Summary:

- Microsoft’s acquisition of Activision Blizzard could provide an 18.19% upside for investors if the deal goes through, but the deal still faces regulatory hurdles in the UK and the US.

- If the deal falls apart, Activision Blizzard could potentially receive a $3 billion termination fee from Microsoft, which could be used for share buybacks, acquisitions, or debt reduction.

- Activision Blizzard’s strong balance sheet, low P/E ratio, and potential for increased EPS make it an attractive investment option regardless of the acquisition outcome.

Sascha Schuermann

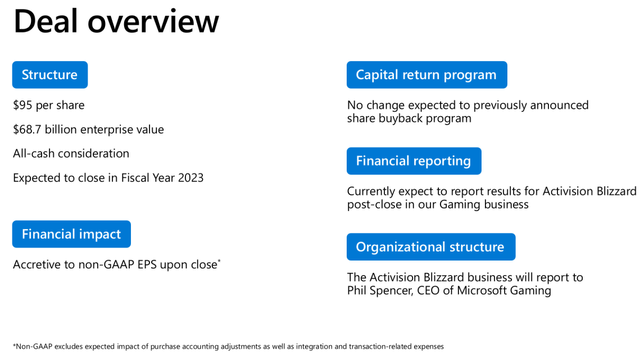

By now, the news about Microsoft (MSFT) acquiring Activision Blizzard (NASDAQ:ATVI) is old news. The deal was announced on MSFT’s website on 1/18/22, as MSFT agreed to pay $68.7 billion for ATVI, which is equivalent to $95 per share. After the news broke, shares of ATVI jumped from roughly $65.85 to $82.31 and have traded sideways since. There have been many hurdles along the way, and while 37 countries have now approved the deal, MSFT still has to overcome regulation impediments from the UK and USA. Nobody can say for certain if this deal materializes, so here is the question to ask. If the deal falls through, is ATVI attractive at $80.38? If the deal closes, there is a guaranteed spread to make a profit, but if the deal doesn’t close, it’s anyone’s guess as to what will occur. I am going to look at ATVI from both sides and determine if it’s worth adding to my capital appreciation portfolio, no matter what the outcome is.

There is a guaranteed upside if Microsoft’s acquisition gets through the legal hurdles

I will start with the easy scenario. MSFT has agreed to acquire ATVI for $95 per share for $68.7 billion in cash. MSFT was projecting to get the deal closed in its 2023 fiscal year, which isn’t going to occur, as MSFT’s 2023 Q4 ends June 30th. MSFT does not report on a calendar year basis. The biggest hurdle to the deal is the UK and USA. MSFT is currently in legal battles with both superpowers, and a trial for MSFTs appeal of the UK decision is set for July 24th, which could last 10 days, and a trial in the USA is scheduled to start in August as the Federal Trade Commission (FTC) sued to block the deal.

MSFT is fully committed to getting the deal approved, and they have the resources to defend their position. On the balance sheet, MSFT has $26.56 billion in cash, and another $77.86 billion in short-term investments, for a total of $104.42 billion in on-hand available liquidity. MSFT has another $9.42 billion in long-term investments and a business that acts as a printing press for profits. In 2022, MSFT generated $72.74 billion in net income, and in the TTM, MSFT produced $69 billion in net income. Between its cash position and ongoing profits, MSFT is armed with a blank check to defend this deal. I am not a legal expert, and I can’t predict the future, so we will need to wait and see what MSFT can pull off.

If the deal gets approved, there is 18.19% upside guaranteed. ATVI trades at $80.38, and the deal is for $95 per share in cash. This is a spread of $14.62 between the current pricing of shares and the buyout price, which is an 18.19% differential. If you were to purchase shares now and the deal gets approved, you would eventually make 18.19%. The guaranteed upside if the deal passes is interesting, and even if it takes a year, 18.19% for sitting back and waiting is a healthy return.

Is Activision Blizzard still interesting if the deal doesn’t go through?

I started with the easy side, but now it’s on to the more difficult question. Is ATVI a buy today with the acquisition falling apart? Everything has value, but at the end of the day, something is worth what someone else is willing to pay for it. There is an argument that ATVI is worth $68.7 billion because MSFT is willing to pay $68.7 billion for it. On the other hand, MSFT can afford to pay a premium due to its level of profitability to fuel future growth. While MSFT is willing to pay $68.7 billion, there isn’t a guarantee that another company would also be willing to pay this valuation for ATVI.

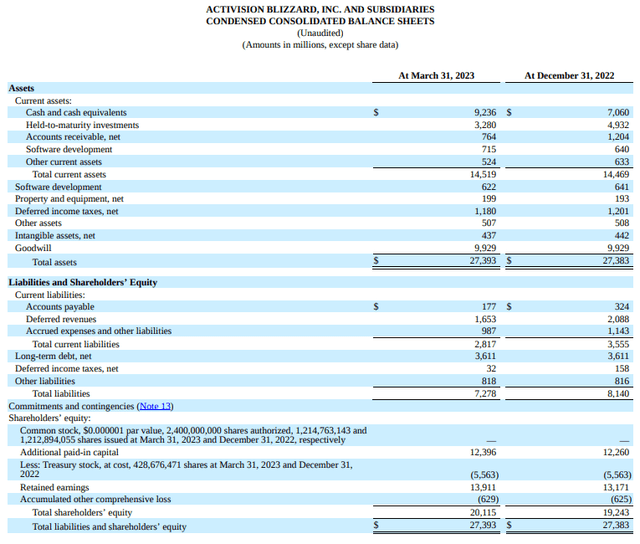

Assuming new bidders don’t emerge, the question is, is ATVI overvalued at $80.38 and a market cap of $63.19 billion? Let’s look at some interesting facts prior to looking at the valuation. ATVI has an impeccable balance sheet. There is $9.24 billion in cash and another $3.28 billion in short-term investments on the balance sheet creating $12.52 billion in current liquidity. ATVI has $3.61 billion in total debt, which is all long-term debt. ATVI has $20.12 billion in total equity on the books and can write a check for its entire debt profile tomorrow and still have $8.91 billion in current liquidity.

Reading through the SEC filing, there is a termination fee of $2.27 billion which ATVI would need to pay MSFT if the merger agreement is terminated in specified circumstances which can be read on page 92. There is also a reverse termination fee that would require MSFT to pay ATVI between $2 – $3 billion if the merger agreement is terminated in specified circumstances which can be read on page 93.

The termination fee is based on a range of dates. MSFT agreed to pay ATVI $2 billion if the deal is terminated prior to 1/18/23, $2.5 if terminated after 1/18/23 and before 4/18/23, and $3 billion after 4/18/23. The reverse termination fee specifically says that ATVI will be entitled to receive the reverse termination fee from MSFT if the merger agreement is terminated due to the deal falling apart due to legal or regulatory restraints or prohibitions arising from antitrust laws. The exact specifications are directly from the SEC filing, which can be read here:

by either Microsoft or Activision Blizzard due to (1) a permanent injunction or other judgment or order arising from antitrust laws having been issued by a court or other legal or regulatory restraint or prohibition arising from antitrust laws preventing the consummation of the merger being in effect, or any action having been taken by a governmental authority arising from antitrust laws that, in each case, prohibits, makes illegal or enjoins the consummation of the merger and that has become final and non-appealable; or (2) any statute, rule, regulation or order arising from antitrust laws having been enacted, entered, enforced or deemed applicable to the merger that prohibits, makes illegal or enjoins the consummation of the merger, except that this termination right will not be available if the terminating party’s material breach of any provision of the merger agreement is the primary cause of the failure of the merger to be consummated by the termination date; or

by either Microsoft or Activision Blizzard if (1) the merger has not been consummated by the termination date, as may be extended pursuant to the merger agreement, except that this termination right is not available if the terminating party’s material breach of any provision of the merger agreement is the primary cause of the failure of the merger to be consummated by the termination date, and (2) all conditions to the merger agreement are satisfied (other than those conditions to be satisfied at the time of the closing of the merger, each of which is capable of being satisfied at closing) or waived (where permissible pursuant to applicable law), other than the regulatory conditions or injunction condition solely with respect to antitrust laws, except that in either case, Activision Blizzard is not then in material breach of any provision of the merger agreement (provided that any breach by Activision Blizzard that is the primary cause of the failure of any condition to the merger agreement to be satisfied is a material breach).

After reading through both termination fee agreements, it seems unlikely to me that ATVI would be on the hook for the $2.27 billion on their side, while MSFT would be on the hook for $3 billion if the deal doesn’t go through due to the legal disputes in the UK and USA. If the deal gets terminated and MSFT pays ATVI $3 billion, ATVI’s on-hand liquidity immediately increases to $15.52 billion. ATVI could use the payout from MSFT to eliminate 83.08% of its total debt, without touching a single penny from its cash stockpile. The $3 billion could also be used to make an acquisition, repurchase shares, or invest at a 4-5% interest rate and earn between $120 – $150 million in interest over the next 12 months from a risk-free asset such as a CD, money market, or T-Bill.

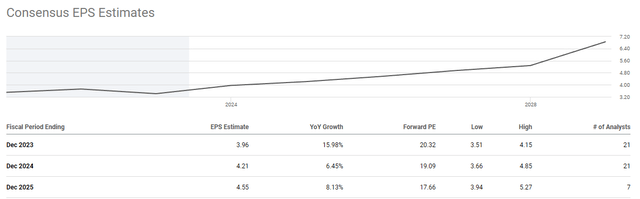

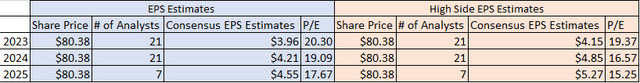

As a standalone company, ATVI is expected to increase its EPS sequentially YoY. In 2023, ATVI is expected to generate $3.96 in EPS, then $4.21 in 2024, and $4.55 in 2025. As it stands now, ATVI trades at a forward 2023 P/E of 20.3, and based on the analyst’s consensus estimates, ATVI is trading at 19x 2024 EPS and 17.67x 2025 EPS. On the high side of the estimates, ATVI is trading at 19.37x 2023 expected EPS, 16.57x 2024 EPS, and 15.25x 2025 EPS.

Steven Fiorillo, Seeking Alpha

This is very interesting as ATVI trades at a relatively low P/E, and it could get even lower. If the deal falls apart and the $3 billion that ATVI is utilized for a massive buyback, ATVI could lower its share count by -4.75% as it would be in a position to repurchase 37.32 million shares. Here is the math behind a hypothetical buyback:

- ATVI has 786.1 million shares outstanding

- Current share price is $80.38

- Termination Fee = $3 billion

- $3 billion can buy 37,322,717.09 shares at current prices

- 37,322,717.09 shares is 4.75% of shares outstanding (37,322,717.09 / 786,100,000)

When buybacks occur, it helps increase EPS as long as the earnings from operations doesn’t decline. When determining EPS, net income is distributed across fewer shares when buybacks occur, increasing EPS. If ATVI has fewer shares and earnings from operations doesn’t decline, then its EPS will automatically increase. Here is an example:

- ATVI has generated $1,858,000,000 in net income during the TTM

- ATVI has 786,100,000 shares outstanding

- The current EPS in the TTM is $2.36 ($1,858,000,000 / 786,100,000)

- If ATVI repurchases 4.75% of the shares with the $3 billion from MSFT they could buy 36,322,717.09 shares

- The new share count would be 748,760,250

- Hypothetically, if this were to occur next week, the TTM EPS would increase by 4.99% to $2.48 ($1,858,000,000 / 748,760,250)

Steven Fiorillo, Seeking Alpha

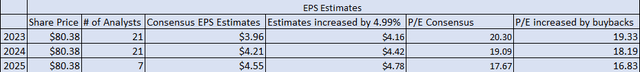

When EPS increases, and the share price stays the same, the P/E drops. Under this scenario, if ATVI conducted a $3 billion buyback with the breakup fee from MSFT and decreased the share count, the actual EPS should increase from the consensus estimates. Based on the math above, the lower share count, combined with EPS projections and ATVI trading at today’s prices, would decrease the forward P/E from 20.30 in 2023 to 19.33, then 19.09 to 18.19 in 2024 and 17.67 to 16.83 in 2025. If ATVI is awarded the $3 billion termination fee and it’s allocated to a massive buyback, it could make ATVI very attractive from a P/E metric and cause analysts to increase their forecasts and create positive sentiment for shares of ATVI.

Conclusion

I am not a shareholder of ATVI, and I currently have no horse in the race. I am considering buying some shares as a speculation arbitrage play. If the deal goes through, I would make 18.19% on my money. That would be the simplest scenario. If the deal falls apart, and MSFT had to pay ATVI $3 billion, then ATVI becomes very interesting. Sure, shares could decline upon the news as that’s always a possibility, but after everything settles, ATVI which is unleveled and in a cash-rich position, would have an additional $3 billion in liquidity. ATVI could make an acquisition, invest in new content, make investments into non-risk-yielding instruments, increase the dividend, pay a special dividend, pay off 83.08% of its total debt, or buy back shares. ATVI trades at a low P/E and could create positive investor sentiment with a large buyback and cause EPS revisions to the upside, which could drive shares higher. While there is a lot of uncertainty, and several ways this can play out, I think shares of ATVI are interesting because if the deal goes through, shareholders have guaranteed upside, and if the deal falls apart, ATVI likely will come out unscathed with $3 billion in additional liquidity and a real buyout price that MSFT placed on the company.

Please keep in mind that I am not a lawyer, and my interpretation that MSFT would have a higher probability of paying ATVI the termination fee rather than ATVI paying MSFT is based on my understanding of reading through the SEC filing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.