Summary:

- Bank of America reported better-than-expected Q1’23 earnings this week.

- Other earnings releases of banks have shown that deposits are flowing back to the community banking market, resulting in easing investor concerns over a financial crisis.

- Bank of America continues to face an NII upside in a high-inflation world.

- The value proposition remains attractive.

Brandon Bell/Getty Images News

Bank of America (NYSE:BAC) handily beat earnings expectations for its first-quarter this week and although recession risks are growing, according to remarks made by the bank’s CEO, I believe Bank of America has a great chance to deliver strong shareholder returns going forward. With inflation pressure persisting, Bank of America is likely to continue to see net interest income tailwinds in FY 2023 and there are clear indications that the financial crisis of March 2023 is easing. Western Alliance Bancorporation (WAL), for instance, disclosed in its earnings report that deposits are flowing back to the community bank, indicating that confidence is returning to the sector as well. Fear over the bank’s HTM losses has also pretty much disappeared. This could create a scenario in which institutional and retail investors push for a re-rating of bank valuations!

Bank of America beats earnings

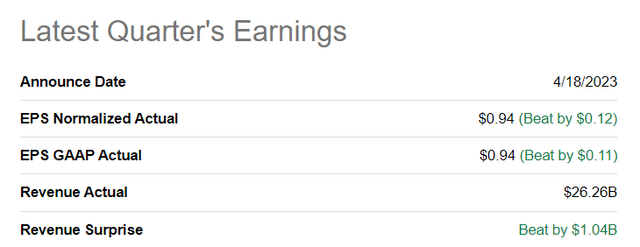

Although Bank of America beat earnings for the first-quarter, the share price marginally retreated after the earnings report. For the first-quarter, Bank of America reported $0.94 per-share in adjusted earnings, beating the consensus by $0.12. Bank of America also reported $26.3B in revenues for Q1’23 which beat the average estimate by more than $1.0B. Overall, it was a solid earnings release that showed both top line and profit growth… against the backdrop of a financial crisis.

Net interest income upside

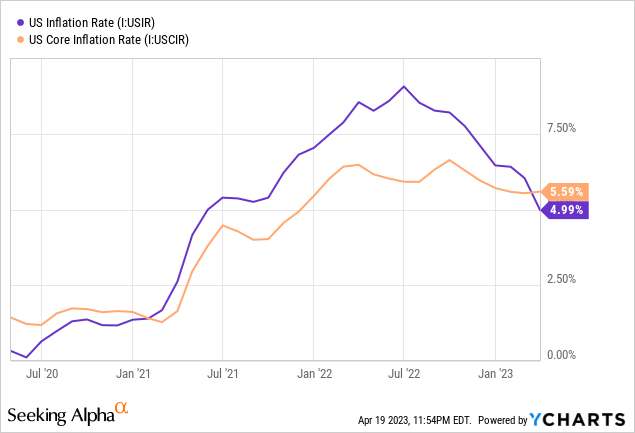

Bank of America has considerable net interest income growth potential as the Fed is likely going to continue to increase interest rates in 2023 as long as inflation remains sticky. According to the latest inflation numbers, consumer prices continued to increase in the U.S. last month which can be expected to trigger additional Fed action regarding rates.

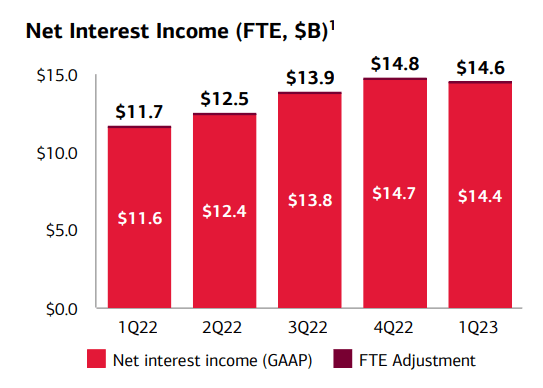

Bank of America stands to benefit from increases in interest rates as the bank earns a higher return on its invested capital. The bank’s net interest income has seen a strong up-trend in the last year and Bank of America added almost $3.0B to its net interest income in the last twelve months… purely because of the Fed.

Source: Bank of America

Since inflation remains way above historical norms, the Fed is set to continue on its current path and raise interest rates in the remainder of FY 2023. Both inflation and core inflation rates remain elevated in the United States, showing that consumers remain under financial pressure… and as long as this is the case, the Fed is all but guaranteed to raise interest rates. Additionally, investors should recognize that the Fed even raised interest rates in the midst of the financial crisis in March which demonstrates that it is committed to bringing consumer price growth back under control. For Bank of America this means that the bank will likely continue to see net interest income growth in FY 2023.

Deposit trend

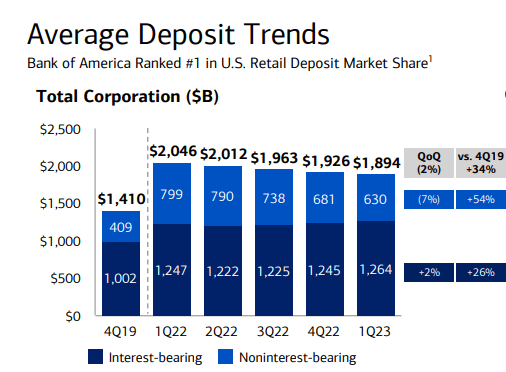

Bank of America’s overall deposit trend is negative, but other banks have also seen declines in their deposit bases over the last year. The reason for this is the same reason why Bank of America posted higher net interest income throughout the last twelve months: higher interest rates.

As the Fed raises interest rates, bank deposits become less attractive for depositors from a yield point of view and, consequently, many investors/depositors have reallocated their cash to money market funds. A big winner of this cash rotation has been Charles Schwab which posted billions of net inflows into its money market funds in FY 2022, but also in the first-quarter of FY 2023.

Bank of America’s deposit base has decreased in the last year as investors reacted to a changing interest rate market environment. Total deposits as of March 31, 2023 were $1.9T, showing a decline of 7.4% year over year.

Source: Bank of America

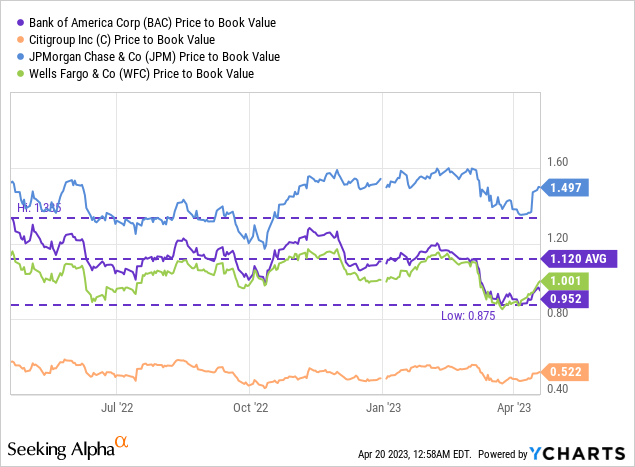

Bank of America’s valuation

Despite a declining deposit trend, shares of Bank of America continue to be attractively valued. While bigger bargains likely await in the community banking market where some banks sell for 30% or higher discounts to book value, Bank of America is still a good deal, in my opinion, largely because the bank is systemically important and will likely never ever be allowed to go out of business. Bank of America’s shares are currently selling for a 5% discount to book value and investors get a solid 15% discount to book value relative to the bank’s 1-year average P/B ratio.

Risks with Bank of America

The biggest risk for Bank of America is not a financial crisis, but a decrease in interest rates which would translate to lower net interest income… which would remove a catalyst for both top line and profit growth. However, the bank’s valuation is so attractive here, in my opinion, that I believe the risk profile is very much skewed to the upside. A reboot of the March 2023 financial crisis is unlikely, in my opinion, chiefly because deposits are returning to the community bank sector — as the earnings report of Western Alliance has proven.

Final thoughts

I am buying more shares of Bank of America although the stock has failed to react positively to the commercial bank’s first-quarter earnings release. I believe that Bank of America will continue to benefit from strong net interest income growth in FY 2023… and perhaps even beyond that if inflation remains a challenge for consumers. The Fed has made clear during the March 2023 financial crisis that it views inflation control as its primary objective which means interest rates are more likely than not going to continue to rise. Since Bank of America’s valuation (based off of price-to-book) remains below its 1-year average P/B ratio, I believe the stock is a solid buy for investors!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, WAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.