Summary:

- Avis Budget Group saw a surge in travel after the worst of the pandemic was over, but the future is still uncertain.

- ROE and EPS have been boosted in the short term by debt levels and share count reduction.

- There isn’t enough potential upside to justify the fundamental risk, especially at current prices.

JHVEPhoto/iStock Editorial via Getty Images

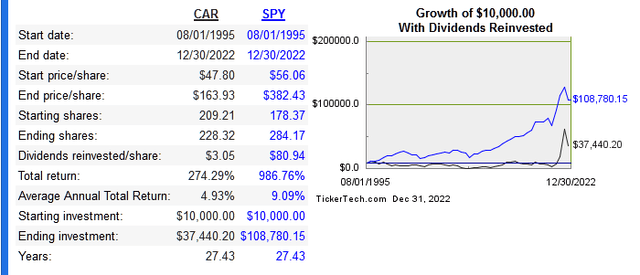

Avis Budget Group (NASDAQ:CAR) is a top three rental car company in the world. Founded in 1946, it has been a public company since 1981. They operate several different rental brands as well as a the car sharing network known as Zipcar. Their main competitors are HTZ and privately owned Enterprise Rent-A-Car. The industry is estimated to grow at 7.5% until 2029. Below is the long term share price performance:

Next are the return on capital metrics versus peers:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

4.7% |

41.8% |

2% |

36.4% |

n/a |

|

|

-1.2% |

2.3% |

0.4% |

n/a |

n/a |

|

|

2.3% |

14.8% |

5.2% |

11.1% |

n/a |

They’ve routinely had good gross margins of around 70%, but operating margins have been much more volatile.

Capital Allocation

I’m a big fan of cannibal companies, ones who use buybacks the right way to boost EPS, but this is a case of unnecessary repurchases. Share count was reduced over 50% since the 2013 peak, but what it has done in the short term was boost ROE and EPS growth.

There is no need to aggressively lower share count when earnings are not consistent and the operations are not continually growing.

Risk

The major risks I see come in three parts. First is uncertainty of industry growth, second is debt levels not lowering enough, third is a capital allocation issue of unnecessary buybacks mentioned above.

Travel trends are a major impact on the company and industry, and a black swan event like the pandemic obviously changed the entire outlook of this industry. I can’t predict exactly how the industry dynamics will look in the future, but I expect business travel to drop more than leisure/personal travel will as time goes on. Moreover, travel as an industry has become harder to predict in a post-Covid world. This brings considerable risk to the sector, so the only way to adjust to such risk is to pay a low enough price. More on that in a bit with valuation.

Next is the debt issue. Current levels still look high at first glance, but the company has a record of significant debt repayment. Over the past decade they have paid down between $10-20 billion each year. Because of this I’m not too worried, but an eye should be kept on rising debt. All figures below in billions:

|

Total Debt |

Operating Profit |

EBITDA |

FCF |

Net Income |

Cash |

|

6.41 |

0.45 |

2.14 |

-5.3 |

2.72 |

0.58 |

Valuation

Below is the multiples comp:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

CAR |

2 |

4.2 |

477.7 |

-13.4 |

|

HTZ |

2 |

6.6 |

-9.9 |

1.9 |

|

SIXGF |

1.9 |

5.8 |

7.2 |

2.5 |

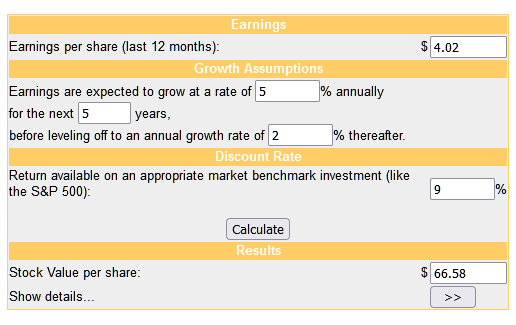

CAR is trading in line with its peers, so no discount is available to us on a multiples basis. Next is the dcf model. I used 2019 EPS to conservatively assume things in the industry would normalize over time.

money chimp

On an intrinsic basis the company is still overvalued, which also means that the buyback strategy isn’t as effective as it may seem at first. This stock deserves a low multiple, but it’s not low enough to be considered deep value. There’s not enough potential upside versus the risk. So this is a stock that shorter term and long term investors should avoid at the current price.

Conclusion

AVIS saw a surge in travel after the worst of the pandemic happened, but I would argue that the future is more uncertain than ever in this sector. The ROE metric is artificially high due to recent aggressive share reductions, which has also given a short term boost to EPS. There is still more risk associated with any potential upside to justify an investment on a fundamental level. When coupled with the stock being overvalued intrinsically, this is an investment to avoid for now. I don’t see a major collapse of the company likely, but it will still be a struggle for the company to even generate average returns going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.