Summary:

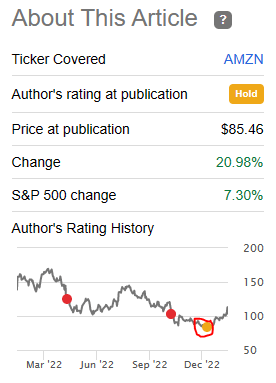

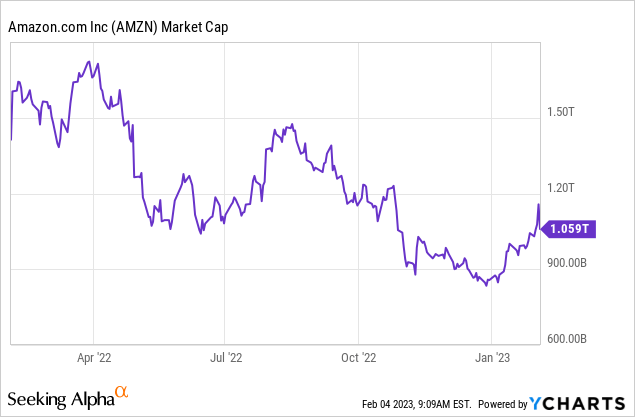

- We had upgraded AMZN to a Hold rating in December as the risk-reward for shorting was not well balanced.

- The stock has bounced nicely since then.

- We look at the Q4-2022 numbers and tell you why we are issuing a fresh downgrade.

Phillip Faraone/Getty Images Entertainment

When we last covered Amazon (NASDAQ:AMZN) we gave it an upgrade to a “Hold” rating after pushing the “Strong Sell” thesis in May and October. The rationale was that the stock was a super bubble in the process of deflating, but deflating will take time and there is never a straight line to fair value. Specifically we said,

A bounce to the 200-day moving average would be rather painful for the short side. Hence we are upgrading this to a “hold”, from a “Strong Sell”. While we would not want to purchase AMZN even 50% lower than this, we think the case for shorting the stock is no longer compelling and we are hence moving to the sidelines.

Source: Fairly Valued For Extremely Poor Returns

That was a timely upgrade as AMZN bottomed within a day of our call and has rallied 21% since then.

Seeking Alpha

We dissect the Q4-2022 results and tell you why it is time to turn bearish again.

Q4-2022

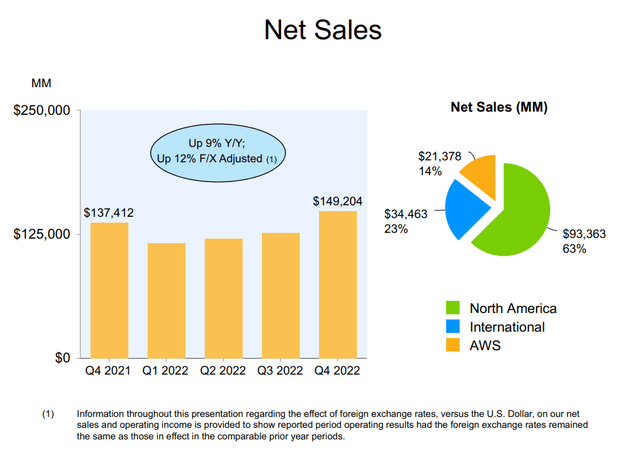

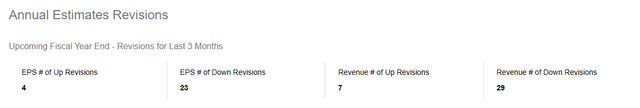

One bizarre side effect of the 2009-2021 bull market has been that investors have been thoroughly conditioned to look at sales first rather than profits. By that standard, AMZN certainly gives the crowd some degree of happiness as the top line number once again beat estimates by $3.4 billion. Sales came in at $149.2 billion, a whole 9% year over year.

Those looking for even a brighter spot could point to the currency headwinds without which sales might have been up 12%. While the number beat estimates, spare a thought for the analysts who worked day and night to lower the bar for AMZN.

At a more important level, AMZN’s 9% revenue growth is about in line with nominal GDP.

Current-dollar GDP increased 9.2 percent, or $2.15 trillion, in 2022 to a level of $25.46 trillion, compared with an increase of 10.7 percent, or $2.25 trillion, in 2021 (tables 1 and 3).

Source: BEA

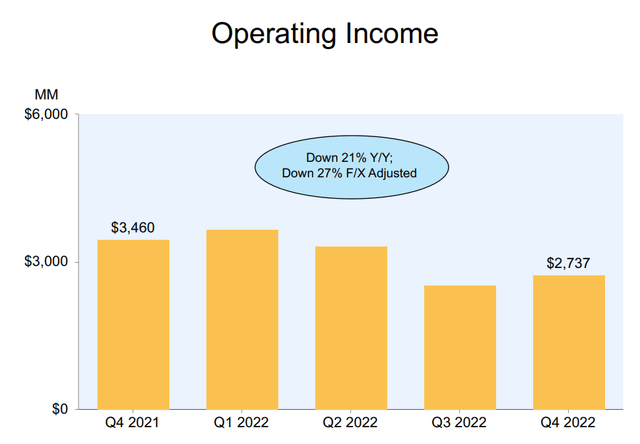

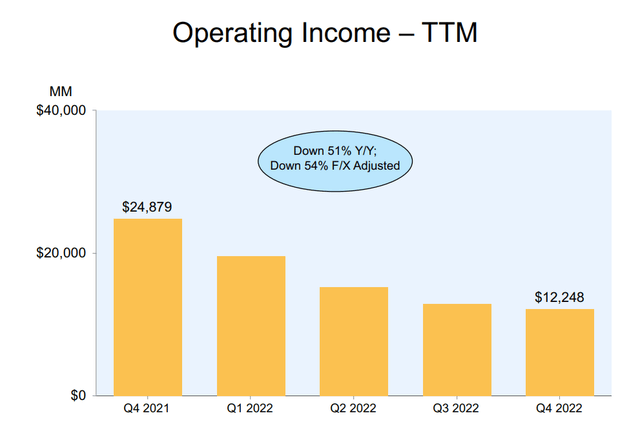

This is the first and most important takeaway. AMZN’s growth is dead. We told you this in May and again in October and we are telling you now so you don’t forget that the growth is gone. AMZN’s revenues are tracking nominal GDP and a majority of companies accomplish that without forcing investors to pay ridiculously demanding multiples. Speaking of demanding multiples, AMZN once again failed to make another year of revenue growth translate into growing profits. Operating income was down 21% year over year.

It is possible that investors do ask themselves the most important question. Exactly when will AMZN start growing the bottom line?

For the longest time investors have dodged that question by singing sweet lullabies of how Amazon Web Services, or AWS, was worth trillions of dollars.

Amazon.com Inc.’s cloud-storage business is on a clear path toward a $3 trillion value, almost triple what the whole company is worth now in the stock market, according to a Redburn Ltd. analyst.

The unit, Amazon Web Services, is so powerful that the company may decide at some point to split it off from the massive, slower-growing online retail operation, analyst Alex Haissl wrote in a 128-page report initiating coverage of the cloud-computing industry. He didn’t say when the $3 trillion value may be achieved.

Source: Bloomberg

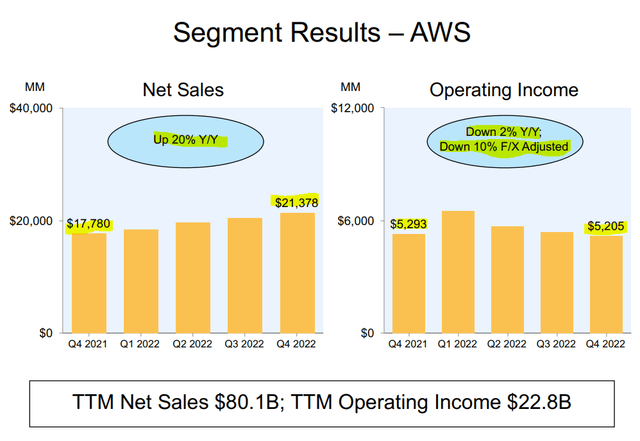

While he did not say when that $3 trillion will be achieved, we believe it will be close to this point. Getting back to reality, AWS shattered the last remaining leg of hope for the bulls. When we wrote about AMZN in October we had reiterated that AWS margins were going to collapse soon.

We see cloud and web services become a commodity service within 2-3 years and expect margins to drop by 40% from these levels (sub 15% operating margin).

Source: Ama-Gone, Why The Fed Is Still Not Bailing Your Poor Investments, Including Amazon

As usual, we were too optimistic with our timeline. Sales grew 20% and operating income dropped 10% when adjusted for forex.

Operating margin is now 24.3% down from a peak of over 30%. We are dropping about 1.5% a quarter in operating margin and that is with revenues still growing at a brisk pace. Our outlook here is that AWS will continue its strong revenue growth for some time before even it joins the nominal GDP growth rate of the rest of the company. For 2023, 2024 and 2025, we see AWS revenue growth decelerating to 18%, 14% and 10% respectively. Over the same time frame, operating margins should contract to 14%-17%. That would keep AWS operating income about flat from these levels over the next 3 years. One thing to keep in mind is that operating income is not pre-tax income. There are a lot of additional costs before you get to your pre-tax income number. So when you boil down this $21 billion operating income to an after tax number, you will likely get far below $15 billion. As to what you should value this at, our best number is about 15X after-tax profits. So our fair value for AWS is about $225 billion. That leaves $800 billion plus for the retail side which by itself has never made a profit.

Verdict

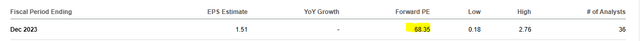

Sure, you may get some “green shoots” on the soft landing front. Historically the Federal Reserve has achieved a good soft landing only once and certainly has never experimented with hiking right into a contracting ISM reading. If the January job numbers were indeed accurate, then you need to price in a terminal rate number of over 5%, possibly closer to 6%. What could possibly go wrong with AMZN if a recession or a higher terminal Fed Funds Rate materializes? After all, it is only trading at a P/E of 68.

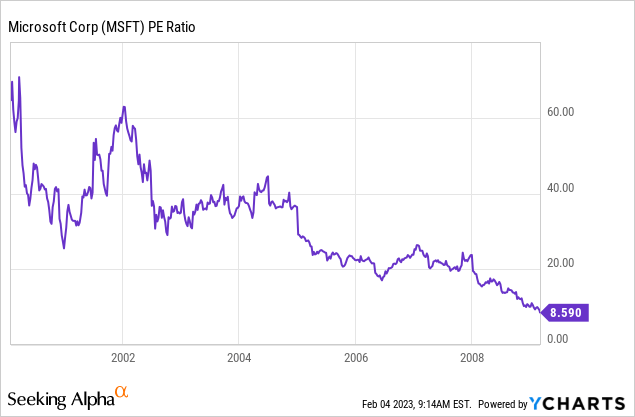

Keep in mind the legendary company known as Microsoft (MSFT), which did not stop making boatloads of money even in the global financial crisis, traded at a P/E ratio of 8.59 at one point.

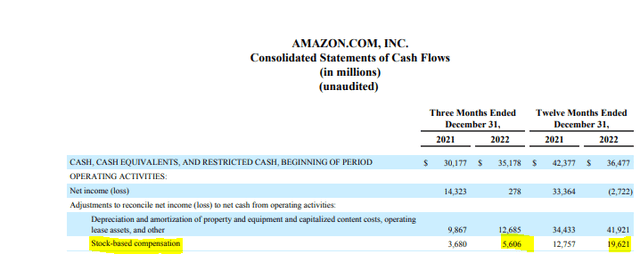

You can run the math at what the P/E ratio was after you subtract out the cash on hand for MSFT at the time. So when you bizarrely accept this 68X multiple on AMZN, remember that you are gambling, not investing. Remember that this multiple also does not count the stock based compensation. AMZN’s stock based compensation was funnily almost the same as its AWS operating income.

We might add that it is growing far faster. Maybe some analyst can slap a negative $3 trillion valuation on this stand-alone and uncounted entity. We are downgrading AMZN to a “Strong Sell” and look forward to the multiple normalization process.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.