Summary:

- Avis Budget Group, a prominent player in the rental car industry, is facing disruption from car-sharing services.

- The rise of car-sharing has increased the supply of rental cars and lowered prices, potentially impacting Avis’ profitability.

- Avis’ heavy reliance on airport sales and plateauing revenue growth are additional challenges investors should consider.

Mixmike/E+ via Getty Images

Introduction

Ah capitalism, the creative force which can both create and destroy wealth and power. Over the course of time, capitalism has led the way to scores of new industries, while at the same destroying so many old ones. Gone are the days when milk is delivered by the milkman, heck, for many of us, gone are the days of drinking milk entirely!

It’s often hard to see these changes before it’s too late, many genuinely smart investors were blindsided as their investments crumbled due to changing times. One industry that I believe is particularly ripe for disruption is the rental car industry, and specifically Avis Budget Group (NASDAQ:CAR).

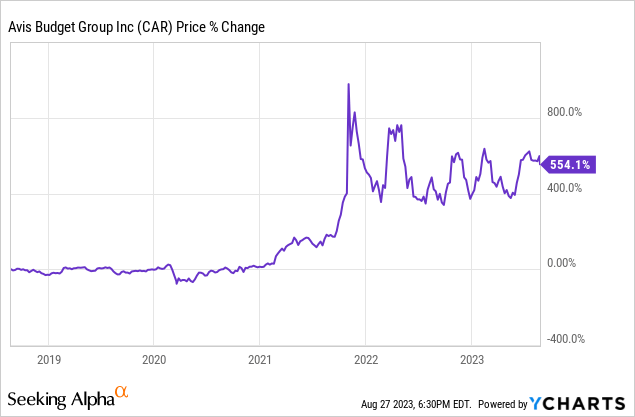

Despite the spectacular stock run, increasing almost 600% over the past 5 years, I believe now may be a good time for investors to re-approach their investment thesis with an increased focus on rationality and the true long-term potential.

Therefore, within this article, I’ll examine the challenges that I believe Avis will face in the coming years, its financial performance, and where I believe the stock could go from here.

A Company and Industry at the Cross-Roads

Avis Budget Group, headquartered in New Jersey, stands as a prominent figure in the American car rental scene with a fleet that comprises ~19,000 vehicles. Avis boasts a portfolio of well-recognized brands including Avis Car Rental, Budget Rent a Car, Payless Car Rental, and Zipcar. In terms of market share, Avis controlled around 26% of the market in 2021, cementing itself as a key player in the US rental car industry. However, it’s worth noting that its market presence falls behind industry giants: Hertz Global Holdings and Enterprise Holdings.

Historically, Avis has been no stranger to M&A maneuvers, often using acquisitions to fuel its growth, especially across different global regions. Notable instances include the 2011 acquisition of Avis Europe, a licensee that effectively unified the Avis and Budget brands worldwide. Looking further, the company broadened its international footprint by purchasing Apex Car Rentals of New Zealand in 2012, and Maggiore Group, Italy’s fourth-largest vehicle rental firm in the country, in 2015. Acquiring these foreign companies allowed Avis to replicate its business model in new geographies and enabled cost synergies as the company could provide shared services like accounting and IT to new subsidiaries at a lower cost.

Changing Times

The rental car industry is undergoing a massive transformation due to the rise of car-sharing services. Car sharing has created an alternative to the traditional car rental model by allowing customers to rent cars for less time and/or in different places from individuals and small operators.

Car sharing has introduced a new level of convenience to consumers. It appeals to those who do not require a car on a regular basis, as they can access vehicles when needed without the financial burden associated with outright ownership.

This shift in consumer behavior is particularly prominent among millennials and Gen-Z, as they seek more convenient and cost-effective solutions to get around town. The convenience of picking up a vehicle nearby for short trips, coupled with digital booking and payment options, has attracted a significant young customer base. Younger Americans, many of whom grew up with services like Uber (UBER) and Airbnb (ABNB), are likely to gravitate towards services like Turo, Zipcar (owned by Avis), and the many other companies operating in the industry.

While Avis had the foresight to enter the industry through its acquisition of Zipcar, there’s no promise that this new business model will be anywhere near as profitable as the old model.

First, the creation of these rental apps greatly increases the supply of rental cars on the market as almost anyone with a decent car could now, at least theoretically, rent their car when they know they won’t need it for a few days. Secondly, these new suppliers have lower overhead costs as they don’t need to hire staff or rent expensive lots as they often utilize their own real estate and time.

Think back to Economics 101: rapidly increasing supply with static demand is expected to yield what?

Lower prices.

This is why I think investors may getting a bit ahead of themselves. The growth of this industry might not yield the profits that, so many, seem to be banking on.

Domestic and Airport Focus

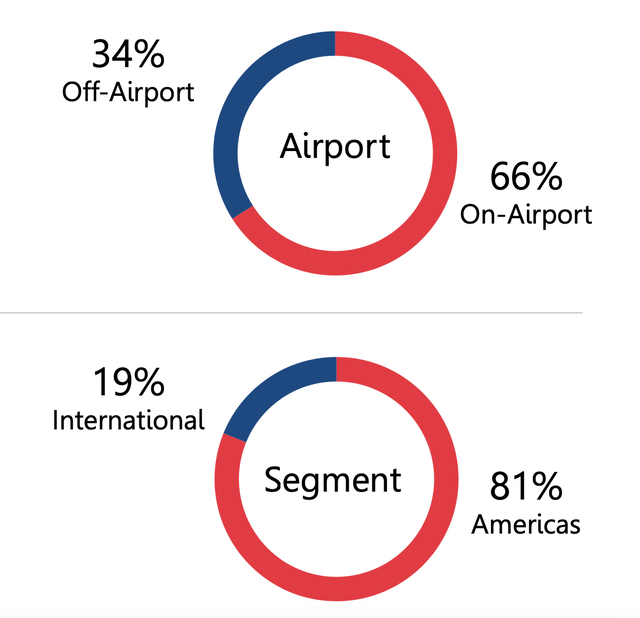

As of 2021, around 66% of Avis’ business came from on-airport sales, meaning the performance of their business is strongly tied to ongoing air travel demand. Since most air travel is discretionary, this has historically been one of the first areas consumers cut in times of slowing economic growth or recession. While its exposure to airports may be troublesome, I’m more positive about its US exposure. Since 80% of its sales come from the US, Avis is closely tied to, arguably, the strongest economy in the world (lower inflation, and faster growth compared to most of the developed world).

Financials and Valuation

Revenue Growth

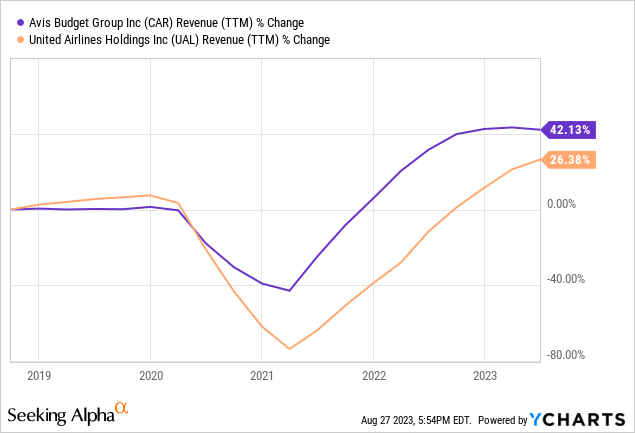

Thinking back to Avis’ strong association with the air travel industry, I thought it worthwhile to compare its revenue growth against United Airlines (UAL) a company that I recently wrote about on Seeking Alpha. Looking back over the past 5 years, you can see the impact of decreased air travel on Avis’ car rental business. Something to note here is that Avis’ revenue growth has begun to stall even though air travel continues to increase, which, in my view, indicates that a short-term peak in demand for car rentals may have been reached.

EPS Growth Worries

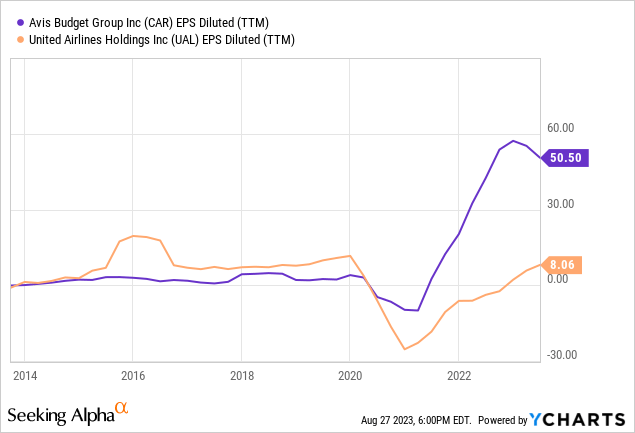

While revenue growth at Avis has flattened, its EPS has begun to drop sharply even as United Airlines’ EPS continues to grow. In the realm of EPS, all is not bad at Avis as their EPS is still significantly above where it was pre-pandemic, the same cannot be said about United.

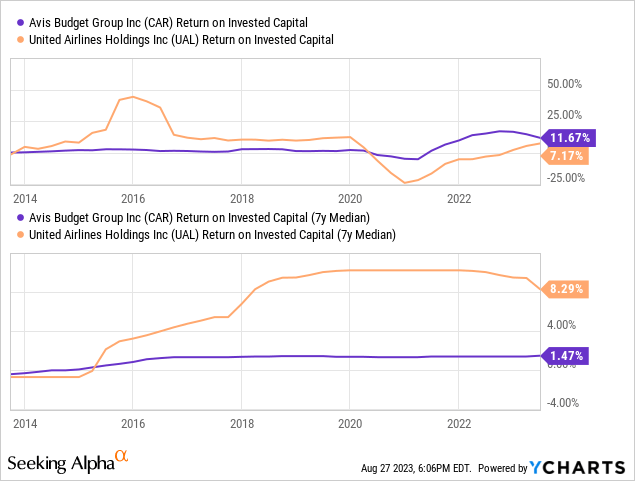

Return on Invested Capital

In the past, Avis has been a poor capital allocator, generating a meager ~1-2% return on invested capital. Since the pandemic ended, returns on invested capital have surged to the low double digits, while this is an impressive improvement, it’s still a bit below what I look for in companies I invest in.

Given the recent decline in returns on invested capital at Avis’ consider me skeptical whether they can maintain returns at these levels.

Valuation

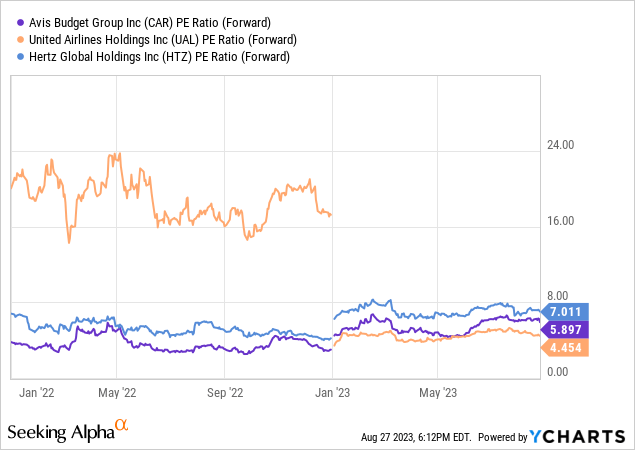

On an absolute basis, and compared to Hertz (HTZ), at 5.9x forward earnings, Avis trades at a fair multiple. Still, compared to where it traded just last year this is markedly higher, despite greater risks vis-a-vis flat revenues and falling earnings.

Conclusion

Avis stands at a critical juncture. Despite that remarkable stock price surge, challenges loom with the disruptive force of car sharing reshaping the landscape. Avis’ strategic acquisitions and significant market presence don’t shield it from the impacts of oversupply and lowered prices inherent in car sharing. Heavy reliance on airport sales and plateauing revenue growth warrant careful consideration.

As the industry navigates changing times, investors should tread carefully, while car sharing provides an avenue for growth, there’s no promise of sustained profits. The multiple expansion over the past year in the face of growing risks leaves me worried.

All that said, I rate Avis Budget Group a “Sell”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.