Summary:

- AT&T’s Q2 2023 earnings were 63 cents per share, and revenue was $29.9 billion (up 0.9% YoY), with solid growth in mobile and fiber businesses and a focus on debt.

- Favorable fundamentals include shifting wireless competition, steady fiber growth, strategic investments, and effective pricing.

- AT&T faces a lead cable investigation, emphasizing safety and cooperation with regulators. The issue is a short-term obstacle, presenting a value investing opportunity.

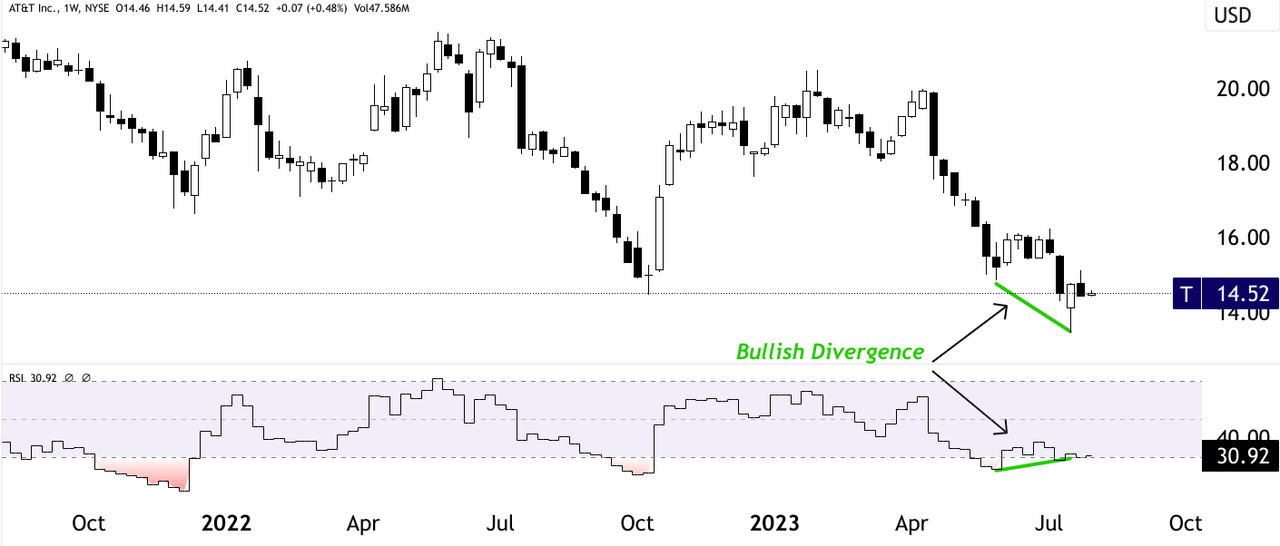

- AT&T’s stock represents a bullish divergence and an oversold RSI on the weekly chart, forming an ideal entry point for long-term investors.

Brandon Bell

Investment Thesis

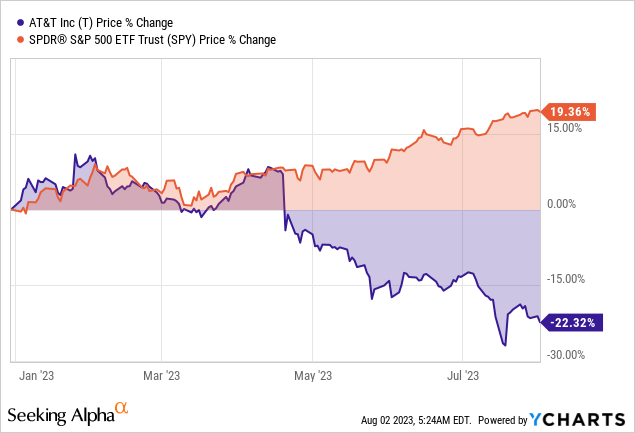

Despite macroeconomic adversities, AT&T’s (NYSE:T) Q2 2023 earnings report indicated robust growth in mobile and fiber businesses, bolstered by prudent debt reduction and strategic capital investments. Steady fundamentals, including shifting wireless competition and expanding fiber networks, may support possible upside. Despite facing a lead cable investigation, AT&T remains steadfast in collaborating with regulators. For savvy investors, its current historical lows represent an attractive entry point.

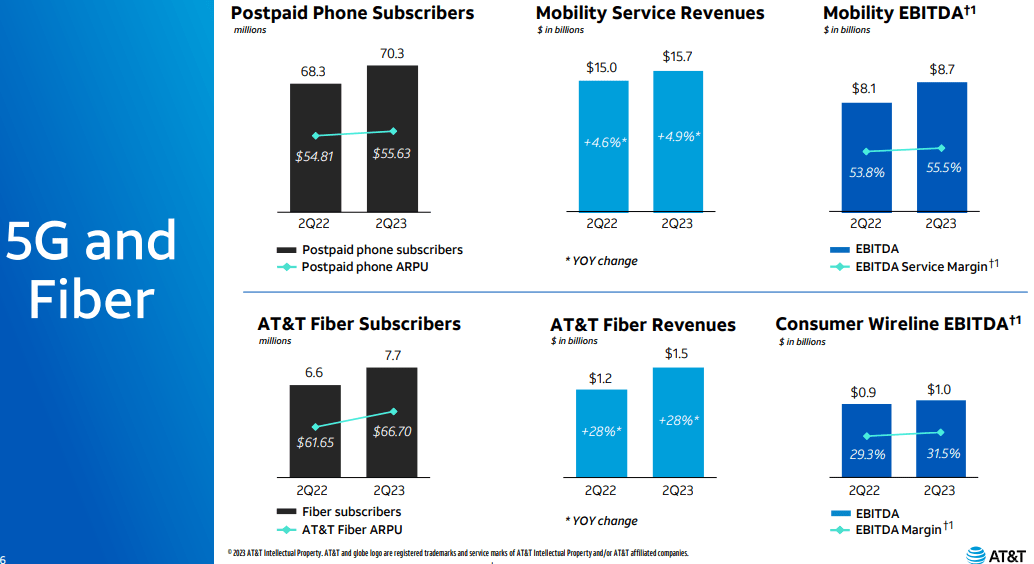

Promising Path Ahead: Strong Performance, Growth, And Financial Strength

AT&T reported mixed Q2 2023 results, with adjusted earnings per share of $0.63 and revenue of $29.9 billion, representing a 0.9% year-over-year increase. The mobility unit generated $20.3 billion in revenue, adding 326K postpaid phone subscribers during the period, falling short of the estimated 397K. Mobile service revenue grew 4.9% year-over-year, with the overall segment experiencing its best Q2 operating income. Further, AT&T’s fiber internet service saw 251K new subscribers, continuing its trend of 14 straight quarters with 200K or more additions.

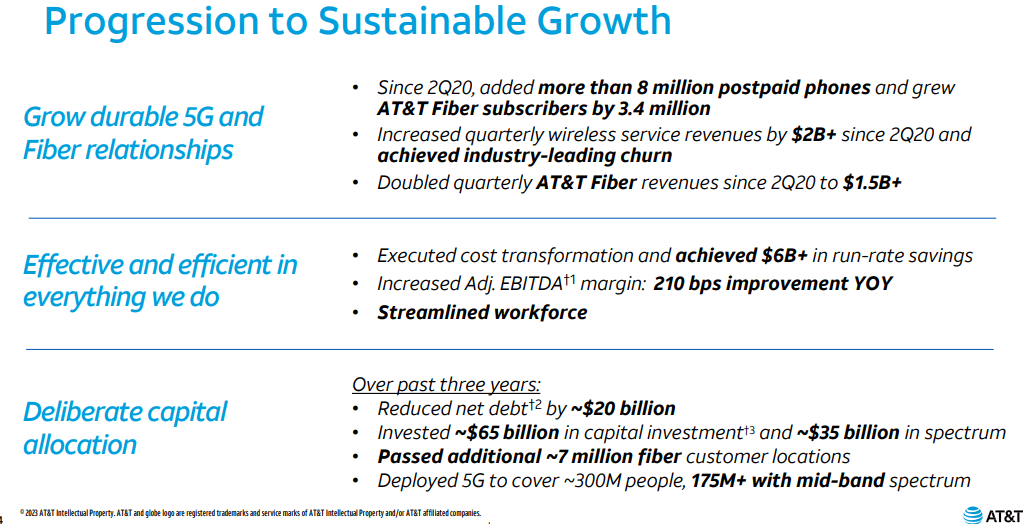

AT&T has generated good growth in the wireless sector over the past three years, adding 8.3 million postpaid phone net additions and closing the gap to the industry leader by around 350 basis points in market share. The company also improved wireless service revenue share versus the industry leader by approximately 250 basis points and achieved historically low churn levels, indicating high customer satisfaction.

AT&T Investor Presentation

Moreover, The fiber business has been a significant growth driver, adding over 3.4 million net AT&T fiber additions and boosting the subscriber base by around 80% over the past three years. Surprisingly, the company’s average fiber penetration rate is about 38%, and quarterly fiber broadband revenues have reached over $1.5 billion.

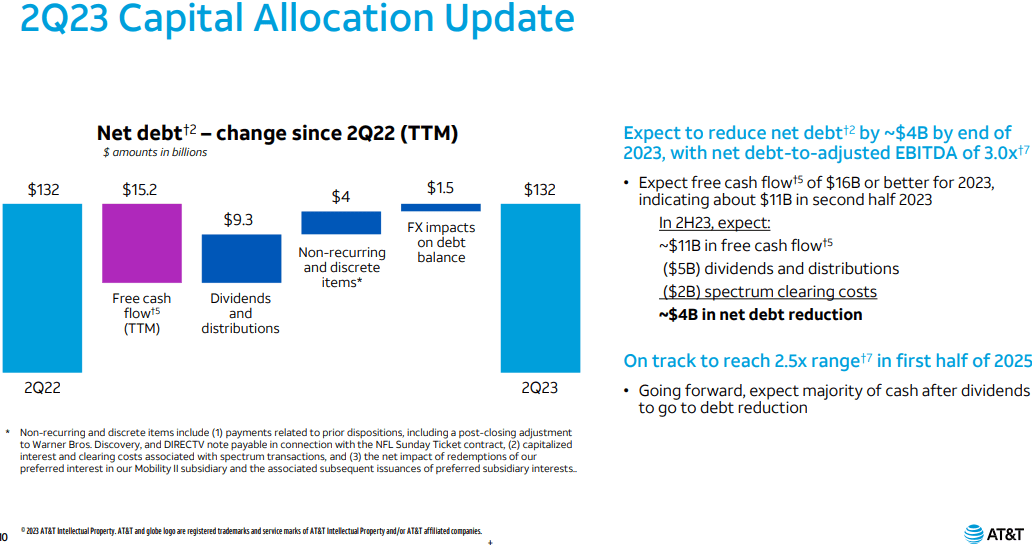

Additionally, regarding its capital management, the conglomerate generated approximately $4.2 billion in free cash flow, surpassing estimates of $3.77 billion. AT&T reaffirmed its expectation to cut net debt by $4 billion in the year, aiming to end with a net debt-to-EBITDA ratio of 3x. Specifically, the company remains committed to an additional $2 billion in cost savings over the next three years following the achievement of its $6 billion savings target. The company expects its capital investment to decrease by approximately $1 billion in the year’s second half after peaking in the first half.

Notably, AT&T targets to reduce its net debt to 2.5x adjusted EBITDA in the first half of 2025. It has significantly reduced net debt by about $20 billion in the last three years. Finally, the company expects to use increasing amounts of free cash flow after dividends to accelerate debt reduction efforts while investing in the company’s future and America’s broadband infrastructure.

AT&T Investor Presentation

AT&T’s strong performance in its wireless and fiber businesses, cost-saving initiatives, and debt reduction efforts position the company for long-term benefits. The wireless sector’s growth in market share and ARPU, coupled with low churn and improved margins, indicates sustainable profitability and customer satisfaction.

The significant expansion of its fiber network has resulted in substantial subscriber growth and revenue increases, supporting long-term growth prospects. AT&T’s focus on reducing net debt and improving credit quality will enhance its financial stability and create shareholder value. Finally, the company’s strategic investments in its networks will ensure a competitive edge and support its possible growth in the telecommunications industry.

AT&T’s Wireless Gameplan: Targeted Growth, Fixed Wireless, And Fiber Expansion

Regarding Wireless Competition and Gross additions, AT&T experienced a shift in Q2 due to new accounts and offers in the market. However, the company remains focused on targeted segments for customer acquisition, with a deliberate approach to attracting valuable, long-term customers. The company does not foresee any dramatic shifts in its tactics or messaging.

Also, fixed wireless plays an essential role in specific geographic regions where it is the optimal solution to provide reliable internet fast. While unsuitable for all states, fixed wireless may be a good catch for AT&T in certain markets, especially for small and lower-end midsize businesses with different use characteristics than residential households.

Furthermore, AT&T experienced softer results in Q2 in the fiber business, likely influenced by reduced moving activity and seasonal dynamics. However, they expect to maintain a steady customer acquisition rate through share take, less dependent on move activity. Also, the company’s consumer wireline segment margins are expected to improve over time as legacy networks are gradually modernized and costs associated with older infrastructure are reduced. AT&T is confident in the potential of its fiber infrastructure and expects to achieve competitive margins as the rollout progresses.

Notably, AT&T expects to invest roughly $24 billion in CapEx for the year, which is expected to be past the peak investment phase. They have been deploying a 3-gigahertz spectrum for 5G and are on track to cover around 200 million POPs. Further plans for expansion and investments beyond this point have not been specified yet.

Looking ahead, AT&T is making significant strides in expanding its fiber and broadband footprint. The company’s focus on infrastructure reinvestment signifies a solid line of sight for future growth. About two-thirds of the footprint is expected to yield an easy business case for reinvestment, while the remaining third will depend on market conditions and subsidies. AT&T aims to strategically inject infrastructure in areas with growth potential, complementing their existing wireless business and serving their customer base effectively.

AT&T Investor Presentation

The company anticipates being competitive in its target markets, although other interested parties may exist. AT&T has a range of tools at its disposal, including a strong presence in communities, effective labor structures, and advanced technology offerings, positioning it well in the bidding process. The rollout of fiber infrastructure is expected to unfold in 2024, with awards likely not impacting 2024’s business. The outcomes will be incorporated into the company’s plans for 2025 and beyond.

Finally, AT&T is passing around 24 million homes with fiber, and their plans remain on track to pass 30 million locations by 2025. The company’s average revenue per user (ARPU) is slightly below the industry average due to the maturity of its customer base and pricing strategy. However, AT&T may increase ARPUs by offering consolidated products and services, targeting high-quality customers, and carefully managing pricing strategies.

AT&T’s Proactive Approach: Addressing The Lead Cable Issue & Unlocking Value

AT&T is currently facing an investigation regarding the use of lead-clad cables in its telecommunication networks. These cables have been widely used in the nation’s infrastructure due to their durability and ability to protect interior wires from exposure to the elements. While the telecommunications industry began phasing out new lead-clad cables in the 1950s, some are still in use, particularly in critical applications such as the power grid and railway systems, providing essential voice and data services.

Regarding the issue of lead in the network, AT&T has a constructive relationship with regulators and prioritizes safety. There haven’t been any significant claims related to lead exposure, and the company believes the issue does not impact its dividend policy or leverage situation.

On record, AT&T plans to conduct a review in collaboration with the Environmental Protection Agency (EPA) and other industry partners, using reliable scientific data to evaluate the potential risks posed by these cables. During the earnings call, AT&T reported that independent experts and established scientists have not provided any reason to believe that the cables pose a public health risk. The company has already conducted its testing, confirming the cables’ safety.

In response to recent concerns, AT&T is conducting additional testing at selected sites and cooperating with the EPA to provide the necessary information for a comprehensive assessment. The company already has a track record of prioritizing employee safety and compliance with regulatory standards related to lead exposure for workers.

As an extra precaution, AT&T has expanded its practice of providing testing for employees involved in cable removal and introduced a voluntary testing program for any employee who works with or has worked with lead-clad cables. It covers the testing expenses and provides them during company time.

As an important note, AT&T emphasizes that lead-clad cables represent only a small part of its network, with most cables being underground and encased in protective conduits. Considering the size of its operations and sustainability over its long history, AT&T operates responsibly based on scientific evidence and protocols. If new and reliable information emerges, the company must collaborate with the industry, scientific experts, and government agencies to adjust its approach accordingly.

As AT&T’s stock is trading at the historical lows of three decades, the lead cable issue remains a short-term obstacle. It is essential to recognize that this challenge is not unique to AT&T alone but rather an industry-wide concern subject to statutory policies. Consequently, based on the proactive response from AT&T, finding a resolution is an anticipated outcome, which could involve a regulatory fine or a collaborative effort among industry stakeholders to address the matter collectively.

Finally, from a value investing perspective, the current situation presents an attractive opportunity, as the stock trades at a substantial discount. Bears are not aggressive on AT&T, as evidenced by the relatively minor short interest of 1.37%, even after regulatory actions led to an investigation.

Technical Analysis Suggest A Good Entry Point

On the weekly time frame, T has formed a bullish divergence with the Relative Strength Index (RSI) at oversold levels below 30. The emergence of bullish divergence near earnings and lead cable-related investigations is critical at the historical lows. Any positive development in the company’s operating and business environment may push prices into a bullish trajectory. Technically, the current price level offers an ideal entry point for investors with a long-term perspective.

tradingview.com

Takeaway

In conclusion, AT&T’s strong performance is driven by remarkable growth in mobile and fiber businesses and supported by proactive debt reduction and CapEx. Apart from favorable fundamentals, the stock’s historical lows present an attractive opportunity. AT&T’s financial stability and strategic network investments position it for long-term value creation in the telecommunications industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.