Summary:

- I analyze Meta Platforms Inc. and compare Wall Street’s sales forecast to historical records.

- The historical precedent suggests that it is unlikely for a company of Meta’s size to achieve the forecasted growth rate.

- I recommend avoiding investing in Meta shares due to excessive optimism reflected in price and superior risk-adjusted alternatives.

Ralf Geithe/iStock via Getty Images

I’ve just spent a few days in quarantine, and I’ve been quite bored, so I thought I’d spice up my life a little bit by writing about a company that will likely generate some passionate commentary from readers. Today, I’m going to write about Meta Platforms, Inc. (NASDAQ:META). Using the process I outline below, I’m going to compare Wall Street’s current forecast to the historical record and will generate a forecast of my own to see if the net present value of future cash this business can generate is worth the current price.

Here’s the outline of this article and what I will do at each step in turn:

-

Work out what Wall Street is forecasting for future sales.

-

Compare that forecast to the historical record to see what the probability is of a company of Meta’s current size growing at the forecasted rate (i.e. rate Wall Street’s optimism).

-

Come up with my own EPS forecast over the same time horizon. I’m going to apply what I consider to be a reasonable discount factor of the 10-year Note plus an equity risk premium to work out the net present value of future cash.

-

If the net present value of my forecasted future cash flows from this investment is greater than the current stock price, I’ll buy. If not, I’ll either avoid the name and/or may buy deep out of the money puts when the technical analysis indicators line up.

First, I’ll review what Wall Street is forecasting here. I’m just getting over a bad case of Covid, and I remember amusing myself with my financial calculator as I sat bored and gooey, but now I can’t find it. Absent the aid of my simultaneously “handy” and “dandy” financial calculator, I was obliged to revert to the old “plug and chug” method of working out CAGRs. This obviously took more time, but I think it was time well spent. Based on my “plug and chug” calculations, the Wall Street consensus seems to be that Meta’s revenue will grow at a CAGR of about 9.182% over the next nine years.

Next up, I want to compare this forecast to the historical record. Put another way, in order for this figure to have any meaning, we should put it in some sort of historical context. I mean, a company starting from about $120.5 billion in sales, and growing at a rate of 9.2% for 9 years may actually be reasonable. Or, it may not be. I think we can decide that question by thinking about Wall Street’s forecast from a slightly different angle, and we’re going to use some market history in order to do that. The question I have of the Wall Street forecast is “what percentage of companies, starting from Meta’s current size, have grown revenues at a CAGR of 9.2% over the next decade?”

Thankfully, an analyst that I respect a great deal, Michael Mauboussin, along with a few colleagues has answered that question for us. You can find the answer to that question on page 25 of this document.

If you start by turning to page 21, though, things will make a great deal more sense because on this page you’ll get an explanation of what the good people at Credit Suisse did some years ago, and the methodology employed. In a nutshell, they analyzed a host of global companies by base sales levels, from the years 1950-2015. They then calculated subsequent CAGR sales growth for each firm and charted the results. They were trying to work out how likely it was for companies starting with a certain level of sales to grow those sales at a certain rate. Put another way, it answers the question “what does history show us about companies of a certain size achieving certain growth rates over the coming decade?” Obviously, the bigger the starting level of revenue, the harder it might be for it to grow revenues at a high rate.

The analysts divided each of these companies into deciles of varying sales growth. So, if you turn to page 25 of the document, you’ll find the “Sales >$50,000 million,” which is where Meta finds itself today. If you then go down the first column of sales growth to the row marked 5-10, that’s relevant to Meta’s forecast, because 9.2% forecasted growth is obviously between 5%-10%. You then go across to see what percentage of companies starting with Meta’s base revenue managed to grow revenue at a CAGR between 5-10% over the next decade. The answer is 17.2%, or 189 companies of the 1,099 companies in the sample that both started the decade with sales over $50 billion or greater and survived the decade. So, I’d characterize the historical precedent here as “ok, not great”, given that most (65%) companies sported growth rates between -5% and 5%. It turns out that it’s hard for elephants to dance.

While this analysis is helpful, I think it deserves further comment. First, Meta’s starting point of $120 billion is far greater than the $50 billion hurdle to get into this decile. Second, a CAGR of 9% is on the high side of the 5-10% revenue growth range. For that reason, I think 17% is an extremely optimistic forecast. Put another way, if Wall Street forecast growth were only 80 basis points higher, the percentage of companies to achieve that would drop from 17% to 3%. Thus, I would suggest that the probability is very high that Meta will fail to achieve this growth rate. I think a much more reasonable growth rate here would be about 3%-4% over the decade. Splitting the difference to 3.5%, that brings us to revenue of $164 billion in 2032, which is about 38% lower than Wall Street’s forecast.

If we hold the shares outstanding constant, and we assume the same net margin as we’ve seen over the past 3 ½ years (31.3%), we get to my, I think reasonable, forecast of profitability over the next several years.

Remember that the current 10-year is 4.287%, so I’ll be discounting these future cash flows by that amount plus a 3% equity risk premium. To help with the arithmetic, I’ll therefore be discounting future cash flows by 7.287% in order to compensate for the opportunity cost of tying up capital in this stock, plus what I consider to be a very forgiving equity risk premium for buying a stock instead of a risk-free government bond.

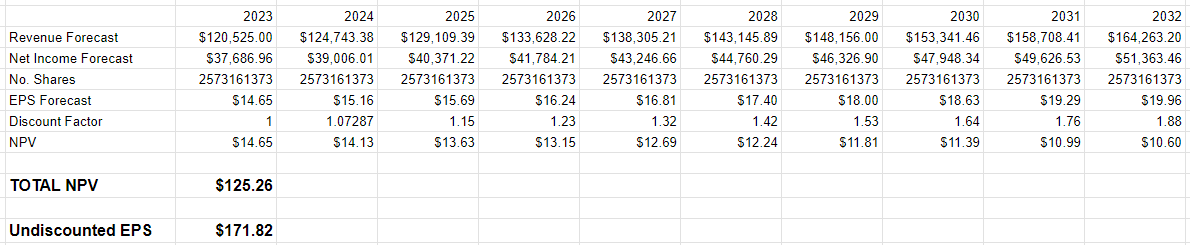

Given the above inputs, I estimate that the total NPV of earnings per share is about $125 over the next nine years. Additionally, I estimate that undiscounted earnings come in at about $171 per share, per the following:

My NPV Forecast of Meta Earnings (Author forecast)

As of this moment, Meta shares are trading hands at about $302.50. Given that a stock is worth no more, and no less than the cash that investors can pull out of it in the form of earnings, this doesn’t fill me with a great deal of optimism. For that reason, I’m going to eschew Meta shares and would recommend others do the same.

I’ll conclude this article with a sermon that I sometimes bore my regular readers with. We’re not seeking “returns”, we’re seeking “risk-adjusted returns”, and I think the returns here aren’t sufficient to make up for the various risks involved. Given what we know about market history, it’s a very rare company that can grow revenues from a base of $120 billion at a rate of 9%, so I think Wall Street is being optimistic in its forecasts. I hope you’re not shocked by the idea that the Wall Street hope factory can be excessively optimistic in its forecasts. Further, I think it’s worth remembering that humans are pretty loss-averse, which means we’re much more impacted by a loss of a given size than a gain of that size pleases us. In my experience, investors who “win” at this game do so more by avoiding losses than they do by hitting home runs.

I can’t say when exactly, but in my view, over the next 9 years Meta shareholders will suffer a rude shock. Additionally, the higher the price travels from current levels, the more rude will be the shock. For that reason, I would recommend avoiding this name and finding investments that’ll let you sleep at night.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.