Summary:

- Dividends this high, if sustained, can lead to amazing compounded returns all by themselves.

- The spinoff will be compared to examples from “You Can Be A Stock Market Genius.”

- AT&T Inc. stock has been a value for a decade, treating it like a bond with yield increases for inflation is a good way to evaluate it.

Toby Jorrin

Lessons from Joel Greenblatt on spinoffs

One of my favorite books on special situations and spinoffs is Joel Greenblatt’s “You Can Be a Stock Market Genius.” The book covers spin-offs in great detail with a few case studies. While AT&T Inc. (T) is not a stock spun off but rather the spinner, there are still some great benefits to ridding itself of Warner Bros. Discovery, Inc. (WBD). Three case studies of spinoffs are laid out in the book:

- Host Marriott and Marriott International

- Briggs and Stratton

- Home Shopping Network.

The most valid of the three case studies to apply to AT&T is that of the Home Shopping Network. The business consisted of two parts: a broadcast company, and a retail company. Greenblatt points out that broadcast companies are typically evaluated on a cash flow basis while retail would be scrutinized on EPS performance. I’ll cover more from this case study throughout the article, showing that the spinoff of Warner Discovery was the right choice and one that makes AT&T a strong dividend compounder play and one of my top holdings. AT&T Inc. stock is a buy and one I plan to hold on to for the long run.

The story up to here

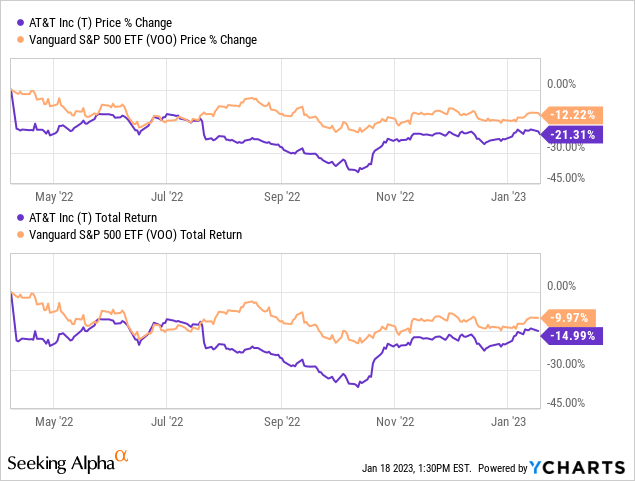

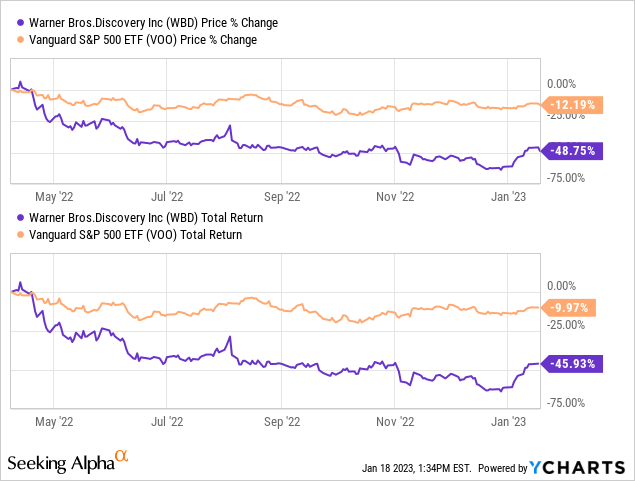

The spin-off date occurred April 8th, 2022, and above is the customized YChart covering the performance of AT&T against Vanguard’s S&P 500 Index fund (VOO). On a total return basis, AT&T has underperformed by about 5% since the spinoff, and Warner Brothers Discovery has fared far worse.

While many value investors, including Joel Greenblatt protégé Michael Burry, tried to take early stakes in Warner Brothers Discovery as a value play, it was way too early. The wisdom of “You Can be a Stock Market Genius” points out that when a spinoff occurs creating a smaller than institutional portfolio requirement-size company, combined with added debt from the spinner’s balance sheet, this can create an undesirable situation. While the AT&T Inc. spinoff was unique in that it still resulted in a large company, institutions were not interested. As we all know, institutional money runs the market, so as soon as I received my WBD shares I liquidated and reinvested back into AT&T. Good choice.

While Warner Bros. Discovery, Inc. may be a great deal, it will take time to play out. The book advises that when you find the metrics of the spinoff beaten down enough to where the comps are way out of whack, that’s when to pounce. The best way to approach the value play according to the book is with LEAPS, but that is for another article.

HSN case study

Back to the Home Shopping Network (“HSN”) case study. Page 85 of the book points out that in the 1980s, HSN bought several independent UHF broadcast stations:

That wasn’t so bad, but television stations don’t have much in the way of assets. Their value derives from the cash stream received from advertising revenues, not from the amount of broadcasting equipment used to transmit the program.

Unfortunately, paying a large purchase price for something that relies on a relatively small amount of fixed assets and working capital to generate profits usually results in a large amount of goodwill being placed on the balance sheet of the purchaser. Goodwill arises when the purchase price exceeds the value of the acquired company’s identifiable assets. This excess in purchase price over the value of identifiable assets must be amortized over a period of years. Like depreciation, amortization of goodwill is a noncash expense that is deducted from reported earnings.-You Can Be a Stock Market Genius Pgs. 85-86

Herein was the problem with AT&T trying to diversify their business to ones that had a lot of amortization: the noncash expense was hurting EPS and making AT&T too hard to evaluate.

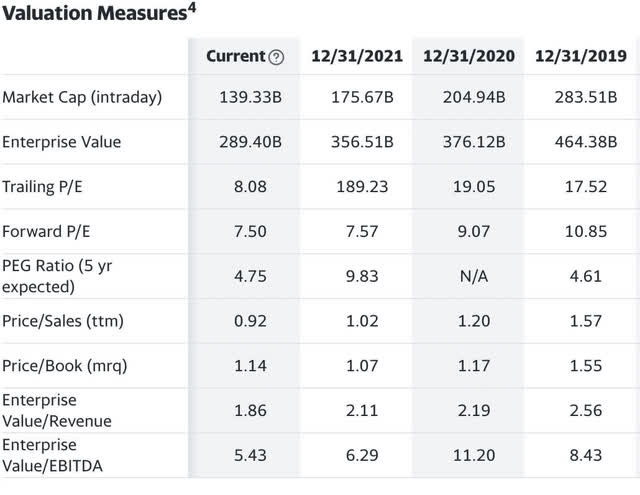

Some of the assets that the Discovery Media company had were hurting the appearance of AT&T’s EPS metrics, as evidenced by the last three years’ trailing versus forward price-to-earnings ratios. As the accounting began to become more muddled from the media company’s business, AT&T did the right thing to spin off the company. The dividend cut did hurt AT&T’s share price afterward, but it was simply a portion of the free cash flow (“FCF”) moving from company A to company B. It should not have been looked at negatively at all.

The balance sheet

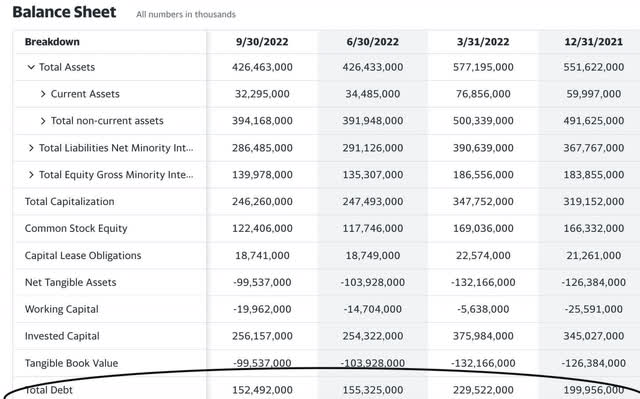

Total debt decreased significantly from 2021 to 2022. This was a combination of debt pay-down plus a migration of debt flowing from its balance sheet to Warner Brother Discovery’s. One of the main arguments against AT&T was always its large amount of debt. While cash flow also left with the spinoff, the debt reduction should be something to be cheered about as AT&T offloaded it before rates began to rise.

The income statement

The TTM versus 2021 numbers post spin-off: revenue has declined $13 Billion or 8%. Annualized from April 2022 to the current, 8 months, the decrease is about one percent per month or 12%. Pretax income decreased by $2.927 Billion.

A recap of the spinoff is as follows:

Under terms of the agreement, which was structured as a Reverse Morris Trust transaction, at close AT&T received $40.4 billion in cash and Warner Media’s retention of certain debt. Additionally, shareholders of AT&T received 0.241917 shares of WBD for each share of AT&T common stock they held at close. As a result, AT&T shareholders received 1.7 billion shares of WBD, representing 71% of WBD shares on a fully diluted basis. Discovery’s existing shareholders own the remainder of the new company. In addition to their new shares of WBD common stock, AT&T shareholders continue to hold the same number of shares of AT&T common stock they held immediately prior to close.

$41 Billion would represent about 30% of the value of AT&T’s current market cap of $139 Billion. With a current earnings yield of 12.27% or a P/E of 8, the extra $2.97 Billion in pre-tax income would be another 2% yield in pre-tax income or about 1% after taxes. While the value of Discovery was in the cash flows, we can see the earnings yield go up as the market cap went down significantly but the earnings stayed almost flat. This improved the visuals of AT&T’s EPS considerably.

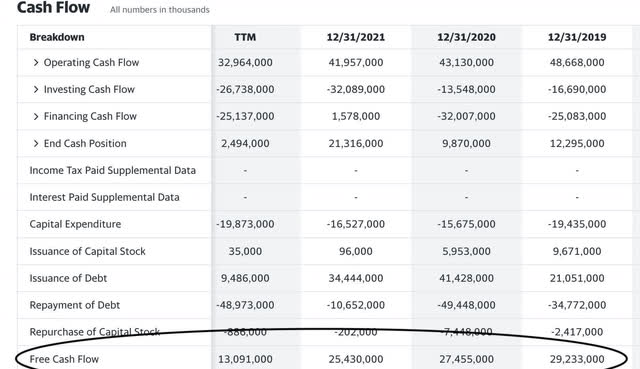

Free cash flow trends

Here is where we see a larger divergence than the drop in earnings and revenue. Free cash flow dropped from $25 Billion in 2021 to $13.09 Billion TTM. With 7.126 Billion shares outstanding and a forward dividend liability of $1.11 a share, we can see the expected dividend payment to be $7.9 Billion. The payout ratio is 60.4% of $13 Billion, still very manageable.

Compound dividend model

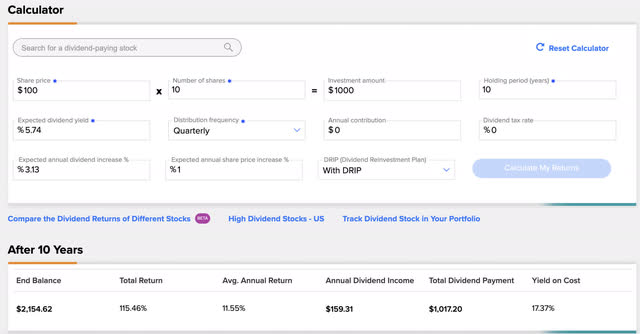

I like to look at AT&T when whittled to the core internet and phone business as a utility. If you asked 100 people what are 3 necessary things a home must have, 100 would say energy water, and internet. All are needed for basic modern survival (those without internet aren’t reading this anyways so you can’t criticize me). Comparing the revenue growth rate of a quality energy utility like Duke Energy Corporation (DUK) is where I would like to bet a good utility would track. Duke has had a CAGR in revenue over the last 5 years of 3.13%. If AT&T keeps it simple and focuses on this business, I would hope they could increase their dividend by at least 3% a year ongoing.

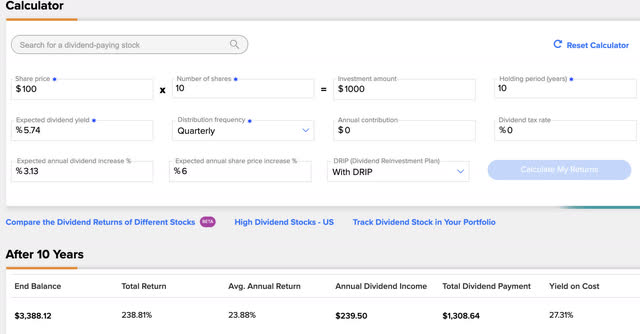

With the current yield at 5.74% on drip for 10 years with only a 1% annual share price appreciation, this ultra-conservative assumption would see an 11.55% average annual return. The yield on cost would be over 17%. If AT&T can maintain its’ utility-like business, this is my worst base, almost bear-case scenario.

Valuation

AT&T has been cheap for a decade or more. The most logical valuation for AT&T to use in my opinion is The Graham Number model, incorporating both the book value per share and earnings per share to find a fair price. The Graham Number is simply the square root of: 22.5 × (Earnings Per Share) × (Book Value Per Share). 22.5 represents the threshold where a combination of P/E times P/B does not exceed 22.5. Our inputs for AT&T are a $17.8 book value and an TTM EPS of $2.42. Therefore; SQRT (22.5 X 17.8 X 2.42)= $31.13 or a potential 62% undervaluation.

While the stock has been very cheap for a long time, the market is seeing zero growth potential and pricing it more like a fixed-income product. I say if they finally reduce their debt load while maintaining growth in free cash flow from this clean slate, realizing 6% a year in appreciation while getting a compounding dividend of 5.74% growing at 3% a year for 10 years is not out of the question. If we re-run the model with these assumptions, let’s see the results:

This could be considered my bull case model over the next 10 years and it still seems conservative. A 23.88% average annual return from here would be rivaling a long-term Warren Buffett performance.

Catalysts

5G. The possible ways to monetize new 5G technology still have a lot of unknowns and many undiscovered opportunities. A recent press release from AT&T and Northrop Grumman Corporation (NOC) details uses for private 5G networks in the battlefield to assist the Defense Department.

A specific growth initiatives summary laid out by CFO Pascal Desroches recently is as follows:

- The company continues to focus its efforts on driving solid growth in 5G and fiber services, driven by continued high demand for connectivity.

- Looking ahead to 2023, Desroches said he expects the company to maintain its focus on growing customer relationships in a disciplined manner, proactively reducing costs and remaining deliberate in its capital allocation. He said that 2022 and 2023 are expected to be peak years for capital investment as the company continues to invest in 5G and fiber. AT&T remains focused on achieving its 2.5x net debt-to-adjusted EBITDA target and expects to use cash after dividends to reduce debt until that time.

- Desroches indicated he expects 2023 free cash flow growth to be supported by wireless revenue growth from a bigger postpaid phone base with increasing ARPUs; growth in fiber subscribers, ARPUs and revenues; and the benefits of ongoing cost transformation initiatives, which are expected to increasingly support the company’s profitability. Expected offsets to these trends include expected higher cash taxes and lower cash distributions from DIRECTV.

- Desroches reiterated AT&T’s commitment to its target of 30 million-plus fiber locations, including business locations, by the end of 2025. The company ended the third quarter of 2022 with the ability to serve 18.5 million consumer locations and approximately 3 million business customer locations with fiber.

The initiatives are all centered around 5G, fiber investments, cost reductions, and reducing debt after dividends. If the dividend holds up and debt continues to be paid down with the remaining 40% of free cash flow after the dividend, AT&T Inc. stock should appreciate on those merits alone.

Risks

I don’t see the internet, phone, and fiber business not being a commodity any time in the next 10 years. If AT&T Inc. just sticks to its core business and doesn’t get infatuated with hyper-growth or diversification of its business, this seems like a very logical bet. The risk is the company chasing growth. General Electric (GE) is still paying for the errors of its previous insatiable hunt. One of Buffett and Munger’s favorite quotes:

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone,”-French philosopher Blaise Pascal.

Boring is the best way forward for AT&T. If they are going to expand, do it organically and from within your sphere of competence.

A final risk laid out in CFO Pascal Desroches’ summary from the catalysts section is taxes. The Biden administration has pumped their chests claiming that they will be aggressive in corporate tax increases. How much of that policy sticks is questionable, with the House of Representatives now firmly in Republican control. More GAAP earnings unfortunately also mean more taxation. The market voted for this by their treatment of AT&T’s earnings, and now we will begin to see if there are any repercussions in pivoting towards pure GAAP earnings evaluation.

Conclusion

AT&T Inc. is one of my largest holdings. I doubled down after the spinoff of Discovery as I love the fiber and internet business. The business itself is almost monopolistic, with only a few major players. The models of a 10-year investment even with the most conservative of approaches would most likely beat the S&P 500 over the next 10 years. Fingers crossed AT&T Inc. doesn’t muck it up, but I am still a buyer at these prices. Dripping and compounding AT&T Inc.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.