Summary:

- In this article, I will list 2 reasons why I believe Palantir Technologies is ripe for a sell-off.

- Even when accounting for strong future growth, the stock seems to be quite overvalued.

- Also, the market seems to be overly optimistic about the time scale at which the company could continue to reap benefits of AI.

- Palantir is a quickly-growing and promising company, but shares are currently priced for perfection. Any bump on the road could derail the share price.

PhonlamaiPhoto/iStock via Getty Images

Palantir Technologies (NYSE:PLTR) has been somewhat of a battleground stock here on Seeking Alpha during the past couple of months. Although the stock’s year-to-date performance has been great, rising more than 40 percent, and during 2023 it skyrocketed 168%, valuation raises doubts with some analysts, including myself. Before the 40 percent rise, at the start of this year I was already of the opinion that Palantir shares were trading for extreme valuations. In my article 7 investments to avoid in 2024 I included the stock in my list of picks to ignore this year. I am doubling down on my prediction, and in this article I will provide my two main reasons why I believe Palantir is overvalued and could be ripe for a sell-off.

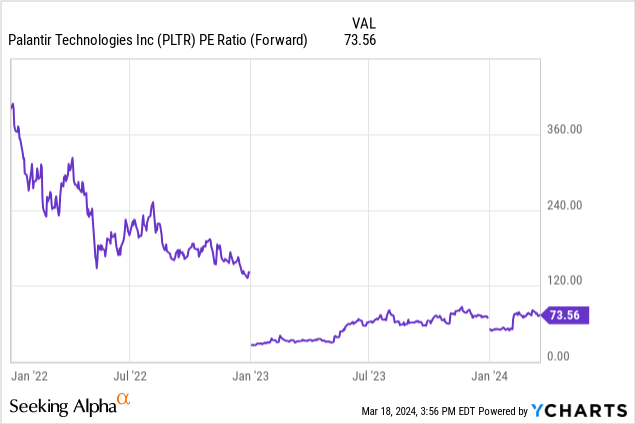

Palantir’s current valuation is simply not justified by its results and growth expectations

Currently, Palantir is trading for a forward PE ratio of more than 73. Of course, for growth stocks, PE ratios are often not very useful, and it’s hard to deny that Palantir is a stock with some decent growth potential.

But bear with me here: even if Palantir would continue its very decent ratio of growth until, say, 2028, shares are still valued at a very high multiple today. Let us investigate what happens if Palantir keeps growing its revenue at the same rate for the next five years and achieves more or less the same profit margins. I will be using the following metrics:

- An average annual revenue growth rate of 27% (the average between 2020 and 2023)

- A cost of revenue of 20 percent

- Constant operating expenses of $1,700M (which might be optimistic, but let’s use it)

- I’m increasing the total number of outstanding shares of Palantir by 3% annually (again, might be optimistic, but stock-based compensation, which came in at a staggering $476M in 2023, is decreasing as a percentage of total revenue).

| Year | Revenue in millions of dollars | Earnings per share | PE ratio (today’s price: $24) |

| 2023 | 2,225 | $0.10 | 240 |

| 2024 | 2,826 | $0.25 | 98 |

| 2025 | 3,589 | $0.50 | 48 |

| 2026 | 4,558 | $0.80 | 30 |

| 2027 | 5,788 | $1.18 | 20 |

| 2028 | 7,351 | $1.63 | 15 |

Note that my calculated earnings per share are different from the expected EPS on the Seeking Alpha earnings page for Palantir. In 2024, my value looks quite pessimistic, while in 2025, my value looks too optimistic. I assume my values for the years after this would look too optimistic as well, if analysts would provide estimates for these years, but the picture gets increasingly blurry the further away in the future you get.

This table implies that Palantir could reach a PE ratio of 20 after 2027 and 15 after 2028 using my assumptions, which sounds quite reasonable and attractive for a growth stock. But I used a couple of assumptions that I believe are much too optimistic:

- I assumed that Palantir’s revenue would continue its growth at the rate of 27 percent for five more years (more than doubling every three years)

- I assumed that operating expenses remained an annual total of $1,700M until 2028 (growing revenues often also mean growing operational costs)

- I assumed an annual dilution of only 3 percent, which has been much higher over the last couple of years

If one of these assumptions would change for the worse, this is where the PE ratio of Palantir after 2028 ends up:

- Change the company’s annual revenue growth to an annual 15 percent: 2028 PE ratio of 33

- Increase annual operating expenses by 15 percent: 2028 PE ratio of 25

- Change the average annual dilution to 7 percent (not far from the average during the last three years): 2028 PE ratio of 18

Add any combination of these three and the outcome gets exceedingly more negative. If all three happen at the same time (which is not likely), PE ratio after 2028 would be an astronomical 463.

Let me be clear: I do not imply that I expect Palantir’s numbers to deteriorate, the only reason that I listed these possibilities is to show the influence one decreasing metric could have on the future PE ratio of Palantir. Again, a PE ratio is not very useful for the current metrics of quickly growing corporations. But by extrapolating a company’s results into the future, I believe we can get a grasp about whether a quick grower is currently over- or undervalued. My attempt at doing this for Palantir seems to suggest that the stock is currently quite overvalued.

Current expectations about the timescale of AI are too optimistic

Palantir’s AIP platform can be regarded as a layer built into their Foundry platform. It is basically a finetuned ChatGPT-4 instance which runs on its existing Foundry platform, which has been used in Palantir’s AIP bootcamps (please view this link in case you want to know more about the technical properties and uses). One of the added values of AI in this platform is that is enables the user to create intelligent data models using almost no code. Also, as Alex Karp writes in his annual shareholder letter, AIP can help the customer to set up the data integration and analytical software platforms in a matter of hours (instead of weeks or months previously).

The company does no effort at moderating the market’s optimism about AI, quite to the contrary (quotes are from the annual CEO letter):

AIP is the future of our company, and we believe that it will become the dominant platform for the entire industry.

I believe that integrating AI into Palantir’s platforms was a very intelligent step. Not only because of the use case and the gap between domain knowledge and data science has been made significantly smaller, with AI taking on many of the data integration tasks. But also commercially. As large language models have successfully shown the world the added value of large-scale AI, the IT and data sector in particular seem very keen on using it. By jumping on this bandwagon, Palantir might be able to quickly broaden their potential customer base and create interest for its products using AI as a crowbar.

But AI is not simply a magical formula to solve most company’s data problems. AI might support the easier and swifter data integration of companies, but it cannot change an entire system overnight. As with most technological innovations, AI will take time to take off and lead to tangible benefits for companies using it. For companies and governments already using Foundry, Gotham and Apollo, AIP will often have easy advantages. For organizations that are already ready for AI, it might even be more beneficial. But let’s face it: many organizations, governments and companies that are no customers at Palantir yet, even those that deal with large amounts of data, probably need time to transform in order to reap the benefits from AI, let alone integrate it with one of Palantir’s platforms. There are many reasons for this: legacy systems, decentralized data, ethical considerations, organizational structures hindering the free use of these data (to name only a few of the many potential ones).

AIP could lead to a sudden boost in sales and number of different customers for Palantir, but my estimate is that after an initial upsurge, this number of added customers is likely to stagnate. AI simply needs time, but this is not a problem for Palantir, which is playing the long game. But it might be a problem for the market, which seems to have inflated expectations.

The market is simply not accounting for the possibility that the timescale after which the advantages of AIP (or other AI integrations into large data integrations) are likely starting to lead to tangible benefits for many companies could be much larger than expected. Of course I am convinced that there are some corporations that will be able to reap the benefits of advanced AI quite quickly. But these corporations are also the most likely ones to already be customers of Palantir.

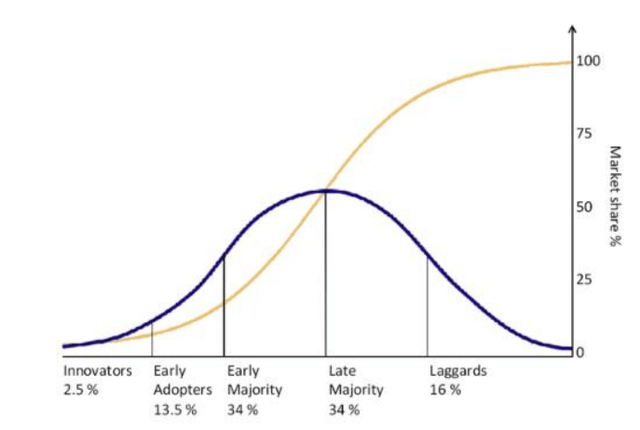

Some years ago, I wrote a diffusion analysis for Bitcoin, in which I used the following graph:

Diffusion of innovation (Everett Rogers)

This diffusion graph of innovation shows the types of adopters on the horizontal axis and the market share on the vertical one. Innovators are the truly groundbreaking companies and individuals trying out a technology as the first ones. Early adopters are the more innovative firms, not afraid to try a new technology as one of the first ones. After this comes the majority.

Note: this graph says nothing about the timescale of diffusion. As we currently are in the early innings of AI adoption, most firms applying or wanting to apply deep levels of AI right now are likely to be early adopters. These companies are likely to be the current target group of Palantir at the moment. Note: I’m not talking about companies applying AI in ‘at least one business function’, as Palantir sells expensive and powerful software solutions, I am only interested in companies that are at least knee-deep into AI implementation.

I believe that the AIP bootcamps are quite an intelligent tool to get more companies and governments interested in the AIP platform, but I also think that we have currently not yet reached the early majority of companies that are applying advanced AI, let alone the late majority. I believe it will take much more time than currently expected to reach the early and late majority of firms applying AI at a deep level to their data analysis, because it is complex, can be difficult to use and understand and it is a very costly investment.

Takeaway

Palantir had its first profitable year in 2023, and continues to have a solid growth rate. Palantir seems to be a company with very good long term prospects and a solid business model. But its current share price has simply run much too far ahead of its business fundamentals.

In my analysis I have shown that, even when extrapolating Palantir’s current revenue growth rate into the next five years, Palantir is at risk of remaining an expensive investment if as little as a single metric (revenue growth, operating expenses, share dilution) will be anything less than perfect. Palantir is priced for perfection at this moment. And because the expectations of AI are also sky-high, there is ample room for disappointment. I believe AIP expectations are much too inflated, especially about the time scale at which the majority of companies can achieve benefits from this platform.

Palantir may continue to ride the AI wave for a while, but eventually the company will need to show that it is worth its valuation. I do not believe that it is at this price level, and I believe it is likely that the company will experience a strong correction sooner or later. My current rating on Palantir is a sell.

I expect that Palantir has short-term potential to return to price levels seen before the Titan contract was made public, of around $17 per share, simply as a rebound. But even at that level, I would consider the shares quite expensive.

At a price level of $10 though, Palantir would have a forward PE ratio of 30, and according to my model presented in this article, a 2025 PE ratio of 20, considering expected earnings per share of $0.50 during that year. A price level of $10 would provide enough safety margin to switch my thesis from a sell to a buy. I am aware that this value might sound extreme, as it would entail a drop of 60%. But please be aware that Palantir’s stock already experienced much more extreme movements in the past, for example when it dropped by more than 80 percent between January 2021 and May 2022.

Of course, with such a promising company like Palantir it would be foolish to only use PE ratios and share prices as a metric to monitor my thesis. If the growth rate of Palantir will prove to be consistently higher than the one I used in my model (an annual 27 percent), this will likely cause me to change my thesis as well. As I already mentioned, I would expect Palantir to experience a one-time bump in revenue growth resulting from its smart AI strategy. But I am skeptical about such an acceleration to continue for multiple years. If Palantir proves me wrong and could achieve, say, revenue growth rates of 35 percent for two years, the company deserves a larger premium than I pictured and my thesis will change for the better. But as for now, my rating remains a sell.

Note: I am a long-only investor, but even if I wasn’t, I would not recommend shorting Palantir. This has nothing to do with CEO Alex Karp’s remarks who has not been mincing his words lately when talking about short sellers, but I simply believe that the stock is not a sure enough bet to sell short. Side note about the remarks of Karp: with 97.08M shares sold short, or 5.18 percent of total float on this 29th of February, the company seems to not have to worry about short sellers at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.