Summary:

- AT&T stock and Verizon stock have both suffered along with the broader telecom sector due to rising interest rates and other challenges facing the sector.

- Both offer high yields today and appear to be undervalued.

- We compare T and VZ stocks side by side following their Q3 results and share our take on which is the better buy today.

Shutter2U

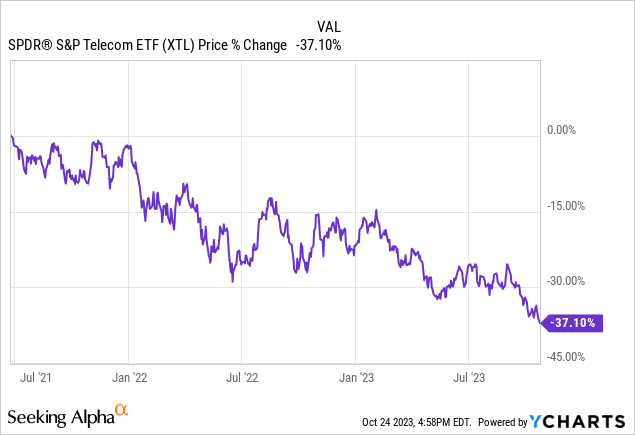

The telecommunications industry (XTL) has struggled mightily over the last 25 months. Stocks across the sector have taken a beating due to persistently low returns on invested capital, substantial capital expenditure demands, rapidly rising interest rates, concerns about the possible entry of Amazon (AMZN) into the sector, and a recent inquiry initiated by the Justice Department and EPA into telecom companies regarding lead cables.

In this article, we will compare two leading telecom high-yield stocks – AT&T (NYSE:T) and Verizon (NYSE:VZ) – to update our thesis on each and determine which is the better buy following the release of their Q3 results.

AT&T Q3 Earnings Results

AT&T reported a strong third quarter, with particularly impressive free cash flow generation leading to a slight upward revision of 2023 guidance to ~$16.5 billion. Although wireless customer trends were not as strong as the previous year, they improved sequentially as the competitive landscape in the U.S. wireless industry appears to be improving for carriers, leading to expectations of steady growth and increased cash flow for wireless providers like T.

A negative from the quarter was that net postpaid phone customers declined from 708,000 to 468,000 year-over-year. However, a silver lining was that they improved from 326,000 in the previous quarter. As a result, AT&T believes it has regained its share of industry growth following the loss of a large enterprise customer last quarter.

Other positives from the quarter included:

- Revenue per customer grew by 3.7% in wireless service revenue compared to the same quarter last year.

- Cost-cutting measures and a decline in phone upgrades contributed to a more than 2 percentage point increase in the wireless EBITDA margin year-over-year, reaching 43%.

- T generated $5.2 billion in consolidated free cash flow during the quarter, bringing the year-to-date total to $10.4 billion, nearly 30% higher than the previous year’s total at this point.

- Net debt decreased by over $3 billion during the quarter, falling to $129 billion, which is approximately 3.0 times consolidated EBITDA. AT&T is expected to generate sufficient cash in the fourth quarter to cover dividends, pay the remaining $2 billion in C-band spectrum clearing costs, and surpass its year-end net debt target of $128 billion by paying down at least $1 billion of debt in Q4.

- Management gave very encouraging guidance for growing free cash flow in 2024 as wireless network investment stabilizes. However, investors hoping that this will translate into higher capital returns to shareholders will likely have to wait, as management plans to utilize the extra free cash flow to retire upcoming debt maturities rather than to buy back stock or grow the dividend.

While this is all encouraging news, topline growth remained anemic at a paltry 1.3% year-over-year. Moreover, adjusted EPS declined by ~6% year-over-year, and cash flow from operations only increased by 2% year-over-year. The numbers looked even worse on a continuing operations EPS basis, with that number declining by a whopping 39% year-over-year in Q3.

Yes, T’s free cash flow picture seems to be improving, which is a big deal as it enables them to pay down debt as it matures rather than seeing their interest expense soar with rising interest rates. However, the business remains in very low-growth mode and appears to be stuck in that mode for the foreseeable future.

Verizon Q3 Earnings Results

VZ’s Q3 performance, meanwhile, clearly impressed Mr. Market, with the stock up by 9.27% today following the results release and earnings call. As with T, VZ generated a lot of cash in Q3 and increased their full-year cash flow guidance from $17 billion to over $18 billion while also guiding for continued cash flow generation growth in 2024.

Highlights from the quarter included:

- 100,000 net year-over-year postpaid phone customer growth, which lagged T’s 468,000 net year-over-year new postpaid phone customers.

- Average revenue per consumer postpaid wireless account increased by ~2.2% year-over-year.

- VZ has generated $14.6 billion year-to-date in free cash flow.

- VZ has reduced its debt to $143 billion, bringing its leverage ratio down to 3.0x.

That said, similar to T, VZ’s growth remains very weak, with revenue declining by 2.6% year-over-year and adjusted EBITDA inching only 0.2% higher year-over-year during Q3.

AT&T Vs. Verizon: Dividend Analysis

Both T and VZ are expected to have limited dividend growth prospects in the coming years as both remain focused on investing in their capital-intensive businesses and deleveraging their balance sheets in a higher cost-of-capital environment. Wall Street analysts are clearly expecting this as well, projecting a modest 1.2% compound annual growth rate for T and an only slightly better 1.7% CAGR for VZ through 2027.

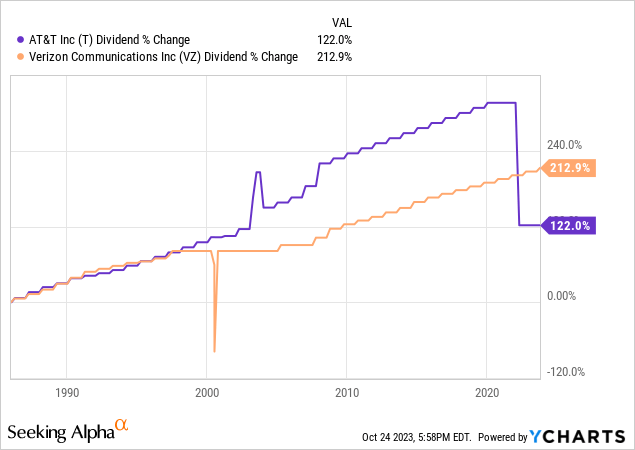

Both businesses have similar leverage ratios at the moment and remain committed to strengthening their balance sheets in the coming quarters. In terms of payout ratio, VZ’s expected payout ratio in 2023 is 55% whereas T’s is 45.5%, seemingly indicating that T’s dividend is on firmer footing. However, VZ’s dividend track record is much more impressive than T’s, as T slashed its dividend in 2022 whereas VZ has grown its dividend every year for 17 years in a row.

Moreover, when the management teams spoke about the future outlook for their respective dividends on their Q3 earnings calls, T’s sounded like it was trying to assure investors that its current dividend payout was sustainable whereas VZ’s management continued to speak about future dividend growth:

T’s CEO said:

we remain committed to our dividend payout level and expect its credit quality to consistently improve. In fact, we’ve already generated more than enough cash to meet our annualized dividend even before the fourth quarter, which is generally our highest cash generation quarter.

Meanwhile, VZ’s CEO said:

During the third quarter, we paid down $2.6 billion in debt and increased our dividend for the 17th consecutive year, a current industry record that we take pride in. Our dividend coverage is very healthy. Year-to-date our free cash flow dividend payout ratio is approximately 56%, a significant improvement from a year ago… Number one in the capital allocation is to invest in our business. Number two is to continue to put our board in a position so they can increase our dividend. We are on 17 years of consecutive increases.

While the raw leverage and payout ratio numbers imply that T’s dividend is on as firm of footing as VZ’s, given their past track records and language being used to describe their respective future outlooks, we trust VZ’s management much more than T’s to continue growing their dividends.

T Stock Vs. VZ Stock: Valuation Analysis

When comparing T and VZ based on price-to-earnings (P/E) ratios, T appears to be the more attractive value with a forward P/E ratio of 6.00x, while VZ has a higher P/E ratio of 6.82x.

Moreover, when assessing their valuation on a leverage-neutral metric such as EV/EBITDA, T once again appears to be slightly cheaper. T is priced at a multiple of 6.10x, and VZ is priced at a multiple of 6.44x.

When considering their historical EV/EBITDA multiples, T is still the better bargain, as VZ’s 10-year average is 7.10x, whereas T’s 10-year average is 6.86x, indicating that VZ’s current EV/EBITDA is ~9.3% below its historical level whereas T’s current EV/EBITDA is ~11.1% below its historical level.

That said, VZ does offer investors a more attractive NTM dividend yield of 8.52% compared to T’s NTM dividend yield of 7.56%.

T Stock Vs. VZ Stock: Investor Takeaway

Overall, both businesses are facing similar growth challenges while increasing free cash flow generation and deleveraging their balance sheets. While T does trade at a discount to VZ, the discount is not huge. Meanwhile, VZ has a near 100 basis point higher dividend yield, a much better track record in terms of its dividend, and management sounds much more committed to continuing dividend growth moving forward.

As a result, while T may offer investors a slightly more interesting proposition as a value opportunity, for dividend investors, VZ is the easy choice between these two. Overall, we rate both as Buys and if we had to pick one, we would choose VZ given its higher dividend yield plus growth and more trustworthy management.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!