Summary:

- AT&T stock is trading at a 7% dividend yield, but there are important risks to consider.

- Net debt has remained the same over the past year due to one-time charges, but management expects free cash flow to pick up dramatically moving forward.

- The late entry into the fixed wireless access market poses a risk for AT&T, potentially leading to market share loss and pressure on free cash flow.

- If AT&T can execute on paying down debt, then this can still be a big winner.

Brandon Bell

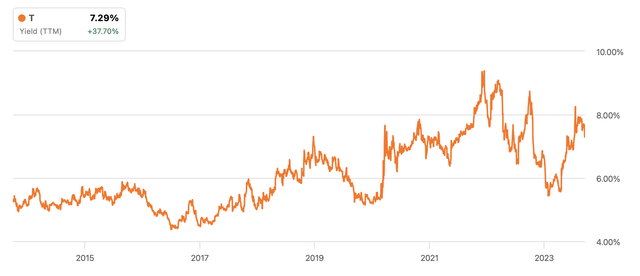

AT&T (NYSE:T) is trading around a 7.3% dividend yield and understandably remains a battleground stock. That high of a dividend yield looks attractive even in this higher interest rate environment, but where are the catalysts? The most obvious catalyst may be execution on debt pay down, but for whatever reason, that has not been an easy task as management has been distracted with M&A over the last several years. While management continues to outline a path for excess free cash flow available to bring down debt, there is a new risk on the horizon, and I’m not talking about lead. T is a late entry into the fixed wireless access market, and I am concerned that while they are playing catch-up with familiar competitors, they may lose market share in the meantime, pressuring free cash flow available to pay down debt. The dividend is not necessarily in danger, at least in the near term, but I do not see a clear path to above-market returns.

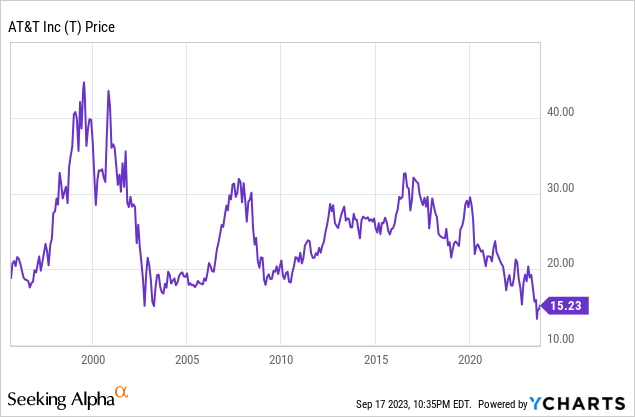

T Stock Price

After a bounce from the lead lows, T stock has treaded water and continues to trade near a 7% dividend yield.

I last covered T in July when I discussed where I see the stock “bottoming” from the lead allegations. In this report, I discuss another less-talked about risk from fixed wireless access, as 5G becomes a “winner takes most” market.

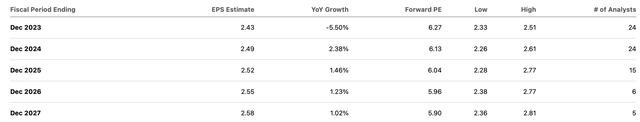

T Stock Key Metrics

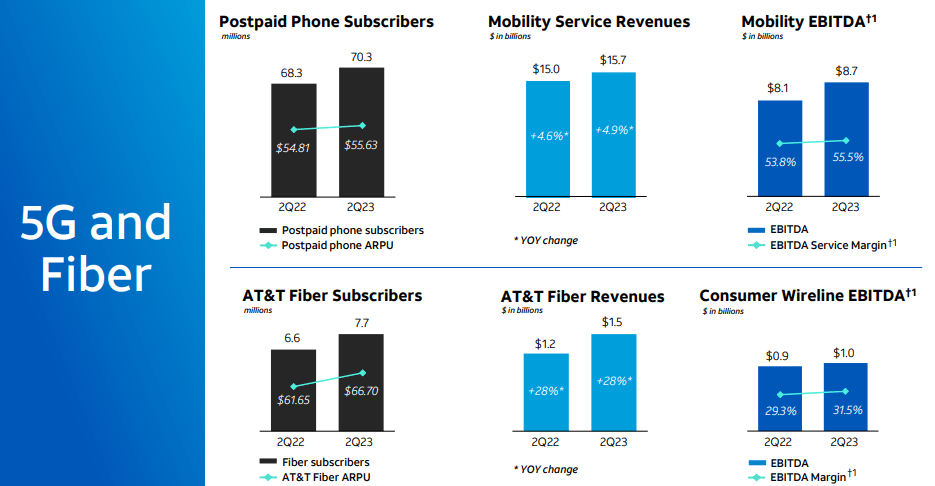

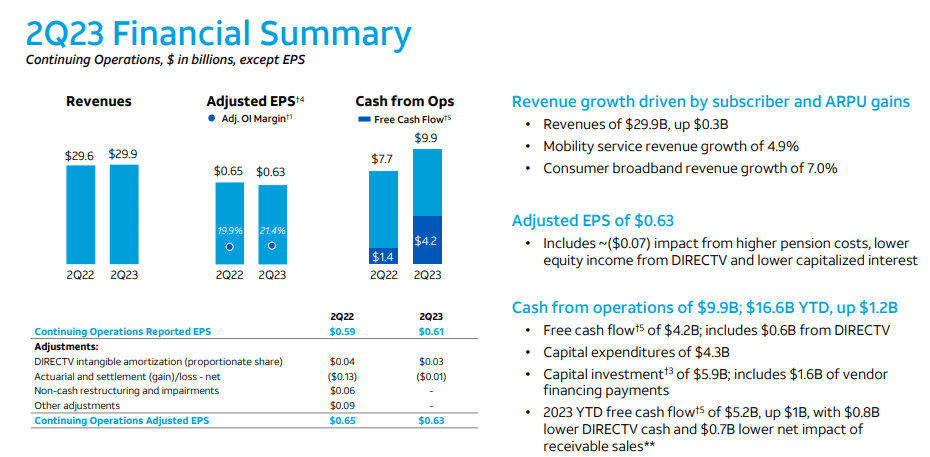

In its most recent quarter, T delivered solid top-line growth, led by 4.9% YOY growth in mobility service revenues and a stunning 28% growth in fiber revenues.

2023 Q2 Presentation

On a consolidated basis, revenues grew by just over 1%, though adjusted EPS declined 3% YOY due to higher pension costs and lower equity income from DirecTV. T nonetheless was able to generate $4.2 billion in free cash flow, up significantly YOY as the company began lapping easy investment comparables.

2023 Q2 Presentation

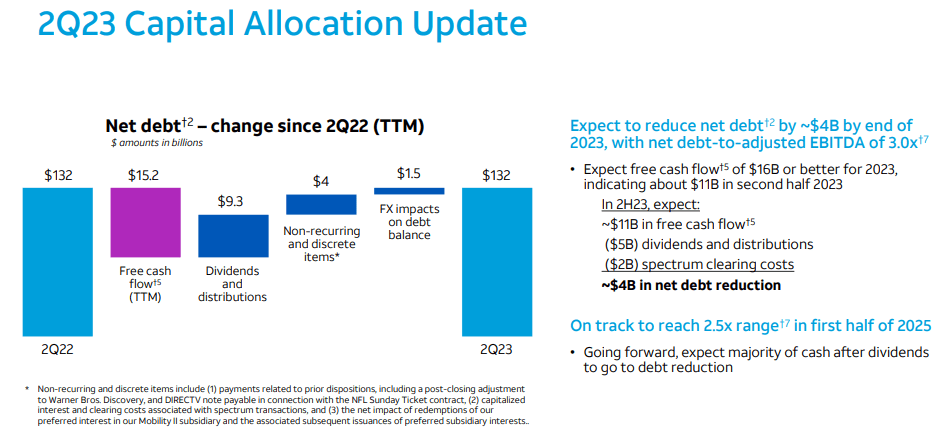

Despite the surge in free cash flow, net debt remained unchanged at $132 billion on a YOY basis. This was mainly due to the company needing to spend $4 billion on non-recurring items as well as foreign exchange increasing the debt balance.

2023 Q2 Presentation

Looking forward, however, management expects to generate $11 billion in free cash flow in the second half of this year, with $4 billion available and penciled in to pay down debt. T generated $11 billion in adjusted EBITDA in the quarter, good for a 3x net debt to annualized adjusted EBITDA ratio. On the conference call, management reiterated expectations to generate $16 billion in full-year free cash flow, though some investors may be wondering if the implied back-half step-up is too ambitious. To ease these concerns, management noted that the first half of this year saw a peak in capital investments, with the second half expected to see $4.5 billion less in device payments. The first half of the year also included $1 billion in annual compensation payments that won’t be repeated in the second half. Together with expected working capital improvements and projected adjusted EBITDA growth, the numbers do seem to work out for a second half ramp up in free cash flow. Management noted that they plan to make one final clearing payment of $2 billion related to their 2021 spectrum acquisitions. That would be the last of their non-recurring near-term items, in theory allowing for greater free cash flow in subsequent quarters.

Together with an anticipated $2 billion in cost savings over the next three years, management continues to expect net debt to adjusted EBITDA to decline to around 2.5x by the first half of 2025. By my estimates, T can achieve this by paying down $16.5 billion in debt over the next eight quarters (assuming 5% growth in adjusted EBITDA). As in years past, the path to lower leverage looks achievable and within reach – but long-time investors may be wondering if management can remain focused to achieve it this time around? CEO Stankey had replaced the former CEO Stephenson in 2020 and investors may be hoping that Stankey may be less M&A hungry than his predecessor.

Is T Stock A Buy, Sell, or Hold?

At recent prices, T was trading at attractive valuations of around 6.3x earnings.

Investors may wish to focus on dividend yield given the company’s heavy capital requirements and necessity to pay down debt. I reiterate that capital investments may more closely align with depreciation & amortization expenses moving forward (easing that first concern) but the latter concern remains valid. As of recent prices, T was trading at a 7.3% yield.

That’s among the highest the stock has traded at and this is inclusive of the reduction following its spinoff of WarnerMedia last year. Moreover, the stock has a clear and visible catalyst through debt reduction – if and when leverage is brought down to the 2.5x targeted range, I wouldn’t be surprised if T began its share repurchase program again in earnest. With the stock trading at around a 14% earnings yield, share repurchases would add substantial upward momentum to the stock price.

But there are some glaring risks here. I have already previously highlighted the large amount of near-term debt maturities that may drag on the bottom line as the company refinances them with higher rates. But today I highlight a less discussed risk – that of 5G. More specifically, I am referring to “fixed wireless access,” which is the telecom carriers’ version of broadband home internet, powered by wireless connectivity between 5G towers and a 5G wireless hotspot. Long-time investors know that T has been trailing the likes of T-Mobile (TMUS) and Verizon (VZ) in the 5G race, but thus far that has not led to serious issues in the fundamentals. However, I expect that to change. Earlier this year, T finally announced an entrance into the 5G home internet market. That’s a problem though, as both TMUS and VZ have already been rolling out their products for several years. I know from personal experience that it takes considerable time and capital to fully perfect this service (I had tried Verizon 5G home internet one year ago to no success, but recently tried it again with much better service), meaning that it will likely take quite a bit of time before T can effectively compete. 5G home internet poses great existential risk to the broadband providers, but arguably also to wireless providers who do not have a competitive offering, such as T. I wonder how many 5G home internet subscribers will be tempted to switch wireless providers as well, possibly lured by bundling discounts? Yes, T may be able to offset this through eventually winning new FWA broadband subscribers. However, mobility is still its cash cow, and 5G home internet may be the Trojan horse for TMUS and VZ to take market share. Wireless mobility is already a price competitive market and T’s inability to compete via a home internet bundle puts it at a competitive disadvantage relative to these peers. I note that I am not saying that this disadvantage will lead to imminent downside, but instead that there may be upcoming headwinds as TMUS and VZ begin leaning more and more into their 5G home internet offerings. Those may make T stock look like a 7% yield without much more potential for upside, offering a poor risk-reward proposition (as T stock is most certainly not offering bond-like risk). I reiterate my neutral rating on the stock but note that I may upgrade the stock to a buy if management does execute on its plans to reduce leverage.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!