Summary:

- Avis Budget Group’s financials show a high level of debt and lack of growth catalysts, leading to a low valuation multiple.

- Solvency metrics indicate the company is overleveraged, and efficiency and profitability have started to decline.

- Analysts expect a drop in earnings for Q4, and the company’s lackluster revenue growth and debt pile are concerning for investors.

Jeff Greenberg/Universal Images Group via Getty Images

Investment Thesis

Avis Budget Group (NASDAQ:CAR) is going to report its Q4 results on February 12th after the bell, so I wanted to take a look at the company’s financials and see why the company is trading at such a low multiple. The balance sheet is not great with lots of debt, and the lack of growth catalysts is keeping investors at bay, I am giving the company a hold rating and would like to see margins and top-line growth improving. The company is trading above my intrinsic value calculations.

Financials

As of Q3 ´23, the company had around $572m in cash and equivalents, against $4.7B in long-term debt, not including around $15B related to Avis Budget Rental Car Funding LLC, which is a special purpose entity [SPE] created specifically for vehicle financing. There may be a lot of people who will stay away from companies that use so much leverage, but I like to look at a couple of solvency metrics that show me whether the company is overleveraged. Also, I will be using the whole debt, including the SPE’s large debt outstanding to be more conservative.

Firstly, the debt-to-assets ratio stood at around .72, which is just slightly over my max of 0.60, so it can be better but it shows that, in terms of assets, the company doesn’t seem to be overindulging on debt. Secondly, I like to look at the company’s ability to pay off its annual debt obligation in the form of annual interest expense on debt. Here, the company is pushing it a little as well, because it doesn’t pass my more stringent requirements. Many analysts look for at least a 2x interest coverage ratio, however, I prefer to see at least a 5x because it allows for much more leeway for bad years of performance, and a 5x is much safer than a 2x. As of Q3, the company’s coverage ratio stood at around 3x, so analysts would still consider the company healthy, however, I’m going to be more conservative in my valuation section of the company.

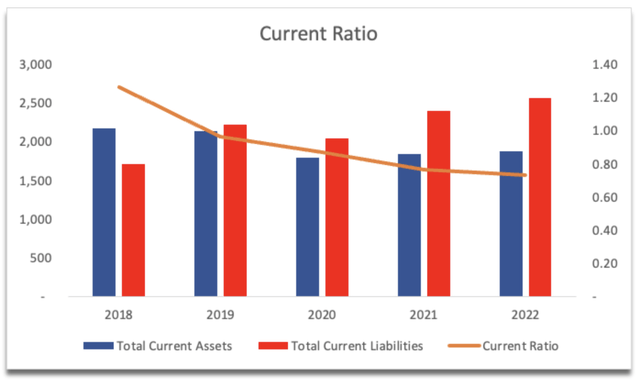

The company’s current ratio has been on a downtrend over the last few years, which is not ideal as it is now under 1, however, is this a cause for concern? It could be, but many companies operate with lower current assets against current liabilities. In the long run, I would like to see the company getting back up over 1, but for now, I will be even more conservative in my valuation estimates in the later section. As of Q3, the current ratio stood at around 0.8.

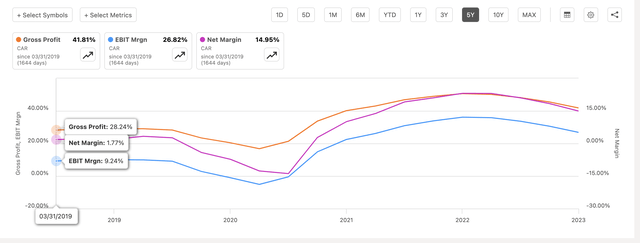

In terms of efficiency and profitability, the company’s margins have seen quite a bit of improvement in the last 5 years, however, we can also see these peaked around Q3 ´22 and started to curve downward, indicating inefficiencies in operations are starting to appear. 2023 was not an easy year for many companies due to high interest rates and inflation and an overall uncertain environment, so, understandably, efficiency dipped, but it is too early to tell if it will continue to go down or will it stabilize over the next couple of quarters.

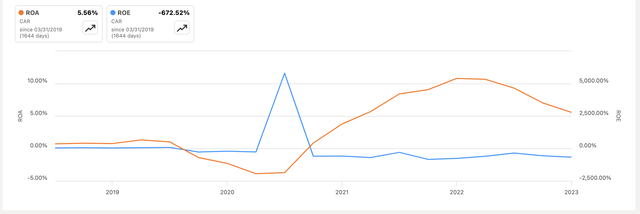

Continuing with efficiency, the company’s ROA has experienced a similar peak unsurprisingly, however, the company’s ROE has been negative for a few years now, so that will have to be taken into account also when I do the company’s valuation. In the latest quarter shareholder equity has improved to $-28m, so I would expect a lot of fluctuations in this metric going forward especially if it crosses into the positive territory.

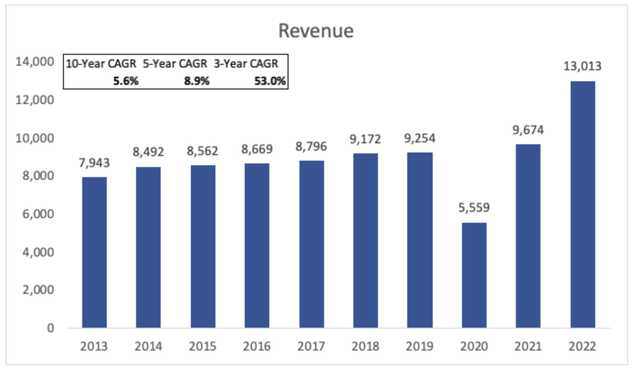

In terms of revenues, I would say the company had decent growth over the last decade, which also accelerated since the bottom of the pandemic lows. For the upcoming full year, the analysts are estimating little to no growth for the next three years, which is very disappointing. The company was doing so well in the last three years and now the revenue growth is stagnating. The management is not giving guidance on what revenue the company will do, which doesn’t help the company’s case at all.

Overall, the company has improved quite a bit since the bottom of the pandemic scare, however, it seems that in terms of revenues, it is plateauing. In terms of the company’s balance sheet, there is very little to like there in my opinion, and many investors would see the same. A lot of debt, which is manageable for now, however, if the company sees a decent drop in performance, there is very little wiggle room and it could be in some solvency troubles.

What to Expect from Q4

Analysts are expecting quite a drop in earnings y/y and sequentially of around $2.81B in revenue. As I mentioned the management isn’t providing guidance, so I will have to stick to these estimates and see how they differ from the actual ones.

Upcoming Earnings estimates (SA)

Over the last 12 quarters, the company beat EPS estimates 100% of the time while beating revenues 83% of the time, with the last two being small misses. I think the company has a good chance of beating estimates this time around also. The very low EPS seems to be due to seasonality, however, it is still very low compared to the other recent Q4s.

Comments on the Outlook

I would like to see top-line growth improve because analysts’ estimates are very lackluster. a growth of 1% or less is not something many investors would like to own in their portfolios, and if the company is not improving operationally, which I think is even more important than top-line growth, then the company will be trading at such a low multiple for a while and justifiably so.

The continuation of building its electric fleet will be a tough mission to get through. Just looking at the company’s competitor Hertz (HTZ), reported a worse-than-expected loss in Q4 due to the high cost of repairs and maintenance of the EV fleet. This has forced the company to abandon its plan to electrify 20,000 of its vehicles in favor of gas-powered vehicles. That is a big shift, and I think it’ll be the same story for Avis too. EVs still seem to be in the very early stages of mass market production and are too expensive to look after, which means current generation EVs are not worth the effort. Maybe once the next generation of EVs comes around, the cost of repairs will be on par with ICE at least, but for now, the company may scale back its efforts also.

If it is going to go full speed into the EV transition, I would expect its margins to continue to contract and profitability to wane, which most likely will force the management to shift course as well, just like its competition.

Valuation

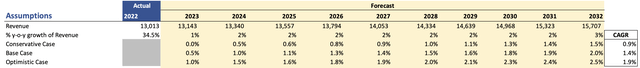

I will be approaching the valuation model as I usually do, with a conservative mindset. That way my margin of safety is higher and I don’t overpay for a company. So, for the revenues, I went with hardly any growth for the base case, around 1.4% per year for the next decade. This seems very conservative but analysts are expecting no catalysts. I also went ahead and modeled a more conservative scenario and a more optimistic one to give myself a range of possible outcomes. Below are those assumptions, and their respective CAGRs.

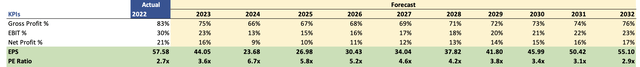

In terms of margins, I went with analysts’ estimates that the company’s EPS would halve and then start to come back over time and grow at around 10% CAGR for the next decade after halving. Below are these estimates.

Margins and EPS assumptions (Author)

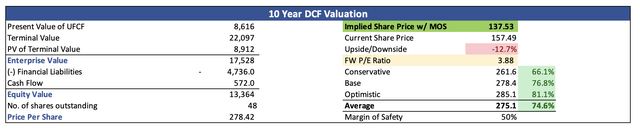

For the DCF model, I went with the company’s WACC of 9.50% as my discount rate and 1% terminal growth rate. Furthermore, I decided to discount the final intrinsic value by 50% to account for the subpar balance sheet and the lack of top-line growth, which may be the reason the company trades at such a low PE ratio. With that said, Avis’s intrinsic value is around $137 a share, meaning the company is still trading at a premium to its fair value.

Closing Comments

It seems that the company is trading at such a low PE ratio for a reason. The company’s lack of top-line growth and enormous debt pile keep investors away from it. Furthermore, the company has a 14.5% short interest on its float, which could mean a short squeeze if the company becomes more enticing to investors or the share price may continue to go down due to inefficiencies in its operations. I am assigning the company a hold rating until I see massive improvements in the top line or earnings but that will take a few quarters to find out.

The company is trading near its 52-week lows and $150 seems to be a bit of a support, however, if the earnings are not great, I don’t see how it will hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.