Summary:

- Intel’s stock has plummeted due to disappointing earnings, but the current low price and potential strategic moves suggest it may be a hold.

- The company is considering selling parts of its business to focus on core operations, though this is controversial and may not be the best move.

- Reasons to buy include the potential success of the 18A process node, compelling valuation, and promising technical outlook.

- Despite past mistakes, Intel’s bearish sentiment may be overdone, and the stock could be at a bottoming range, warranting a hold rating.

Duncan Nicholls and Simon Webb

Thesis Summary

Intel (NASDAQ:INTC) has seen its price plummet following disappointing earnings, and things are not looking up.

The company is considering selling parts of its business, a controversial decision that markets actually seemed to like.

But is this really the right way forward? Should Intel double down on foundry or focus its operations elsewhere?

Despite some very negative sentiment around the company, we could be within a bottoming range.

I discuss three reasons the stock could be a buy; valuation, the 18A and also technical analysis.

In my last INTC report, I highlighted the stock was a Sell after disappointing earnings. However, now that the price is even lower, and we may have some more clarity on what could happen, I am upgrading to a hold.

However, the future of Intel depends on the decisions it makes over the next few months.

The Vultures Are Circling

Intel has made some mistakes, there’s no doubt about that. Now, the company is paying the price, and it is facing some tough decisions.

Following its huge plan to remake itself as a Foundry business, there are now rumors that the company is exploring spinning off its Foundry division. The stock rallied following this news, though it is now back trading near its lows.

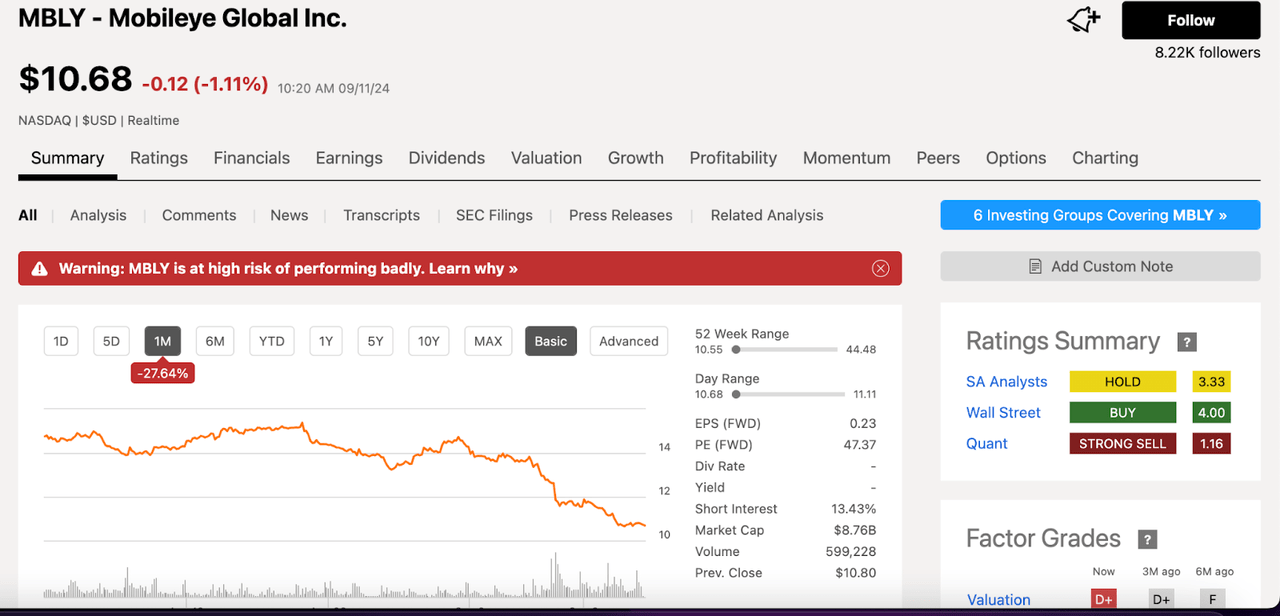

Intel is also considering selling part of its stake in Mobileye in a rather untimely manner.

Mobileye IPO’d almost two years ago, but the stock has been in free fall over the last year.

And it seems like other parts of Intel’s business are also up for grabs, with Qualcomm (QCOM) reportedly showing an interest in Intel’s PC design division

Why Is Intel Selling?

With the company performing so poorly, it makes sense for Intel to try to lean down and focus on its operations, but there are even more pressing reasons to sell.

After being a paragon of profitability for the last 20 years, Intel’s large investments in Foundry have rendered the company unprofitable.

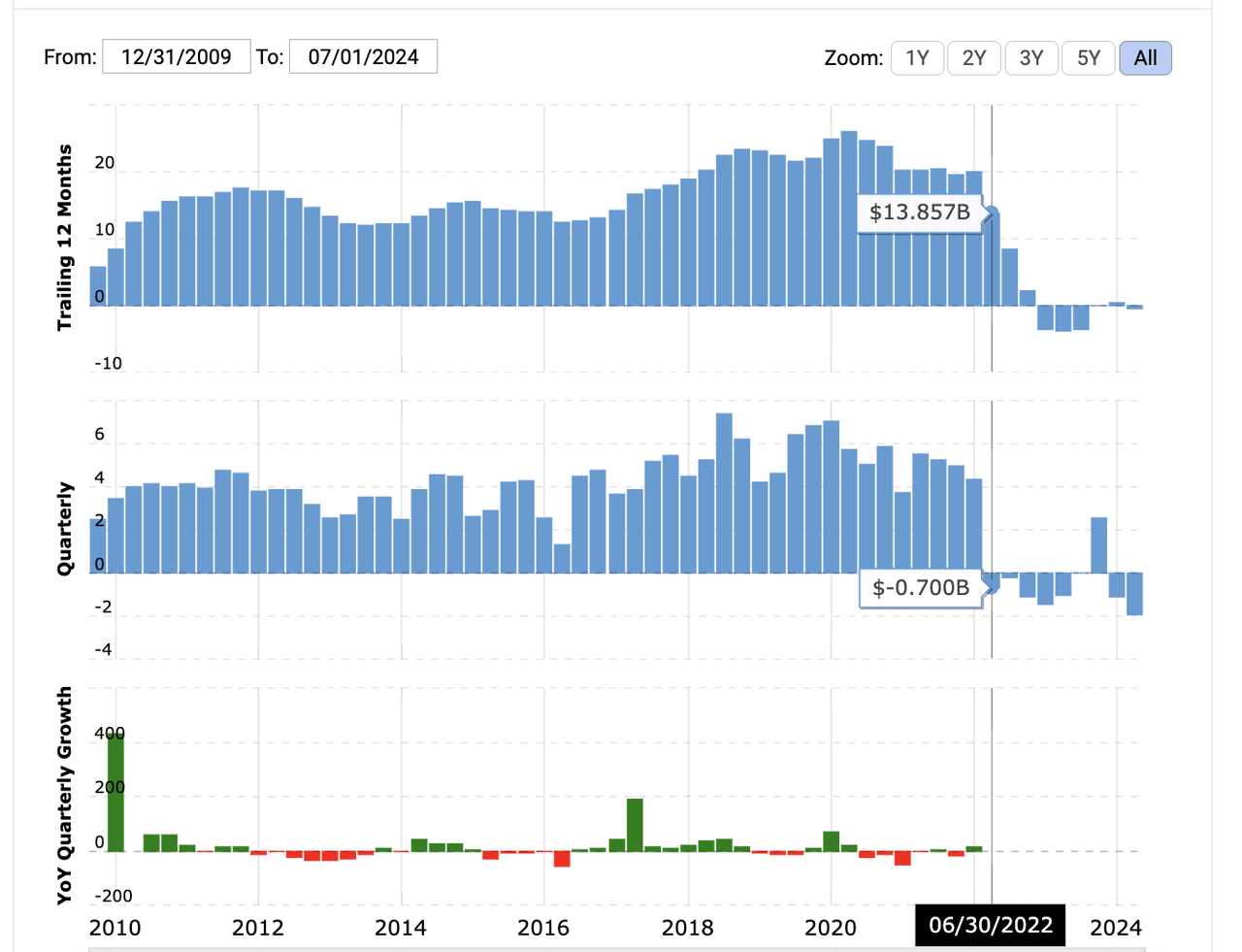

Intel operating income (Macrotrends)

Operating income, shown above, entered negative territory in 2023, and though it became positive in Q1 of this year it dipped back into negative territory in Q2.

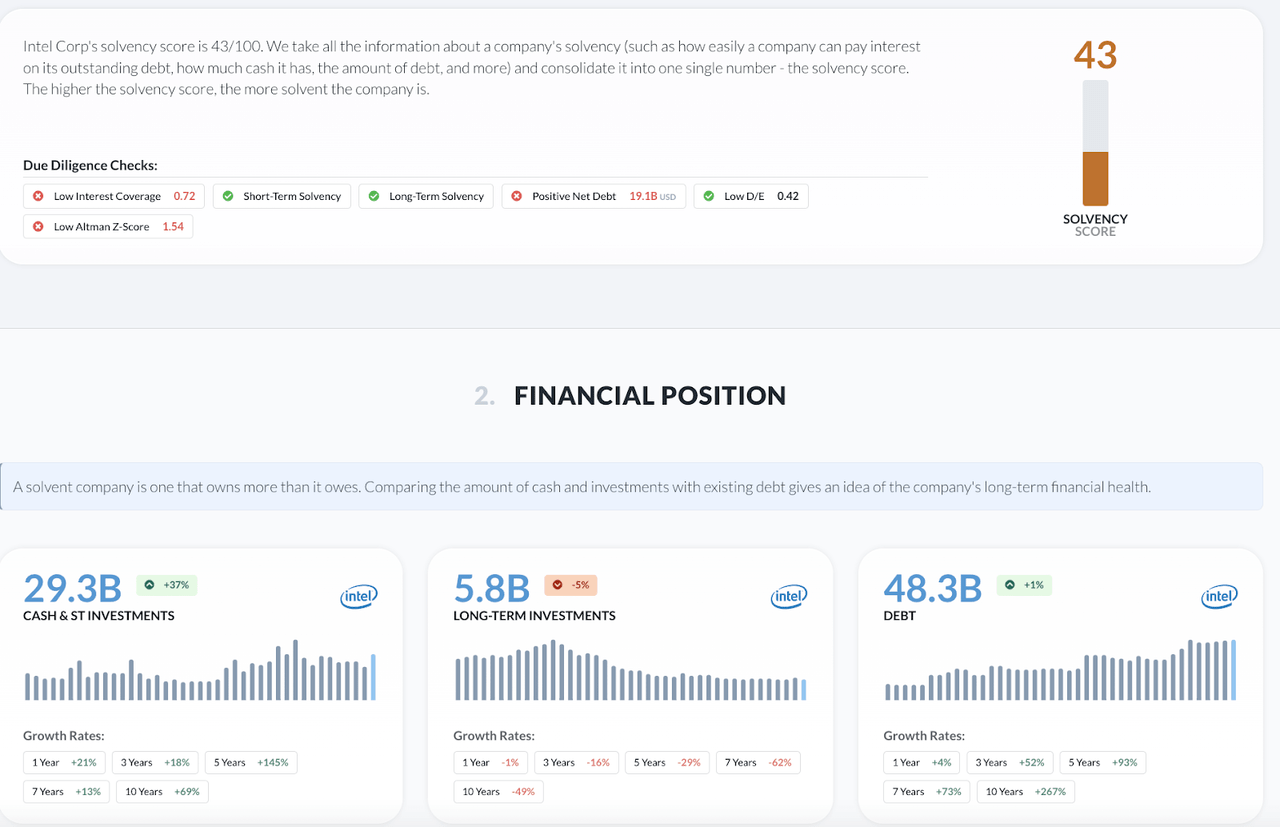

With added new costs, and revenues failing to catch up, Intel is now fighting against time in terms of cash burn. While the company is still not close to bankruptcy levels, it is certainly a lot less solvent than it used to be.

The company’s interest coverage is lower than 1, and it carries a significant amount of debt. Arguably it has plenty of assets over the debt, but the market is beginning to question the worth of these assets, which is in fact why Intel is currently trading below its book value.

Baby Or Bath Water?

The real question is, whether Intel should indeed be selling all these assets, and it’s a very hard one to answer.

On the one hand, it certainly makes sense for Intel to consolidate its efforts and focus on what it does best. This is sound advice now, and it would have been even better advice to follow 10 years ago.

But it may be too late for Intel now. The company has already committed towards the Foundry vision, and I don’t necessarily think it was a mistake. As I wrote before, there’s a lot to like about Intel building out an asset which will be strategically important to the United States.

What would be a mistake, in my opinion, would be to sell off its assets now at fire sale prices, including Mobileye. Two wrongs don’t make a right, and Intel should weather the storm for the time being. Selling now would be admitting to itself and investors that things are going to get much worse.

3 Reasons To Buy

Intel’s future will be very largely determined by the potential success of the 18A process node. Based on the company’s data, it is performing well and could even compete with TSM’s offerings.

Intel 18A is driving next-gen AI innovation across Intel products-and the early results are very encouraging. The Panther Lake client processor is powered on and booting Windows, yielding well, in use inside Intel and ahead of schedule on product qualification milestones.

Source: Intel.com

Intel will have to compete head-to-head with TSM’s current products and the upcoming A16, which is should be released in the second half of 2026

If you ask me, Intel should, perhaps literally, go for broke, and try its best to compete with TSM. It has the support from the US government, and this should definitely aid its cause.

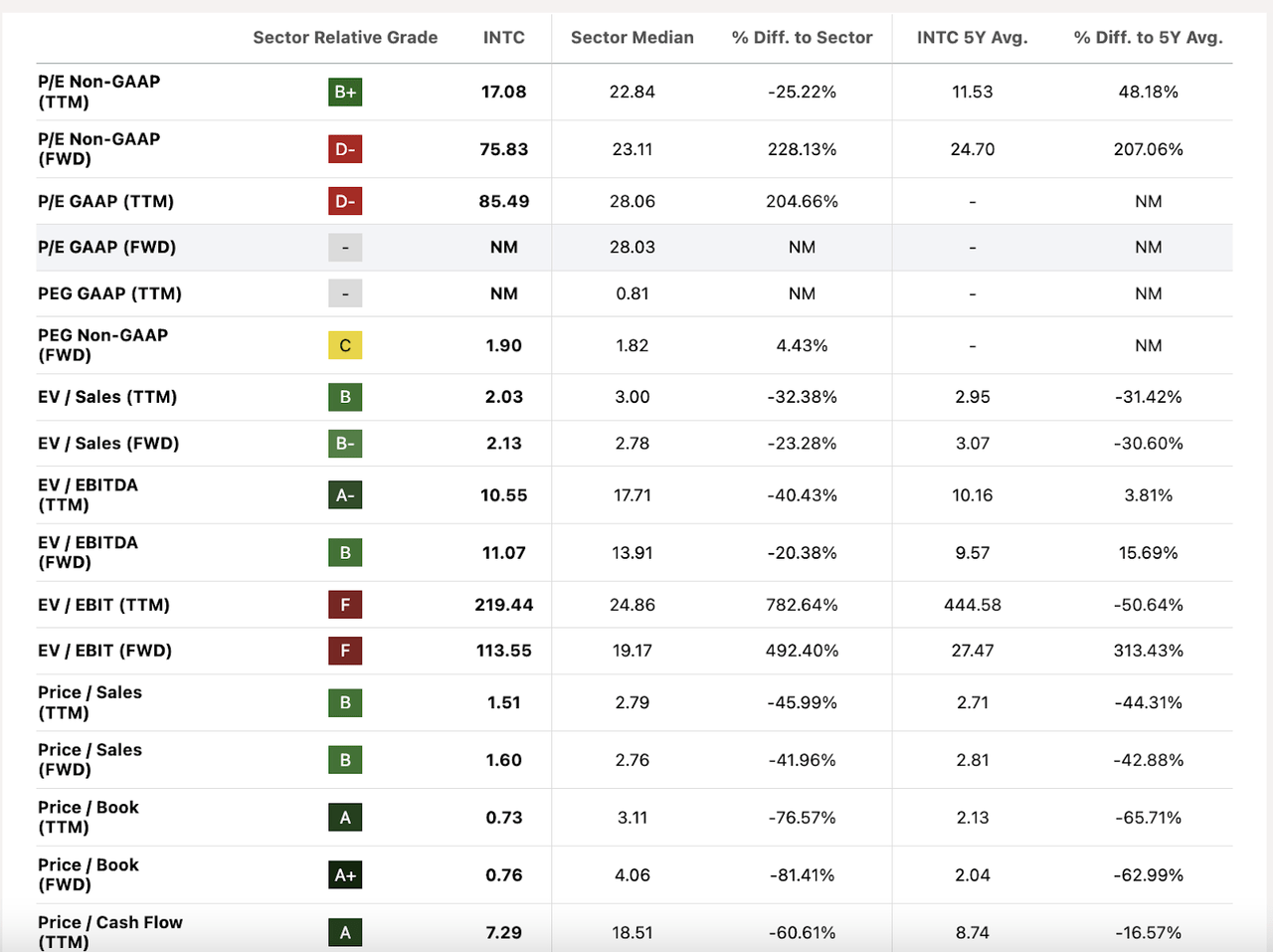

The second reason to buy Intel is the compelling valuation.

Intel is now trading below its Book value, which is pretty compelling. Though the company has struggled the past few quarters, it is nowhere near distressed levels. It also trades at 7.29x cash flow, and even with today’s low estimates, the forward PEG is reasonable at 1.9

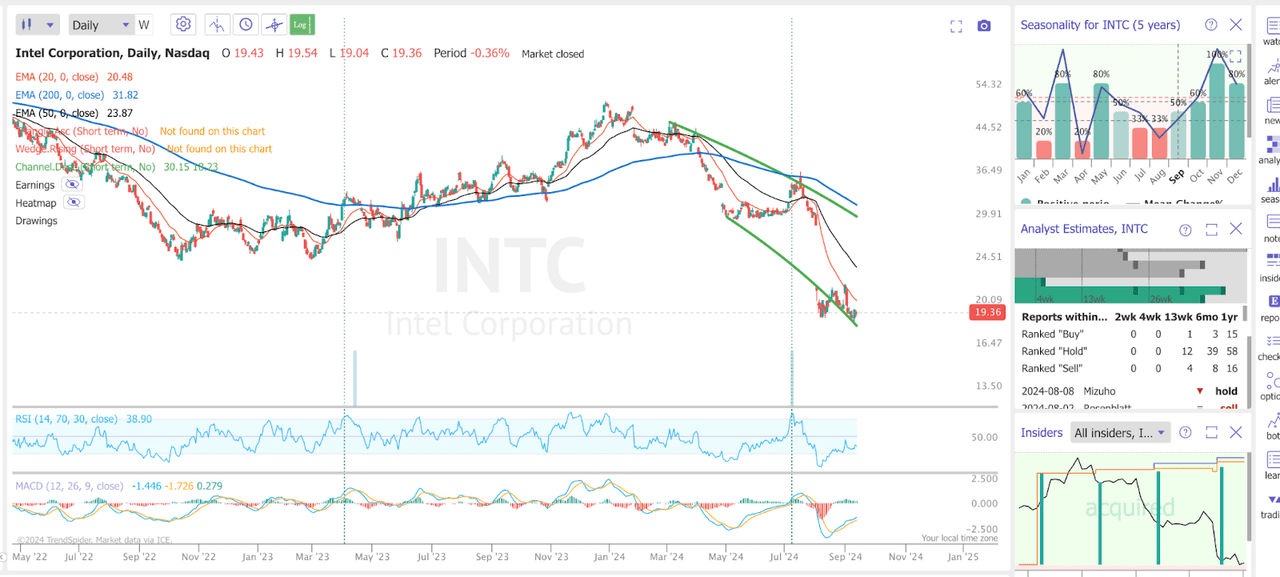

Thirdly, the technical outlook is looking a bit more promising

After completely collapsing, we seem to have found some support around the $18 area. While it is still early days, we can see a bullish divergence in the RSI, which has bounced from oversold levels, while the price continued to grind lower.

We also have a bullish crossover in the MACD, and as we can see on the right, favorable seasonality dynamics over the coming months.

Final Thoughts

Intel hasn’t done much to deserve investor confidence, but I think the bearishness may now be too extreme. While there are challenges ahead and the future is still uncertain, I think the stock is at least a HOLD at these levels. I’ll be willing to add if we get a more clear message that Intel is ready to double down on Foundry, instead of selling the assets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video