Summary:

- Bank of America’s Q3 results show solid net interest income and well-covered preferred dividends, with a net profit of $6.9B and EPS of $0.816.

- The bank’s CET1 ratio remains stable at 11.8%, despite dividend payments and stock buybacks, indicating strong financial health.

- The Series GG preferred shares offer a 6% yield but carry an imminent call risk, making them less attractive for new investments.

- I maintain a small long position in both common and Series GG preferred shares, favoring common shares for potential growth and writing out-of-the-money put options.

jetcityimage/iStock Editorial via Getty Images

Introduction

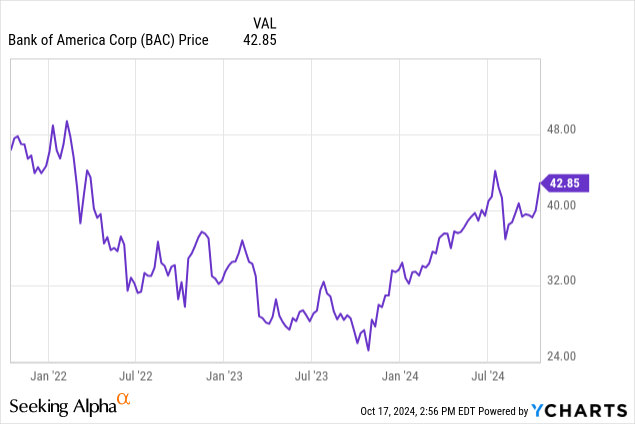

Bank of America (NYSE:BAC) likely doesn’t need a lengthy introduction as this financial powerhouse enjoys a worldwide brand recognition. In my previous articles I focused on both the common shares as well as the preferred shares, and now the bank has published its financial results for the third quarter of this year, I wanted to have a look under the hood to see if I need to be worried about my exposure.

The Q3 results were satisfying and the preferred dividends remain well covered

Bank of America reported on its Q3 financial results earlier this week. Although the 10-Q hasn’t been filed yet, the data provided in the earnings update already contains enough information to judge on the safety of the preferred dividends.

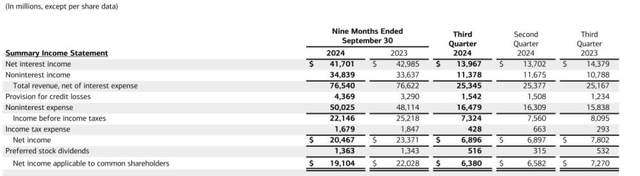

In the third quarter of this year, the bank reported a total net interest income of $13.97B. That’s a decrease of just over $0.4B compared to the third quarter, but it does show a sequential improvement compared to the Q2 2024 net interest income, which came in at $13.7B. As the income statement below shows, total non-interest income did decrease on a QoQ basis while the non-interest expenses increased.

Bank of America Investor Relations

This ultimately resulted in pre-tax income of $7.32B compared to $7.56B in the second quarter of this year as the combination of higher non-interest expenses and lower non-interest income with a slightly higher loan loss provision left its marks. The net profit generated in the second quarter was approximately $6.9B, of which $516M was used to cover the preferred dividends. This means there was approximately $6.38B on the table for the common shareholders, and divided over a 7.82B average share count, the EPS was approximately $0.816.

The relatively decent result in the third quarter has pushed the 9M 2024 net profit to $20.5B, of which $1.36B was spent on preferred dividends. This resulted in a net income of $19.1B attributable to common shareholders. This represented an EPS of $2.42 but keep in mind that’s based on the average share count of just under 7.9B shares while the current share count will likely have dropped below 7.8B shares.

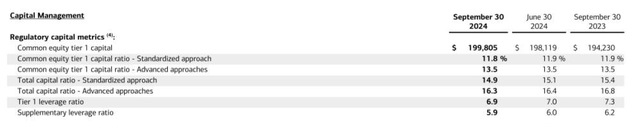

Also important: The bank’s CET1 ratio came in at 11.8% as of the end of September, which is pretty stable compared to the 11.9% reported in June 2024 and September 2023, despite making dividend payments and spending billions on buying back its own stock.

Bank of America Investor Relations

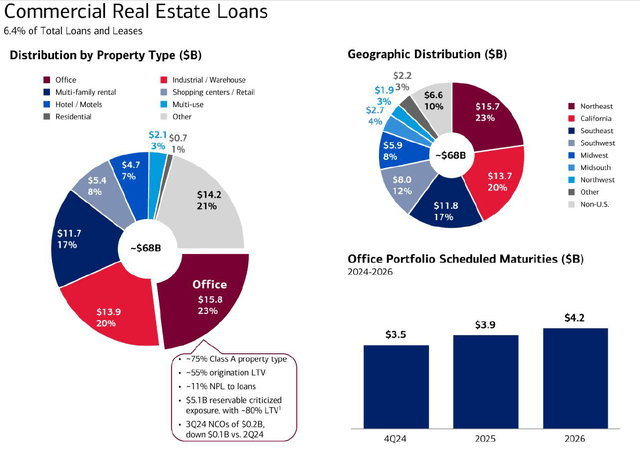

And for those worrying about commercial real estate exposure on Bank of America’s balance sheet: Of the $68B in commercial real estate loans, only 23% or $15.8B were issued to borrowers with office properties. The LTV ratio at origination was approximately 55%, so Bank of America should be able to keep the impact of a weakening office sector limited.

Bank of America Investor Relations

Almost half of those office-related loans will have to be refinanced between now and the end of 2025, so it will be interesting to see if there’s any fallout from the difficult office property market, especially in the segment where the LTV ratio is higher.

The Series GG preferred shares: Attractive – while it lasts

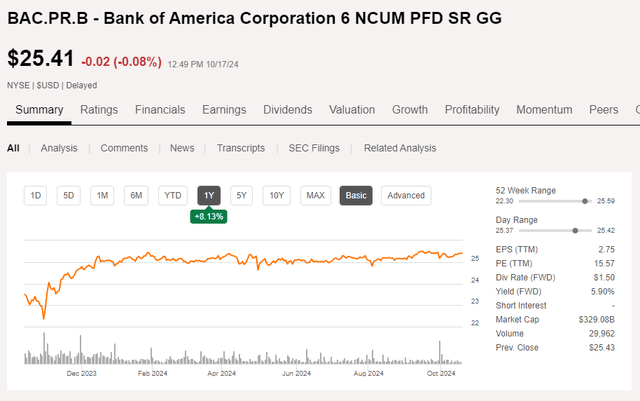

Almost a year ago, I had a closer look at the Series GG preferred shares, which are trading with (NYSE:BAC.PR.B) as the ticker symbol. That specific series of preferred shares offered a preferred dividend of $1.50 per share per year, for a dividend yield of 6% based on the $25 principal value. Bank of America is allowed to call these shares at any time. That’s a deterrent as it also means the share price likely won’t exceed the $25 call price by too much considering there’s a risk the preferreds could simply be called by Bank of America. As such, we should consider the preferred shares to be a 6% yielder, but with an imminent call risk.

Seeking Alpha

The stock is currently trading at $25.41/share, which represents a $0.41 premium to the call price. As one quarterly preferred dividend payment is just $0.375, anyone who buys BAC.PR.B now is betting on the securities to remain outstanding until at least the end of November (the $0.375 quarterly preferred dividend will likely be paid on or around Nov. 15, with an ex-div date earlier that month).

Investment thesis

I have a small long position in Bank of America’s common shares, but I also have a small long position in the bank’s Series GG preferred shares but with the caveat these preferred shares can be called at any given time. That’s also the main reason why I have a larger long position in (NYSE:BAC.PR.L) although the yield on that security is lower (at 5.75%). I’m happy to “hold” the Series GG preferred shares (I can’t justify a “buy” rating due to the immediate call risk), but I think the common shares of Bank of America are still attractive and I will be writing out of the money put options in an attempt to increase the size of my current long position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I also have a small long position in BAC.PR.B, but I realize that position may be called at any given time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!