Summary:

- Avis Budget Group (CAR) faces a bleak financial outlook and increased competition from ride-sharing services and car-sharing platforms, posing risks to its market share and profitability.

- Despite past strong performance, CAR’s growing debt, interest expenses, and industry trends make it a potentially risky investment at its current price.

- The recommendation is to hold off on investing until the company proves its resilience or the industry landscape stabilizes.

LumiNola

Investment Thesis

Avis Budget Group (NASDAQ:CAR) is a provider of vehicle rental and car-sharing services. It operates in the US, Europe, the Middle East, Africa, Asia, and Australia. Since 2022, the stock has fluctuated significantly, ranging as high as $300 per share and as low as $138. CAR seems like a bargain now that it has settled in at slightly over $200 per share.

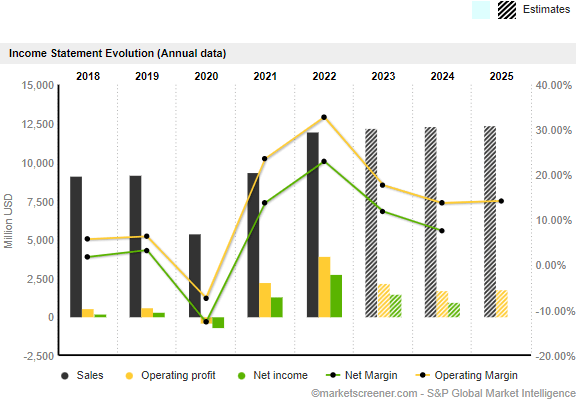

However, before making an investment decision here, investors ought to evaluate the trends in the industry and how detrimental they could be as far as their investment is concerned. This analysis should be done against the company’s fundamentals to make an informed decision. Upon doing such an evaluation, the future is blurred, as shown by the company’s downward trajectory financial forecasts, especially the bottom lines.

Market Screener

Given these blurred future financial projections and the risks associated with the trends in the industry, I hold my cards close to my chest regarding investing here.

CAR’s Business Model

The company buys a fleet of cars from different makers at prices that have been negotiated. They keep a variety of cars, trucks, and other vehicles in their fleet to meet the wants of a wide range of customers. The price of buying and taking care of these cars is a big operating cost. The main income source is renting out these automobiles to customers, both private and commercial. Customers pay a charge to rent a car on a daily, weekly, or monthly basis. The vehicle type, rental length, location, and season can all affect price. Another source of income is from long-term leases.

They also provide additional services in addition to the standard rental rate for an additional fee. These might include fuel service options, GPS navigation systems, car seats, Wi-Fi, and insurance waivers. The corporation also receives revenue from late return fees, one-way rental costs, and concession recovery fees.

The company has partnerships with a number of airlines, hotels, and other travel-related businesses, which offer deals and bring in a consistent flow of renters to Avis. The business also offers benefits and prizes to loyal customers through loyalty programs, which promote repeat business.

What Has Been and Its Implication, And Expectation In Future

CAR has consistently posted record-breaking revenue, net income, and adjusted Ebitda, displaying exceptional performance. This achievement can be credited to a combination of stable consumer demand in domestic and foreign markets and a favorable price environment. To evaluate this trend, I will track the company’s financials for the last ten years.

In light of this, the company’s improved cost-of-revenue efficiency can be seen in the gross margins, which increased from 29% in 2013 to 50% in 2022. The more striking statistic on the income statement is how Avis controlled operating costs. While revenue surged by 51% between 2013 and 2022, from $7.9 billion to almost $12 billion, total operating expenses only rose by 30%, from $1.3 billion to $1.7 billion. The corporation reduced the total number of outstanding shares by approximately 60% over that time, from 106.9 million to 39.8 million. The continuous share repurchasing, in my view, has been instrumental as it improves shareholder value even more.

Moving from the ten-year financial performance to the shareholders’ position currently after this strong growth, the stock hasn’t had a particularly fantastic run recently. The share price dropped 10% in the most recent quarter, certainly not pleasing shareholders. The returns over the past three years have been remarkable despite this, though. In the longer run (3 years), the share price has increased by about 969%. According to long-term investors, the current decline doesn’t really affect the longer-term picture much. If there is still too much excitement surrounding the company’s future, it is something to think about.

Regarding the future, the financial estimates, as represented in the investment thesis section, point out a bleak outlook that could be very detrimental. Further, its long-term debt has increased from $3.3 billion to $4.6 billion, and its interest expense is about $800 million. Looking at these figures against a bleak financial outlook, then in my mind, mirrors a skeptical view of investing here.

The Industry Trends: The Apparent Risks?

One industry trend that poses a major risk to investing in Avis is the shift towards alternative transportation options, including ride-sharing services and car-sharing platforms. These emerging trends have disrupted the traditional car rental business model and threaten Avis’s market share and profitability.

The increased popularity of ride-sharing services like Uber and Lyft has made it more convenient for consumers to access transportation without needing to rent a car. This trend has the potential to reduce the demand for this company’s rental vehicles, leading to a revenue decline.

Additionally, the rise of car-sharing platforms like Zipcar and Turo has provided consumers with a flexible and cost-effective alternative to traditional car rentals. These platforms allow individuals to rent out their own vehicles or access shared vehicles on-demand, eliminating the need for a dedicated rental car company. This trend further erodes the customer base and market share of companies like Avis.

To adapt to these industry trends, the company has made efforts to invest in its own car-sharing services, expand its presence in ride-hailing partnerships, and develop innovative mobility solutions. However, the company’s ability to successfully navigate this changing landscape remains a risk, as competition in the space continues to escalate and disrupt the traditional car rental industry.

Conclusion

It is no doubt that Avis has been excellent in the past, but with the dynamics in the industry and the bleak outlook in its financials, I don’t think now is a good entry point. Further, the company’s growing debt and interest expenses at a time when the industry is becoming competitive, and financials are estimated to decline to add more downside potential to this stock. In my view, this company is faced with a potentially strong downside in the future based on the risks. As a result, I recommend holding until these storms stabilize or until the company proves to be resilient to the looming adverse climate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was researched and written by January Mbuvi Of Fade The Market.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.