Summary:

- AT&T’s high dividend yield (5.6%) understates its upside potential.

- Because the dividend is only part of shareholder yield, and other parts include share buybacks and debt paydowns.

- In particular, shares repurchased at discounts are in essence a wealth transfer from the existing shareholders to the staying shareholders.

- I think this is exactly the case, judging by T’s valuation metrics, especially when debt pay downs are considered.

RapidEye

T stock: previous thesis and total shareholder yield

I recently wrote an article titled “AT&T Q2: Catalysts Galore” about AT&T stock (NYSE:T) stock. Published on July 27, 2024, this piece delved into the company’s second-quarter earnings report, as you can already tell from the title. In particular, I highlighted several factors that could support a bullish investment thesis, despite some unevenness in its Q2 performance. Quote:

All told, I see far more positives than negatives from its Q2 report. I see plenty of profit catalysts to drive its EPS growth in the years to come. To reiterate, the top ones on my list are the stabilization of CAPEX (and the subsequent growth potential of FCF), the growth of its fiber network, and the many synergistic opportunities between fiber and its other segments.

Thus, that article covered a range of topics with a broader stroke. After reading recent articles on this stock, I thought it would be helpful to focus this article on one thing – its dividends. As a textbook dividend stock, T’s generous dividend payouts are a factor underpinning many bulls’ theses (and some bearish theses too where they argue the high dividend yield is not enough). However, the cash dividend is only one way that companies can return capital to shareholders. As such, I urge investors, especially dividend investors, to look past cash dividends and look at total shareholder yield (TSY). TSY includes cash dividends of course, but also net share buybacks and debt paydowns.

In the remainder of this article, I will explain why its high dividend yield (currently yielding 5.6%) understates its upside potential when its TSY is considered.

T stock: share repurchases in focus

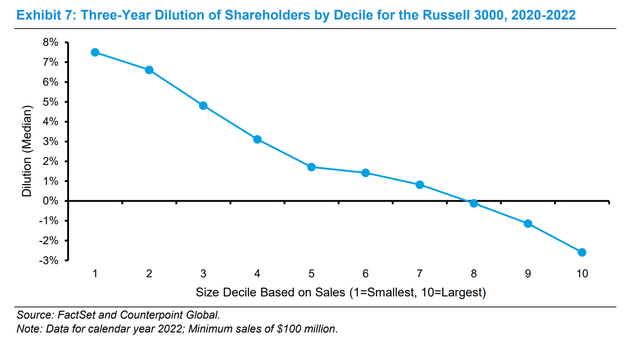

Let me start with share repurchases, the next chart below from a Morgan Stanley study shows the overall statistics of share repurchases for companies in the Russell 3000, ranked in size by decile. The observations from these charts are twofold, which are quoted and summarized below. The second one (highlighted me) is especially relevant here for T in my view.

The companies in the smallest three deciles realized an average dilution of six percent, while the largest three deciles collectively retired equity. Share buybacks are a way to return capital to shareholders that are equivalent to dividends under strict assumptions.20 But unlike dividends, which treat all shareholders equally, buybacks that occur at any price other than fair value result in a wealth transfer. A company that buys back undervalued stock transfers wealth from the selling shareholders to the ongoing holders. And companies that repurchase overvalued stock transfer wealth from the ongoing shareholders to the selling shareholders.

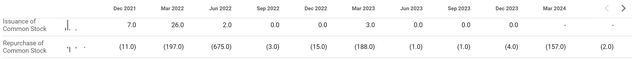

First, the largest companies tend to be net buyers of their own shares. And this is what has happened to T since its WarnerMedia spinoff. The spinoff has drastically improved its capital allocation flexibility (more on this later) and the company now has the means to afford repurchases. More specifically, the following cash statements show its issuance of common stock and repurchase of common stocks in recent quarters (after the spinoff). As seen, the company has primarily focused on repurchasing shares rather than issuing new ones during this period. In every reporting period, the repurchase has exceeded the new issuance.

Later, I will argue that, as the above Morgan Stanley report pointed out, these repurchases are very likely to result in a wealth transfer from the sellers to the buyers under current conditions.

T stock: debt pay downs

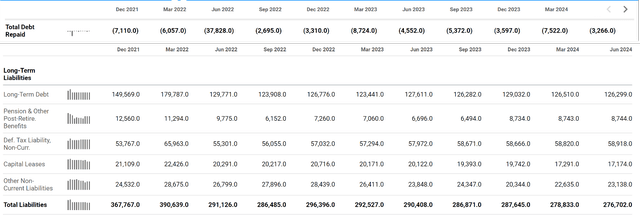

Before diving into the wealth transfer, I need to examine the final piece of TSY: debt paydowns. The chart below shows the debt repaid and other liabilities for T stock since the WarnerMedia spinoff. As seen, T has consistently repaid debt in this period. As a result, its long-term debt and total debt have been on a decreasing trend recently – a quite rapid one I might call it. For instance, in December 2021, the total liabilities stood at $367B+, and by March 2024, the figure had decreased to $276B. The largest driver for the lower total liabilities is the reduction in its long-term debt. As seen, its long-term debt has decreased from over $149B in Dec 2021 to the current level of $126B.

Next, I will argue that such debt paydowns have made the company more attractive to shareholders (i.e., existing shareholders) just as the cash dividends have.

T stock: valuation discounts

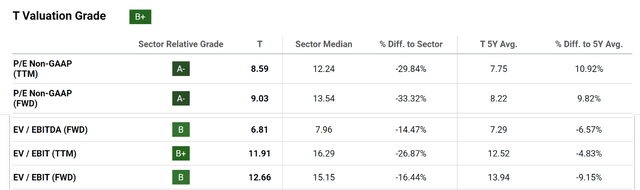

A reduction in debt directly translates into a lower EV (enterprise value) with everything else being equal and thus makes the company’s valuation more attractive – if you analyze the stock from the perspective of a business owner (or a buyer who wants to buy the entire company). Specific to T, the commonly quoted P/E ratios thus underestimate its attractiveness because it ignores the debt component. As seen, T’s current P/E ratios, either on a TTM or FWD basis, are significantly below the sector median but above its 5-year average. For example, its P/E (TTM) is 8.59x compared to the sector median of 12.24 (representing a -29.84% difference) but about 11% above its 5-year average of 7.75x.

If we switch to EV-based valuation metrics to incorporate the impacts of debt reductions, the pictures change substantially. As also seen in the chart below, T’s EV-based multiples, such as EV/EBITDA or EV/EBIT ratios are currently both below the sector median substantially and also below its own 5-year average by a good margin. For example, its current FWD EV/EBIT ratio is 12.66x, compared to the sector median of 15.15x (representing a discount of 14.47%) and its 5-year average of 13.94x (representing a discount of more than 9%).

When shares are repurchased such discounts, as the Morgan Stanley report pointed out above, I see good odds for a wealth transfer from the existing shareholders to the staying shareholders.

Other risks and final thoughts

In terms of downside risks, T shares most of the risks common to the telecom sector and also faces some more specific risks. The common risks include intense competition, rapid technological advancements, regulatory risks, heavy CAPEX requirements, etc. The telecom market is highly competitive, with both established companies like T and new entrants vying for market share through price wars, service bundling, and innovative offerings. Additionally, to stay competitive in a rapidly evolving technological landscape, these companies have to spend heavily on CAPEX (such as rolling out 5G networks and potentially investing in AI-related features). As a risk more specific to T, its vast legacy network of cables (some of them are lead cables) can expose the company to environmental regulatory and legal risks. As an example, the Environmental Protection Agency (EPA) recently investigated the environmental and health risks that these cables represented. As a ramification of these investigations, a shareholder lawsuit was recently filed against AT&T claiming the board and other top executives knew of the environmental risks that the cables represented. These investigations/lawsuits could lead to financial impacts for T and also violent share price volatilities.

All told, my conclusion is that the market has already priced in all the negatives, but is likely understating the positives. In particular, the dividend yield – a point many T bulls emphasize – underrepresents the TSY from the stock as the company transitions from share dilution to reduction – at discounted valuation multiples – and pays down its debt aggressively.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.