Summary:

- JPM and BAC have benefited from a sharp rally post-election, both outperforming the average financial sector.

- I will argue JPM and BAC rallies are far from over given the potential deregulation expected from the upcoming Trump administration.

- Leading banks like BAC and JPM are especially well-positioned to benefit due to their scale, profitability, and financial strength.

- Their current P/E ratios admittedly appear elevated, but investors should also examine other valuation metrics (such as dividend yields).

- All told, some valuation premium is well justified given the potential for sustained growth ahead.

Robert Way

BAC and JPM stock: previous thesis and new developments

I last covered Bank of America Corporation (NYSE:BAC) back in July 2024. That article was titled “Bank of America: Buy Before It Climbs More After Q2 Earnings”. As you can already guess from the title, the article served as a preview of its Q2 earnings report and rated the stock as a BUY based on the following considerations:

Bank of America Corporation stock price may rise further on Q2 earnings. A strong balance sheet, robust interest income, and diverse operations, position Bank of America Corporation for another strong quarter.

As for JPMorgan Chase & Co. (NYSE:JPM), my last work was published in June 2024. That article was titled “JPMorgan Chase Will Keep Looking For Direction”. In that article, I rated it as HOLD due to the following mixed picture that I saw at that time:

JPMorgan Chase faces mixed signals with concerns about profitability uncertainty and overvaluation. There are certainly positive factors here, including its strong net interest income growth and optimistic outlook. However, I see limited upside potential in the next year due to uncertainties related to rates, operating expenses, and capital return programs.

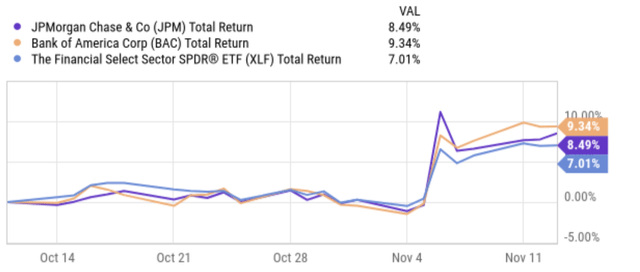

Since then, there has been a crucial catalyst evolving around both stocks: the potential of substantial deregulation for the banking sector in the upcoming Trump administration. As a reflection of the potential impact of such deregulation, the chart below displays the total return of JPM and BAC compared to The Financial Select Sector SPDR® Fund ETF (XLF) after the results of the presidential election came out. As seen, the financial sector has enjoyed a sharp rally, and both JPM and BAC have performed even better. To wit, BAC had the highest total return at 9.34% in the past month among these 3 securities, followed by JPMorgan Chase at 8.49%.

As to be detailed in the subsequent sections of this article, I will argue that these rallies so far are only the beginning, and I expect the tailwinds to persist further. In the end, the deregulation catalyst has led me to reiterate my bullish rating on BAC and upgrade my rating on JPM to buy.

Seeking Alpha

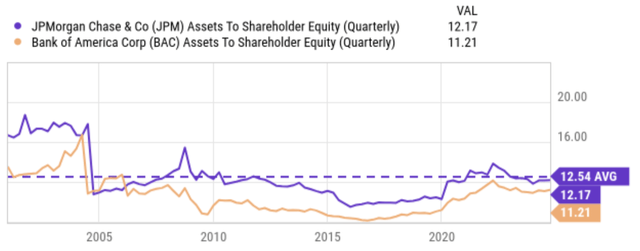

BAC and JPM: historical perspective of regulation

To better appreciate the magnitude of the potential deregulation, let me start by providing a historical perspective. The banking sector has been under heavy regulation since the 2008 crisis. As an example, the chart below displays the leverage (on a quarterly basis) defined as the assets to equity ratio for both JPMorgan and Bank of America Corp since 2000. As seen, both banks experienced a significant deleverage shortly after the 2008 financial crisis. Before the crisis, JPM’s leverage ratio approached almost 20x. After the crisis, it deleveraged to a ratio that has stayed between 10x and 12 most of the time for about 2 decades. The picture for BAC is very similar but to a more severe degree. Its leverage ratio was similar to JPM shortly before the crisis. And it deleveraged to a ratio between 10x and 8x for the most part of the following two decades.

Seeking Alpha

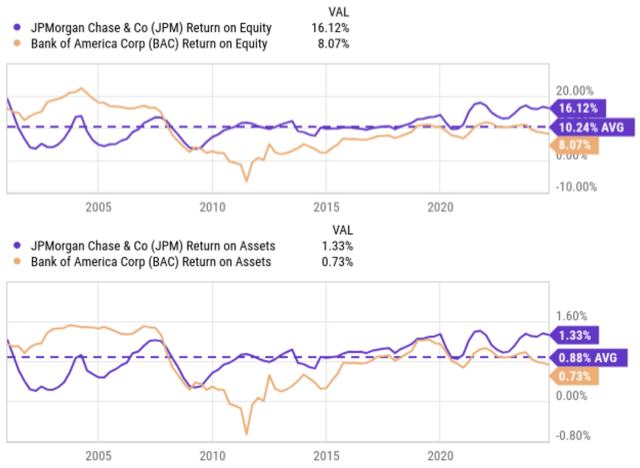

During the past ~20 years of heavy regulation, their profitability (either measured by ROA or ROE as you can see from the next set of charts below) has largely stayed below their historical averages. I expect this to change soon in a material way given the potential deregulation ahead. I expect a series of changes in the Trump administration (some examples are quoted below). In a nutshell, the key impacts I expect are more friendly regulators, the end of the Basel III endgame proposal, and more capital for banks to deploy (for example, towards lending, buybacks, or acquisitions).

Nov 7 (Reuters): The banking industry is expected to win big as former President Donald Trump returns to the White House, ushering in Republican regulators who are expected to ease capital rules and merger approvals, industry experts and analysts said. The President-elect’s picks are likely to further dilute the contentious Basel III endgame proposal aimed at requiring big lenders to hold more capital to safeguard against soured loans… The aggressive financial regulators of the Biden era, including Gary Gensler at the U.S. Securities and Exchange Commission, Lina Khan of the Federal Trade Commission, and Rohit Chopra at the Consumer Financial Protection Bureau, are also likely to be replaced by more business-friendly agency heads.

Seeking Alpha

BAC and JPM: profitability in closer examination

The above potential for deregulation could benefit financial stocks in general. However, I think leading banks like BAC and JPM are especially well-positioned to benefit due to their scale, profitability, and financial strength.

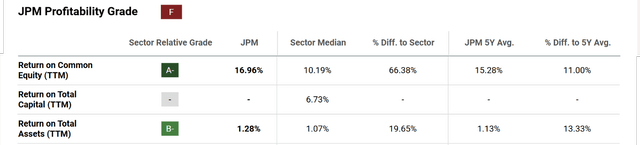

JPMorgan is the biggest bank in the United States (and also one of the largest banks in the world). It boasts total assets of roughly $4.1 trillion at present and a strong balance sheet. When the September interim concluded, its cash and interest-bearing deposits with banks amounted to $434.3 billion. Leverage is at a very manageable level at the same time. If you recall from the earlier chart, its asset-to-equity ratio is about 12.17x currently, noticeably below its historical average. Also, the common equity tier 1 capital ratio resided at 15.3% currently, relative to 2023’s 14.3% figure. The bank also features superb profitability when compared to its peers. As an example, the next table compares JPM’s profitability metrics to its sector median and its own 5-year average. As seen, its ROE is 66% above the sector median and also 11% above its 5-year average.

Looking ahead, I expect the profitability to further improve. Besides the tailwinds from the deregulation mentioned above, I also expect its earnings to enjoy a boost from its continued deployment of digital technology. These efforts should strengthen its relationships with clients and improve operating efficiency. I also expect good odds for acquisitions given the strong corporate finances.

Seeking Alpha

BAC is another leader in the sector with integrated operations in four primary segments. The Consumer Banking unit is the largest unit, followed by the Global Wealth and Investment Management unit, Global Banking unit, and also the Global Markets unit. Among the many reasons that I like BAC, three key differentiation factors stand out on my list compared to other major banks. First, BAC has a strong focus on retail banking, with a significant customer base and a wide range of consumer financial products. This provides a stable revenue stream and allows BAC to leverage its scale to achieve cost efficiencies. Second, BAC has a significant presence in wealth management. And finally, thanks to its complimentary units, I see a strong resonance between its retail and wealth management segments.

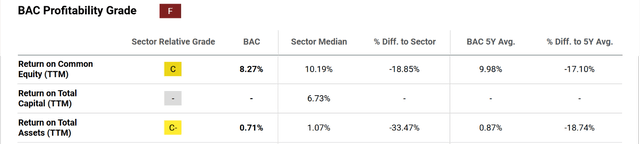

BAC’s current profitability metrics are healthy, but not as outstanding as JPM’s as you can tell from the following chart below. The bank has been experiencing some unevenness among its segments latterly. For example, the Consumer Banking unit experienced lower deposit levels and elevated costs recently. These headwinds outweighed improved loan demand and increased consumer investments.

However, looking ahead, I see a bright outlook. Besides the benefits from the expected deregulation, I also see a few catalysts afoot that are more specific to BAC. At the Global Wealth and Investment Management unit, I expect to see higher AUM due to capital inflows and market appreciation. At the Global Banking unit, I expect a rebound in investment banking fees given my outlook for deregulation in the new administration. I also think the bank’s digital platforms are well-poised for growth as online and mobile banking is becoming increasingly popular across its various businesses.

Finally, the bank also boasts very strong financial strength. If you recall from an earlier chart, its leverage ratio is noticeably lower than JPM’s. America. BAC is well capitalized with average global liquidity sources of almost $950 billion. At the end of the last quarter, BAC’s Common Equity Tier 1 capital stood at 11.8%, comfortably higher than new regulatory minimum requirements.

Seeking Alpha

Other risks and final thoughts

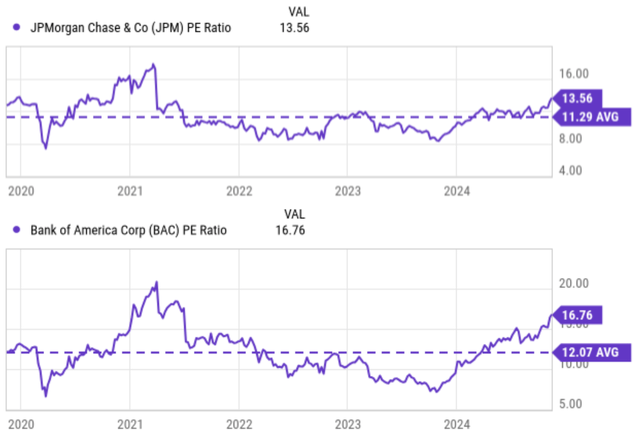

In terms of downside risks, both banks are trading at above-average P/E ratios due to the recent price rallies. More specifically, the two panels of the next chart display the P/E ratios for JPM and BAC, respectively. As seen, JPM’s P/E ratio has averaged around 11.29 in the long term, while BAC’s has averaged around 12.07. Both banks experienced a sharp decline in their P/E ratios in the aftermath of the COVID-19 pandemic, with P/E ratios bottoming in the single digits. Since then, their P/E ratios have recovered to the current level of 13.56x for JPM and 16.76x for BAC, both considerably above their historical average and signaling elevated valuation risks.

Seeking Alpha

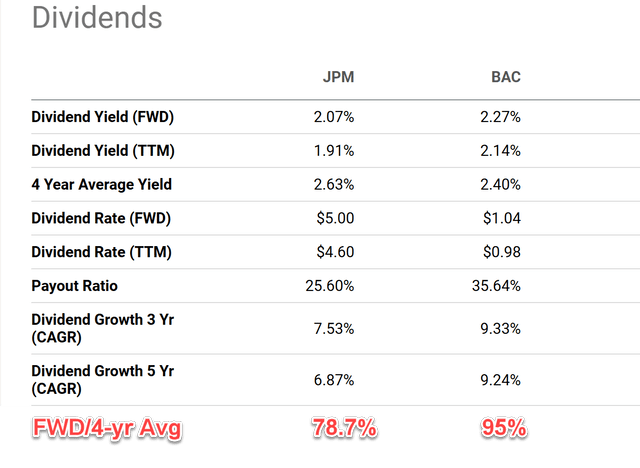

However, I suggest investors also look at other valuation metrics, in particular, their dividend yields. Both banks have a long history of paying out dividends and I consider their payouts a more indicative measure of their owners’ earnings. The table below displays their dividend metrics. As seen, both banks currently provide relatively higher dividend yields, with JPM at 2.07% and BAC at 2.27% (in contrast, the overall market yields about 1.2%). Also note that JPM’s current yield is significantly lower than its 4-year average (by about 21%), while BAC’s is close to its 4-year average (within 5%). Thus, my overall judgment is that JPM is very likely trading at a premium currently, but BAC is very likely trading near its fair valuation.

To conclude, my view is some degree of valuation premium is well justified given the tailwinds I expect in the years to come. Looking at historical data, BAC was able to grow its dividend at 9.33% in the past 3 years and JPM at 7.53% – which I again consider as a good measure of the growth of their true owners’ earnings – under relatively stringent regulations in the past. Looking ahead, I expect such healthy growth to either sustain or even accelerate with the potential of deregulation in the upcoming Trump administration. As such, here I am reiterating my BUY rating on BAC and upgrading my rating on JPM to BUY from my earlier HOLD rating.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.