Summary:

- AT&T Inc.’s stock remains reasonably valued despite its 30% run.

- Recent actions have restored some of the lost trust in management. Some. Not all.

- Dividend coverage looks much stronger than its closest competitors.

- To each their own. And I am staying with AT&T for now.

Ronald Martinez

I see Seeking Alpha as an equilateral triangle with three perfectly equal sides: stocks, authors, and readers. Take away or even reduce the importance of one, you will be left with a disfigure, if not a complete pile of rubbles. Authors write about stocks (predominantly) for the benefit of the readers. In an almost unique way, we also get a nice synergy on Seeking Alpha when authors themselves are readers (followers) of other authors who write about a common favorite stock.

I was caught in that nice synergy this morning when I read an article from David Alton Clark (“DAC”), one of the few authors I follow, on one of my favorite stocks AT&T Inc. (NYSE:T). It took me a minute to link the title of DAC’s article to its content. Blame it on a slow Friday morning. Once I got the connection, I immediately had my title ready to go from the same movie, Ghostbusters. There’s something you don’t see every day.

It is not every day that I see a sell rating on AT&T. More specifically, it is not every day that someone with more than 100 articles on AT&T advocates a sell. If you are thinking this is a rebuttal piece, I am sorry to disappoint you. It is not. Because DAC is absolutely right when saying “Let me say this, everyone’s situation is different.” The fact that he ended up selling should not by and of itself dissuade others to follow suit. This article is my earnest attempt to present a few reasons why selling AT&T here may not be the right call for everyone. Let us get into the details.

Stock Valuation

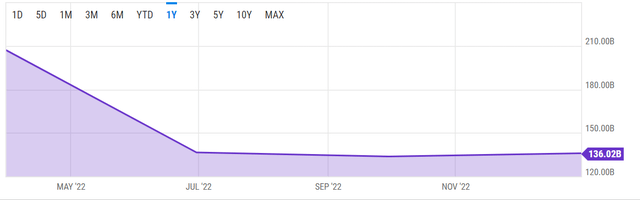

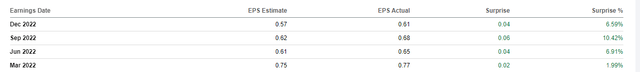

Despite the nice 30% run higher in stock price since October 2022, AT&T’s stock is still trading at a reasonable valuation with a forward multiple less than 8. Granted, AT&T is not about to set the world on fire with its growth rate, but this run is backed up by the fact that the company beat its earnings estimate each of the preceding four quarters, as shown below. Not to forget, the company met its own lofty goals for Free Cash Flow (“FCF”) in the recently reported quarter.

ATT Earnings History (Seekingalpha.com)

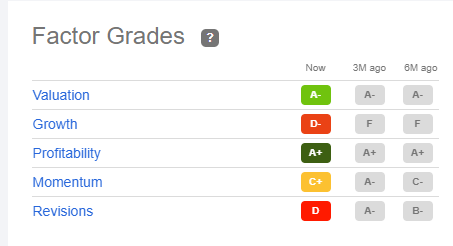

Seeking Alpha’s quant ratings agrees with my valuation assessment as well as the fact that strong earnings coupled with on-going cost cutting measures have resulted in rock-solid profitability. Once again, there is no question that, since being back to primarily being a Telecom player, AT&T’s growth prospects are not too bright, but if you are looking for growth here, you are barking up the wrong tree. We will look at revisions and momentum in the sections below.

ATT SA Ratings (Seekingalpha.com)

Shareholder Trust – Finally

It takes years to build trust but seconds to break it. AT&T did deserve to lose the trust of its investors with their ballooning debt and bad acquisitions, to name a few. So, I am not calling it a win yet and I fully acknowledge these are still early days. But we must celebrate the small wins along our journey. AT&T’s recent actions are showing that the company finally cares about its image with shareholders. A few examples below:

- Despite having more access to credit (AKA debt), AT&T’s management has not yet tapped into the cookie jar yet, as the debt level has remained steady since the spinoff.

- Knock on wood, the company hasn’t undertaken any further ridiculous “di-worsification” efforts.

- These plus the fact that the company met its own lofty free cash flow (“FCF”) goals, which was followed closely, is encouraging enough for me to stick with the stock, especially if the yield remains above 5% and the forward multiple remains in single digits.

Business Reality

I pay a lot of attention to shareholder updates from my largest holdings. AT&T’s COO and CFO both recently provided updates to shareholders that offer plenty of insights. Key things that got my attention are the following:

- The COO’s report mentioned the company’s investments over the last two years is now leading to cost efficiencies. This is having an impact on the immediate bottom-line as well as the operating leverage (that is, the ability to set pricing point price profitably).

- The company expects to use “cash after dividends” to reduce debt until it reaches its goal of 2.5x net debt-to-adjusted EBITDA. Read the order again. Cash -> Dividends -> Debt. In simpler words, the earnings and free cash flow strength referenced above and below will translate into shareholder payments first before being sent towards debt. This is a simple yet magical cycle as long as the company does not indulge in overcompensation and bad acquisitions.

- All these don’t mean the company is planning to skim on its growth plans. It is still on track to reach its target of 30 million fiber locations by end of 2025. This is not a new goal from last quarter as it was established almost two years ago and the recent reports show the execution is on track.

The Verizon Comparison

While Verizon Communications Inc. (VZ) has a higher yield right now, AT&T has a better dividend coverage based on Free Cash Flow, as explained below:

- Verizon’s total shares outstanding: 4.20 Billion

- Verizon’s quarterly dividend per share: 65 cents.

- Quarterly FCF needed to cover dividends: $2.73 Billion

- Verizon’s average quarterly FCF Trailing Twelve Months: $2.60 Billion

- Verizon’s average quarterly FCF over last 5 years: $1.74 Billion

- In other words, Verizon’s dividend commitment is well over its recent free cash flow.

Let’s see how AT&T fares in comparison.

- AT&T’s total shares outstanding: 7.13 Billion

- AT&T’s quarterly dividend per share: 27.75 cents

- Quarterly FCF needed to cover dividends: $1.97 Billion

- AT&T’s average quarterly FCF Trailing Twelve Months: $3.09 Billion

- AT&T’s average quarterly FCF over last 5 years: $5.882 Billion. Please note this may not be a fair comparison as it included cash flow from the pre-spin off business units as well.

- In other words, AT&T’s dividend coverage is much stronger than Verizon’s using Free Cash Flow.

For those who prefer payout ratio based on Earnings Per Share (“EPS”), AT&T has a forward payout ratio of 45% compared to Verizon’s 55%.

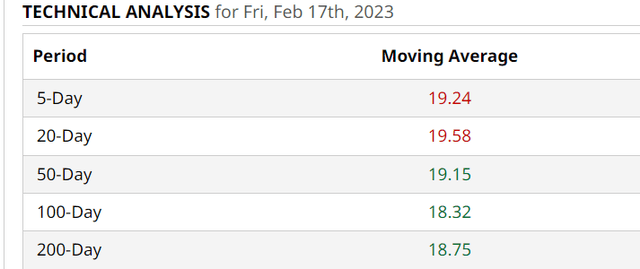

Technical and Revision Momentum

This is not as important as the business and its fundamentals but it does play a role in the short to medium term, especially when judging entry points. The fact that the stock is trading above the all important 200-Day moving average is encouraging. The recent market weakness is likely the biggest reason for the stock to be trading below its 5- and 20-Day moving averages but they don’t matter as much in grand scheme of things.

I am also comforted by the fact that the current 200-Day average is very close to the 6% yield mark. With the current 30 year treasury rate hovering in the mid to higher 3% range, investors do need a higher yield to get in and stay invested in low growth stocks like AT&T.

Lastly, while AT&T’s earnings estimates have trended down over the last 90 days, the fact that the current full year estimates have fallen by just 5% over 90 days tells me the revisions will be fairly tight, allowing investors to get a fair multiple easily. For example, using the current 2023 EPS estimate of $2.44, AT&T stock is currently trading at a multiple of 7.78. If the estimate falls by even 10% by end of the year, the forward multiple still be around 8.50. That’s tight enough for investors to form a realistic range of outcomes.

Conclusion

To reiterate, I am in agreement with DAC that everyone’s situation is different. However, while there maybe reasons to sell AT&T Inc. now or anytime, there are also enough reasons to be cautiously optimistic about the stock. I consider AT&T Inc. stock a buy as long as the yield hovers close to 6% with the stock’s forward multiple being less than 10.

AT&T Inc. has shown more discipline in the post-spinoff months than anytime I can recall in the past 10 years as a shareholder. I understand that AT&T is not a high-growth stock, and I am perfectly fine with it. I just hope AT&T Inc. management does not once again try to make itself and the company look cool at our expense. Until those signs show up, I am staying with AT&T.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.