Summary:

- I think it’s now time to update my bullish thesis on AT&T, Inc. stock and find out if my previous “Buy” rating is still relevant.

- As far as I can see, AT&T’s management has successfully cut costs and prioritized growth segments.

- I like what I see regarding debt management: AT&T’s net debt to adjusted EBITDA ratio is ~3.2, which I think is close to normal following the generally accepted standards.

- The management is now focused on deleveraging and network expansion. FCF is going to grow >4% in 2024 despite a rise in CAPEX.

- My updated DDM model yields a new “fair value” of $20.55, which is nearly 19% above the current market price. I’m positive about the medium-term growth potential of AT&T stock and reiterate my previous “Buy” rating today.

Justin Sullivan

Introduction

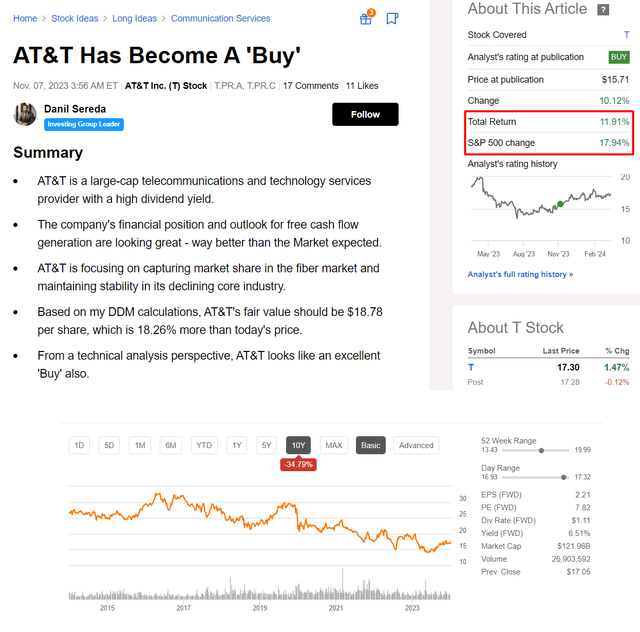

In early November 2023, I published an article here on Seeking Alpha about AT&T Inc. (NYSE:T) stock with a ‘Buy’ rating, noting that the company’s financial position and FCF generation prospects looked excellent. I also had a DDM model that said the stock was ~18% undervalued at the time. More than 3 months have passed since then, and AT&T stock has gained almost 12% in that time (the total return price), which is lower than the return of the S&P 500 (SPX), but still a pretty good result for a stock that has been declining rapidly in recent years.

Seeking Alpha, author’s coverage

I think it’s now time to update my thesis on the company and find out if it is still relevant.

Recent Financials And Corporate Developments

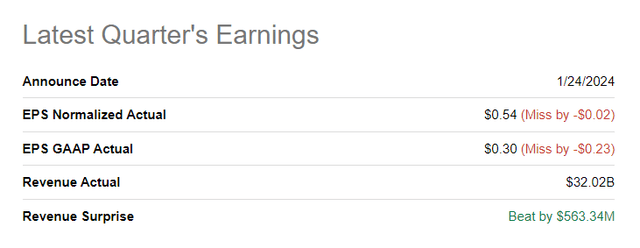

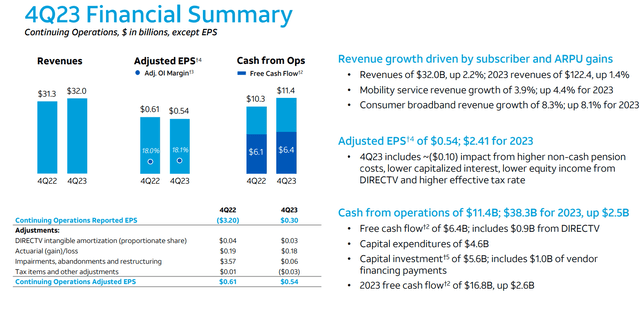

AT&T released its Q4 FY2023 financial results on January 24, exceeding the consensus revenue estimate by a significant margin of ~$563 million, but falling slightly short of the expected adjusted EPS by $0.02.

Seeking Alpha, T stock

I assume that trading algorithms, which are trained to react primarily to EPS surprises, caused AT&T stock to fall by almost 4% after the report was published. However, over the course of that post-earnings trading day, a significant portion of the initial drawdown was bought back, and the stock even managed to trade at around $18 afterward before getting into a flat dynamic. Overall, the stock price is now about 0.6% higher than before the earnings report saw light:

TrendSpider Software, author’s notes

Let’s look at the financials that helped AT&T’s price action survive its slight earnings miss.

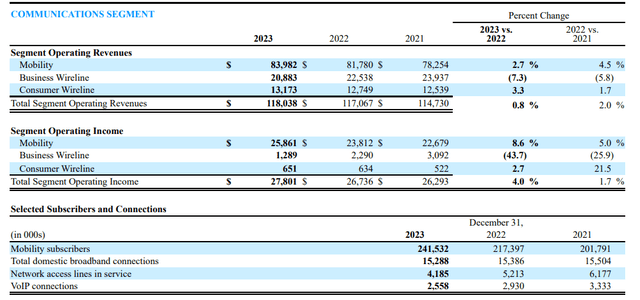

AT&T has 2 reportable segments: Communications (97% of total revenue, comprising 3 business units – Mobility, Business Wireline, and Consumer Wireline) and Latin America, which provides wireless services and equipment in Mexico.

Thanks to a net addition of 759,000 postpaid subscribers in 4Q (including 526,000 high-value postpaid phone net adds), AT&T’s Mobility sub-segment showed the 6th consecutive year of revenue and EBITDA growth: +3.9% and +5.6%, YoY, respectively. Postpaid phone churn remained historically low at 0.84%, while the postpaid phone ARPU reached $56.23 last quarter (+1.4% YoY, driven by price increases and subscribers trading up to higher-priced unlimited plans). The Business Wireline sub-segment can’t boast the same strength, showing an EBITDA YoY decline of ~19% in Q4. According to the management’s commentary, this drop was influenced by mainly discrete intellectual property transaction revenues in 2022 that did not repeat in 2023.

Regarding the Consumer Wireline sub-segment, AT&T added 273,000 fiber customers, which looks solid given the bad seasonality. Broadband revenues grew over 8% YoY and the fiber ARPU reached $68.50, with intake ARPU surpassing $70. As a result, Consumer Wireline EBITDA grew >10% for the quarter and 8.1% for the full year.

AT&T’s 10-K

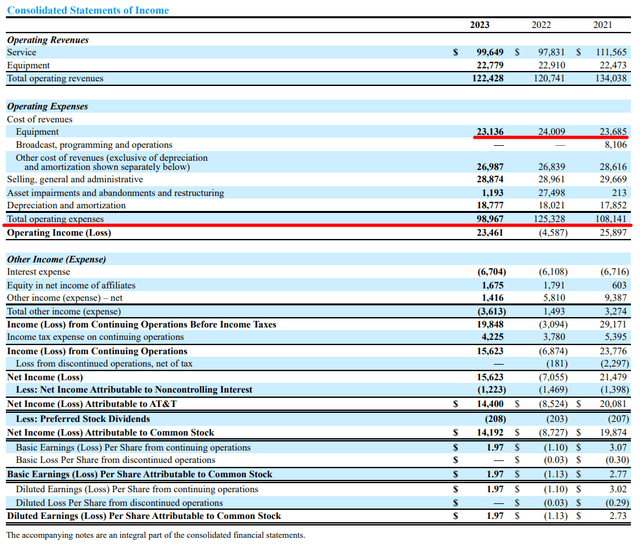

I like what I see in AT&T’s cost management. Equipment costs (part of COGS) decreased by 3.6% YoY in FY2023 and total OPEX decreased by 21.25% YoY because there were no severe “asset impairments, and abandonments and restructuring”. This item in the P&L statement looks like a one-off event, but even compared to FY2021 the OPEX amount decreased by ~8.5%, which is also a notable achievement.

AT&T’s 10-K, author’s notes

AT&T’s full-year adjusted diluted EPS declined 6.2% (to $2.41 from $2.57) due to “higher non-cash pension costs, lower capitalized interest, lower equity income from DIRECTV and higher effective tax rate”, according to the IR presentation. Most importantly for AT&T as a cash cow company in the late stage of its business cycle, however, the operating cash flow was up 10.7% year-over-year, resulting in FCF growth of nearly 5%.

AT&T’s IR materials

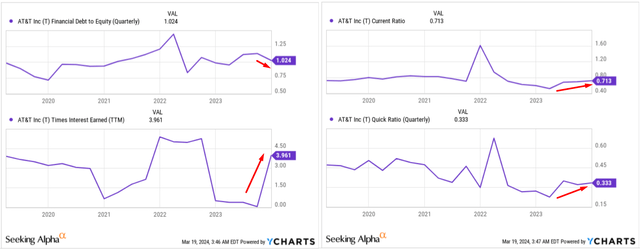

It’s also important to note some of the recent changes in the company’s balance sheet. AT&T is known for its massive total debt, which amounted to $136 billion at the end of 2023, of which $7.5 billion is due within 1 year. Based on the increase in the Times-Interest-Earned (TIE) ratio, we can see that servicing interest payments is not currently a serious problem for the company. The company’s net debt to adjusted EBITDA ratio is ~3.2, which I think is close to normal following the generally accepted standards.

The most important liquidity ratios such as the current ratio and the quick ratio continued to improve in the last quarter, which also appears to be positive for AT&T.

YCharts, author’s notes

I don’t see any clear red signs in AT&T’s balance sheet to date.

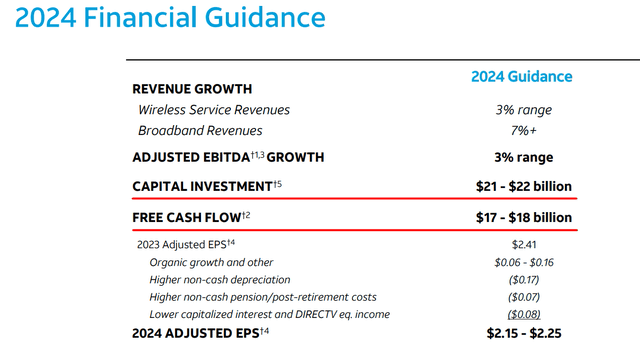

As Argus Research analysts noted in their post-earnings note (proprietary source), the management has clearly signaled that its top priorities in capital allocation are debt reduction and investments in the expansion of the 5G mobile network and the fiber optic network. If we look at the company’s guidance for FY2024, we see a CAPEX plan of $21.5 billion (mid-range), which is 20.4% higher than in FY2023. And despite this, the FCF should amount to $17.5 billion in the mid-range – that’s a potential growth of 4.16% YoY:

AT&T’s IR materials, author’s notes

From what I’ve seen in the 10-K and IR materials, as well as other sources, I tentatively conclude that the company’s financial position has only improved recently, and operations are picking up steam despite all the headwinds of the industry. But what about the valuation of the stock? It’s up almost 12%, while I forecasted a potential upside of ~18% three months ago – so is the current upside limited? Let’s find out.

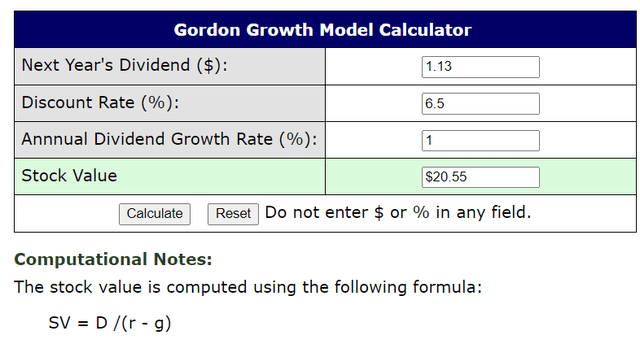

AT&T Stock Valuation Update

Last time I used the DDM model, which requires as assumptions only the amount of the company’s dividend in the next year, the annual dividend growth rate, and a discount rate. Last time I used $1.266, 7%, and 1% respectively. Today, using the current dividend consensus estimates (Seeking Alpha data), we see that the market’s expectations have barely changed – it has only increased to $1.3 per share for FY2025. I suggest going with a 6.5% discount rate this time because I believe we are approaching the peak of Fed tightening. Given the company’s forecasts for modest revenue and EBITDA growth, I assume this will translate into at least 1 annual dividend growth over the long term. With the revised assumptions, the model yields a new “fair value” of $20.55, which is nearly 19% above the current market price.

DDM model by BuyUpside

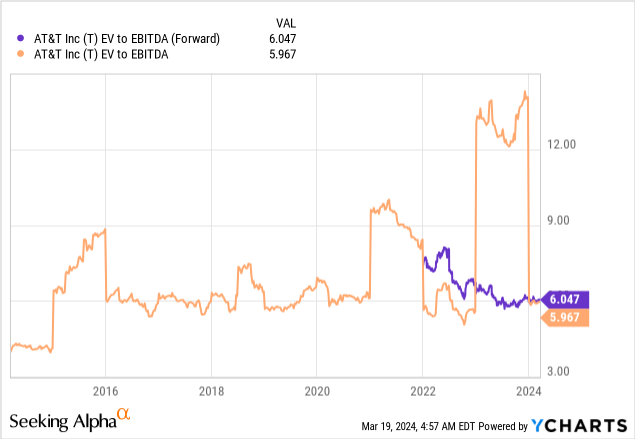

Valuing AT&T using multiples such as EV/EBITDA does not contradict the DDM calculation above: the forwarding EV/EBITDA ratio is currently around 6x, which is at the low end of the historical range for this metric. So I don’t think AT&T’s EV/EBITDA can go any lower from there.

Where Can I Be Wrong?

As I mentioned in my past article on the company, AT&T is facing uncertainty about potential liabilitу related to the Wall Street Journal’s revelations about potential risks associated with lead-insulated copper cables used in the telecommunications industry.

In addition, it is important to understand that AT&T is competing with traditional and newer competitors in the telecom industry, especially as the industry moves toward wireless data and converged fixed broadband models. As Argus Research writes (proprietary source), the saturation of the U.S. wireless market has led to increased competition for subscribers and lower profit margins. Cable companies are also serious competitors in the area of video and broadband Internet services.

Another risk lies in the conclusions regarding AT&T’s fair value calculation that I reached above. My assumptions in the DDM model may turn out to be too optimistic – this is especially true for the discount rate and the projected dividend growth rate. The model is very sensitive to these assumptions, and the simplicity of the “fair” price calculation may prove to be too far off.

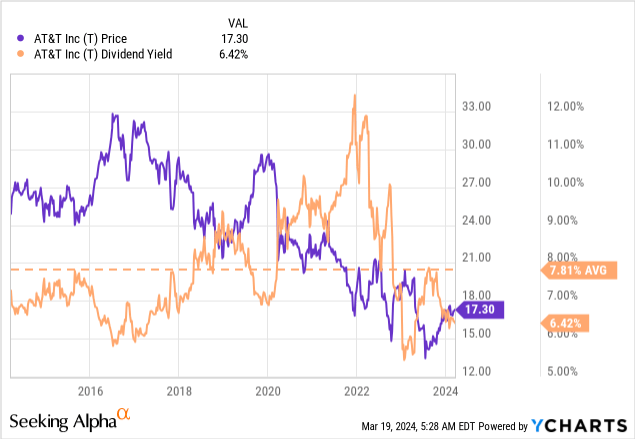

Perhaps the AT&T stock price needs to fall even lower to reach its true fair value – at least that’s what the current dividend yield suggests in the context of the history of the last 5-10 years:

The Verdict

Notwithstanding the above risk factors, which should be taken with great caution by all readers, I believe AT&T’s upside potential is still there. As the company completes its arduous turnaround, its valuation should theoretically depend on its dividend, which I believe has become much more sustainable over the past 2 quarters.

I definitely like how management has been able to cut costs and focus on growing segments in recent months. AT&T’s debt raises fewer questions as key solvency metrics have consistently improved recently. Overall, I am positive about the medium-term growth potential of AT&T stock and reiterate my previous “Buy” rating today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!