Summary:

- Canopy Growth’s stock has significantly declined due to high debt, negative cash flow, and underwhelming financial performance, with a potential to drop to $1.

- The company’s revenue and EBITDA have been disappointing, and analysts’ projections for FY25 and FY26 remain weak.

- Despite some improvement in adjusted EBITDA, Canopy Growth’s valuation is too high compared to peers like Organigram and Cronos Group.

- Investors should consider better-valued and financially stronger cannabis stocks, as Canopy Growth’s outlook remains bleak amidst ongoing financial struggles.

Diy13/iStock via Getty Images

I wrote about Canopy Growth (NASDAQ:CGC) here in early January, suggesting to readers that they avoid the name after the failed equity sale. I said then that the stock should be trading 50% lower than the price then, citing its high level of debt and negative operating cash flow. Well, they did get the stock sold a few days later (8.16 million units at $4.29), and the stock rallied a ton, but it has pulled back and is now 6.2% lower than it was when I shared my perspective.

A lot has happened since then, but my outlook is a lot worse now than it was near the beginning of the year. Today, I look at the chart, review the first half of FY25, discuss the analyst outlook and share my valuation thinking.

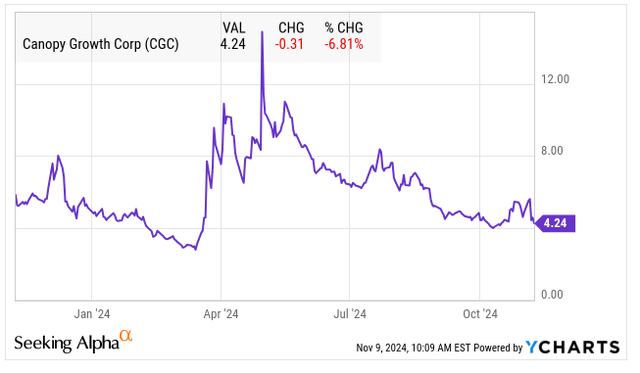

The Canopy Growth Chart Is Nasty

The stock dropped after my January article to an all-time low of $2.76 in March, ahead of the fiscal year-end. This was below C$4 too. Afterwards, it shot up as the market soared on the news that the DEA was officially in the process of rescheduling cannabis from Schedule 1 to Schedule 3.

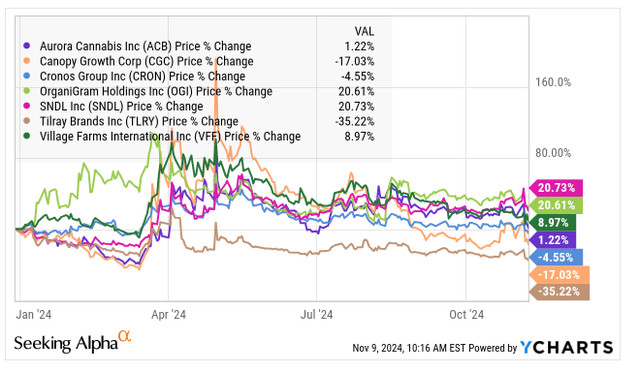

The stock closed on 4/30 at $14.92, so it has dropped now 71.5% and is down 17.0% year-to-date at $4.24. The New Cannabis Ventures Global Cannabis Stock Index is down less year-to-date, with an 8.3% decline, and it has dropped 36.5% since April 30th.

Looking at the leading LPs, CGC is the second-worst so far in 2024:

I like some of these and dislike one of these, Tilray Brands (TLRY). I explained why I expect TLRY to break $1 last week. I am actually more negative on CGC, as it has a balance sheet problem and burns cash but trades so much above my target.

Fundamental Failure at Canopy Growth

Canopy Growth released its fiscal Q2 financials on 11/8. The company had been expected by analysts to generate C$65 million in revenue with adjusted EBITDA of -C$8 million. It reported net revenue at C$63.0 million, which was down 5% sequentially and below what was expected. Revenue fell 9% from a year earlier. Adjusted EBITDA was better than expected at -C$5.5 million, which was an improvement from a year earlier.

Looking at the first two quarters, the company has declined in revenue from a year ago by 11%. This decline has been due to lower adult-use sales (offset partially by increased medical cannabis sales and slightly higher international cannabis sales) and C$17 million from This Works (sold in December 2023) and Other. Storz & Bickel grew.

Adjusted EBITDA has improved a lot but remains negative at -C$10.8 million. Operating cash flow has been -C$105.6 million. The company has spent very little on capital spending.

While revenue has been declining, Canopy Growth’s share-count has been soaring. In Q2, the company sold stock using its ATM Program, selling 12.06 million shares. Subsequent to the end of the quarter, it sold another 11.5 million shares. The total share-count was 131.6 million (105.36 million common shares and 26.26 million exchangeable shares) on November 7th. This is up a lot from early February, when it reported 91.1 million shares.

The balance sheet is a little better now than at quarter-end due to the 11.5 million sales sold subsequently, but it is not strong. Cash and short-term investments totaled about C$231 million, but debt was about C$554 million. The current ratio is declining fast but is still above 1X at 1.4X (and better now). Tangible book value was reported at C$370 million and should be about C$430 million now.

Analysts Are Not Excited About Canopy Growth

Going into the Q2 report, analysts, according to AlphaSense, were projecting for FY25 that revenue would be C$281 million with adjusted EBITDA of -C$30 million. These were both weaker than the forecasts three months ago. For FY26, revenue was projected at C$310 million with adjusted EBITDA of C$25.5 million. There have not been updates yet, but I don’t expect big changes.

It’s nice to see smaller losses, but the company continues to report losses. The analysts appear to believe that the adjusted EBITDA could get better, but the FY26 outlook has not been getting better over the past year. Even if the company were to finally have a positive adjusted EBITDA, the level is unexciting. The consensus estimate ahead of this report was for a margin of just 8.4%.

Canopy Growth Should Break $1

The valuation of Canopy Growth currently is 1.9X tangible book value. This seems way too high for a company that is burning cash and shrinking. Organigram (OGI), which I really like, trades at 0.8X. Cronos Group (CRON) trades at 0.8X too. Village Farms (VFF), which is a diversified company beyond cannabis, trades at just 0.5X. OGI and CRON have net cash, and VFF has a small amount of net debt. I think that investors worried about downside risk can look at this metric to help them gauge it. 0.75X would suggest a price of $1.67, which is substantially lower than the current price.

Investors looking at the opportunity potentially in CGC can use enterprise value to projected adjusted EBITDA. The stock trades currently at 70X the blended 2025 projection and 23X the FY26 projection. This seems way too high. Organigram, for instance, trades at 8.2X the calendar 2025 projection currently. If Canopy Growth were to trade at 10X, the price of the stock would worthless. Perhaps the estimate is too low (or too high!), and perhaps the lower price will excite some, but the stock appears to be headed much lower.

I think that the company is trying real hard to be able to include its U.S. financials and keep its NASDAQ listing, but there has been no progress. I continue to believe that this isn’t likely, but I could be wrong. If NASDAQ allows this, one can expect American MSOs to pursue NASDAQ listing too. The MSOs are much cheaper than Canopy Growth and would, in my view, attract a lot of investor attention if they were able to get on the NASDAQ.

The analyst numbers aren’t so great, and the company is burdened with debt and negative cash flow. I think that the stock could break $1. My own target of is based on an enterprise value to projected revenue of 1.5X. Assuming the estimated revenue for FY26 holds, this works out to be $1.06 (C$1.47), which is 75% lower. Organigram, by the way, trades currently at about 0.9X. My favorite large MSO, Verano Holdings (OTCQX:VRNOF) trades at just over 1X, though it is a federally illegal operator.

Conclusion

I am a lot more bullish on cannabis stocks than I was when I wrote the last article on Canopy Growth near the beginning of the year, but I am more bearish now on CGC. I think the stock could test $1, which would be a decline of 75% or so after what has already been a horrid decline.

Of course, Canopy Growth could receive approval from the NASDAQ to maintain its listing while operating as the owner of Acreage Holdings, Wana Brands and Jetty Extracts. If this were to happen, CGC would be able to report higher revenue and adjusted EBITDA, and the stock could rally. Another potential risk to my Strong Sell rating is that Constellation Brands (STZ) could acquire the rest of the company at a higher price.

For those who like cannabis stocks, there are so many better ideas in my view. One can find Canadian LPs that are better valued and stronger financially, and one can invest in MSOs that are down a lot and cheaper. Of course, if rescheduling doesn’t happen, this will be bad for the MSOs. Canopy Growth carries its Canopy USA on its balance sheet with an asset value of C$136 million, and it would be bad for that too. The company also has other financial assets that are related to these American investments that are carried at C$242 million (mainly loans receivable). I think that there are some very attractive ancillary stocks as well.

Canopy Growth is down 17% in 2024, and it declined nearly 78% in 2023. The stock is way down, but so are other cannabis stocks. Canopy Growth, burdened with substantial debt, has shrinking sales still, and the expected profitability does not justify the current valuation of a market cap of $583 million.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We have moved the service to Seeking Alpha. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks, and we are excited to be doing it here!