Summary:

- Azure, Advertising and AI present huge opportunities for Microsoft.

- While Azure is a widely known and understood business, the company’s advertising business is running under the radar.

- By enhancing its services with the AI capabilities of OpenAI, Microsoft could cement its market leadership and enter new markets.

lcva2

Over the path months, Artificial Intelligence has become a buzzword again with the emergence of public AI Chatbots like the OpenAI Chatbot. Besides rampant fear over the business model of search engines like Alphabet’s (GOOG, GOOGL) Google being disrupted (my thoughts on the topic), one company has been in focus: Microsoft (NASDAQ:MSFT) has been one of the early backers of OpenAI since July 2019, where the company invested $1 billion to support building artificial general intelligence (AGI) with widely distributed economic benefits and delivered the required computing power over its Azure Cloud platform. Now Microsoft is looking to reap the benefits of this technology and has been very vocal about it. In this article, I’ll talk about Microsoft’s, what I call, triple-A growth strategy.

What does triple-A mean in this context?

Triple-A in the context of Microsoft has two meanings:

- Firstly, Microsoft’s credit rating is AAA according to S&P Global (SPGI) and Aaa according to Moody’s (MCO), the best possible ratings which are only granted to Microsoft and Johnson & Johnson (JNJ). This showcases the incredible financial strength and durability of the company.

- The second AAA is, as mentioned in the title, Azure-Ads-AI. This is the growth engine of Microsoft for this decade, while Windows and Office are, despite still growing, already at a gigantic size and the market leader. This article will focus on combining these three segments and how they can propel Microsoft forward.

Breaking down the different parts

Microsoft is one of the world’s largest companies and one of the most intensively covered companies. Yet, I think the advertising opportunity is underrated and AI has just recently come back into the spotlight.

Azure

I won’t discuss Azure in great detail here because it is a well-known part of the company. In short, Azure is the fastest business group inside of Microsoft and is home to the cloud computing business. Over the last 12 quarters, the growth has consistently decelerated from 59% to 40%, but at an annual revenue rate of over $67 billion, that is still incredibly fast growth.

Advertisement

According to Research and Markets, the global digital advertising and marketing market is expected to continue its fast growth of 13.9% annually until 2026, when it’s expected to reach $786 billion. If you think about digital Ads, the first companies that come to mind are Google, Facebook (META), and maybe Amazon (AMZN), but most people probably don’t think about Microsoft. Yet the company generates over $10 billion through ads, taking a small market share of this enormous pie. Microsoft’s advertising business consists of three parts:

- Bing ads and news

- LinkedIn ads

- Xandr platform

Bing is the second-largest search engine in the world, with a tiny market share of around 3% versus the Behemoth that is Google Search. Despite its small size, Microsoft managed to generate $11.6 billion in revenues through 2022 with Bing Ads and News, a customized news feed. Microsoft is pushing its Edge browser (4% market share) and Bing on all Windows computers, which probably is a big part of the market share because right now, Google is the better search engine, without a doubt.

LinkedIn is the world’s largest social network for professionals, with over 875 million professionals and 61 million companies using the service. LinkedIn’s revenue consists of Premium subscriptions (between $30-100 a month per account) and advertising on the site and inside Microsoft’s whole ad network.

Xandr is a recently acquired online platform for buying and selling consumer-centric digital advertising. Last year, Microsoft announced it would be the provider of Netflix’s (NFLX) ad-supported subscription tier. It’s speculated that this deal could bring billions of dollars in revenue to Netflix. If the Netflix Ad tier is successful, this could be used as a case study for Microsoft to gain more deals in the space, especially in the connected TV and video space.

Artificial Intelligence

I already mentioned Microsoft’s initial investment in OpenAI. Yesterday’s news broke that the company reportedly plans to invest $10 billion to purchase a significant stake in OpenAI, valuing the company at $29 billion. Microsoft would get 75% of OpenAIs future profits until it makes back the $10 billion, after which the company would retain a 49% stake in OpenAI. According to an article from the information, Microsoft is looking to add OpenAIs chatbot technology to Word, Outlook, and other Office solutions. The company also announced integrations of ChatGPT and DALL-E 2, OpenAIs image generator, into Bing. Microsoft is clearly looking to leverage OpenAIs capabilities to enhance its own products in the office and advertising space. This could further strengthen its office products’ market leadership and help Bing capture more market share. Overall, I like the risk/reward in this integration for Microsoft. The future of AI is exciting and Microsoft could be a key player here.

Microsoft is a buy

Let’s value Microsoft based on the multiple and inverse DCF methods.

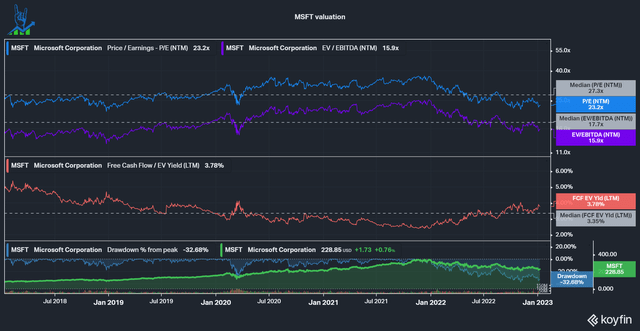

I usually use the ten-year median multiples, but with Microsoft, I believe that a shorter timeframe is needed because the company transformed itself entirely in the last decade with Subscriptions and Cloud computing. We can see that Microsoft was incredibly expensive during 2020 and 2021, trading around 35 PE and 25 EV/EBITDA. Now the valuation has come down considerably under its median. A similar picture can be seen if we look at the FCF yield, which is now slightly above the median (remember that we are looking at a yield, and thus, the higher, the better).

MSFT historic multiples (Koyfin)

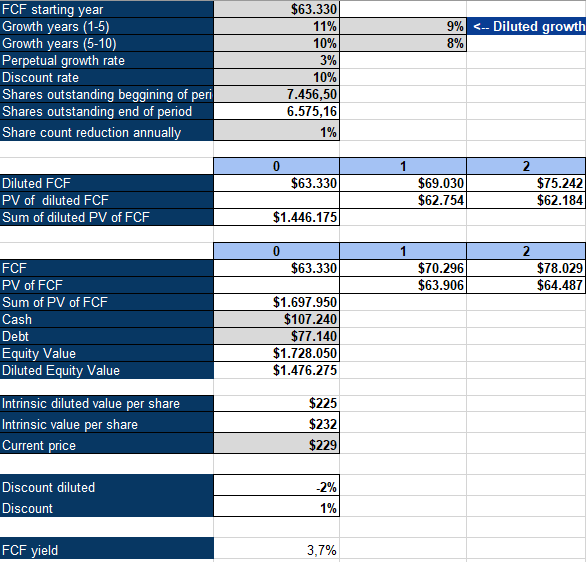

For my inverse DCF model, I always use a 10% discount rate/required rate of return, a 3% perpetual growth rate, and an assumed 1% reduction in shares outstanding annually due to Microsoft’s share buybacks, more than offsetting dilution from Stock-based compensation. Microsoft typically doesn’t dilute to acquire businesses due to its massive cash pile, so there is no need to account for dilution from that side either. With those assumptions, Microsoft’s price implies a 9% growth rate in the first five years, followed by an 8% growth in the next five years, a considerable deceleration from its five-year FCF per share CAGR of 18%. I do not expect Microsoft to compound at 18%, but I believe that a low double-digit FCF per share growth rate seems highly likely.

Microsoft Inverse DCF Model (Authors Model)

To conclude, Microsoft has ample opportunity ahead of it in the advertising market and enhancing its products with AI capabilities to stay competitive and gain more market share. Microsoft currently is the largest position in my stock portfolio, with around a 13% allocation.

Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: What do you think about Microsoft’s ability to capture market share in the ad business? Let’s continue the discussion in the comments below. This is not financial advice.