Summary:

- An elephant in the room, Bank of America’s $136 billion in unrealized losses is a cause for concern, but it wouldn’t directly affect the company.

- The sector crackdown due to these losses would.

- Higher rates are not exactly beneficial for the business.

- Bank of America’s exposure to commercial real estate loans is also a concern.

MediaProduction

The thesis

Bank of America’s (NYSE:BAC) troubles are getting more and more worrisome every quarter. The company made quite the news on its unrealized losses worth $136 billion. The market reacted with slight pessimism and stock took a small hit. However, it seems like it’s already been priced in as shares are down 27.4% YoY. Undeserved, right? These losses are not real and do not affect operating results. But I wouldn’t rush to conclusions. BofA’s performance just reflects a much wider picture of the state of the banking sector as a whole. There are lots of problems here and these are ‘mice in the room’, just as scary as an elephant, but are hidden from plain sight.

Elephant in the room – $136 in unrealized losses

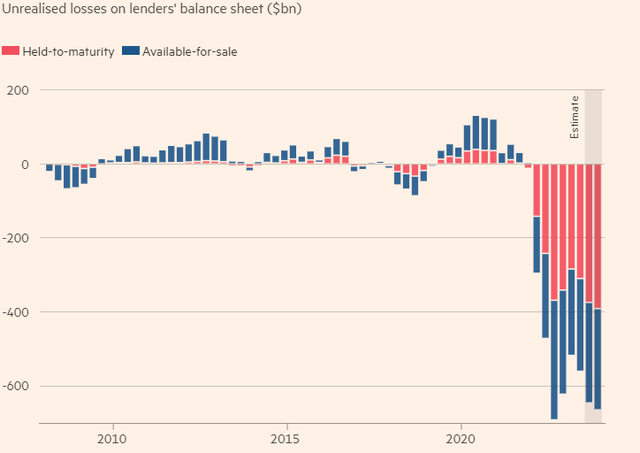

Paper losses on portfolios have been a sore spot in the sector as asset value quickly decreased once the Fed started its aggressive hiking campaign. Bank of America, along with other banks got stuck with a huge amount of low-yielding bonds on its balance sheet that went well below par, resulting in huge floating losses.

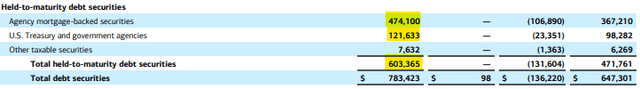

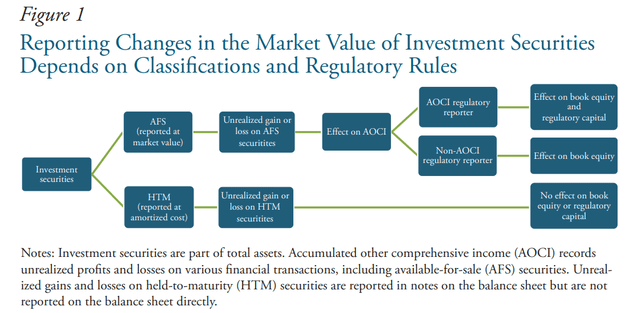

There are mainly two types of securities the banks hold: AFS (available-for-sale) and HTM (held-to-maturity). The key difference is that the financial result of the HTM portfolio doesn’t affect book equity or regulatory capital. This moved Bank of America to transfer most of the loss-making bonds into HTM, effectively pushing losses off the balance sheet.

Source: the study by W. Blake Marsh and Brendan Laliberte

BofA holds $603 billion in HTM (77% of all debt securities), of which approximately $122 billion is in Treasury bonds maturing in just over six years, as well as $474 billion in mortgage-backed securities. And everything is generating losses. Most problems are caused by rising mortgage rates as MBS losses ballooned 25.7% QoQ. Given the Fed is done with hiking (or will be done soon), the further loss expansion rates on portfolios would likely not be that rapid.

So the AOCL (Accumulated other comprehensive loss) of $22 billion that has an effect on book equity looks manageable. The risk of recognizing a critical amount of losses for a giant like BofA is now completely under the regulator’s control, and under almost no circumstances will these paper losses actually drown the company. In addition, this huge portfolio continues to generate coupon income, which the bank reinvests in instruments high rate so funds remain in an investment portfolio.

The mice in the room

When everybody sees the problem but prefers to not talk about it, it’s an obvious example of an ‘elephant in the room’. But what if no one even wants to see the problem in the first place? Well, I call this a ‘mouse in the room’.

Losses are fine until everyone has them

It is important to understand that rate hiking always leads to systemic losses. This time they are very deep and will almost certainly in the following be deeper thanks to the recent yield surge. These losses only threaten the bank if it has to sell securities and that would only happen during a massive bank run. Although it looks almost like an apocalyptic scenario now, it has already happened just 7 months ago with SVB.

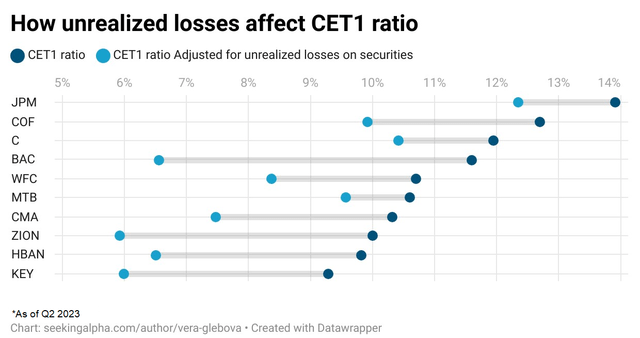

The main problem is that if a March-like scenario unfolds now, it is very likely there will be more failures. At first, sight, looking at the CET1 ratio all banks, including regional ones, look healthy, but if we adjust this for unrealized losses, Zions (ZION) and KeyCorp (KEY), for example, would already be below the well-capitalized ratio of 6.5% with Bank of America about to join that list.

Source: Chart and calculations by author

If these losses begin to be recognized anywhere in the system, this will lead to a drop in equity, and in order to make up for this, expensive sources of equity will have to be used to ensure a bank has enough reserves. If infections continue to spread, deposit rates will soar and interest margins will begin to decline at a record pace due to rising costs. Moreover, regulators immediately would place restrictions on shareholder returns (buybacks and dividends), as was the case in 2020-2021.

High rates are pressuring the banking business

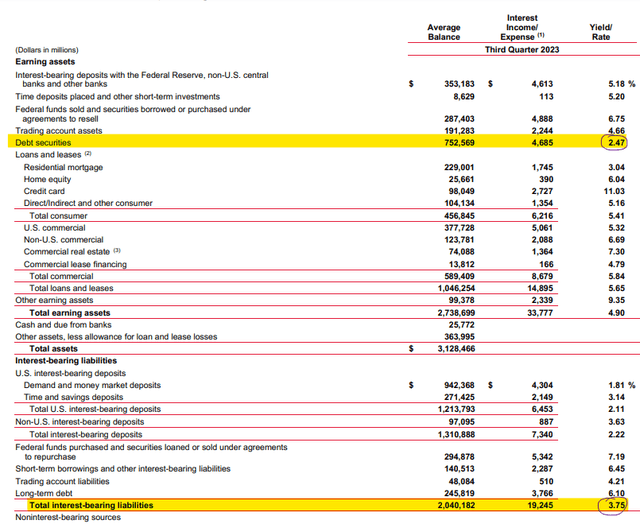

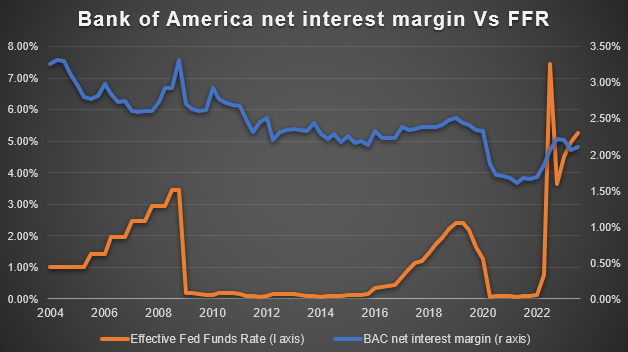

The thing here is it’s not just unrealized losses that occurred during the hiking cycle that are causing the problems. It’s the high-interest rate environment as a whole. Bank of America’s bond portfolio is structurally unprofitable already as interest costs are rising rapidly (2.47% yield vs 3.75% rate).

Although at some stage of raising rates cycle the net interest margin grows, in general, aggressive hiking has a destructive effect on the profitability of the bank. BofA’s NII is holding well now but all the main assets with floating rates have been rising in value, but not quite the liabilities yet.

Source: Author, Bank of America 10Q

It is also important to understand that besides duration risk, higher rates also mean the realization of credit risk. The overall delinquency rate is not problematic now as it is at a pre-pandemic level, although it is growing rapidly as the debt burden is getting heavier every quarter. However, breakdowns are already real in small banks (not among the 100 largest): the delinquency rate on credit cards there is at an all-time high of 7.5%. On one hand, this shows the resilience of large banks compared to regional ones, and on the other hand, the credit spiral that developed in 2020-2021 is starting to backfire as Americans are running out of excess savings and the labor market is slowly cooling down. As for Bank of America, obviously, asset quality is way higher here, but this process always starts from the bottom.

CRE exposure

Speaking of the bottom, the company’s exposure to CRE is pretty big with $73 billion worth of loans. Big concerns here are related to office space with 25% of the portfolio. Non-performing loans (NPL) represent 6%, which is already pretty high, but the challenge is still ahead as more than a third of maturities are coming in 2024.

Source: Bank of America Q3 presentation

The problems here are expressed primarily in the long-suffering CMBS.

Nearly 70% of the CMBS office loans that were scheduled to mature in 2023 were unable to be refinanced. About half were modified and the others defaulted.

There’s also $10B+ scheduled to mature next year. About $4.7B has already defaulted or is in special servicing, and another $4.5B has low debt yield or significant lease expirations

Empty offices cause damage, but the main reason here is that with mortgage rates nearing 8%, the entire real estate market just stops working, and then it’s just a matter of property type and time. All in all, it’s not just offices at risk.

Source: CRE Analyst on X (@CREanalyst1)

Nearly $1.5 trillion in commercial real estate loans are set to mature through 2025. Big landlords at this point prefer simply write off their losses. For example, a loan secured by the Mall at Tuttle Crossing, Ohio, was liquidated with a realized loss of $93 million in October, and $670 million CMBS backed by The Helmsley Building was sent to special servicing. The portfolios are full of low debt yield assets so large companies just stop servicing them. In fact, these are the same paper losses that had to be realized at a discount. For now, these are landlords, but Refinitiv reports that banks like Wells Fargo (WFC) and HSBC USA (HSBC) are off-loading their assets too.

Despite the fact that Bank of America’s exposure is not the largest even among the big five, many regional banks are way overexposed to CRE cracking. And once again, the body here begins to rot from the feet, not from the head.

Why I’m not betting against Bank of America

Although the main thesis of this article is I would stay away at this point, this doesn’t mean I would recommend reversing the risk and selling if you are a long-term holder.

Bank of America is a great company with historically low valuations. Compared to peers, it has the same ratios as Wells Fargo but is cheaper than JPMorgan Chase with comparable growth rates and good profitability. The spread between the two has never been this large. This is understandable given BofA’s weaker position and overexposure to problem areas, but the depth of this spread is a consequence of not the most rational market valuation. The bank also has a stable dividend yield of 3.5%, with a low payout ratio of about 25%.

It’s hard to beat BofA’s holdings as it continues to hold on to $859 billion in global liquidity sources and has above-average returns.

Source: Bank of America Q3 presentation

Conclusions

$136 billion is quite a lot, even in paper losses. One might say that it wouldn’t matter anyway as long as we don’t see the direct effect on capital. But there is always a bigger picture. Bank of America is a classic “decent house in a bad neighborhood” story but I would say it’s definitely stained.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.