Summary:

- Avis Budget Group, Inc. provides car and truck rentals, car sharing, and related products and services to consumers and businesses worldwide.

- Avis has seen margins expand rapidly as second-hand cars increase in value and demand remains at historically high levels.

- We see margins contracting and demand softening as conditions normalize in the coming 12-36 months. Despite this, the coming is attractive relative to peers.

- Management has used these gains to raise debt and fund buybacks, leaving the coming highly leveraged.

- On a forward basis, Avis looks to be valued close to its fair value / potentially at a discount.

Tim Boyle

Investment thesis

Avis has seen a rise to prominence in recent years, as demand has exploded for its services. Since then, the share price has been highly volatile as investors assess where the long-term outlook on the business is. Our objective is to assess the company’s financial performance as a means of providing this perspective to the conversation.

Company description

Avis Budget Group, Inc. (NASDAQ:CAR) provides car and truck rentals, car sharing, and related products and services to consumers and businesses worldwide through its various brands, including Avis, Budget, and Zipcar.

The company offers premium vehicle rental and mobility solutions to commercial and leisure segments of the travel industry under the Avis brand and provides one-way truck and cargo van rental services through its Budget Truck brand. It also operates a car-sharing network under the Zipcar brand. In addition to rental services, the company offers a range of supporting services.

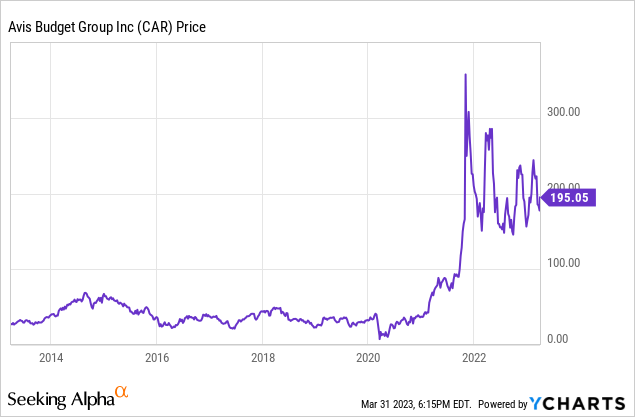

Share price

Avis’ share price had an uneventful time leading up to 2021, with the share price trending down. This was driven by the relatively mild economics of the company’s operations. In 2021, we saw a large rise in share price driven by a fantastic performance in the post-lockdown period, alongside a squeeze on shorters. Since then, the share price has been quite volatile, as markets attempt to assess where the “new normal” is.

Financial analysis

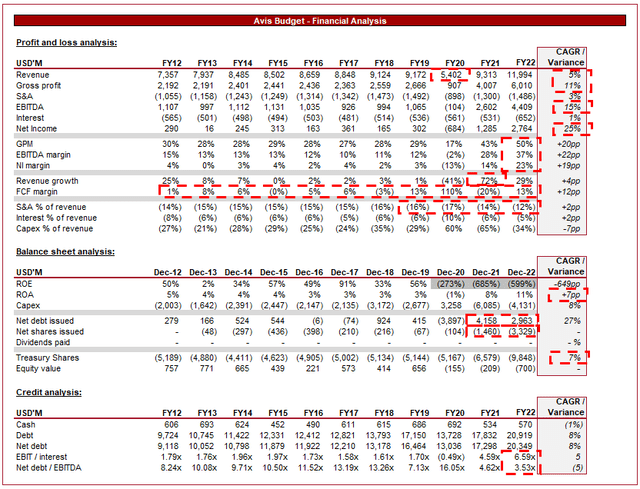

Avis Financial performance (Tikr Terminal)

Presented above is Avis Budget’s financial performance for the last decade. Our view is that the company is fundamentally overperforming currently, with little evidence to suggest the sustainability of these levels.

Revenue

Revenue has grown at a CAGR of 5%, driven predominantly by the most recent trading periods. Before this, the company achieved low single digits, which is a reflection of the maturity of the industry.

The COVID-19 pandemic has drastically impacted the travel industry, with a significant decline in travel across the world. However, this led to a rise in domestic travel and road trips, as consumers were unable to go overseas but still sought a holiday. This is the primary reason revenue was able to bounce back to the degree it did in FY21, and is a contributing factor to the continued growth of the business.

Another factor driving revenue in recent years is an aggressive pricing strategy. Avis has been increasing its rental prices consistently without seeing demand miss a beat, driving record gains. This has been possible in part due to a shortage of cars, which has contributed to an imbalance of supply and demand across many vehicle-related industries. The chip shortage impact is subsiding but will remain an issue in the medium term, which could mean continued inflated prices across many related industries. This does pose an issue for Avis as expanding its fleet will be more expensive and potentially take longer if deliveries are delayed.

Avis and its peers have been disrupted by the rise of ride-sharing services as these companies have been focusing on convenience and low costs. Internally supporting apps allow tourists to land in a location and immediately access vehicle travel, which is something that was previously more complicated. Further, these ride-sharing services have undercut traditional taxi services, making it more cost-effective to use this form of transportation.

The emergence of subscription-based car rental services, or “car-sharing” services, has contributed to improving growth in the industry. This is where customers pay a monthly fee for access to a fleet of vehicles or a daily/hourly rate. This model offers customers more flexibility and convenience compared to traditional car rental, with Avis expanding into this segment via its Zipcar brand. Our view is that this segment represents a fantastic opportunity to be a growth driver, as it offsets the impact of the above point while giving consumers more of a reason to rent a vehicle. Where previously an individual would take a taxi as they are only intending for a couple of hours, they can now easily take a car-share which is far cheaper. Further, it continues to support the domestic tourism industry as it gives people more flexibility in traveling.

In the short term, we could see demand soften due to economic factors. Inflationary pressures are contributing to a decline in discretionary income, as consumers see their cost of living sour. With this occurring, many will likely avoid or defer tourism, either because they cannot afford it or because it is not a logical decision. For this reason, we could see demand either soften or decline. In the most recent quarter, sales were up 8%, which suggests the company is not feeling the impact yet.

As travel numbers continue to rise, especially with China finally seeing the end of Covid-19, we should see continued growth in the medium term. Our view is that any outperformance will be driven by innovation in services such as Zipcar. This being said, there are question marks around the near-term performance of the business.

Margins and costs

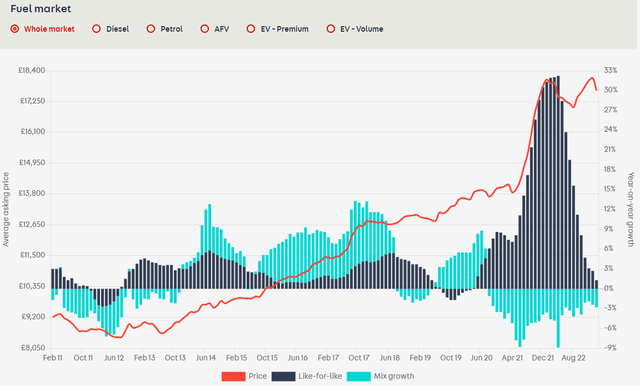

The impact of pricing power has translated directly to GP, with margins rising from 28-30% to 50%. Further, we are seeing the impact of the rise in second-hand car prices. The following illustrates the degree to which prices have risen.

Second-hand car market (Autotrader)

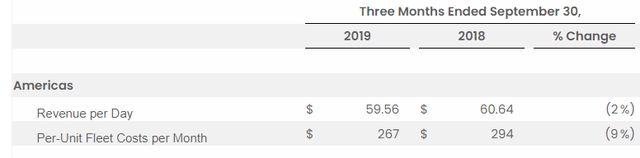

With Avis’ fleet value rising, the company is depreciating its cars more slowly, contributing to a sharp decline in this expense. The following are two excerpts from quarterly reports, one from 2019 and the other from 2022.

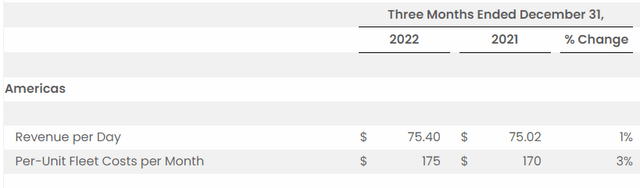

Revenue per day / per-unit fleet costs (Avis Budget)

Revenue per day / per-unit fleet costs (Avis Budget)

As the following illustrates, pricing has contributed to a greater revenue per day but a big factor is also a reduction in per-unit fleet costs.

The key to the sustainability of this is whether demand will continue to remain at the level it is, otherwise we could see prices declining as quickly as they rose. Further, we need to consider if the fleet will remain valued at the level it is, or if the car market sees a softening of prices.

Our view is that demand will likely soften, as inflationary pressures have only compounded across the last few quarters. Consumers can only take so much before we see demand really begins to nosedive. For the second-hand market, we believe this will begin to soften. The FT believes the chip shortage impact will ease by the end of 2023, with many automakers over-ordering chips to avoid a repeat of this in the future. With these assumptions in mind, Avis’ margins should begin to revert toward prior levels in FY23.

Balance Sheet

Moving onto the balance sheet, Avis has used these superior returns to aggressively buy back shares and raise debt. We have seen net debt grow at a rate of 8% across the historical period, reaching over $20BN. At these levels, the company’s net debt to EBITDA coverage is 3.5x, which is above optimal in our view. This has contributed to a sizeable annual interest payment, with this expense representing 5% of revenue. Our view is that this is problematic for the business as if profitability does begin to decline, Avis could quickly find itself in trouble.

Outlook

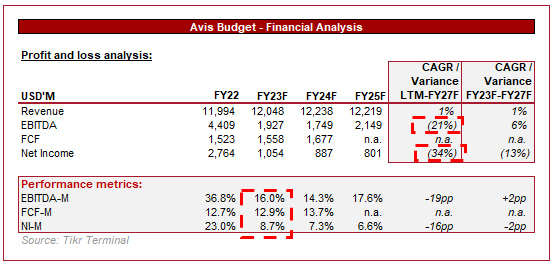

Avis Budget forecast (Seeking Alpha)

Presented above is Wall Street’s consensus view on the coming 5 years.

Revenue is expected to slow to a standstill, with a growth rate of 1%. This is likely based on the assumption that we are currently experiencing outsized demand, which will contribute to a slowdown in the coming years as things normalize. We concur with this view although expect FY23 to perform worse.

Analysts are expecting margins to contract rapidly, with EBITDA-M more than halving within one year. This is based on the factors we have mentioned previously. Our view does align, although we do not expect such an aggressive correction in margins in FY23.

Peer analysis

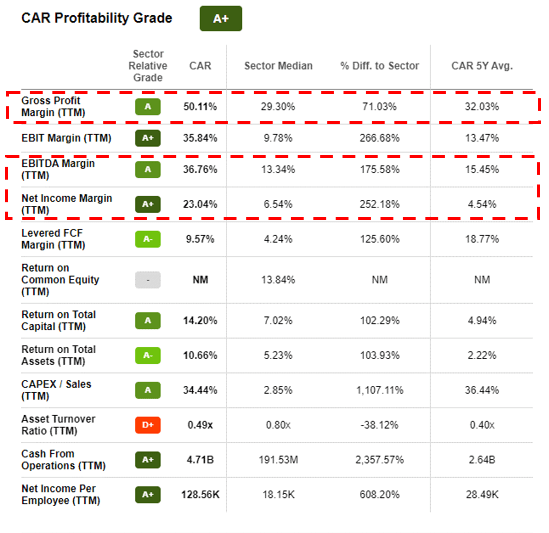

Profitability (Seeking Alpha)

Presented above is Seeking Alpha’s profitability rating for Avis, which is based on a relative comparison to its peers.

Unsurprisingly, Avis scores incredibly well, with its current outsized returns far ahead of others. What is more important for us in this breakdown is what the peer averages are, namely an EBITDA-M of 13% and a NI-M of 7%. These levels are very similar to Avis’ historical performance and below its forecast performance. This suggests inherent value in the business should margins contract.

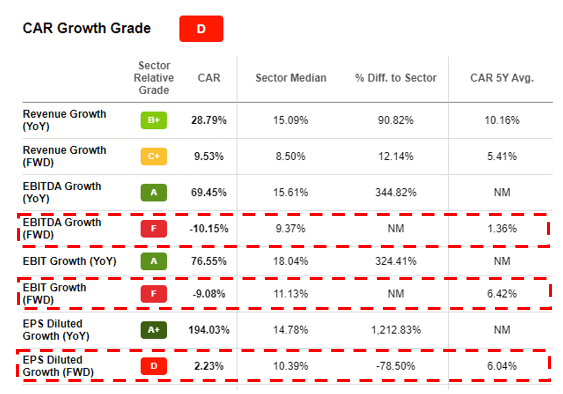

Growth (Seeking Alpha)

For the same reason Avis scores well for profitability, it scores poorly for growth. With a sharp margin contraction expected, the forecast period looks far worse than its peers. Interestingly, peers are expected to grow, suggesting resilience in the sector against economic headwinds. This has the potential to offset the impact on Avis if the company outperforms the forecasts.

Valuation

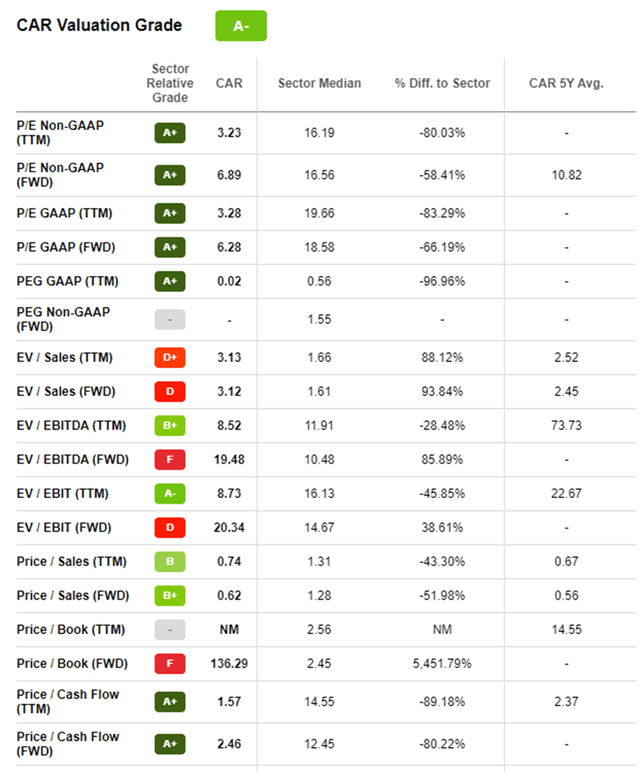

Valuation (Seeking Alpha)

Based on what we know, looking at Avis’ forward-looking valuation metrics is key to assessing the business. Avis stock surprisingly looks quite attractive, trading at a minuscule 6x NTM P/E ratio. Further, its sales and EBIT margins are quite attractive too. This to us suggests markets are finding it very difficult to price this asset, given the uncertainty of the coming 12-24 months.

Final thoughts

Avis has done a great job of exploiting current market conditions to maximize its profitability. Its normalized profitability profile is attractive, with our view being that Avis will revert toward this in the coming 12-36 months. We are not a fan of how Management has utilized these short-term gains, potentially leaving the coming overleveraged. On a relative basis, Avis is quite attractive at its normal profitability levels, while trading at an earnings discount to its peers.

We see Avis as a risky investment currently. It is difficult to forecast how margin contraction will play out, the degree to which demand will soften, the impact of vehicle values declining, and whether debt levels are too high once performance normalizes.

On a risk-to-reward basis, we would suggest hesitancy and patience, as a means of gaining greater clarity over the risks we have identified above.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.