Summary:

- AT&T shares surged 5.2% after Q2 financial results, driven by strong free cash flow, postpaid phone operations, and debt reduction.

- Revenue declined slightly due to the Business Wireline unit, while other units like Mobility and Consumer Wireline saw growth.

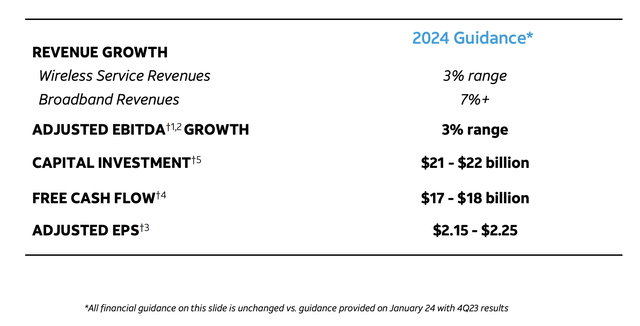

- Management reaffirmed guidance for 2024, with a focus on debt reduction, fiber network expansion, and growth in its FirstNet business.

wdstock

July 24th ended up being a really good day for shareholders of telecommunications conglomerate AT&T (NYSE:T). Shares of the company spiked higher, closing up 5.2%, after management announced financial results covering the second quarter of the company’s 2024 fiscal year. This return on a day when the broader market took a beating came in spite of the fact that revenue fell short of expectations and when adjusted earnings per share only came in line with what analysts anticipated.

The move up, then, was really driven by other factors. Year over year, free cash flow for the company skyrocketed. Management reported strong net additions to its postpaid phone operations. Net debt declined nicely. And management reaffirmed guidance for 2024 as a whole. This is comforting news as a shareholder and an analyst of the business. Just the other day, on July 21st of this year, I reaffirmed my ‘strong buy’ rating on the stock, pointing out that the firm’s core operations are performing nicely.

This earnings release affirms this view of the company. And truly, it’s great to see shareholders rewarded by these developments. With this move higher, shares are actually up by 16.2% since an earlier article, in which I rated the company a ‘strong buy’. That’s almost double the 8.8% move higher seen by the S&P 500 over the same window of time. Of course, there can only be so much upside to be had. But I don’t think we are at the point just yet of downgrading the business.

A great picture

When we focus only on the headline news items reported by management, the second quarter of the 2024 fiscal year was not special for AT&T. Take revenue as an example. Sales came in at $29.80 billion. That’s actually down slightly from the $29.92 billion reported one year earlier. In addition to this, the revenue reported by management was $180 million lower than what analysts were hoping to see. Even though revenue worsened year over year, all of this decline can really be attributable to one piece of the business that, as I detailed in my prior article on the firm, is the only troublemaker that management has to deal with.

This is the Business Wireline segment. During the quarter, sales came in at $4.76 billion. This was down 9.9% compared to the $5.28 billion reported just one year earlier. This part of the company is in a state of permanent decline. And a lot of the problems that AT&T is having on its bottom line can be attributed to it as well. Operating income for this unit was only $102 million in the latest quarter. This was significantly lower than the $396 million reported one year earlier.

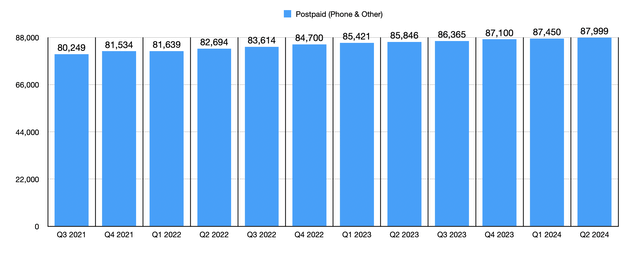

Outside of this, all other parts of the company are doing really well. The Mobility unit under the Communications unit saw revenue grow from $20.32 billion to $20.48 billion. On this front, the company benefited from a 3.4% jump in service revenue as the number of postpaid subscribers hit an all time high of just shy of 88 million. That’s up 2.5% compared to the 85.85 million reported one year earlier. And total net additions for the quarter ended up being a hefty 593,000. When focused just on postpaid phone subscribers, management reported a user base of 71.93 million. This is up from 70.33 million reported for the second quarter of 2023. It’s also 419,000 above what was reported at the end of the first quarter. Revenue for the Mobility unit would have been even better had it not been for an 8% drop in equipment sales.

The Consumer Wireline segment saw a 3% growth in revenue year over year from $3.25 billion to $3.35 billion. This came even as legacy voice and data services revenue plunged 15.7%, and as other service and equipment sales dropped by 7.8%. The real driver, then, was a jump in broadband revenue from $2.56 billion to $2.74 billion. For the company as a whole, total broadband connections came in at 13.84 million. That’s slightly above the 13.70 million reported just one year earlier.

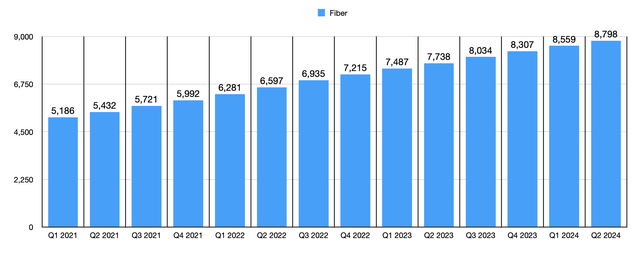

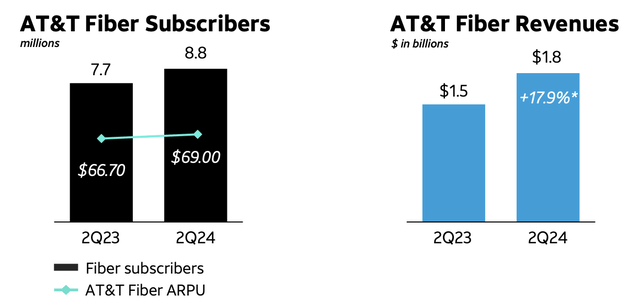

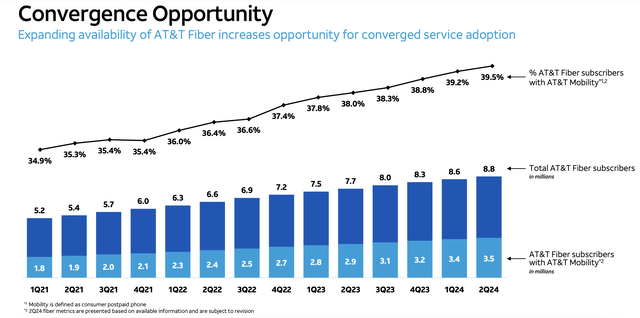

But what was most impressive was the surge in fiber broadband connections, from 7.74 million last year to 8.80 million this year. In fact, net additions for fiber for the second quarter alone ended up being a really strong 239,000. This marks the 18th consecutive quarter that the company has posted sequential growth of 200,000 or more. When it came to fiber, the company benefited from a slight year-over-year improvement in ARPU (average revenue per user) per month from $66.70 to $69. When you add on to this the year-over-year growth in the number of fiber customers, this allowed fiber revenue to jump 17.9% from $1.5 billion to $1.8 billion.

There was also some growth when it came to the Latin America segment. Revenue for the quarter came in at $1.10 billion. That’s 14.1% higher than the $967 million the company reported one year earlier. This came largely because of year-over-year growth in postpaid subscribers. In the second quarter of last year, the firm had 5.03 million such subscribers. That number today is 5.49 million, for a year-over-year increase of 9.2%. What’s really exciting to me about this segment is the fact that, in addition to growing rapidly, it has finally reached the breakeven point from a profitability perspective. In the second quarter of last year, the unit generated an operating loss of $39 million. This year, it reported a gain of $6 million.

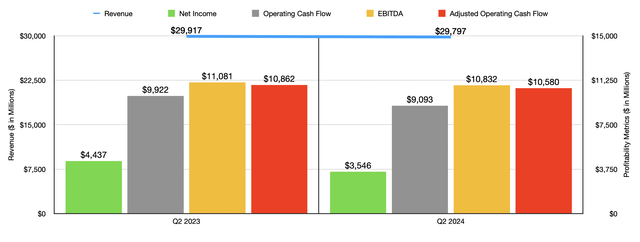

As great as it was to see the core operations improve, there were some issues on the bottom line. Net income actually dropped from $4.44 billion last year to $3.54 billion this year. This brought earnings per share down from $0.61 last year to $0.49 this year. But once we adjust for certain one time events, we get a more modest decline from $0.63 per share to $0.57 per share. This fell in line with what analysts anticipated. Despite the problems from a profitability perspective, which were driven largely by a $480 million asset impairment, as well as a 30.9% decline in other income, other profitability metrics held up a little better.

For instance, while operating cash flow fell from $9.92 billion to $9.09 billion, once we adjust for changes in working capital, we get a decline from $10.86 billion to $10.58 billion. It is true that EBITDA for the company fell from $11.08 billion last year to $10.83 billion this year. But if we strip out from this certain irregular items that are not core to the business, we would actually get an improvement from $11.05 billion to $11.34 billion.

Management seems quite hopeful when it comes to the 2024 fiscal year in its entirety. So much so, in fact, that they reaffirmed guidance for the year. Revenue under the wireless service category is expected to grow by roughly 3%, while broadband revenue should jump by more than 7%. Operating cash flow, at the midpoint, should come in at around $39 billion. This would be down from the $40.77 billion reported last year. However, EBITDA for the company is expected to rise by roughly 3%. If we exclude irregular items from the equation, this should take us from about $43.40 billion last year to $44.70 billion this year.

Using these figures, you can see how shares of the company are valued on a forward basis for 2024 and a historical basis using results from last year. The stock is incredibly cheap. And as I pointed out in my prior article on the business, shares are quite a bit cheaper than rival Verizon Communications (VZ) on a price to operating cash flow basis, and they are trading roughly at parity on an EV to EBITDA basis.

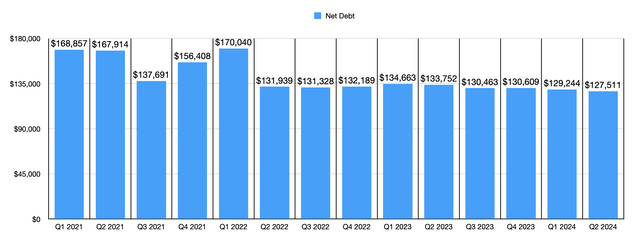

Outside of valuation, there are other reasons to be bullish about the company in the long run. For starters, management continues to focus on debt reduction. At the end of the most recent quarter, net debt was at $127.51 billion. That was $1.73 billion lower than what the company had at the end of the first quarter. Using current projected figures for this year and the current net debt picture for the company as of the end of the most recent quarter, we currently have a net leverage ratio of about 2.9. But management expects this number to drop to 2.5 sometime in the first half of 2025.

The company also has some other attributes that make its core operations prime for value creation. In the image above, for instance, you can see some interesting data points provided by the company. As the company has rolled out its fiber business, it has seen consistent growth in the percentage of fiber subscribers that also pay for the firm’s Mobility solutions. And if everything goes according to plan, both the number and percentage in these cases should continue to grow. This is in part because the company continues to build out its fiber network. As of the end of the most recent quarter, management boasted that the company’s fiber assets now pass 27.8 million consumer and business locations. And by the end of this year, that number should exceed 30 million.

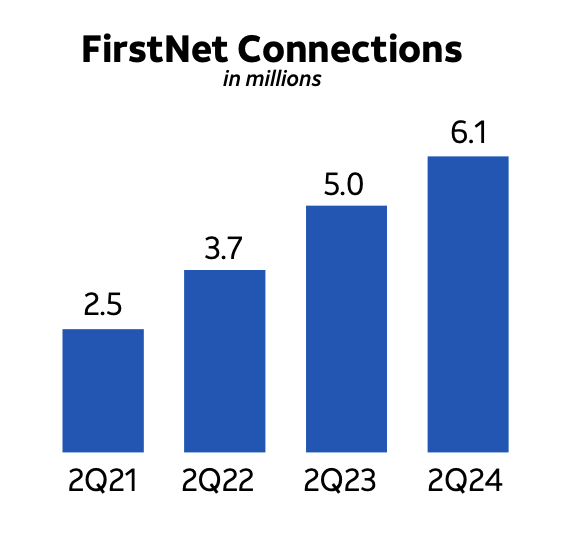

Another growth driver for the company will be its FirstNet business. I wrote about this quite a long time ago. In short, it is a public/private partnership aimed at providing real time connectivity to government agencies during times of catastrophe. Examples include floods, earthquakes, wildfires, and more. Management has invested billions of dollars into this over the years. And as of the end of the second quarter, the firm had 6.1 million connections on it. That’s up from 5 million the same time last year. And in the course of the second quarter of this year alone, the firm boasted around 260,000 net additions to this platform.

AT&T

Takeaway

Even though AT&T is not the largest holding in my portfolio, I do believe that the company is one of the absolute best on the market. Shares are cheap and cash flows are robust. With $4.58 billion in free cash flow in the second quarter alone, which was up from the $4.21 billion reported at the same time last year, management is well on its way to achieving between $17 billion and $18 billion in free cash flow for 2024. Between paying dividends and reducing debt, the firm is making tremendous progress in focusing on what matters most. There is some weakness involving the Business Wireline operations of the conglomerate. And I do hope that management finds some solution there at some point. But outside of that, I couldn’t be happier. Now, at some point, I probably will end up selling my shares. But that probably won’t occur until the stock hits somewhere between $21 and $23 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!