Summary:

- AT&T is seeing strong postpaid subscriber growth, customer retention and revenue growth powered by fiber investments.

- It has a path to margin improvement through cost savings and exiting legacy services.

- The shares are currently very cheaply valued, offering investors potentially strong income and capital appreciation.

Magui-rfajardo/iStock via Getty Images

Growth investments like Nvidia (NVDA) and Microsoft (MSFT) can be fun to have and look at in a portfolio, but they offer little in way of current income and reinvestment opportunities, due to their high valuations.

For example, NVDA currently yields just 0.06%, which is so low that it may as well be considered a non-dividend paying stock at the current price, and MSFT currently yields just 0.9%. This means that it would take 456 shares’ worth of dividends to buy just one share per quarter.

Many investors underestimate the value of dividends, even though it can be attributed to the success of Warren Buffett through Berkshire Hathaway (BRK.A)(BRK.B), through which he holds a number of dividend paying companies.

This brings me to AT&T (NYSE:T) which again is trading in deep value territory at its current price of $16.96 with a 6.5% dividend yield. In this article, I highlight why now may be an opportune time to add to this telecom giant.

Why AT&T?

Let’s face it, AT&T has earned a bad reputation over the past decade for poor capital allocation. That’s because management grew bored of steady returns from the telecom business and decided to venture into a media landscape of which they had no experience in running.

While the current CEO, John Stankey, was a key executive during the ill-fated acquisition of Time Warner, he wasn’t the one calling all the shots. As the current CEO, he has put the company back to its telecom roots by divesting Time Warner and selling a stake in the DirecTV business.

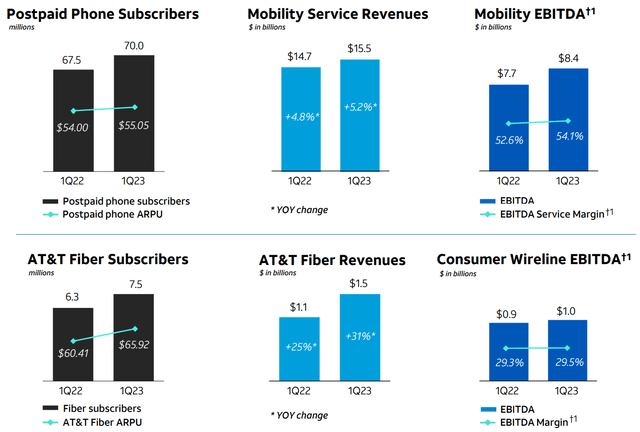

This simplified form has enabled AT&T to focus investments expanding its bread and butter telecom business, and this has paid off with continued 5G and Fiber subscriber gains. This is reflected by the 424K postpaid phone net adds during the first quarter, continuing AT&T’s 11 straight quarters with more than 400K net adds. Notably, customer retention remains strong with a customer churn rate of just 0.81%, sitting just 5 basis points higher than where it was in the prior year period.

Importantly, AT&T’s fiber investments are paying off, as it is now the third largest owner of fiber assets across the U.S., sitting just behind Comcast (CMCSA) and Charter Communications (CHTR). AT&T saw continued strong growth in this segment, with 272K net adds during Q1, marking its 13th straight quarter of more than 200K net adds.

Growth in these segments resulted in domestic wireless service revenues growing by 5.2% YoY and consumer broadband revenue growing by 7% YoY, driven by Fiber revenue growth of 31%. As shown below, AT&T saw growth in both number of subscribers and average revenue per user.

Looking ahead, AT&T plans to raise its accessible Fiber market by over 50% to 30 million households by the end of 2025, up from its current capacity to serve 19.7 million households. AT&T’s fiber customers now outnumber its DSL subscribers, and management expects Fiber to be complementary to 5G with the expectation that 75% of its network footprint to be served via fiber and 5G. Fiber could also help AT&T to sell wireless offerings to 4 million residential customers who are not current customers.

Moreover, AT&T’s exit of legacy copper services footprint (which are more expensive to maintain) should help it to improve margins, and management stated that it’s on track to achieve over $6 billion run-rate cost savings before the year end. Cost savings are also expected to be driven by process efficiencies, including the use of AI to improve fleet dispatches so that field technicians can better serve customers, and to match customers to the right support path.

Lastly, while AT&T generated just $1 billion of free cash flow in the first quarter, management expects the year to be back-end loaded and hit $16 billion in FCF for the full year. This would equate to an FCF to dividend payout ratio of 60.6%. This would also provide ample room for AT&T to pay down debt, with management expecting to achieve net debt to EBITDA ratio of 2.5x by 2025.

Lastly, I find AT&T to be solidly in value territory at the current price of $16.96, after selling off from the $20 level last month. It carries a forward PE of just 6.98. At this low of a valuation, it could produce low to mid single-digit EPS growth and still generate meaningful returns for investors.

Analysts have a consensus Buy rating with an average price target of $21.31, representing a potential 26% upside based on capital appreciation alone and the dividend gives a nice kicker on top of that.

Investor Takeaway

In summary, AT&T is a great play for investors looking to benefit from the 5G and Fiber buildouts that are taking place across the U.S. It has strong subscriber growth, a solid customer retention rate, and a strong path to margin growth through cost savings. Furthermore, it’s trading at a very low valuation with an attractive and covered dividend yield of 6.5%, giving value investors meaningful income while waiting for potential capital appreciation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!