Summary:

- Amazon’s Q4 earnings uptick was largely led by AWS income efficiency. However, AWS growth is drying up.

- Amazon’s “International” segment has been a near-constant income and profitability drag while North America’s e-commerce is going green again.

- Like most of the “Magnificent Seven”, Amazon is betting on AI. It’s a couple of beats behind the leader of the pack but there are some early successes.

Noah Berger/Getty Images Entertainment

Shortly after Amazon (NASDAQ:AMZN) released its earnings for Q4 2023 on Thursday, the stock experienced a rather quick rally northwards. The bulk of the rationale for this was attributed to strong holiday sales in Q4. However, buried deep within its numbers and assertions made during the earnings call lie an interesting rationale for some of the buy-in: the company’s essentially looking to become a “growth stock” again.

A Deep Trend Drilldown

Amazon is a complicated mess: three entirely different businesses – e-commerce, cloud solutions and media – reside within a single stock essentially branded as a “tech” company which can finance itself (if it chooses to) by issuing debt with a relatively lower yield since “tech” bonds tend to be rather attractive. What complicates the media (or “content”) business is the lack of a clear attribution of revenue: buying a Prime subscription gives one access to an enhanced e-commerce experience as well as company-owned content. While it is entirely possible to buy a subscription for just the content, a distinct breakdown isn’t available.

Unlike tech, a “media” business typically pays a higher financing rate to attract investors because it’s a risky bet: it’s almost impossible to estimate earning potential for content, audience buy-in is largely unpredictable and there’s a substantial amount of highly-variable overhead. Given that the company doesn’t release standalone “content” financials, it can be assumed that the costs (and losses) are embedded within its three segments: “North America”, “International” and “AWS” (Amazon Web Services, its cloud business).

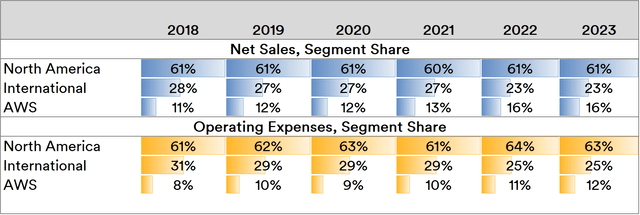

Overall, the net sales and expense share of the three segments to the bottom line has been highly stable and in near-perfect alignment for over six years now.

Source: Created by Sandeep G. Rao using data from Amazon’s Financial Statements

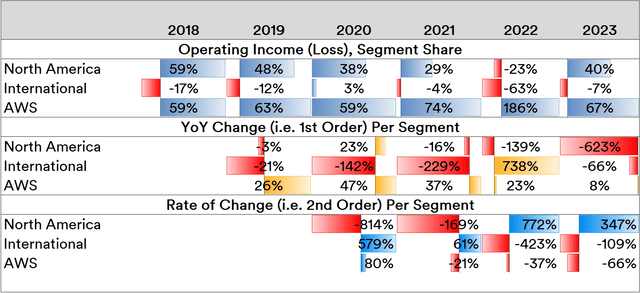

Now, Amazon is one of the “Magnificent Seven” collective that drove most U.S. broad market indices’ performance over the past year. Central to its place within this group is an overall expectation of “explosive” growth. Income, i.e. the net remainder after expenses and sales would be a key watermark of this expectation being met. In this metric, the company’s messiness becomes readily apparent when estimating first- and second-order characteristics of the segments’ operating income while employing the same framework as that employed in the breakdown of Google’s earnings (GOOG, GOOGL) last week.

Source: Created by Sandeep G. Rao using data from Amazon’s Financial Statements

Year-wise, AWS and “North America” tend to shore up the bulk of the company’s income. The “International” segment, however, is the greatest drag. The 1st-order estimation shows that “International” segment had the maximum drag in the worst of times, i.e. 2021 and 2022, and never shows a directional drift at other times either. Triple-digit 2nd-order trends indicate that “International” segment tends to worsen in delivering a contribution quite often.

Of its international businesses, its two biggest markets used to be China (since 2004) and India (since 2013). After 15 years, the company shuttered its domestic e-commerce operations in China and now focuses on “cross-border” selling. Its India e-commerce business (as highlighted in an earlier article) – despite being warmly welcomed by the country’s leadership – remains blighted with net losses, investigations into underreported finances, allegations of programmatically swiping volumes from third-party sellers to favour a proxy-owned seller, and the potential legal consequences of blocking a merger that would create a massive e-commerce rival (which is now being resumed). The company also makes an unusually verbose (yet non-committal) statement about these events in the “Business Risks” section of its Annual Report thus:

Violation of any existing or future PRC, Indian, or other laws or regulations or changes in the interpretations of those laws and regulations could result in our businesses in those countries being subject to fines and other financial penalties, having licenses revoked, or being forced to restructure our operations or shut down entirely.

If the e-commerce business in India were to close, this would actually be a net positive for the company’s bottom line. Given that it’s been over 10 years and some hard lessons were likely learned in China, it bears asking if the company will pull the plug sooner than 15 years. There are a number of vertically-integrated e-commerce platforms in operation in the country; it is increasingly unlikely that Amazon can profitably leverage its way into having net-positive incomes like it did in “North America”.

Any argument that the company is still a “growth stock” should be put paid by the simple fact that the company has been in e-commerce for nearly thirty years now. The relatively-newer AWS, however, has paid off in spades and now helping subsidize the company’s unwieldy business for several years now. In fact, it has also attained positive earnings in India. However, as the 1st- and 2nd-order trends show, growth has slowed down and has been decelerating more and more rapidly over the past three years.

Integration: Fallacies, Facts and Forward

Arguments often abound that Amazon is an “ecosystem”, a roundabout way of reinventing the idea of “vertical integration”. This is not necessarily true. For instance, let’s consider Amazon’s e-commerce rivals in India outside of Walmart-owned Flipkart. Most of these rivals started out as brick-and-mortar merchandise distributors/retailers who found an outreach to a greater market possible via e-commerce. Greater sales in the latter supplement their brick-and-mortar business and vice versa. This is not the case with Amazon’s business.

A portion of the earnings report’s opening comments discussed the company’s “content” business with a mention of accolades won by various properties and the fact that “Reacher” had the highest number of minutes watched for any Prime Video title in 2023. What remain doubtful is if this would compel large masses of users to regularly buy products via the platform if they weren’t already. On the other hand, solid incomes in the e-commerce business would pay for producing more content. This isn’t “vertical integration”. Next, if the e-commerce business and/or the media business was doing well, there is no evidentiary statistic to suggest that more enterprises would purchase cloud solutions; the businesses are driven by entirely different factors. So, this isn’t “vertical integration” either. What does prove to be integrative is the company’s stated intention going forward in the dominant theme for investor interest in 2023 and perhaps even 2024: Artificial Intelligence (or just “AI”).

A host of companies – ranging from hospitality major Accor to Korean conglomerate Hyundai – were announced to have deepened collaborations with Amazon via their Bedrock and SageMaker AI platforms, both of which are vertically integrated with AWS. It’s very likely that with scale would come the potential for expanding usage of AWS’ on-demand cloud capabilities in non-AI applications. In fact, the company reported this being the case with financial services provider Mitsubishi UFJ Financial Group.

Amazon CEO (and erstwhile AWS head honcho) Andy Jassy stated that while generative AI services remain a relatively small business for the company, this could drive tens of billions of dollars in revenue within the next several years. Amazon CFO Brian Olsavsky added that “a lot of interest” has been generated in AWS’ generative AI products such as “Q”, an AI chatbot for businesses. A generative AI shopping assistant named “Rufus” is also being tested among a subset of U.S. e-commerce users.

Mr. Olsavsky also said, “We’re going to continue to invest in new things and new areas and things that are resonating with customers. Where we can find efficiencies and do more with less, we’re going to do that as well.” Rather interestingly, the company also announced that it has begun showing ads on its original content. It is very likely that cracks are beginning to show in the value of forever subsidizing unintegrated projects.

The company would likely do well if it were to spin off the content business entirely and hold it as part of a consortium. However, Mr. Olsavsky did mention that 2024 won’t be “a year of efficiency type thing” so it’s unlikely that massive moves would happen this year.

Going by trends, it’s evident that “AWS + AI” is being positioned as the company’s new growth story. While cloud solutions would always be in demand as AI-driven improvement is being pursued by enterprises to reduce “human” costs, there are a number of alternative providers in this segment (such as Microsoft and Google). Regarding AI, it remains to be seen if the company hasn’t already been pipped to the post by other tech giants and specialist firms who have been in the deep end a while longer.

All in all, it sounds like an interesting year (or set of years) is about to begin but, at the moment, the company’s at an unenviable position. Absent the beleaguered “International” segment and the oddly-placed media business, an “e-commerce” play on the back of rising “North America” segment income would be a great choice. For the “generative AI” play, Microsoft (MSFT) presents as a stronger choice since its products and services are more integrated and its sizeable client list. For the forward looking “generative AI + cloud business”, Google is a more attractive choice with a present offering already poised to better integrated. At least one of two firms might even go public with more innovative “generative AI” solutions for enterprises. These tickers would be very attractive choices.

All in all, it’s a “wait and see”. It might be time the company formed a new segment. While such a carve-out doesn’t seem likely based on the latest earnings call, it’s never a “never” when it comes to business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.