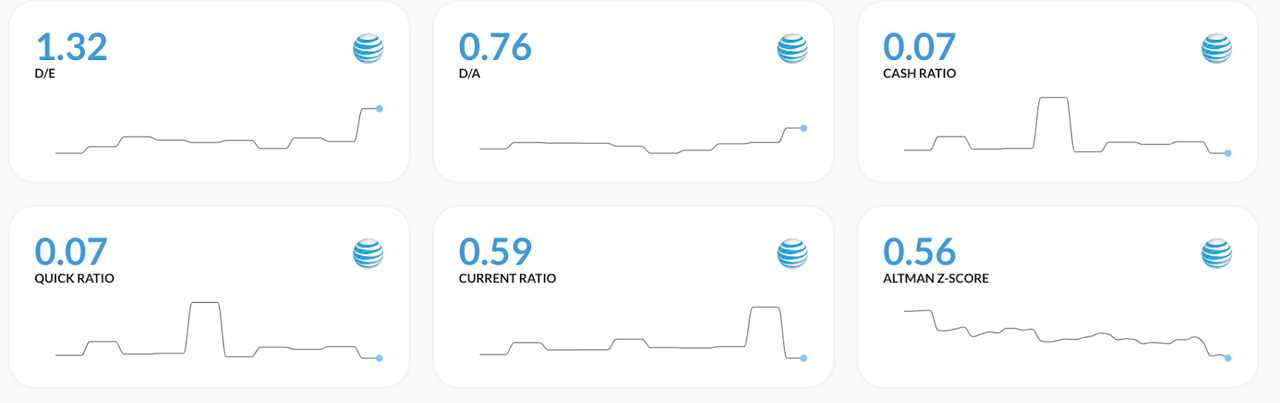

The bigger problem, though is the net debt position of $121 billion. Ultimately, T doesn’t score very high on any of the solvency metrics.

Solvency Ratios (Alpha Spread)

But the company knows this and is taking the right measures to fix it. The last dividend distribution was kept the same, leaving more money for debt repayment. The company hope to pay down $4 billion by the end of the year.

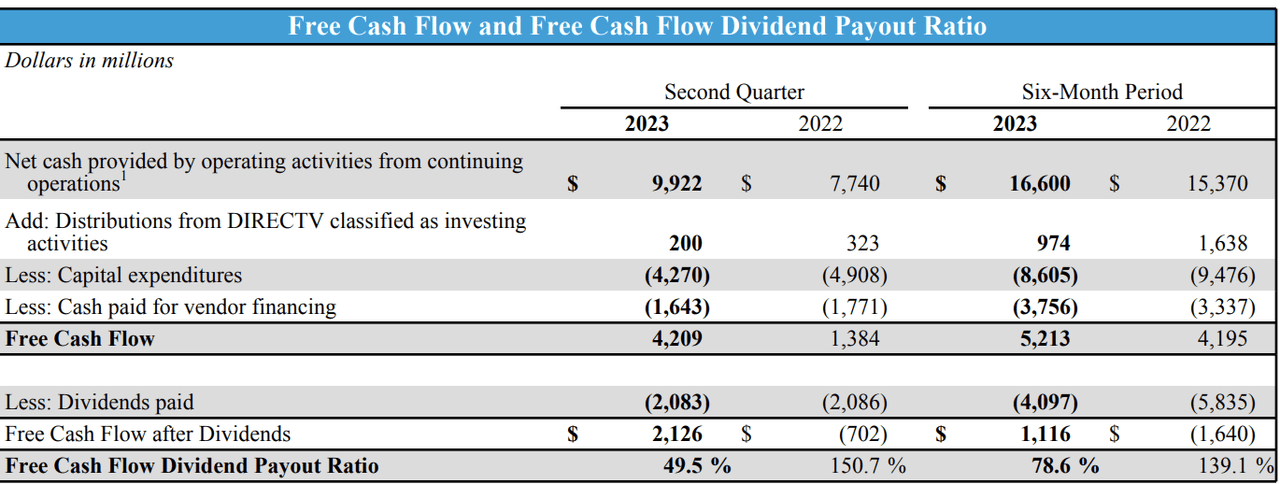

The key to paying down the debt here is cash flow. If the company can maintain its current trend of cash flow growth, then we can expect a turnaround from the company.

In the last quarter, the company improved noticeably YoY. Analysts expect the company to keep increasing EPS at a mild rate, but this might be all that is needed to make these a decent defensive investment.

Valuation

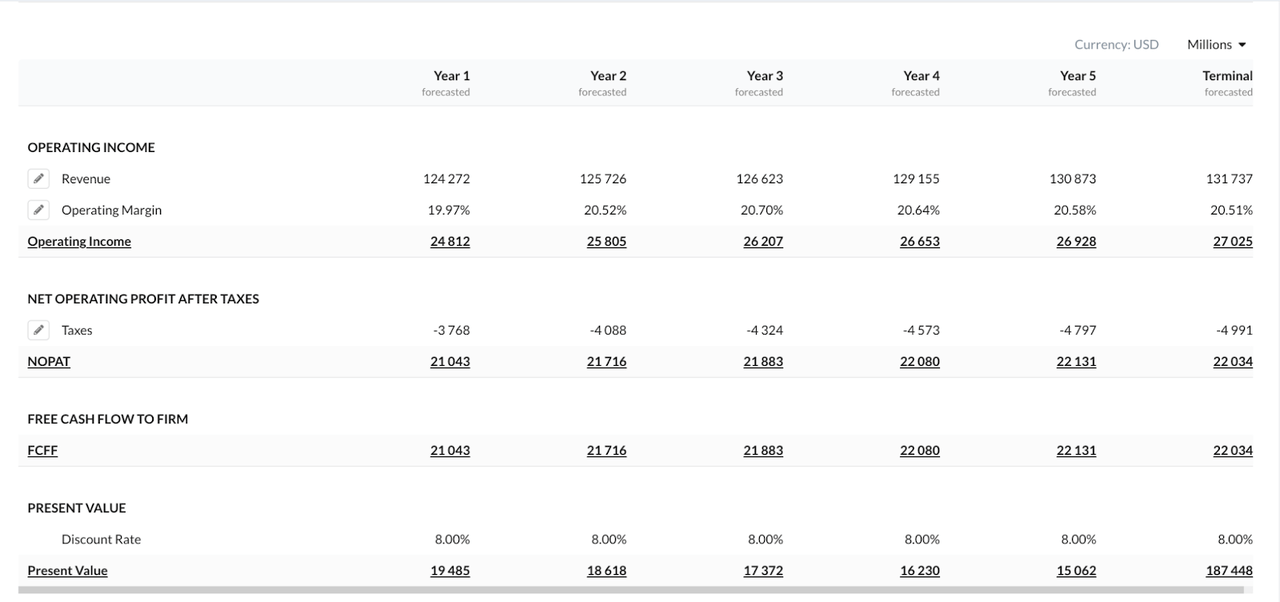

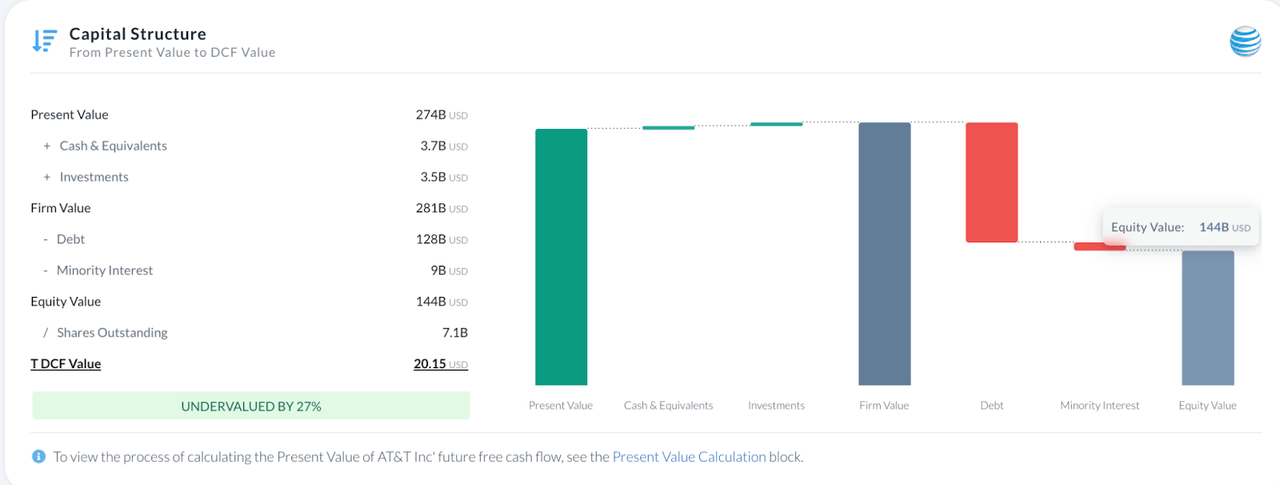

Even assuming a 2.5% growth rate and applying a discount rate of 8%, AT&T looks undervalued.

The above DCF model assumes T can reach $131 billion in revenue in 5 years and maintain an operating margin of around 20.5%.

This implies an undervaluation of 27%.

Even assuming a 0% growth rate, the company is 15% undervalued by my calculations.

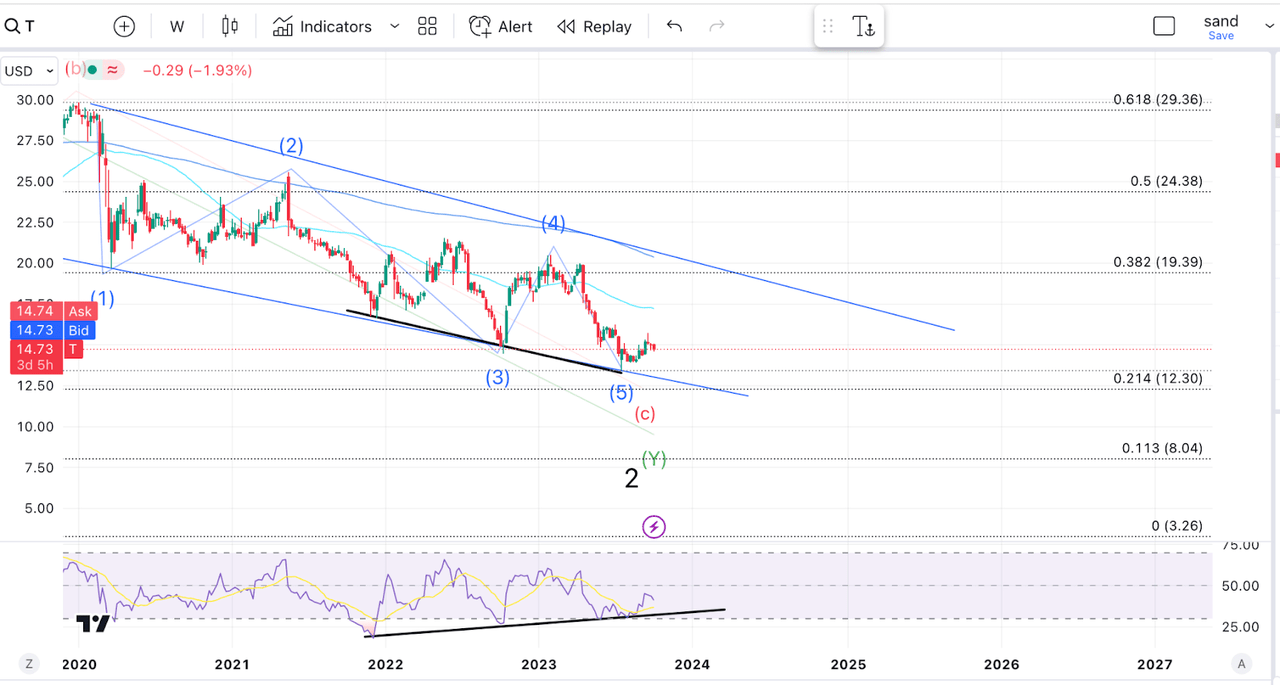

Technical Outlook

From a technical perspective, AT&T could have finished an impulse to the downside when it hit a low in July.

Technical Analysis T (Author’s work)

Furthermore, it is worth mentioning we have been forming a bullish divergence in the weekly RSI since 2022. While the price has made lower lows, the RSI has failed to break lower.

Risks

Of course, AT&T faces many challenges in the weeks and years ahead. The recent news about the lead cables did no favour to their pubic image, though I don’t think it will affect the company financially.

Meanwhile, DirectTV and Comcast, which AT&T still owns, could begin to underperform in the face of continued cord-cutting.

Lastly, with rates higher for longer, AT&T could certainly face more issues if it needs to refinance its debt.

Takeaway

As the market pulls-back, and investors begin to get defensive, it’s time to consider a company like AT&T. AT&T provides a utility-like service and can perform well even in hard times. Besides, the company is already priced for little to no growth. The way I see it, for investors looking to obtain income above and beyond what treasuries can get you right now, AT&T seems like a great option.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.