Summary:

- Avis Budget Group has underperformed the S&P 500 since going public in 1997 but has outperformed over the past 10 years.

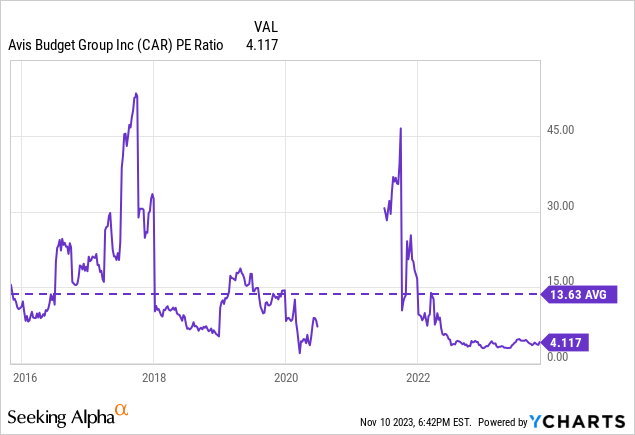

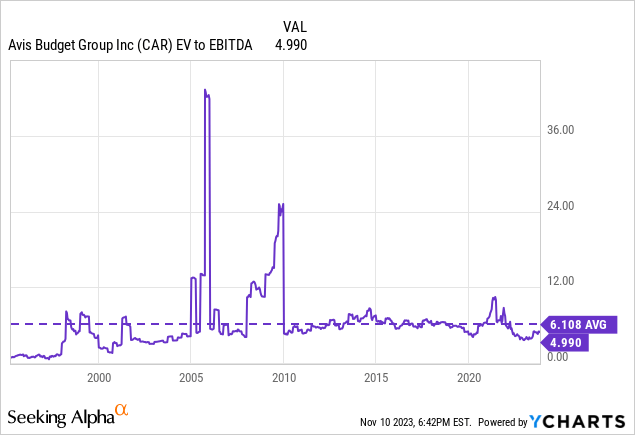

- CAR is a cheap stock as investors are skeptical regarding the company’s future prospects.

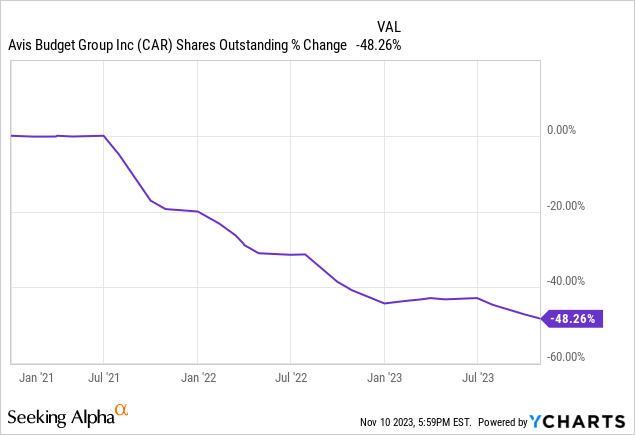

- CAR has delivered strong results over the past few years and has repurchased nearly 50% of its outstanding shares over the past 3 years.

- CAR trades cheap relative to the S&P 500 due to the highly volatile nature of earnings.

- I am initiating CAR with a buy rating and would consider downgrading the company if financial performance falters or the stock rises and is no longer attractively valued.

Scott Olson/Getty Images News

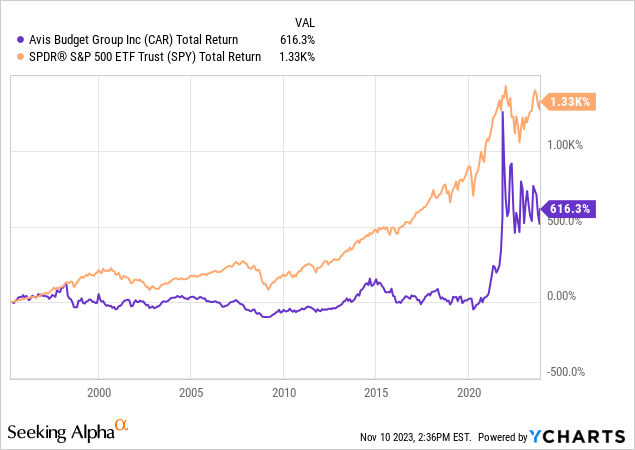

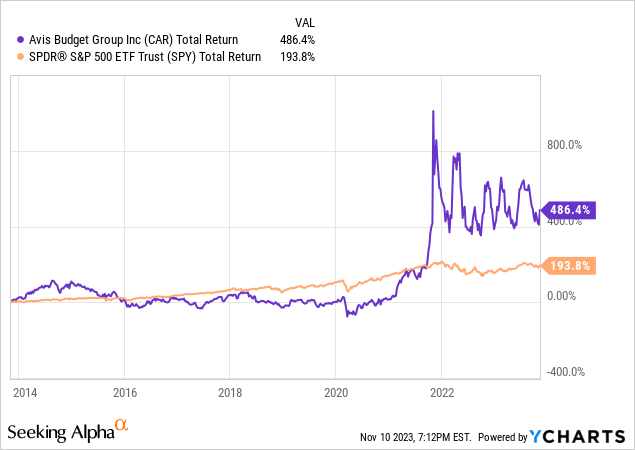

Avis Budget Group (NASDAQ:CAR) became a public company in 1997. Since then, CAR shares have proved a disappointing investment. Since going public, CAR has delivered a total return of 616.3% compared to a total return of 1,330% delivered by the S&P 500. However, CAR has performed much better over recent time frames delivering a total return of 486% over the past 10 years compared to a return of 194% delivered by the S&P 500.

While the level of competition in CAR’s core rental car business has increased over the past few years the company has been able to deliver solid financial performance. However, investors are not confident that this will continue to be the case.

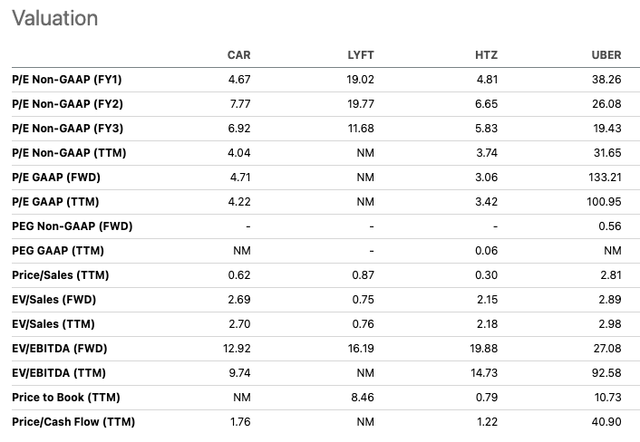

By nearly any metric CAR is a cheap stock. CAR trades at just 4.2x trailing earnings, 7.7x consensus 2024 earnings, and 9.7x trailing EV / EBITDA. However, the stock is cheap for a reason and further analysis is required to determine if CAR is a value play or value trap.

Company Overview

CAR is a leading global provider of rental car services. The company’s most recognized brands include Avis, Budget, and Zipcar. In markets which CAR does not operate in directly, the company licenses the use of its brands to external parties which operate the company’s brands in ~180 countries globally.

CAR has a total of 10,250 rental car locations across the world including 3,900 locations operated by licensees. CAR has a total fleet of ~655,000 vehicles.

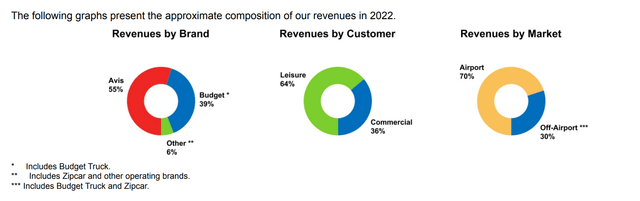

The company operates in two segments: Americas and International. ~77% of total revenue is generated by the Americas division with the remaining ~23% being generated by the International segment.

CAR 10-K

Highly Competitive & Cyclical Business

CAR faces a significant amount of competition in the rental car business. CAR’s biggest competitors include Hertz (HTZ), Enterprise, Europcar Mobility Group, and Sixt SE. The company also competes with smaller local and regional vehicle rental companies.

The emergence of ride sharing companies such as Uber (UBER) and Lyft (LYFT) in recent years has created additional competition as individuals often prefer to rely on UBER or LYFT as opposed to renting a car.

CAR’s business is highly cyclical as 64% of its revenue comes from the leisure category. Consumer travel is a discretionary expense and tends to rise and fall based on the overall strength of the economy.

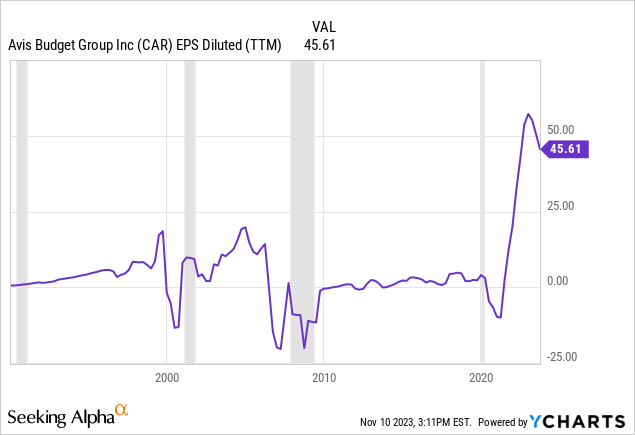

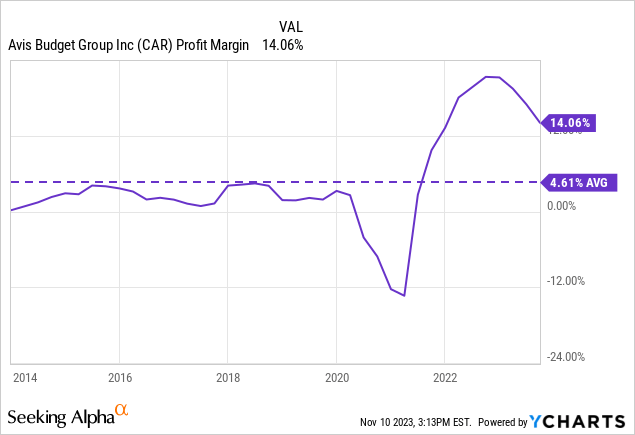

Historically, CAR has experienced high earnings volatility and margin volatility and has achieved an average profit margin of 4.6% over the past 10 years.

Recent Financial Performance

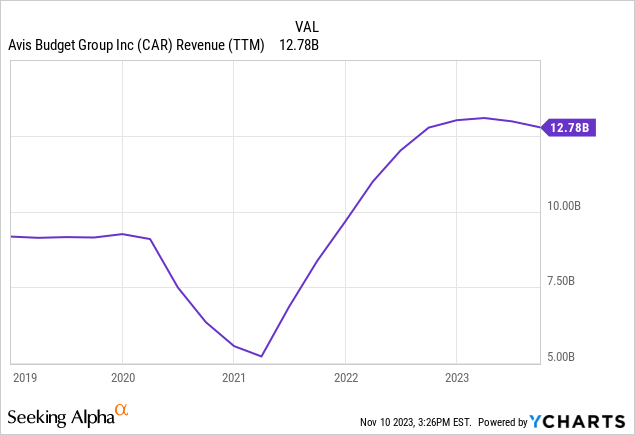

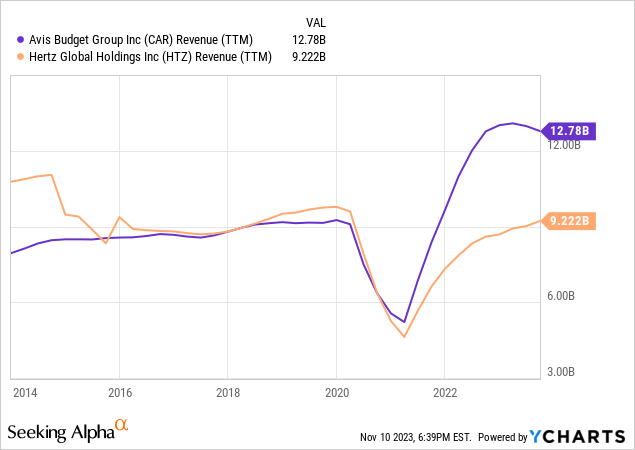

In 2020, CAR suffered a massive drop in revenue and profits due to the COVID-19 pandemic which resulted in a significant drop in travel. Revenue recovered in 2021 back to pre-pandemic levels. In 2022, the company experienced a surge with revenue increasing ~29% on a year-over-year basis.

The revenue surge in 2022 was primarily driven by a 23% increase in volume and an 8% increase in revenue per day.

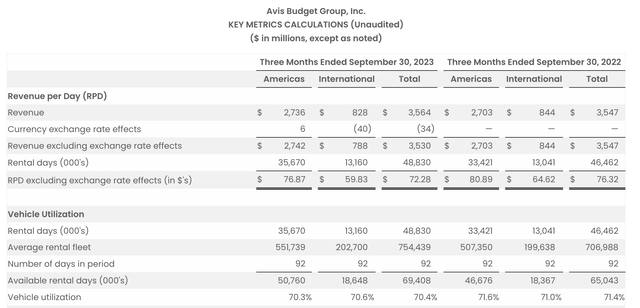

On November 1, 2023 CAR reported strong financial results which beat analyst estimates. The company reported revenue of $3.6 billion which was in line with what the company reported during the same period a year ago. EPS came in at $16.78 which was down from $21.67 during the same period a year ago.

The drop in EPS was driven by a drop in vehicle utilization rates and thus revenue per day.

CAR CEO Joe Ferraro noted that:

“October started off strong and we expect it to continue throughout the holiday season”

CAR Q3 Earnings Release

High Quality Balance Sheet

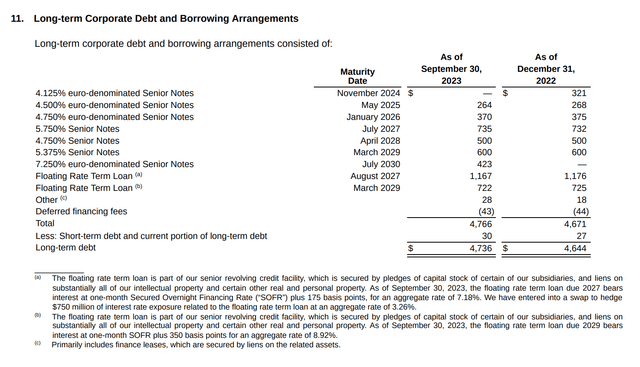

As of Q3 2023, CAR reported total debt of $4.7 billion and net debt of $4.13 billion. Over the past 12 months adjusted EBITDA has come in at $2.8 billion and thus the company has a net leverage ratio of just 1.5x.

In addition to having a relatively low leverage level, CAR has a well laddered maturity profile with most debt not coming due until 2027 or later. The well laddered maturity profile is important given the high level of cyclicality present in CAR’s business.

CAR Q3 2023 10-Q

Share Buybacks

CAR has been aggressively returning capital to investors over the past few years via share repurchases. As shown by the chart below, CAR has reduced its total shares outstanding by ~48% over just the past three years.

During Q3 2023, the company repurchased ~2.2 million shares for a total cost of $487 million. CAR still has ~$ 1 billion remaining on its buyback authorization. The company continues to view share repurchases as attractive as noted by outgoing CFO Brian Choi on the Q3 earnings call:

“We also deployed nearly $500 million into repurchasing 2.2 million of our shares outstanding this quarter. Given that we strongly believe that our current share price does not reflect the fair value of our transformed company, we will continue to aggressively buy back shares until that gap closes and this will be reflected in the cash flow usage of our fourth quarter. The summer has built our war chest and we have built full confidence that substantial free cash flow will continue to be generated in 2024 and beyond. However, as we’ve said on previous calls, we will be nimble and opportunistic with regards to capital allocation and will consider all avenues of returning capital to shareholders.”

Given the fact that company currently has a market value of just ~$6.8 billion, the remaining $1 billion authorization represents a significant potential reduction in shares outstanding.

Valuation

CAR currently trades at 7.7x consensus 2024 earnings. Comparably, the S&P 500 currently trades at ~18x consensus 2024 earnings. Thus, on a relative basis CAR is trading at a much cheaper valuation.

CAR trades at a lower valuation because its earnings are much less stable than the S&P 500. While earnings have been volatile historically, the company has been profitable each year over the past 10 years with the exception of 2020. Moreover, while earnings growth has been uneven the company has delivered a 5 years EPS CAGR of 58%.

CAR’s closest public peer is Hertz (HTZ). CAR is trading roughly in line with HTZ based on forward P/E ratio and at a discount based on forward EV / EBITDA. Historically speaking CAR has been a better operator than HTZ. Proof of this can be seen in HTZ being forced to file bankruptcy in 2020 while CAR was able to ride out the storm. Additionally, CAR has been able to accelerate revenue growth vs the pre-pandemic period while HTZ revenue has only rebounded to pre-pandemic levels. For these reasons, I view CAR as highly attractive vs HTZ based on valuation. CAR is also trading at a significantly lower valuation than ride share competitors Uber (UBER) and Lyft (LYFT).

In addition to being attractive relative to the S&P 500 and its peers, CAR is also trading cheap relative to its historic norms.

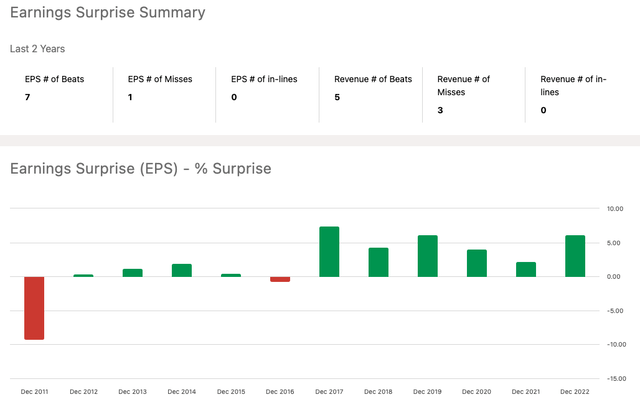

While I view CAR as trading at a highly attractive based on consensus forward estimates, I actually believe there is a good chance that CAR exceeds expectations. As shown by the chart below, CAR has a very strong history of exceeding earnings estimates over the past few years.

Seeking Alpha

Seeking Alpha

Seeking Alpha

Conclusion

In my view CAR is a value play.

While CAR operates in a fairly competitive business, the company has been able to generate solid profits despite challenges from ride share players such as Uber and Lyft.

CAR is currently experiencing very high levels of profitability due to a travel rebound from the disruption experienced during COVID-19. I expect strong financial performance to continue over the near-term.

CAR trades at a valuation which is much cheaper than the S&P 500 and in line with its direct peer, Hertz. While CAR has experienced highly volatile earnings historically it has been able to remain profitable each year over the past 10 years other than 2020. Moreover, the company has also been able to drive substantial earnings growth over the past 5 years despite increased competition from ride sharing players such as Uber and Lyft. Additionally, CAR has a strong history of delivering earnings which surpass analyst expectations.

CAR continued to be an aggressive repurchaser of its own stock as management continues to believe shares are undervalued. I view this as a positive signal given that management likely has better visibility into near-term prospects than the public investing community.

The primary short term risk to my positive view is a potential economic downturn. Given the highly cyclical nature of the rental car business, CAR would almost certainly experience significantly lower revenue and earnings during an economic downturn. However, the company has only modest levels of debt and thus I believe would be able to ride out any economic storm. CAR may even benefit over the long-term if it is able to take share from weaker rivals during an economic downturn.

I am initiating CAR with a buy rating and would consider downgrading the company if financial performance comes in weaker than expected going forward. I would also consider downgrading the stock if it rises significantly from here and the valuation becomes less attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.