Summary:

- Bank of America may face net interest income pressure due to variable deposit beta and low-yielding fixed rate securities.

- The market narrative now predicts rate cuts by the Fed in 2024, which could alleviate deposit beta pressure and maintain net interest income.

- I upgrade BAC stock to “Hold” and revise the base case target price to $37.57/share.

Davis Turner

I have previously argued that Bank of America (NYSE:BAC) is likely to face net interest income pressure, as variable deposit beta cuts into low-yielding fixed rate securities that the bank acquired in the post-COVID aftermath. The thesis was supported by the “higher for longer” narrative that projected that the Fed may keep rates at currently high levels through 2025.

But in the past few weeks, fortunes changed significantly for Bank of America: The prevailing market narrative now sees the Fed cutting rates down by as much as 175 basis points in 2024, with more rate cuts to come in 2025. If this scenario is correct, it is quite likely that deposit beta pressure fades, and BofA’s net interest income may stay at current levels of around $57 billion per year, if not higher.

I upgrade BAC stock to “Hold”; and revise the base case target price upwards to $37.57/ share.

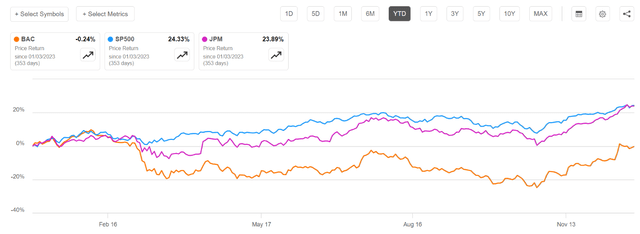

For context, Bank of America stock has underperformed the market YTD. Since the start of the year, BAC shares are down 0.24%, compared to a gain of approximately 24% for both the S&P 500 (SP500) and banking industry leader JPMorgan (JPM).

Seeking Alpha

The Problem In A Nutshell – Revisited

During the liquidity boom post-COVID, BofA received about ∼$670 billion in new deposits, which the bank mostly invested in various fixed-income securities yielding anywhere between 1-2%. The decision made sense at that time because deposit costs were close to zero; and thus, the net interest spread on the capital allocation was positive. Moreover, BofA followed the strategy to not time the market. Here is what BofA CEO Brian Moynihan commented:

Deposits have crossed $1.9 trillion and the loans are $900 billion and change. And that difference has got to be put to work . . . we’re not timing the market or betting. We just sort of deploy it when we’re sure it’s really going to be there

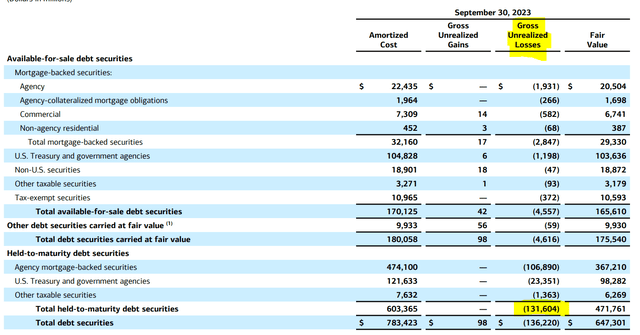

In 2022, however, the Fed started to raise interest rates aggressively. This resulted in enormous paper losses for the bank (remember that prices of fixed income securities are inversely related to interest rate levels, with long-dated securities being more affected by the duration effect). Long story short: In Q3 2023, BofA’s losses on the bank’s securities portfolio stood at a breathtaking $131.6 billion.

BofA Q3 report

While the “paper losses” certainly did not cause any liquidity or solvency concerns, the interest rate dynamics of rising market rates vs. stable (low) rates on the securities portfolio spelled earnings trouble. The major argument for this thesis is anchored on the fact that banks, including BofA, mostly borrow on the money market (think deposits). As deposit costs started to increase on higher Fed funds rate, while BofA’s yield on assets remained broadly stable at low levels locked in post-COVID, the bank’s interest spread was poised for pressure.

Rate Cuts Should Support Earnings

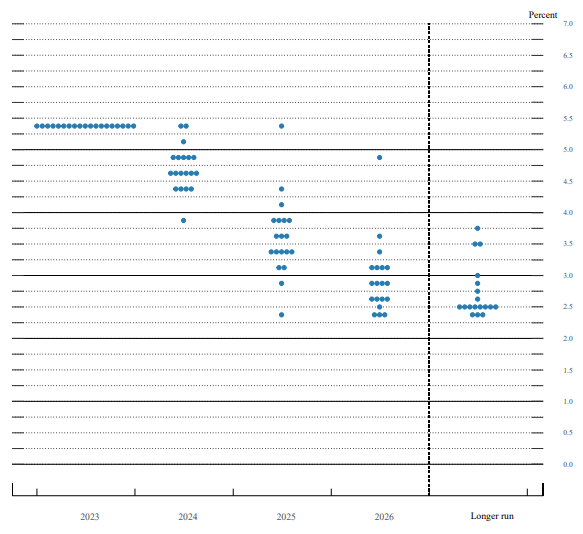

The macro backdrop for rate expectations going into 2024 and beyond changed significantly during the past few weeks. In fact, the FOMC projections released on December 13 contrast sharply with the “higher for longer” narrative. Notably, the committee members have significantly reduced their estimates for end-of-year 2023 inflation compared to their earlier assessment made in September. The collective view among FOMC members now forecasts inflation to range between 2.8-2.9% year-on-year, a notable decrease from the prior range of 3.2-3.4%. Meanwhile, respective projections for GDP expansion jumped aggressively, from about 2.1% YoY estimated in September to 2.6% currently.

Against the backdrop of a burgeoning economic expansion and a diminishing trend in inflation, FOMC participants have significantly adjusted their 2024 rate forecasts. The prevailing consensus now anticipates approximately ~75 basis points in the coming year, a stark contrast to the earlier expectation of only ~25 basis points in cuts projected as recently as September! This sharp pivot has materialized in less than 3 months, highlighting strong dovish momentum.

FOMC projections 2023 December

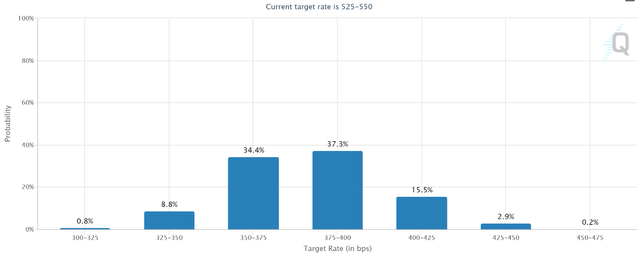

As the FOMC positions itself for a potential dovish shift, the committee’s projection trails behind traders’ expectations, who are even more aggressive in their rate cute assumptions: Notably, as per the CME fed funds tracker, traders are currently anticipating a significant 150 basis points in cuts by the end of 2024, setting rates at approximately 3.75%.

CME Fed funds tracker

All that said, investors should recognize that a dovish rates shift might safeguard banks’ net interest income, anchored on a softened deposit beta and an increasing demand for credit amid an improving economic landscape. Specifically for Bank of America, the fading pressure on deposit funding should be a major game changer, as it would partially, but still significantly offset the headwinds from higher short-term funding pressure cutting into net interest income. In fact, I now believe that BofA’s net interest income may stabilize at around $55-58 billion, only about $1-2 billion lower than the respective income achieved for the trailing twelve months. Moreover, with Fed funds at below 4%, there is also the possibility that funding costs contract, bringing a new tailwind for net interest income. And if this happens, I have little doubt that major money center banks (JPMorgan, Bank of America, Wells Fargo, and Citigroup) will materially outperform deposit beta expectations again, this time on downward momentum. Moreover, as an additional benefit of Fed cuts, investors should also consider that lower rates are bullish for BofA’s investment banking franchise, specifically for ECM, DCM, and M&A volumes.

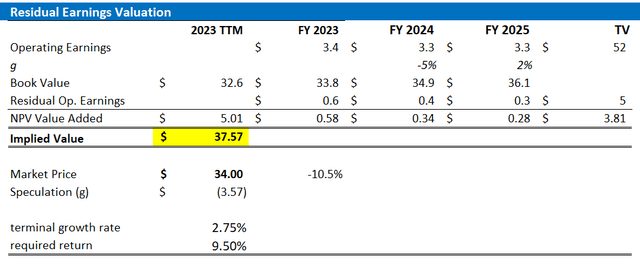

Valuation Update: Adjust Target Price To $37.57

In line with a revised outlook for the Fed Funds rate through 2025, I update the input for my residual earnings valuation model for the bank’s stock: I now estimate that BofA’s EPS in 2024 will likely fall within the range of between $3.3 and $3.5. For 2024 and 2025 I expect EPS of $3.3 and $3.35, respectively. Notably, my estimates are approximately +/-10% in line with consensus EPS, according to data collected by Refinitiv. Moreover, while I continue to anchor on a 2.75% terminal growth rate post-2025, which I see about in line with nominal GDP growth, I reduce my cost of equity assumption by 50 basis points, mostly as a consequence of the lower Fed funds rate projections. On the backdrop of the highlighted model input adjustments, I calculate a fair implied stock price for BofA stock equal to $37.57, which would suggest that the bank’s shares are slightly undervalued (10%).

Analyst Consensus; Company Financials; Author’s Calculations

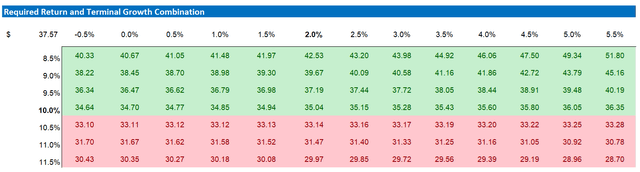

Below is also the updated sensitivity table – the valuation discussion remains a question of rates.

Analyst Consensus; Company Financials; Author’s Calculations

Investor Takeaway

I have previously argued that Bank of America may face net interest income pressure due to variable deposit beta and low-yielding fixed rate securities. My response to this assessment was a “Sell” rating for BAC. However, the picture for BofA stock now is less dark than it was a few weeks ago, mostly as a consequence of the rate cuts roadmap in 2024. The market narrative now predicts rate cuts by the Fed in 2024, which could alleviate deposit beta pressure and maintain net interest income at elevated levels, likely between $55-58 billion per year. In line with this, I update my valuation model for BofA stock and now calculate a revised base case target price of approximately $37/ share, which renders BAC stock a “Hold”.

Although I upgrade Bank of America stock, I would also like to point out that I continue to view the BofA shares as a relatively unattractive investment proposition against banking peers. Specifically, I prefer to be invested in Deutsche Bank (DB) and Citigroup (C), where I have “Strong Buy” rating, and J.P. Morgan with a “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.